U.S. Initial Claims remain low in payroll survey week, GDP revised higher on inventories

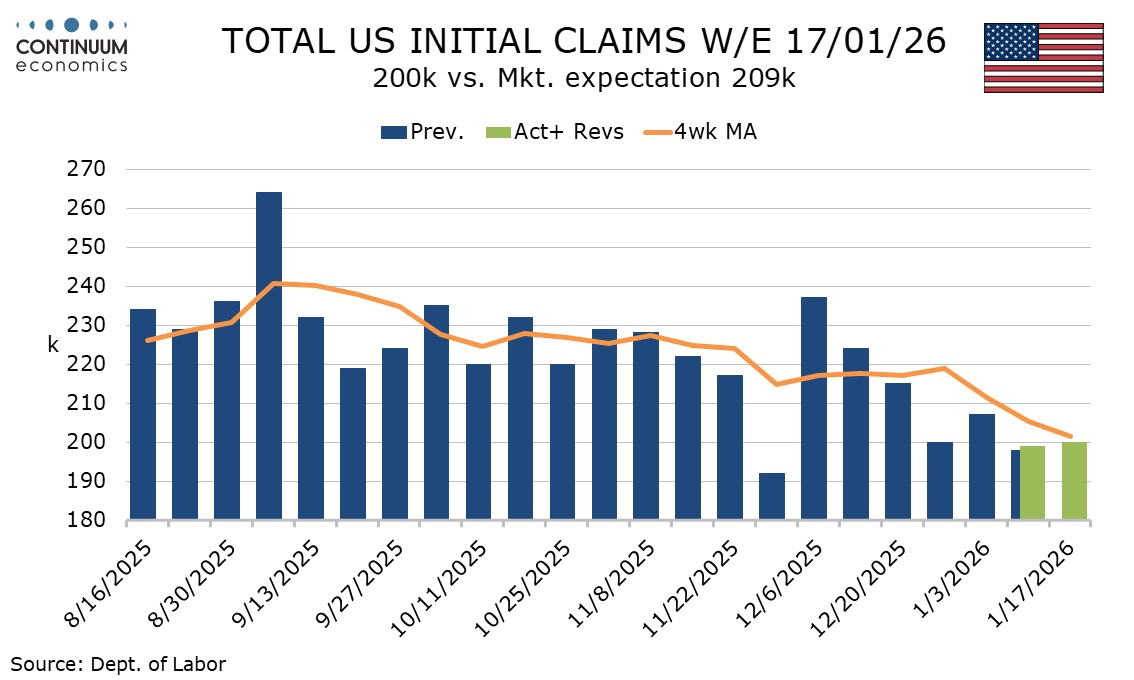

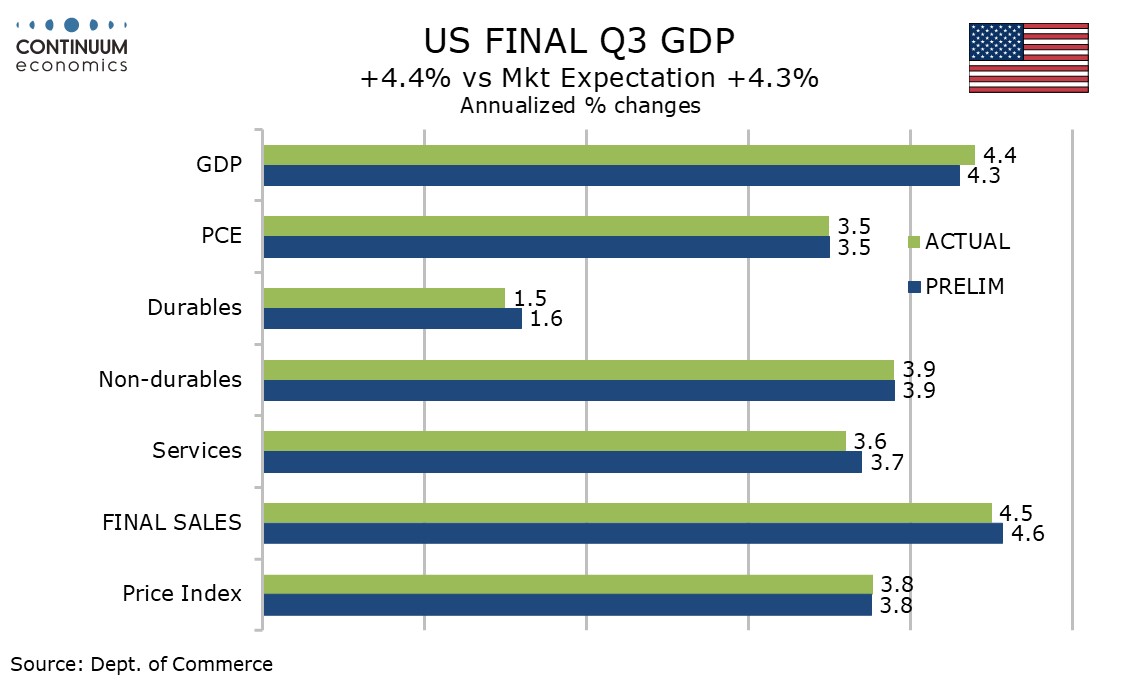

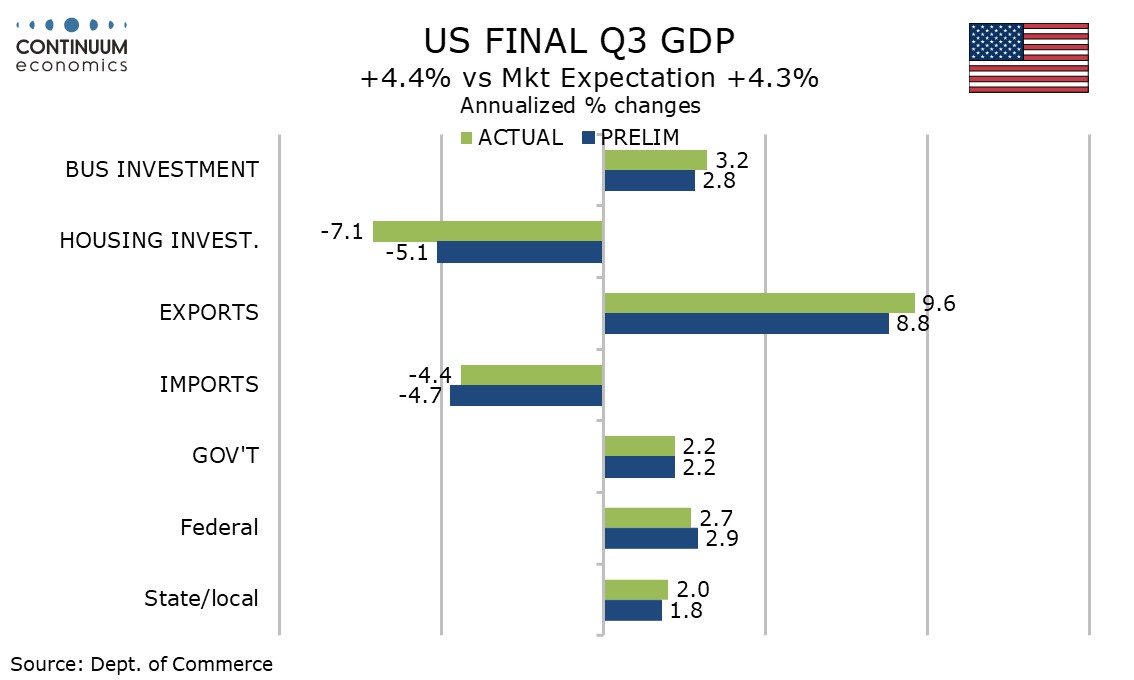

Initial claims remain low in the survey week for January’s non-farm payroll, rising by only 1k to a lower than expected 200k. The Q3 GDP revision to 4.4% from 4.3% is marginal, but is even stronger than an already strong pace.

The 4-week average for initial claims is the lowest since October 2022 and while two of those four weeks include holidays the soft data of the two subsequent weeks suggests that the low outcome in Christmas week may have been less distorted than was generally believed at the time.

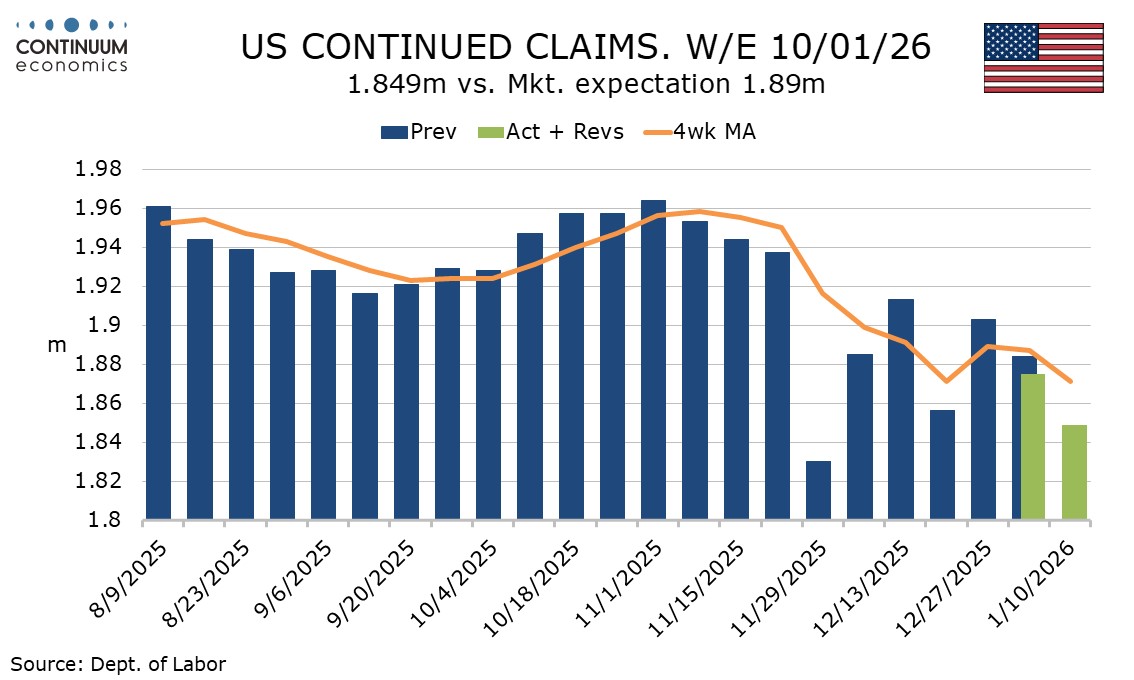

Continued claims cover the week before initial claims and are also lower than expected, falling by 26k to 1.849m. This is a 6-week low. The 4-week average of 1.871m matched that of three weeks ago and lower has not been seen since April 2025.

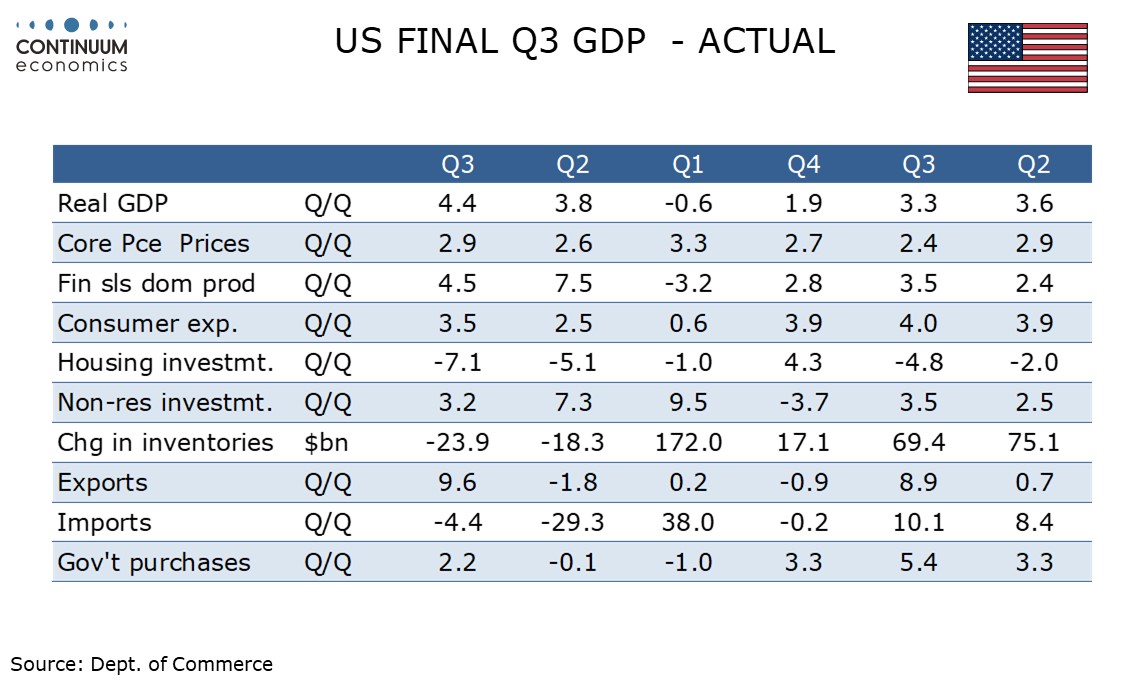

The upward revision to GDP was fully due to inventories with final sales (GDP less inventories) revised marginally lower to 4.5% from 4.6%. Consumer spending was unrevised after rounding at 3.5% but slightly lower before rounding. Housing investment was also revised slightly lower but business investment and net exports slightly higher as an upward revision to exports exceeded an upward revision to imports.

The strength of the GDP gain exceeds that for Gross Domestic income, which increased by 2,4% after a 2.6% rise in Q2 and a 1.0% rise in Q1. The swings in GDP have been smaller than those fir GDP where net exports have been very volatile. The 3-quarter average is 2.5% for GDP and 2.0% for GDI.

The key price indices are unrevised, 3.8% fir GDP, 2.8% for PCE and 2.9% for core PCE.