SEK flows: SEK slightly higher after GDP

Swedish GDP stronger than expected due to inventories. SEK mildly firmer but further upside potential seen

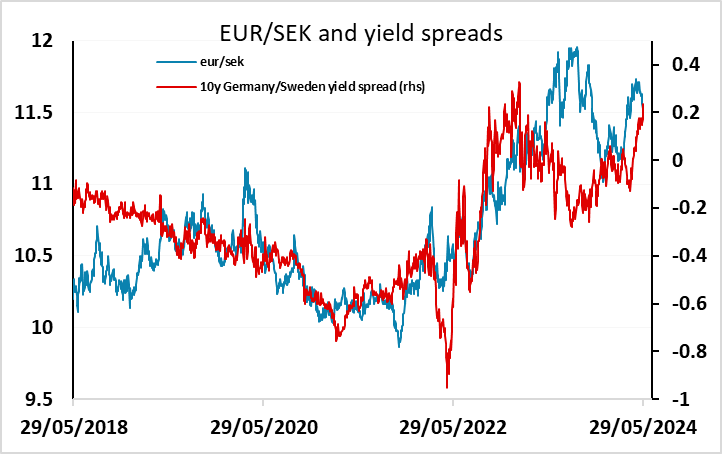

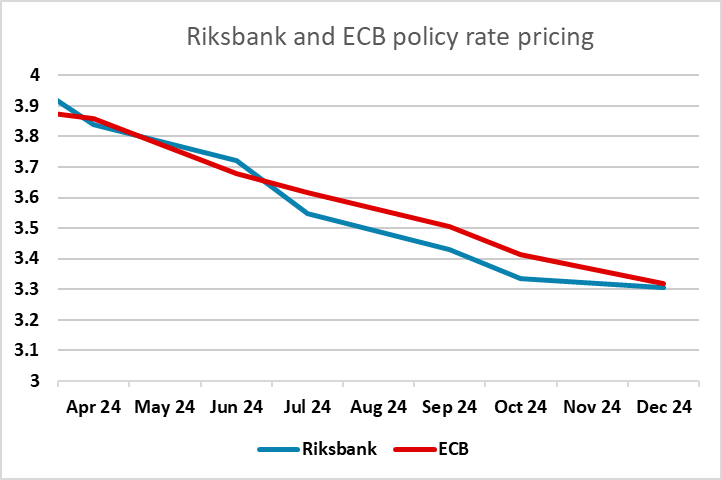

Swedish Q1 GDP data has come in much stronger than expected at 0.7% q/q, but has so far had only a very modest impact on the SEK, with EUR/SEK down slightly to 11.53 after gaining ground in late Asia. The lack of reaction is down at least in part to the fact that most of the strength was due to a rise in inventories, which added 0.5% to GDP on the quarters, while household consumption fell 0.3%. Even so, this adds more weight to the recent indication from Riksbank governor Theeden that a June rate cut was very unlikely. Since this is currently priced as around a 45% chance, there is plenty of scope for front end SEK yield gains. We consequently see scope for EUR/SEK to decline below 11.50, especially since the EUR curve is pricing in only two rate cuts this year, which looks very conservative in the light of the recent comments from ECB council members and the declining trend in Eurozone inflation.