SEK, NOK flows: EUR/SEK steady after GDP, NOK/SEK upside risks

EUR/SEK fairly steady after Q4 Swedish GDP data shows Sweden edging out of recession

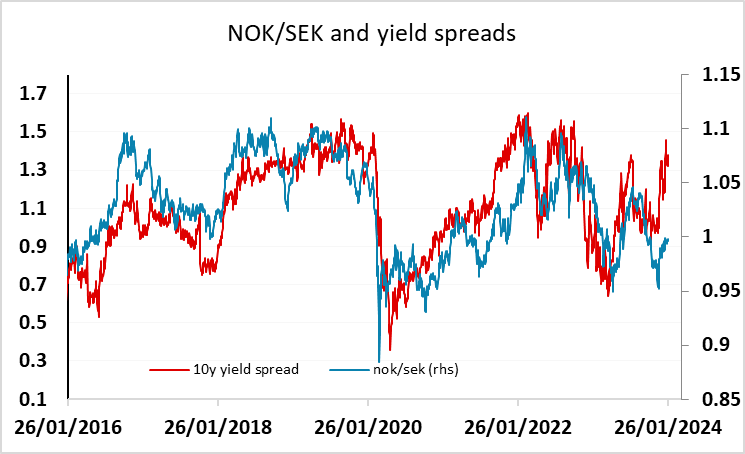

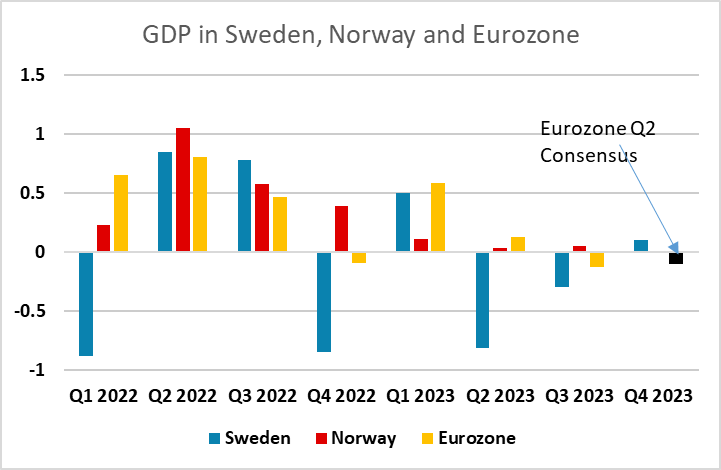

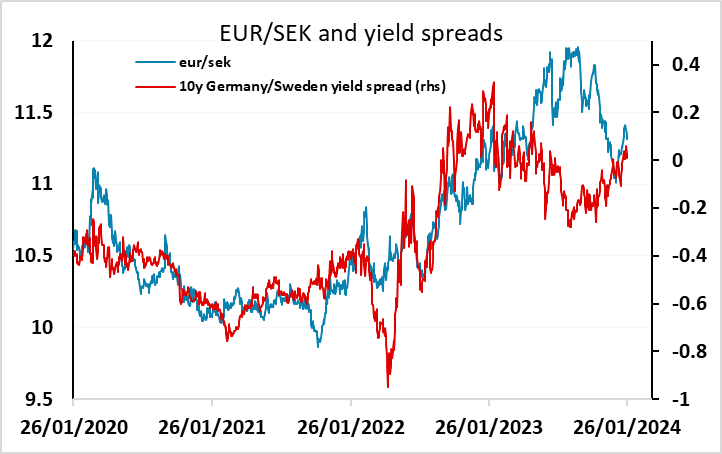

Swedish Q4 GDP came in lower than expected at 0.1% this morning. This is still an improvement on the negative numbers in Q2 and Q3, and there hasn’t been a significant SEK reaction. EUR/SEK continues to look close to fair based on the historic yield spread relationships, but we continue to see upside scope in NOK/SEK, which last week popped back above parity for the first time since October, and looks to have potential to at least 1.05 based on the normal yield spread relationship. While this morning’s Norwegian credit indicator for December was once again weak, showing the lowest y/y growth since the 1990s, and suggests the economy will continue to struggle to grow in the coming quarters. Norway has so far managed to hover just above zero growth and avoid recession, and weak money and credit data is being seen everywhere.

The focus for the SEK now is on Thursday’s Riksbank decision. It is ever clearer that the Riksbank has finished its hiking, this borne out by the unchanged policy decision last month and by the same decision due this time around. The question now turns to policy easing. Recent data have continued to be been mixed, but the much weaker underlying inflation picture and growing weakness in bank lending and deposits have argued for the policy rate staying at the 4.0% level it rose to in September. Indeed, they argue for an easing in policy, something we think may occur in by the next quarter, this made all the more possible by the more frequent Board meetings that the Riksbank Board has reverted to. This could be a trigger for more SEK weakness against the NOK, with the Norges Bank likely to lag in the rate cutting stakes, although the Riksbank may co-ordinate better with the ECB suggesting downside risks for EUR/NOK as well as upside risks for NOK/SEK.