Published: 2026-01-15T16:00:04.000Z

Preview: Due January 23 - U.S. January S and P PMIs - Rebounding after December dips

4

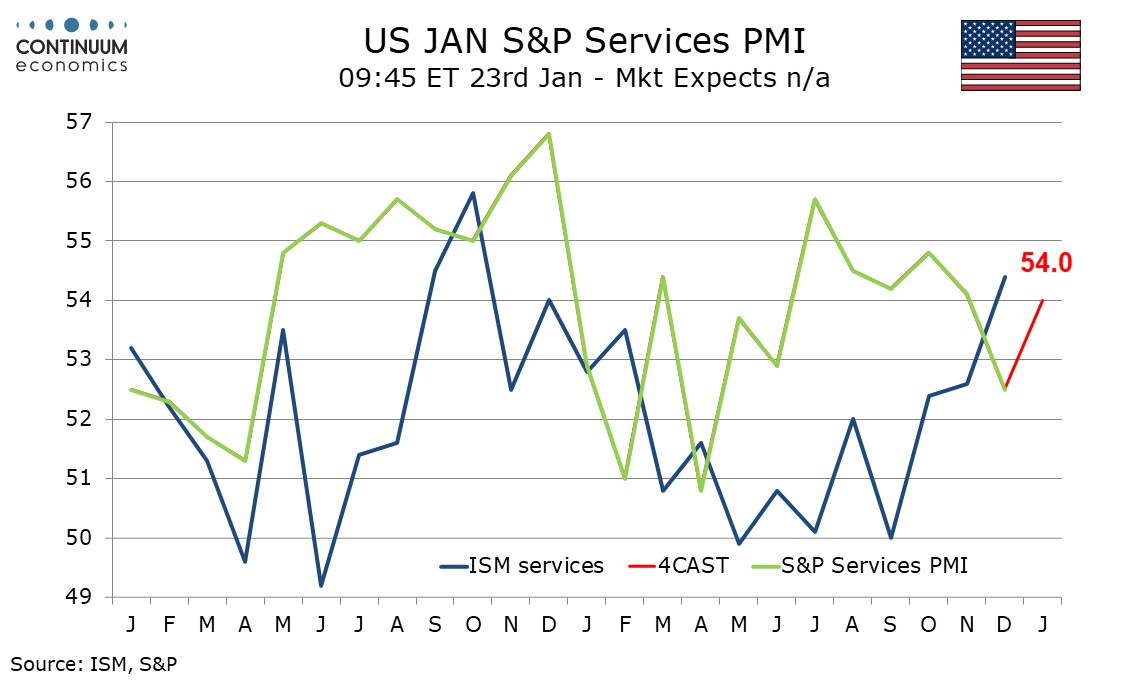

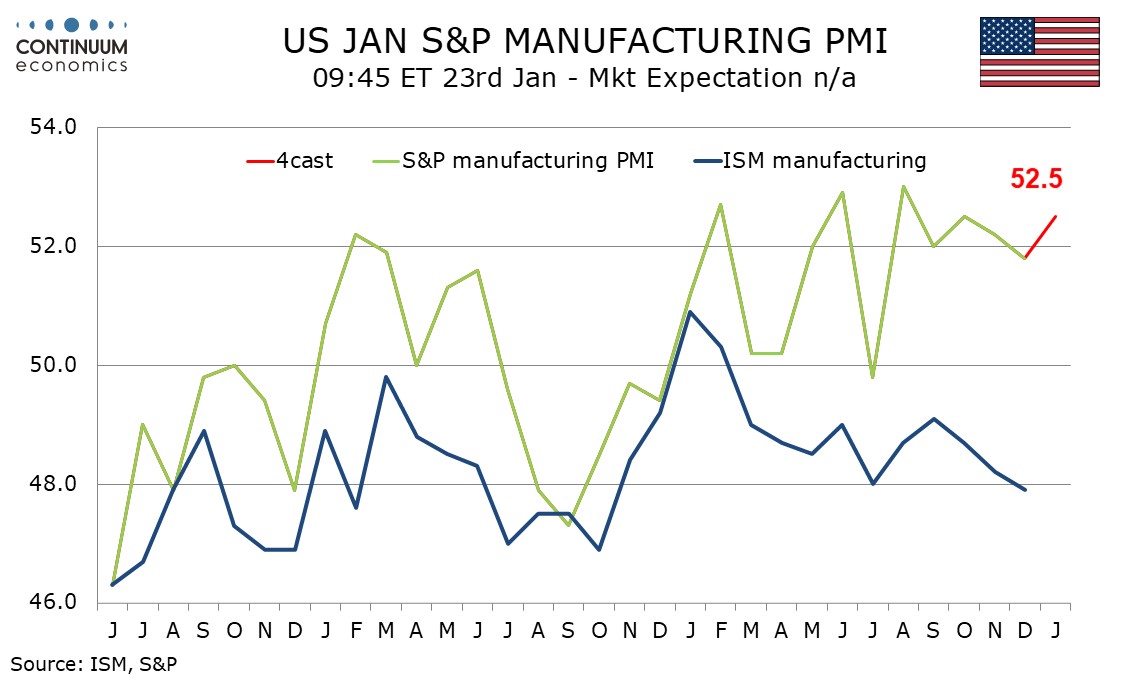

We expect some improvement in January’s S and P PMIs, largely reversing slippage in December, manufacturing to 52.5 from 51.8 and services to 54.0 from 52.5.

Signaling a stronger manufacturing index are bounce backs above neutral from the Empire State and Philly Fed manufacturing surveys. December’s ISM manufacturing index however gives a less positive signal, having slipped to its lowest level since October 2024. Our forecast for January’s S and P manufacturing index would be the highest since July.

The S and P services PMI slipped to its lowest level since February in December which contrasted a third straight increase in the ISM services index to 54.4, its highest level since October 2024. The ISM and S and P service indices are not well correlated, but it is likely that the December S and P weakness will prove erratic. A rebound to 54.0 would put it close to November’s reading of 54.1.