Published: 2025-05-20T14:54:08.000Z

Preview: Due May 29 - U.S. Preliminary (Second) Estimate Q1 GDP - GDP to be revised marginally lower, Core PCE Prices to be revised higher

3

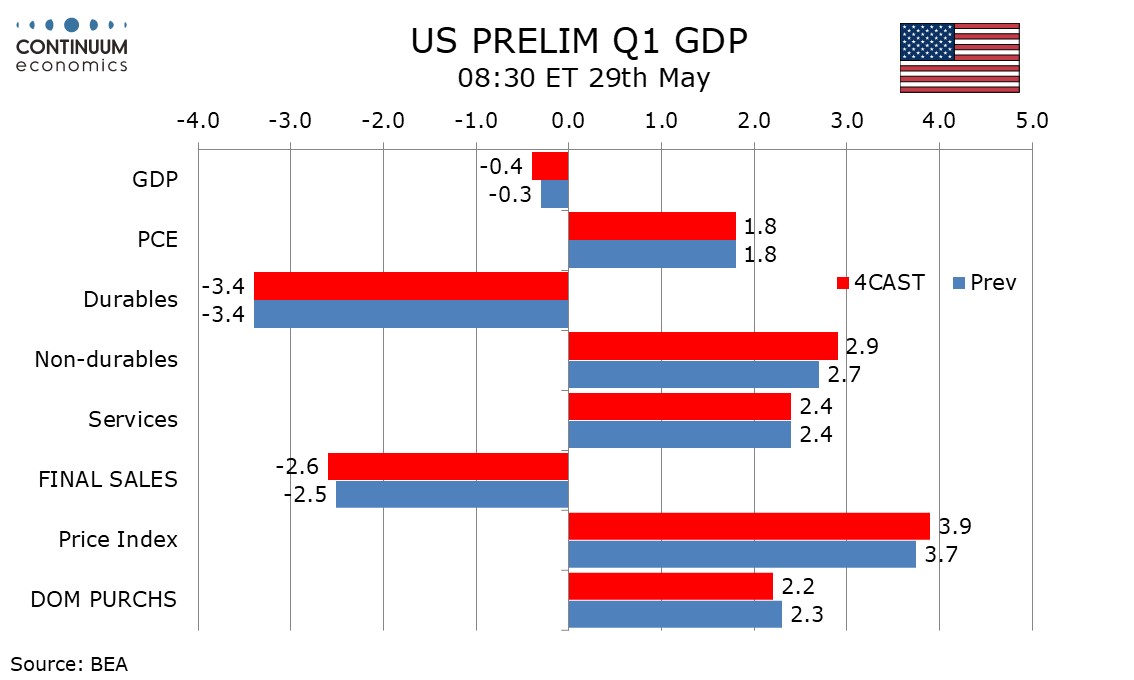

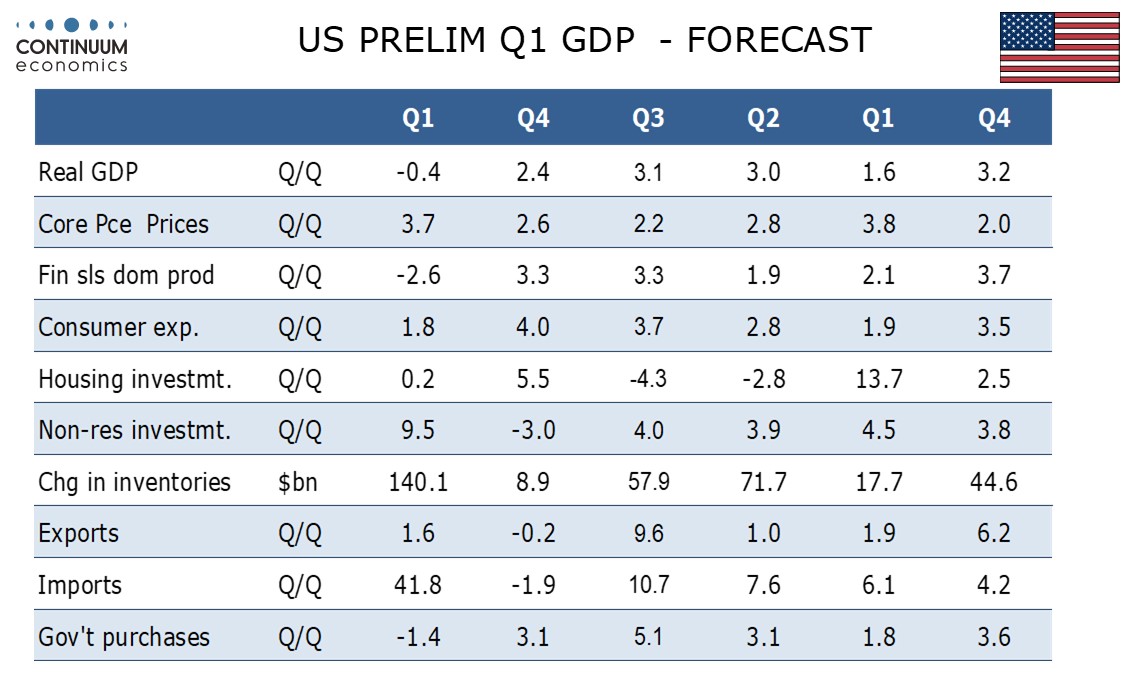

We expect the second (preliminary) estimate of Q1 GDP to be revised marginally lower to -0.4% from the first (advance) estimate of -0.3%, though we also expect an upward revision to core PCE prices, to 3.7% from 3.5%.

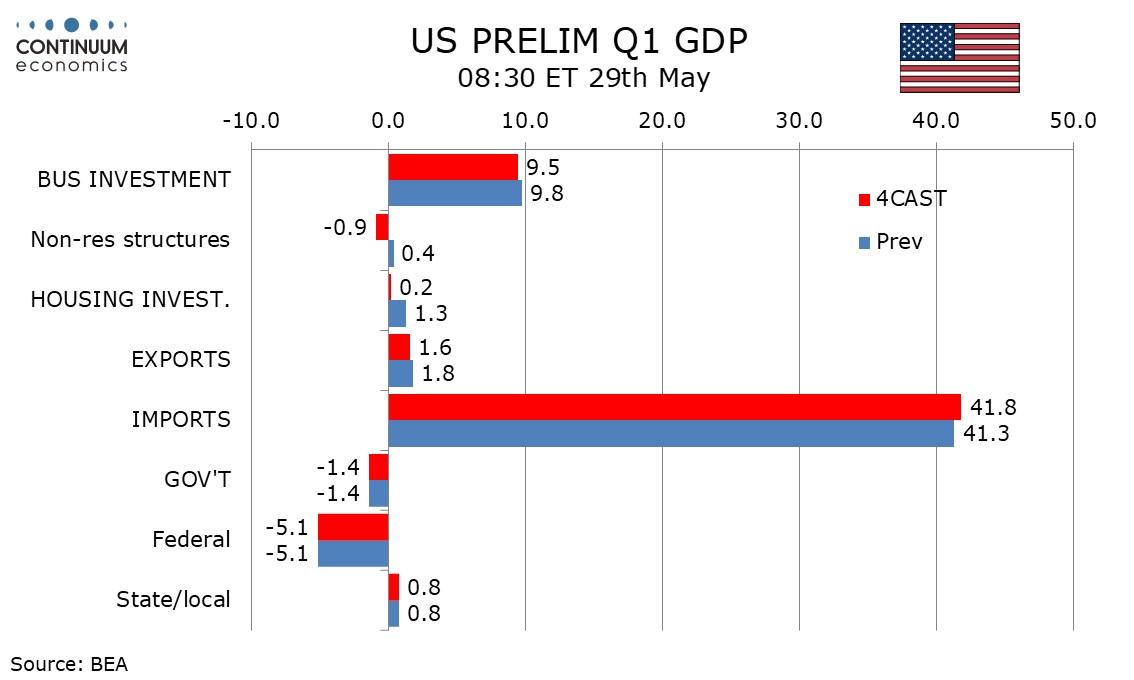

The main negatives we expect in the GDP revision come from construction, which should impact both residential and private non-residential, and net exports, with exports likely to be revised lower and imports even higher. Surging imports took 5.0% off GDP even in the advance report.

The only positive revision we expect is in non-durable retail sales, but that will not be quite enough to lift overall consumer spending from its advance estimate of 1.8%.

We expect final sales (GDP less inventories) to be revised down by 0.1% to -2.6% and final sales to domestic buyers (GDP less inventories and net exports) to also be revised down by 0.1%, while remaining positive at 2.2%.

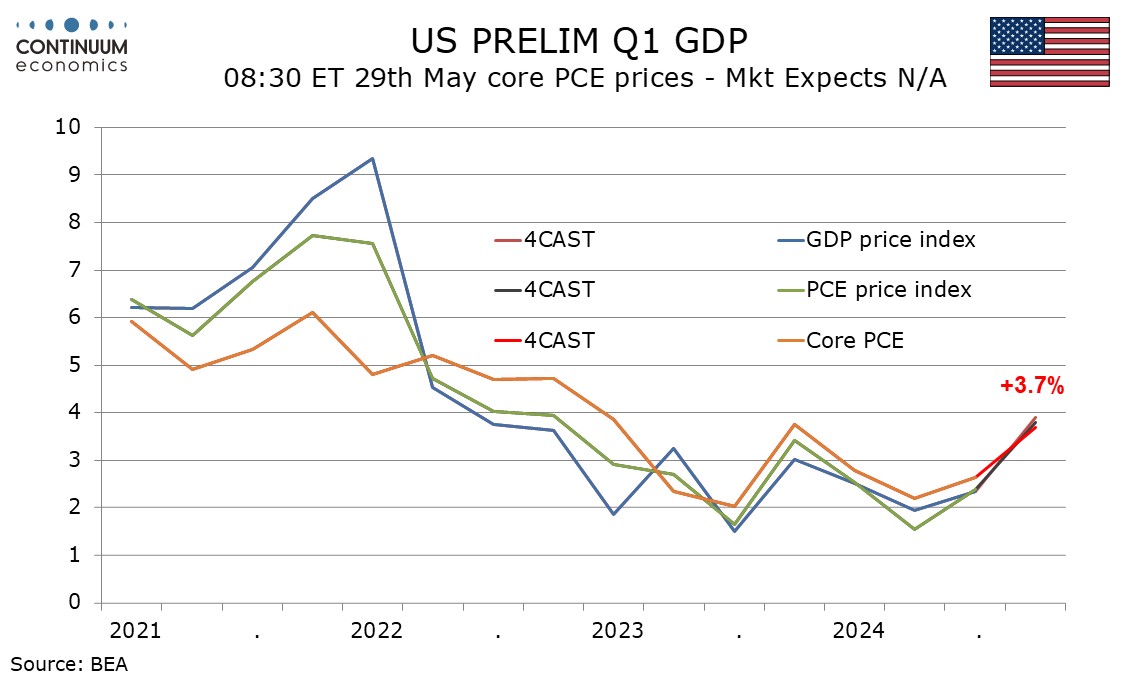

A 0.2% upward revision to core PCE prices to 3.7% will come from an unusually large upward revision to the March PPI. We also expect upward revisions of 0.2% to the overall PCE price index, to 3.8%, and the overall GDP price index, to 3.9%.