GBP flows: GBP softer after BoE

Makrets see BoE comments as dovish despite unchanged 7-2 vote

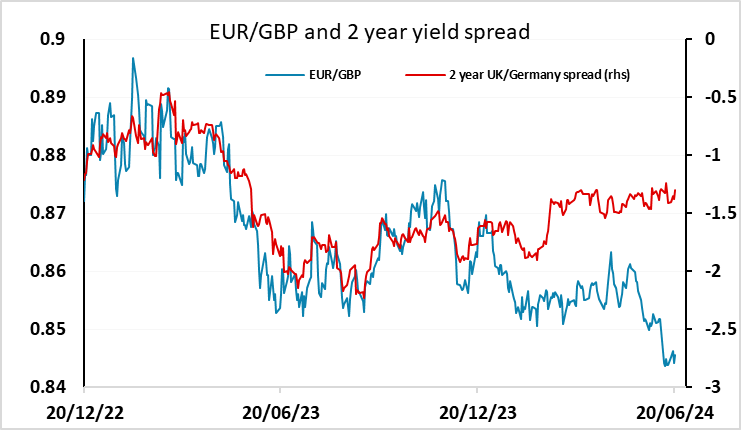

The BoE left rates unchanged as expected with the vote staying at 7-2. There were not a lot of clues in the statement in the likelihood of an August rate cut, but the market has taken the statement as dovish, with the probability of an August cut in rates rising to near 40% from 20%. The dovish reaction may be due to the statement that the higher than expected services inflation reflected factors that would not push up medium term inflation. But on the basis of yield spreads, there is already plenty of justification for EUR/GBP to recover. A more significant recovery will require some fading of EUR concerns related to the French election and/or more evidence that the BoE will be able to cut in August. We mildly favour the EUR/GBP upside, but don’t expect much progress before the French elections on June 30/July 7. The UK election looks less likely to have much impact, as a comfortable Labour majority is fully expected.