SEK flows: SEK little changed but upside favoured

Firmer economic tendency survey and high starting point suggests EUR/SEK downside risks

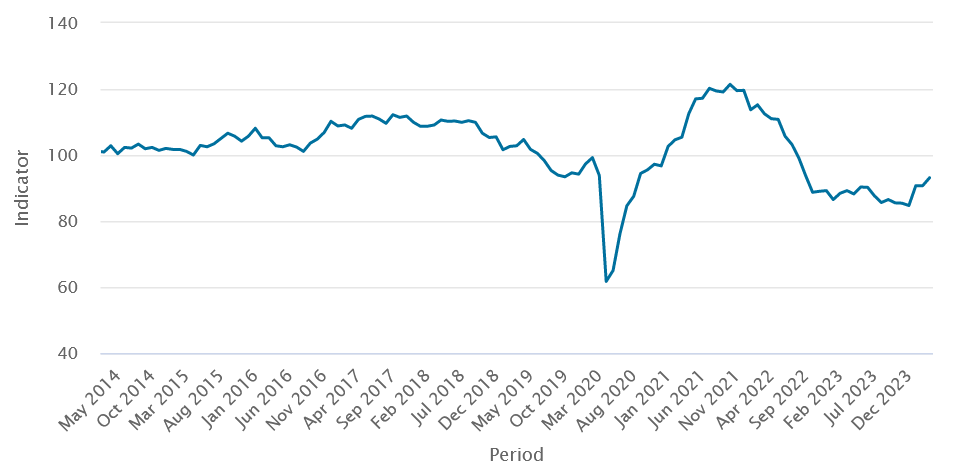

Swedish Economic tendency survey

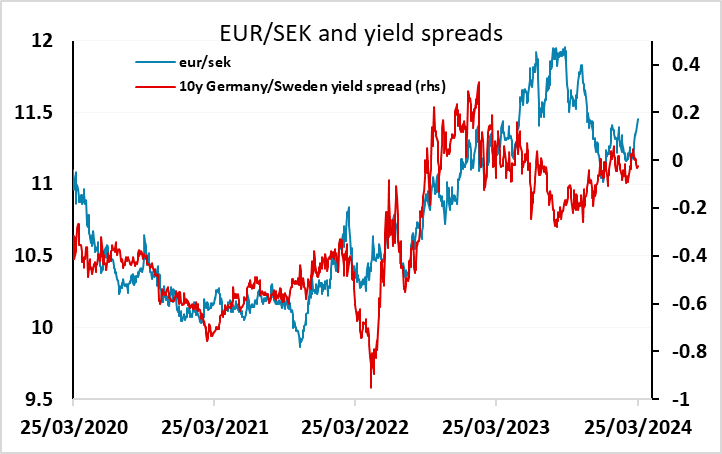

EUR/SEK isn’t much changed after this morning’s Swedish data, but the numbers do not provide any new support for a more dovish Riksbank stance. The Economic Tendency Indicator climbed 2.4 points in March from 90.7 to 93.1. The consumer and service indicators improved most, while only the construction indicator fell. The share of firms anticipating a rise in selling prices was largely unchanged from February across the business sector as a whole, but increased again in the service sector after dropping back to normal levels in February, which may be a factor weighing against early easing. Of course, the Riksbank aren’t expected to ease at tomorrow’s meeting, but the stronger data and the evidence of some inflation pressure persisting in services suggests that the May meeting, which is currently seen as offering a slightly better than 50-50 chance of a cut, might also prove too early. It’s far from being conclusive, and EUR/SEK is not much changed while front end Swedish yields are just a tad higher, but given the starting point of EUR/SEK being on the high side of the levels suggested by yield spreads, there ought to be some downside risks form here.