This week's five highlights

Negotiations to End Ukraine War to Start Soon

Trump’s Tariffs on Steel Then Reciprocal and Then Cars

U.S. January CPI A clear disappointment

USD/JPY Getting the Ebbs and Flows

UK GDP Surprise Resilience

As we envisaged, U.S. president Trump and Russian president Putin talked over the phone on February 12 to discuss the war in Ukraine. According to sources, Trump and Putin agreed to have their teams start negotiations immediately. Under current circumstances, we foresee a Russia-friendly deal in Ukraine in 2025. Russia will continue to annex areas in and around four Ukrainian oblasts, and will likely secure that Ukraine does not join NATO and possibly EU in a foreseeable future. We foresee a direct negotiation process between Trump and Putin, which will be followed and then agreed by Kyiv administration. It seems Europe will have to step in and assume some financial and military responsibilities for the defense of Ukraine after the war is over, despite we feel the EU can’t fill the U.S. shoes and possible peacekeeping forces by Europe will not be very deterrent in the absence of the U.S..

Despite Ukraine war not being a priority in Trump’s agenda, and Trump mostly focused on immigration and tariffs after he took the office on January 20, Trump and Putin finally talked over the phone for nearly 90 minutes to discuss the fate of Ukraine, among other topics such as the Middle East, energy, and AI. Following the call, Trump wrote on social media that “We agreed to work together, very closely, including visiting each other’s Nations. We have also agreed to have our respective teams start negotiations immediately, and I will begin by calling President Zelenskyy to inform him of the conversation.”

In the meantime, U.S. Defense Secretary Hegseth gave some significant signals on what will likely happen next in Ukraine during his speech to NATO leaders on February 12. Hegseth indicated that NATO membership for Ukraine was unrealistic, and the country should abandon hopes of returning to its pre-2014 borders and prepare for a negotiated settlement with Russia that would be backed up by international troops.

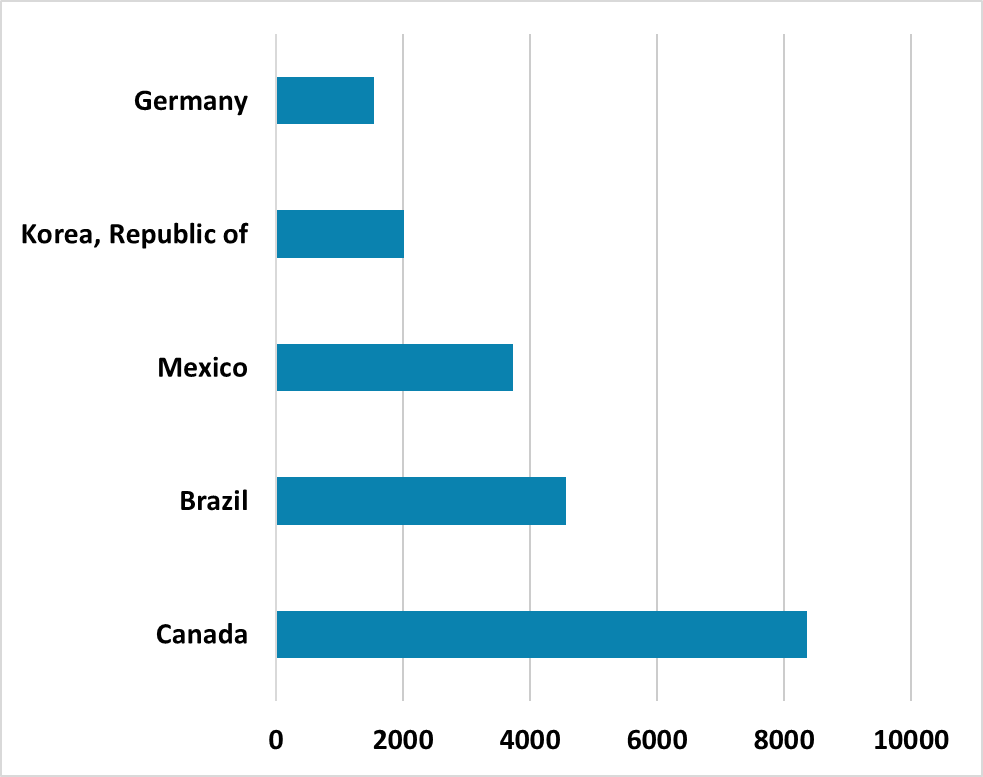

Figure: Top 5 Exporters of Steel to U.S. (USD Mlns)

The 25% Steel and Aluminum tariff could have small to modest adverse inflation and GDP growth impacts on the U.S., but the prospect of reciprocal and more product and country tariffs create trade policy uncertainty/supply chain disruption and paperwork problems. This could amplify the impact of the cumulative tariffs under president Trump’s administration.

President Donald Trump 25% tariffs on all steel and aluminium imports from March 12 has no exemptions currently, though Trump did hint at an exemption for Australia given plans for imports of U.S. aircraft. Canada will likely be hit hardest as it stands based on 2023 data (Figure). Canada/Mexico and Brazil eventually got exemptions in Trump’s first term and it is possible that a handful of countries could get exemptions if they make trade concessions elsewhere. Meanwhile, the adverse effects could be greater for aluminium as the U.S. still has 25% tariffs on most countries steel imports, while the U.S. also imports a greater proportion of aluminium than steel. This can all feedthrough to higher import prices, increased manufacturing costs and higher end product costs and a small/modest boost to CPI inflation and hit to growth.

What is clear is that Trump wants to move from threats to actual tariff action. Trump has indicated that reciprocal tariffs will be announced later this week across the board. For example, the U.S. has a 2.5% tariff on EU car imports, while the EU charges U.S. imports at 10%. The U.S. would then lift tariffs on Europe to 10%. This is not all bad news for individual countries, as the EU is thinking of reducing tariffs on U.S. cars to 2.5% as a bargaining tool – India’s Modi has also cut tariffs on certain goods before his visit to Trump this week. However, in aggregate reciprocal tariffs could be a boost to U.S. prices and hurt growth.

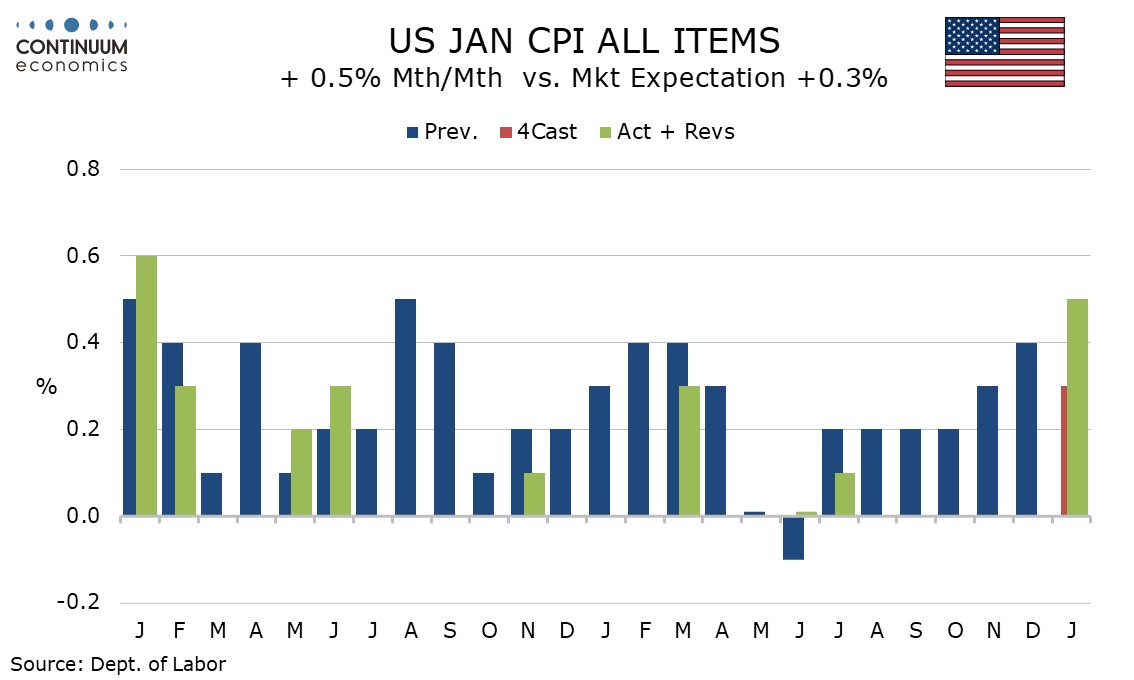

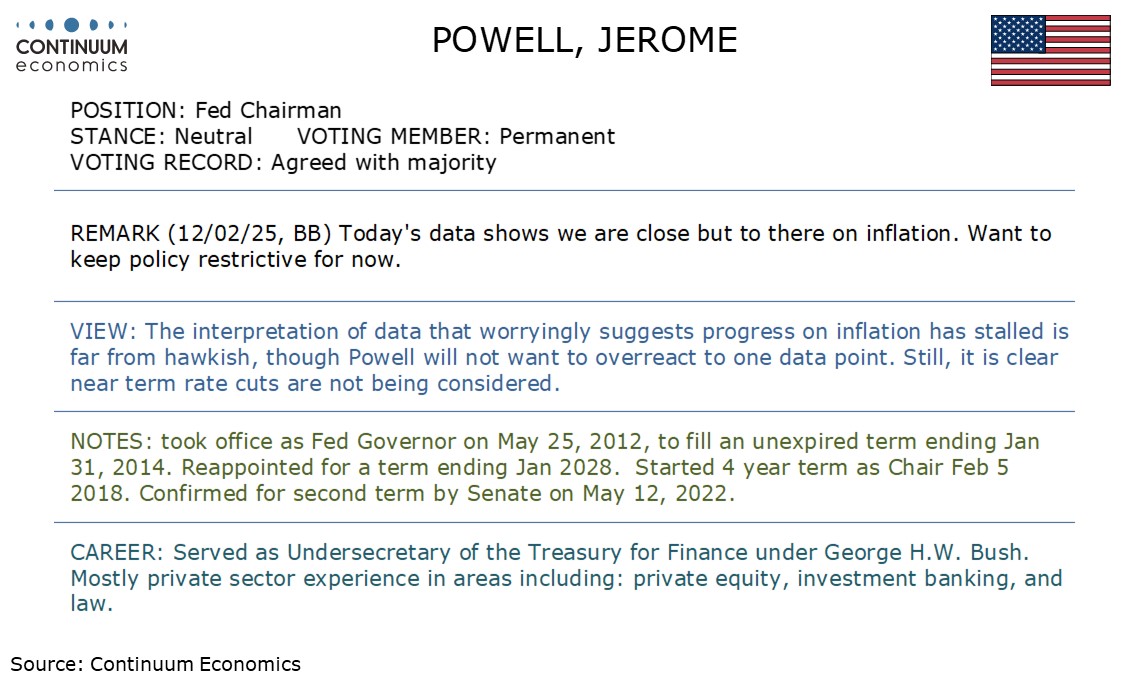

January CPI is a clear disappointment rising by 0.5% overall and 0.4% ex food and energy (0.446% before rounding). While there is a problem of residual seasonality bringing strength in Q1 data, that yr/yr rates accelerated, overall to 3.0% from 2.9%, and ex food and energy to 3.3% from 3.2%, will be particularly disappointing for the Fed. Inflation clearly remains too high, with progress appearing to stall. Energy increased by 1.1% led by a 1.8% rise in gasoline. Food rose by 0.4% with eggs surging by a massive 15.2% on the month. Explaining around half of the rise in food.

Commodities less food and energy rose by 0.3% with most components seeing moderate gains, though used autos with a 2.2% rise were particularly firm and apparel with a 1.4% decline looking erratically soft. Services less energy rose by 0.5%. Owners’ equivalent rent was in line with recent trend at 0.3% sustaining a rennet slowing though shelter rise by 0.4% lifted by a 1.4% increase in the volatile lodging away from home sector.

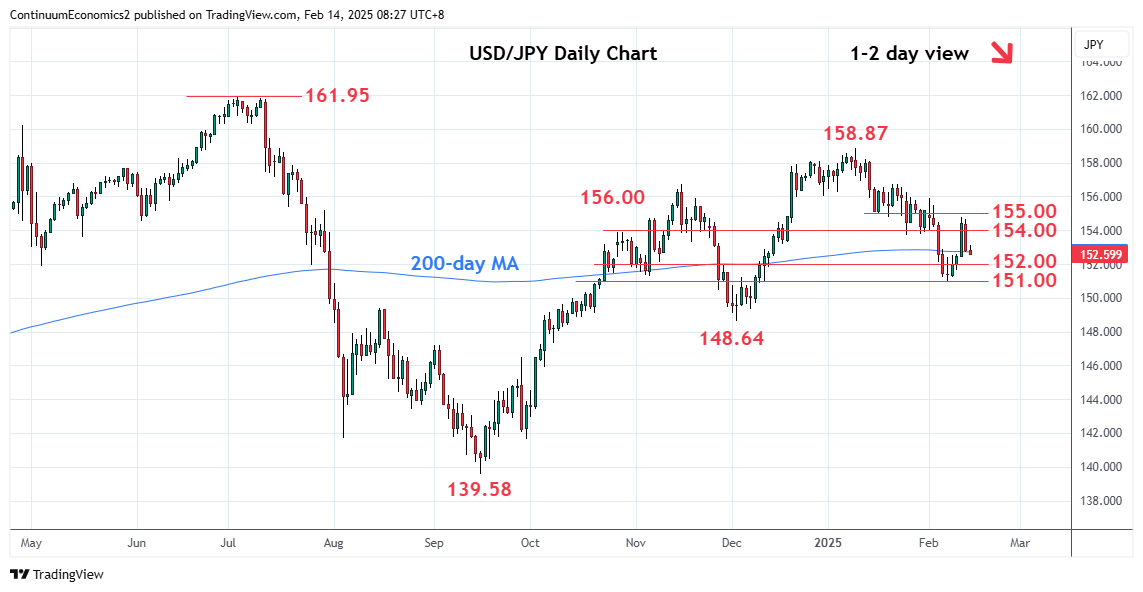

USD/JPY has seen all the ebbs and flow of Trump's tariff and market sentiment. USD initially showed strength as market participants fear the uncertainty on the reciprocal tariff from Trump, also hindering the broader risk sentiment. As Trump announced more details on his tariff plan, market participants broadly view it to be milder with some grace period for negotiation to be held, USD reverse its gains. However, most of the flows came from USD as we see the correlation with moves in U.S. Treasury Yields. 10yr JGB yields have been subtly risen to decade high and could support JPY in a short term.

On the chart, gains to approach the 155.00 level has met with selling pressure at 154.80 which corrects approximately 50% of the January/February losses. Rejection there see room for pullback to the 152.54 support then the 152.00 congestion. Below these will return focus to the 151.00 low. Break here will extend losses from the 158.87 January YTD high to the 150.45 support then the 150.00 level. Lower still will see scope to retest 148.64 low of December. Meanwhile, resistance is lowered to 154.00 congestion which should now cap and sustain pullback from the 154.80 high.

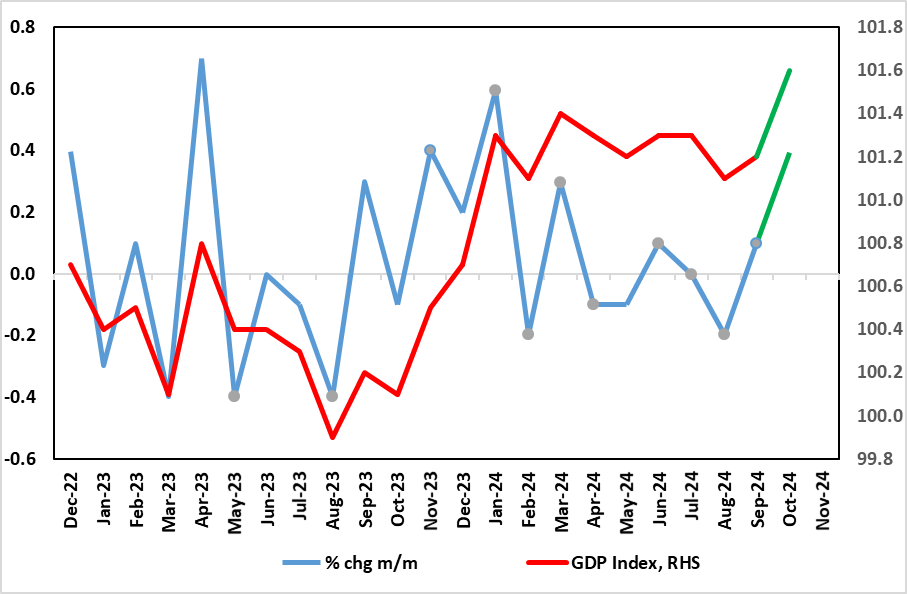

Figure: Momentum Recovering Amid Continued Downside Risks?

GDP data for the end of 2024 very much surprised on the upside albeit still failing to convey an impression of UK’s economy displaying solidity, if not strength. Admittedly GDP rose by 0.4% m/m in December, the largest such gain in 11 months (Figure) and enough to have allowed Q4 see growth of 0.1% as opposed to the largely expected same-sized fall. The data means the economy grew 0.9% in 2024 but amid what looks to be a possible involuntary rise in inventories that supported Q4 GDP and a suspect (ie survey conflicting) jump in manufacturing that boosted December numbers, we doubt that genuine fresh momentum has emerged – GDP per head actually fell. Indeed, we still see growth around 0.7-0.8% for the whole of this year, despite the looming fiscal boost that has persuaded some forecasters to upgrade their projection for the year. Instead we note the sobering message from business surveys as well as from payroll data, all more consistent with tepid growth rather than the upbeat growth aspiration of the government.

As we envisaged, November saw hardly any growth, this almost-0.1% rise came after October saw a second successive m/m drop of 0.1%, all below expectations. But the December rise changes this somewhat even though GDP has declines in half of the last eight months of data during which the economy has growth a mere 0.4%,

This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Indeed, the Q4 picture shows no growth in consumer spending and a fall in business investment and with the growth very much a result of a build in inventories, albeit this partly offset by a jump in imports.