Published: 2025-07-11T17:03:11.000Z

Preview: Due July 31 - Canada May GDP - Another decline, but June may see a bounce

4

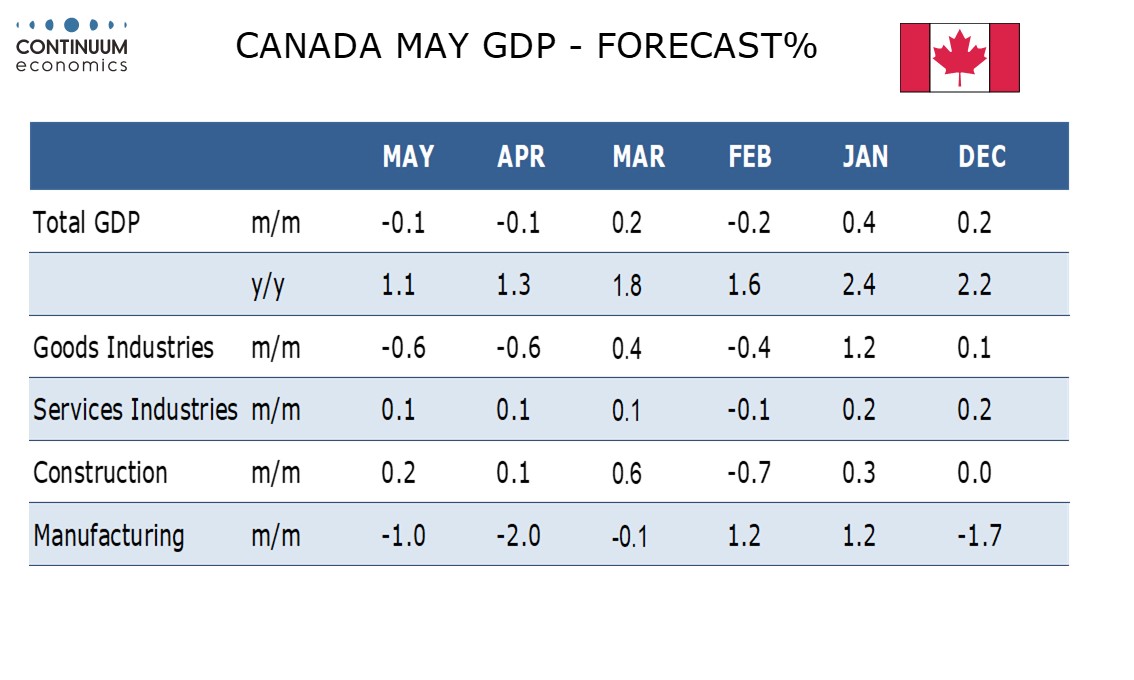

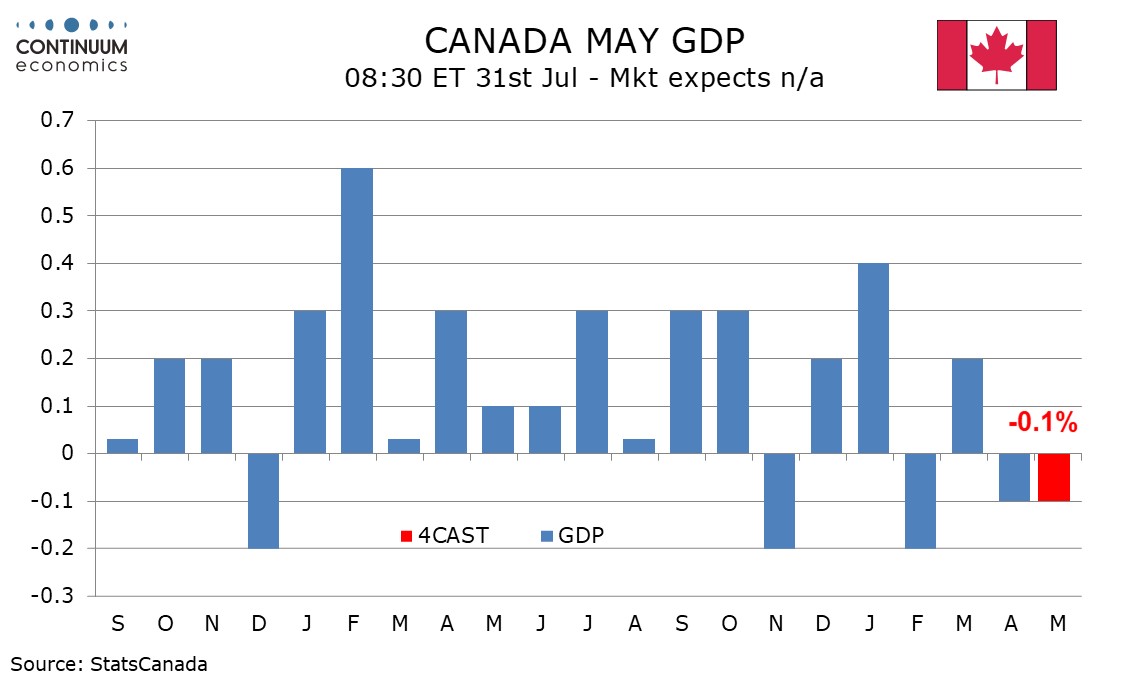

We expect Canadian GDP to see a second straight 0.1% decline in May, consistent with the preliminary estimate made with April’s report. However strong June employment growth hints that June’s preliminary estimate could be positive, we expect by 0.1%. This would leave Q2 GDP flat to marginally negative.

Yr/yr GDP growth at 1.1% from 1.3% in April would be the slowest since March 2023. We expect the monthly detail of May’s breakdown to look similar to April’s, with a second straight 0.6% decline in goods and a third straight 0.1% increase in services.

In the goods detail manufacturing is likely to remain negative but less so than in April, while mining is set to see a decline after a flat April. Services are expected to see a rise in real estate, rental and leasing but slippage in retail and public administration.