Published: 2025-04-28T18:56:05.000Z

USD flows: Asymmetrical data risk

2

The US has a heavy data calendar this week, Q1 GDP on Wednesday and April non-farm payroll on Friday being the highlights. Tomorrow sees advance goods trade and job openings for March and consumer confidence for April.

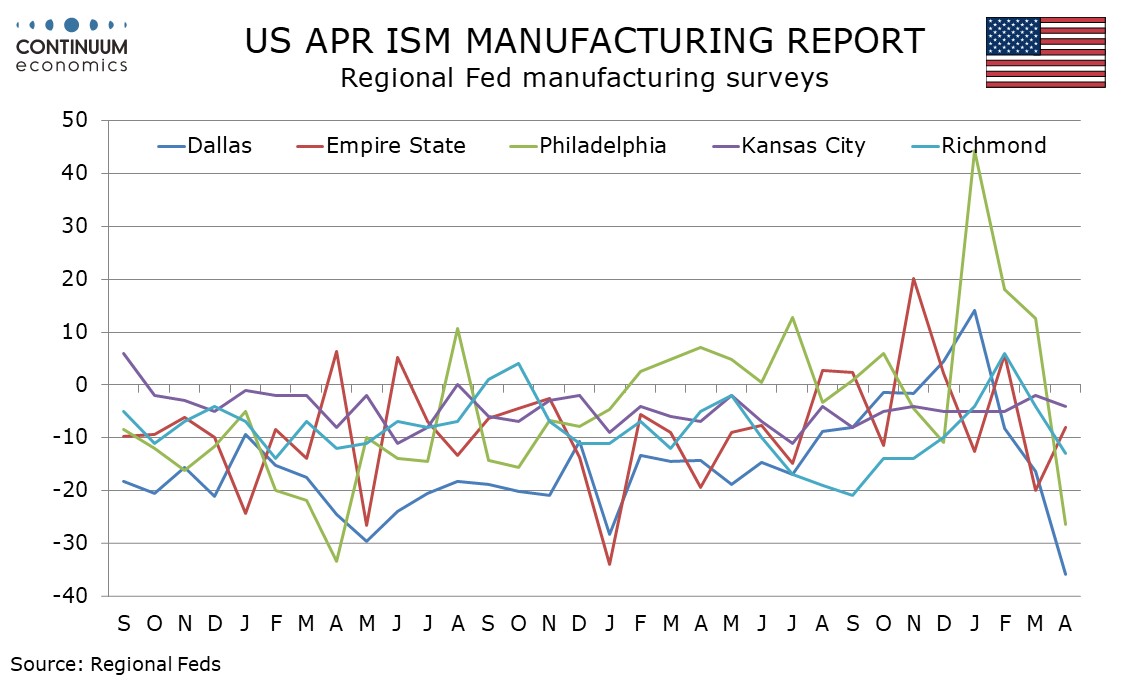

Any weakness in the data is likely to be seen as a warning of more weakness to come, while resilience is unlikely to be seen as signaling continued resilience in the months ahead. That leaves a weak USD tone, with equities struggling and UST yields slipping, as easy to justify. The one data release today, a Dallas Fed manufacturing index of -35.8 in April versus -16.3 in March, was very weak indeed.