Preview: Due Jun 26 - U.S. May Durable Goods Orders - Strong rise but fully on aircraft

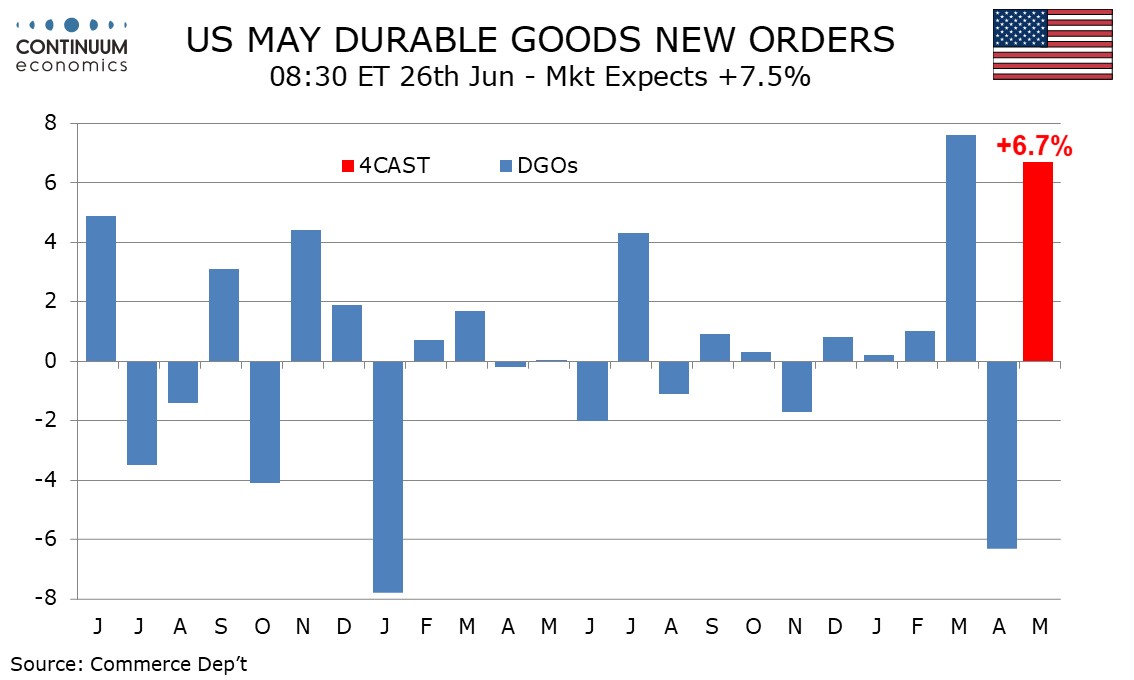

We expect May durable goods to rise by 6.7% overall, with the rise likely to be fully due to a surge in aircraft orders as implied by Boeing data. We expect ex transport orders to rise by a marginal 0.1%, and transport orders to be negative outside aircraft.

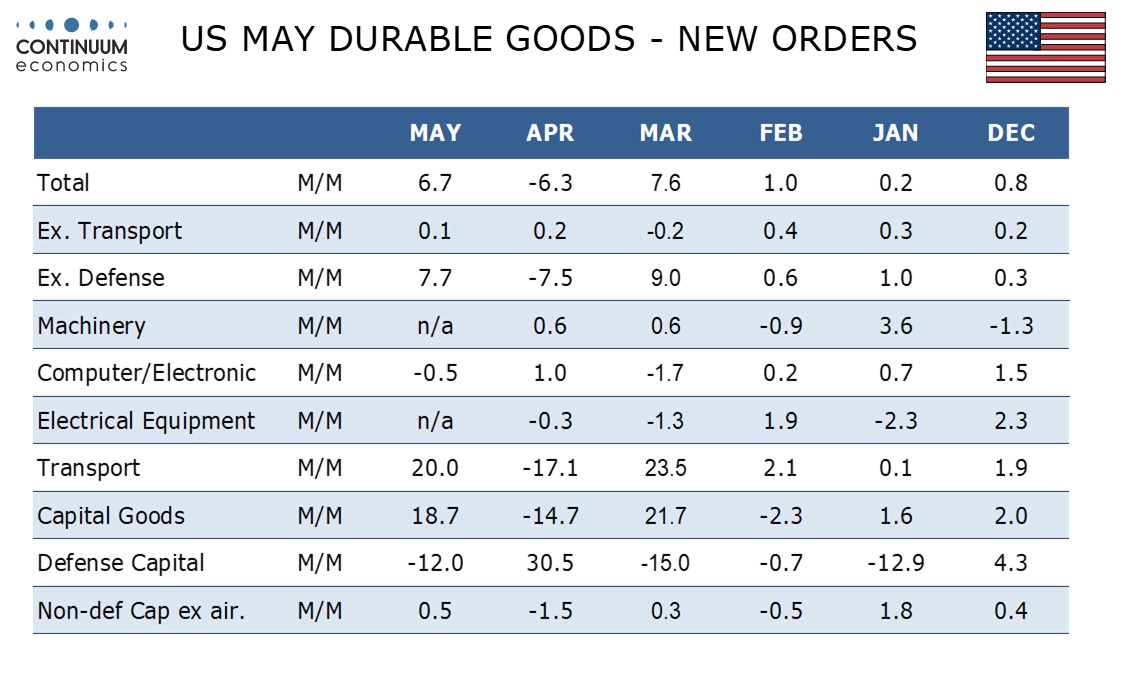

Boeing orders were strong in March, when overall durable goods orders rose by 7.6%, weak in April, when a 6.3% overall decline was seen, but strong again in May. Despite expecting a 20.0% increase in transport, we expect a decline in autos, where sales slipped in May, and a correction lower in defense, which has a strong overlap with transport, from a strong April. Ex defense we expect a 7.7% increase after a 7.5% decline in April.

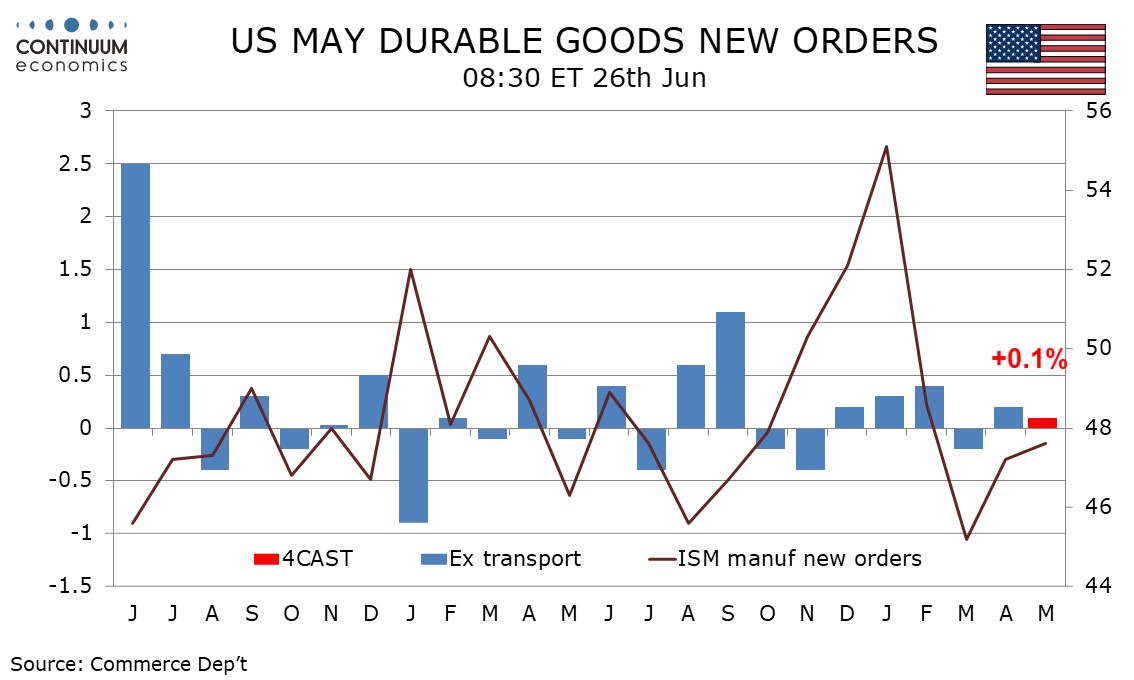

While ISM manufacturing new orders edged up for a second straight month after a very weak March, they remain below the neutral 50. We expect ex transport orders to rise by only 0.1% after a 0.2% April increase reversed a 0.2% March decline. Computers and electronics are likely to slip back after a 1.0% April bounce that corrected a 1.7% slide in March.

We expect a 0.5% correction higher in non-defense capital orders ex aircraft, a key indicator of business investment, after a 1.5% April decline, though policy uncertainty will continue to restrain business investment.