Published: 2024-05-24T14:21:39.000Z

U.S. May Final Michigan CSI - Less weak than the preliminary, with less of a bounce in inflation expectations

1

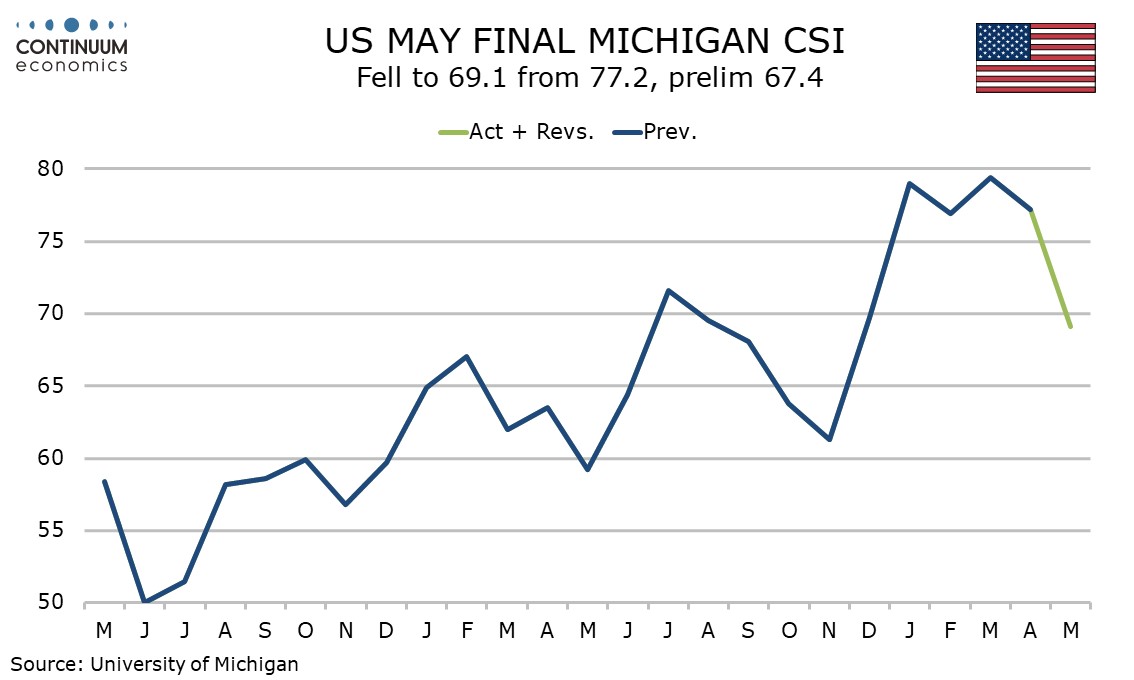

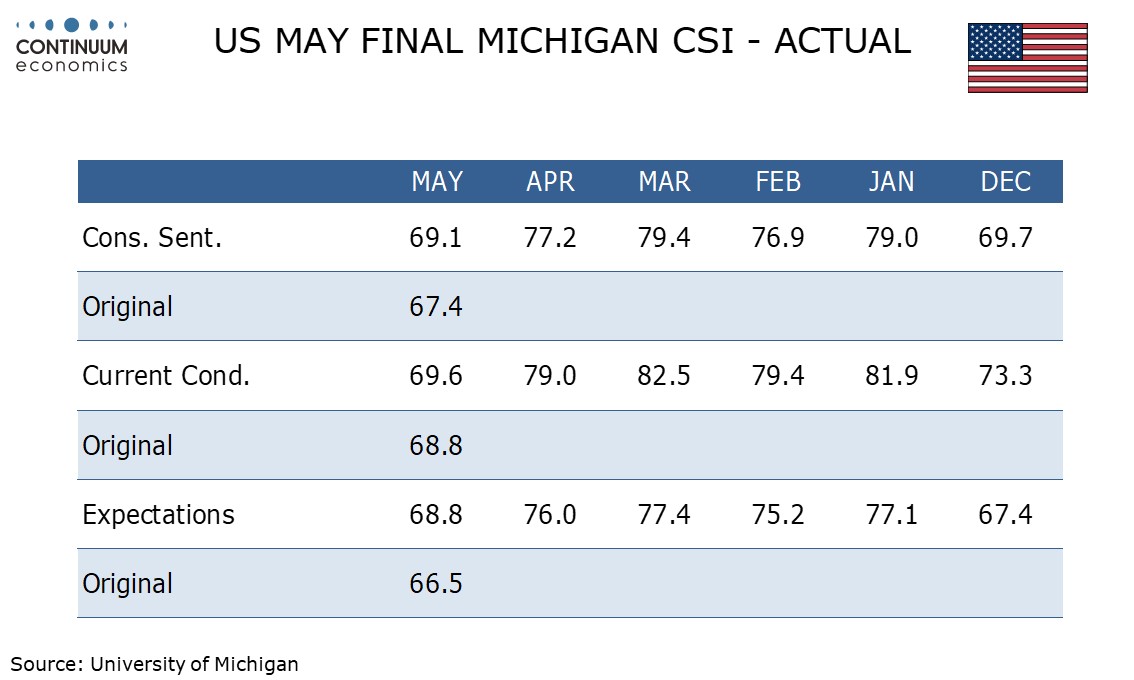

May’s preliminary Michigan CSI showed a substantial fall in confidence and a significant rise in inflation expectations. The final data shows a slightly smaller fall in confidence and less evidence of rising inflation expectations.

The final index of 69.1 is up from a preliminary 67.4 but still well below April’s 77.2 and still the weakest since November 2023. Both current conditions and expectations were revised up, the latter by more.

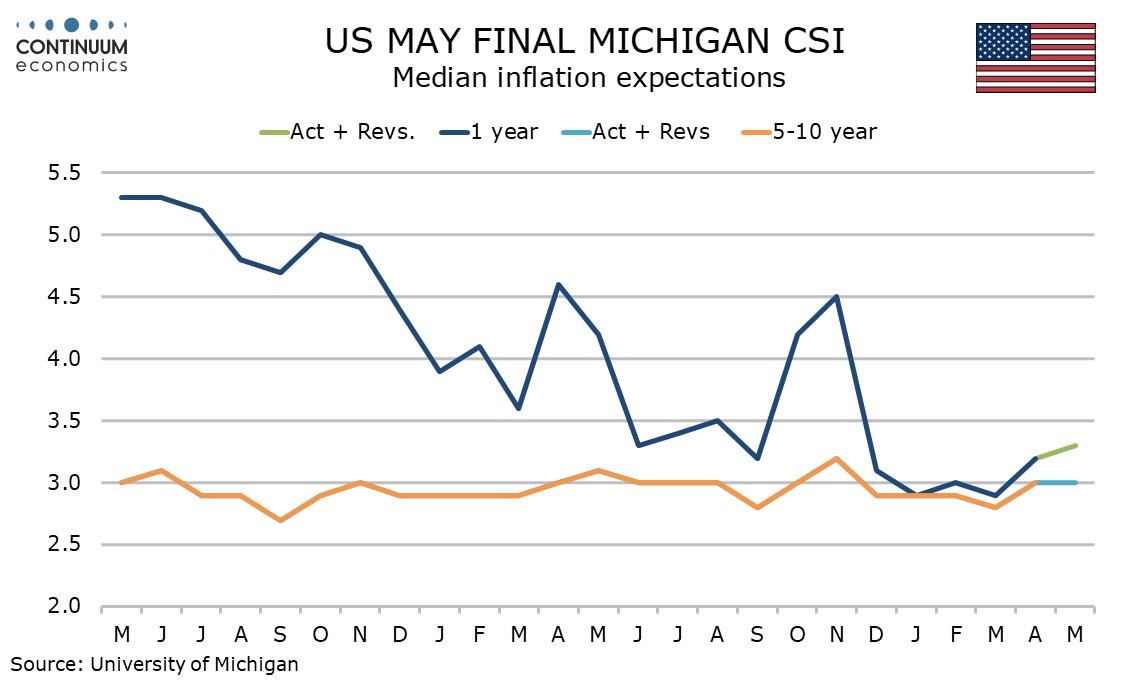

The 1-year inflation now stands at 3.3%, revised down from 3.5% and now only marginally above April’s 3.2%. The 5-10 year view, of more significance to the Fed, is now back at April’s 3.0% pace rather than edging higher to 3.1%.

The less pessimistic view on inflation could be related to the release of a less alarming April CPI, but we suspect consumers are more focused on gasoline prices, which rose in April, but corrected lower though May.