Published: 2024-01-25T16:09:32.000Z

Preview: Due January 26 - U.S. December Personal Income and Spending - Q4 totals to be confirmed, PCE prices seen softer than CPI

Senior Economist , North America

-

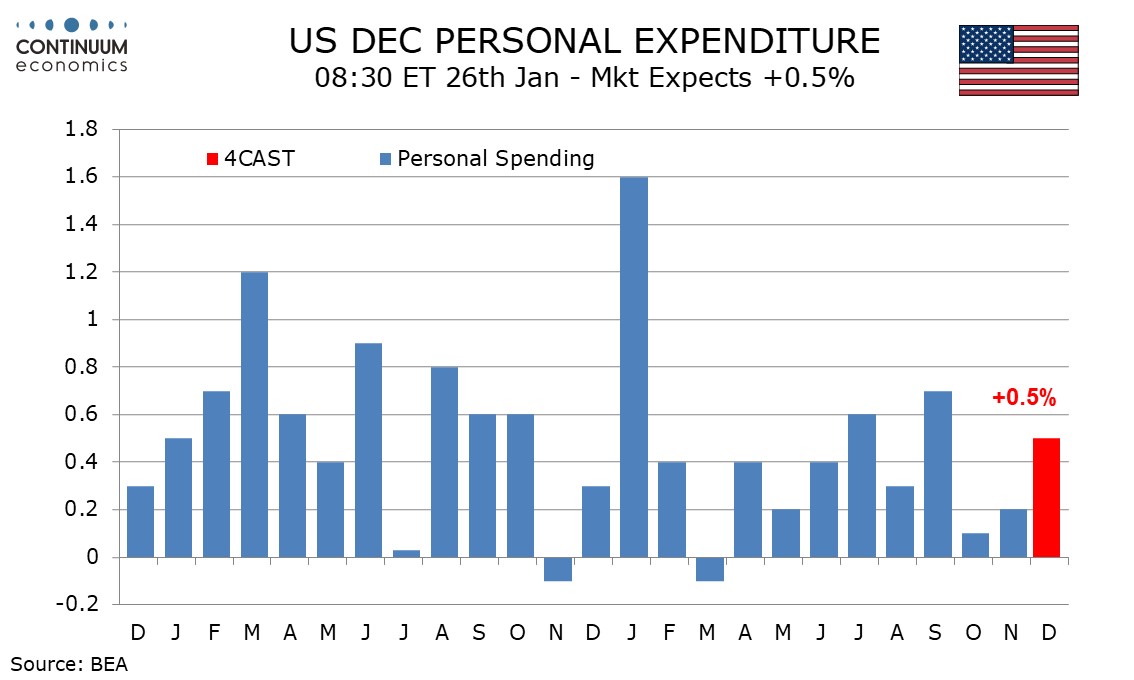

December’s personal income and spending report will be largely old news with Q4 totals already seen in the GDP report. The Q4 totals are consistent with our forecasts for a 0.2% gain in core PCE prices and a 0.3% gain in personal income, though imply a 0.7% gain in personal spending, above. 0.5% is still possible if October and November are revised higher.

CPI increased by 0.3% in December, both overall and ex food and energy, but recently CPI has been outperforming PCE price data, where we expect December gains of only 0.2% both overall and ex food and energy.

In fact we expect the December PCE gains to be marginally below 0.2% both overall and ex food and energy before rounding even though CPI gains were very marginally above 0.3% in both series. Yr/yr PCE prices would then remain at 2.6% but the core rate would slow to 2.9% from 3.2%.

In the personal income detail we expect a 0.4% rise in wages and salaries with a dip in the workweek weighing against strong gains in employment and average hourly earnings. We expect the other components of personal income to be in line with trend, after a weak November corrected a strong October.

Retail sales increased by 0.6% in December but we expect a slightly slower 0.4% rise in services, with real spending in services increasing by 0.2% for a fourth straight month. The GDP detail is consistent with our services view, with non-durables being the main source of the Q4 beat. This could easily come at least in part from upward revisions to October or November.