U.S. Initial Claims show strong labor market, Housing Starts and Permits resilient, but Philly Fed still weak

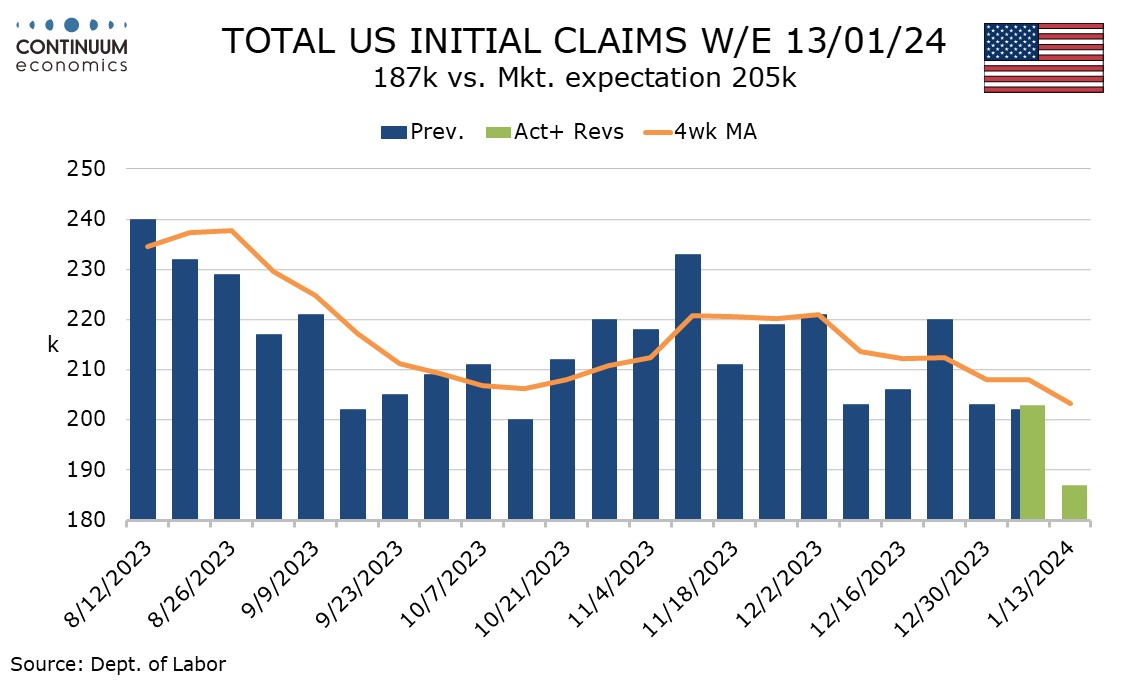

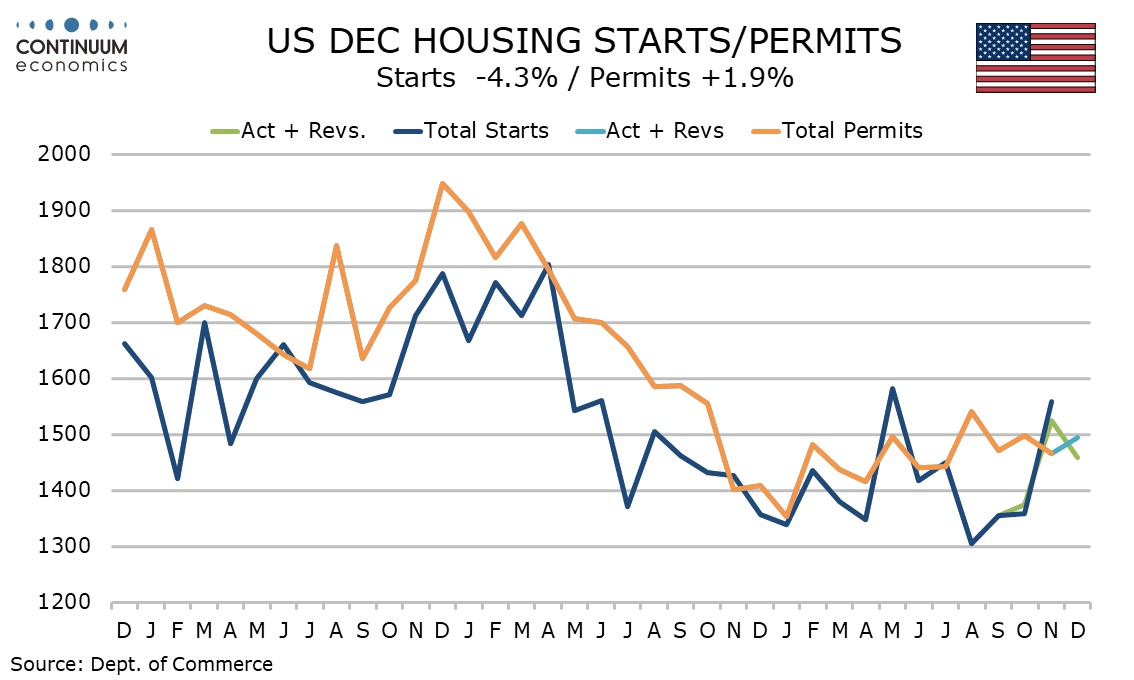

The latest US data provides more evidence of strength than weakness, with initial claims at 187k from 203k the lowest since September 2022, and housing starts, -4.3% to 1460k, and permits, +1.9% to 1495k, both stronger than expected. However the Philly Fed manufacturing survey at -10.6 from -12.8 remains weak.

The latest initial claims data covers the survey week for January’s non-farm payroll and even if the latest fall proves erratic the 4-week average of 207.5k is at a 13-week low.

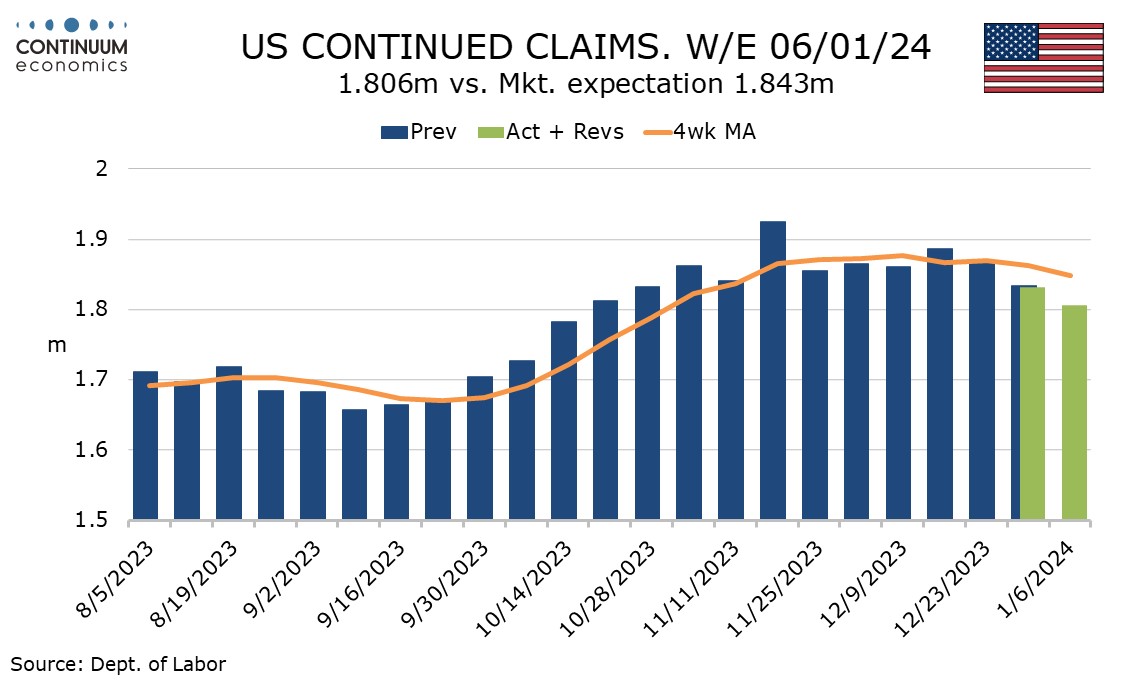

Continued claims at 1.806k from 1.832k are at their lowest since October 28, but cover the week before initial claims. The data hints at upside non-farm payroll risks but recent harsh weather may be a downside risk. Still, underlying strength in the labor market appears to persist.

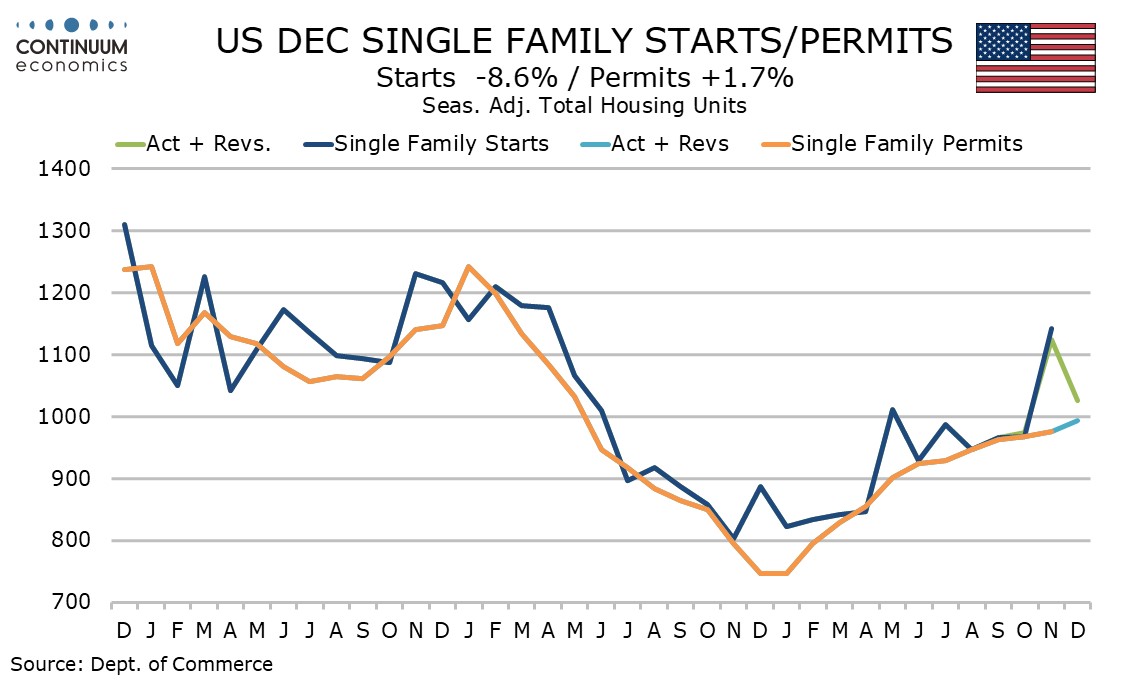

December’s 4.3% fall in housing starts follows a rise of 10.8% in November. Singles fell by 8.6% after a 15.4% November rise while multiples, usually the more volatile component, rose by 8.0% after a 0.2% decline.

December’s 1.9% permits increase does not quite reverse November’s 2.1% decline but singles rose by 1.7%, an eleventh straight gain, showing that trend remains positive despite recent weakness in home sales. Multiple permits rose by 2.2% after a 7.4% November decline.

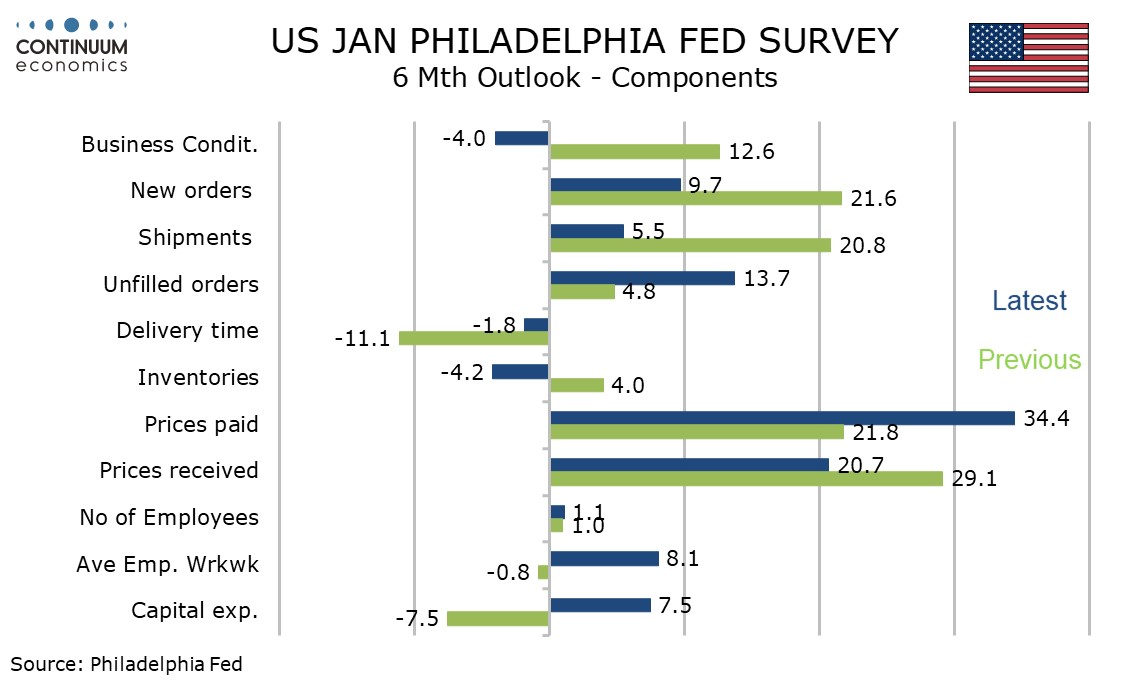

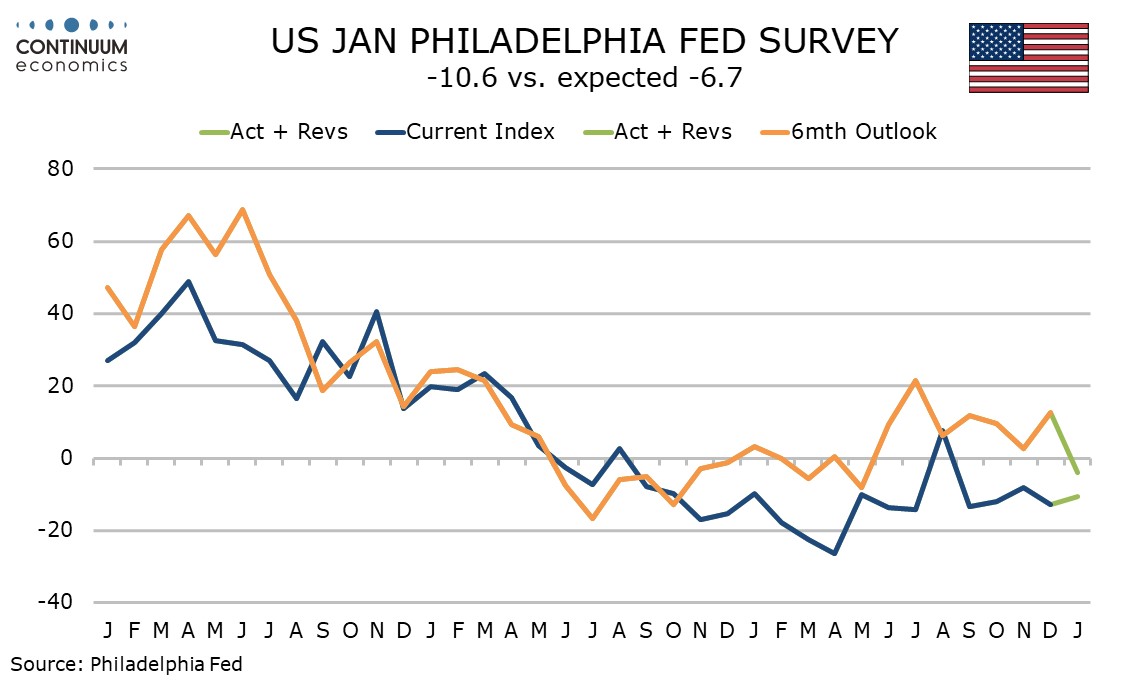

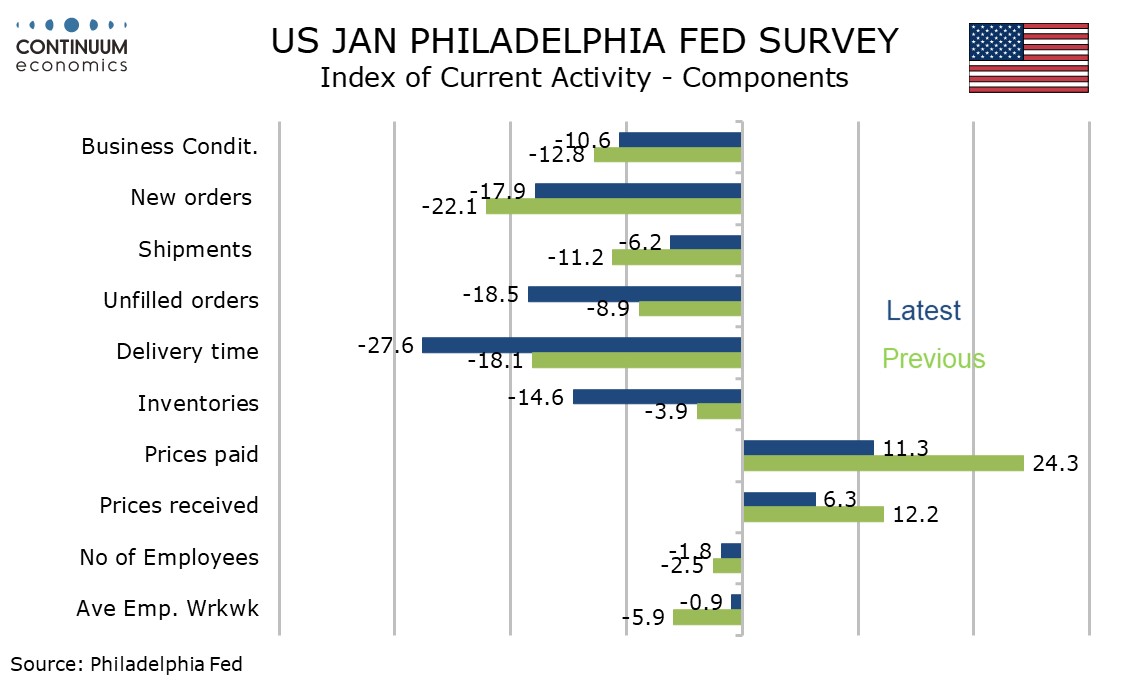

January’s Philly Fed support our view that the Empire State survey’s exceptional weakness yesterday is likely to prove erratic, but suggests a clearly negative picture persists. Most components of the current month breakdown remain negative if a little less so than in December.

Six month expectations on activity are a clear disappointment, falling to -4.0, and the first negative since May, from 12.6 in December.

Price data was softer, prices paid at 11.3 from 24.3 the lowest since April and prices received at 6.3 from 12.2 the lowest since June. 6 month expectations were firmer for prices paid but softer for prices received.