U.S. Initial Claims rise may have multiple explanations, GDP revision sees core PCE prices higher, Durables rise on aircraft

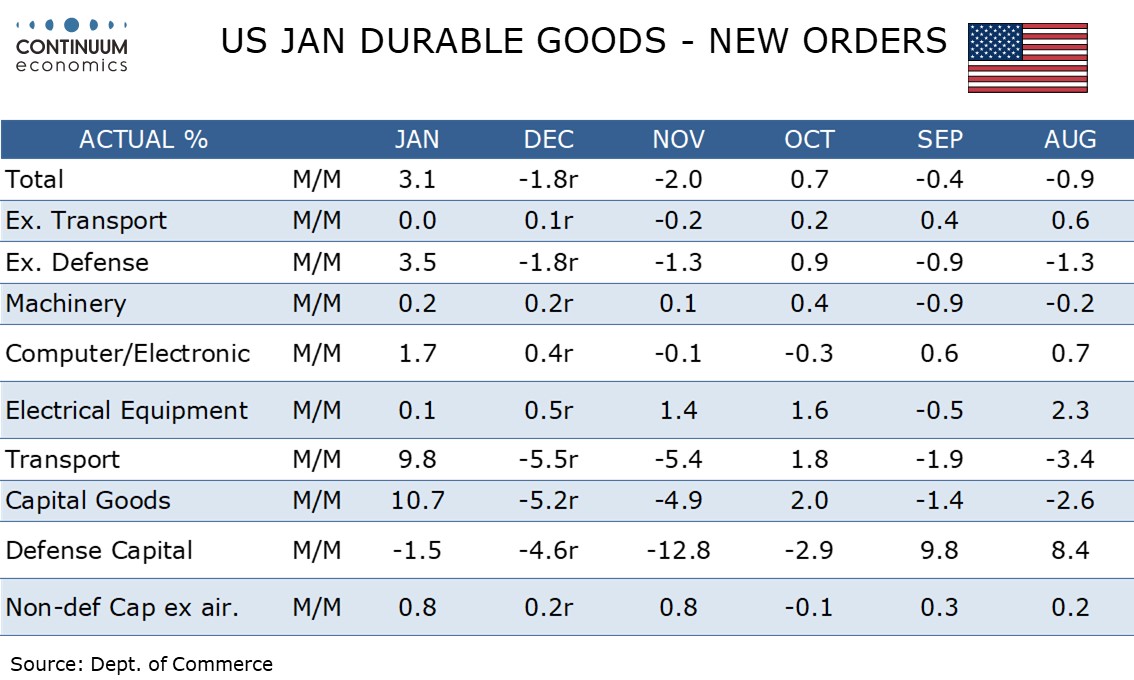

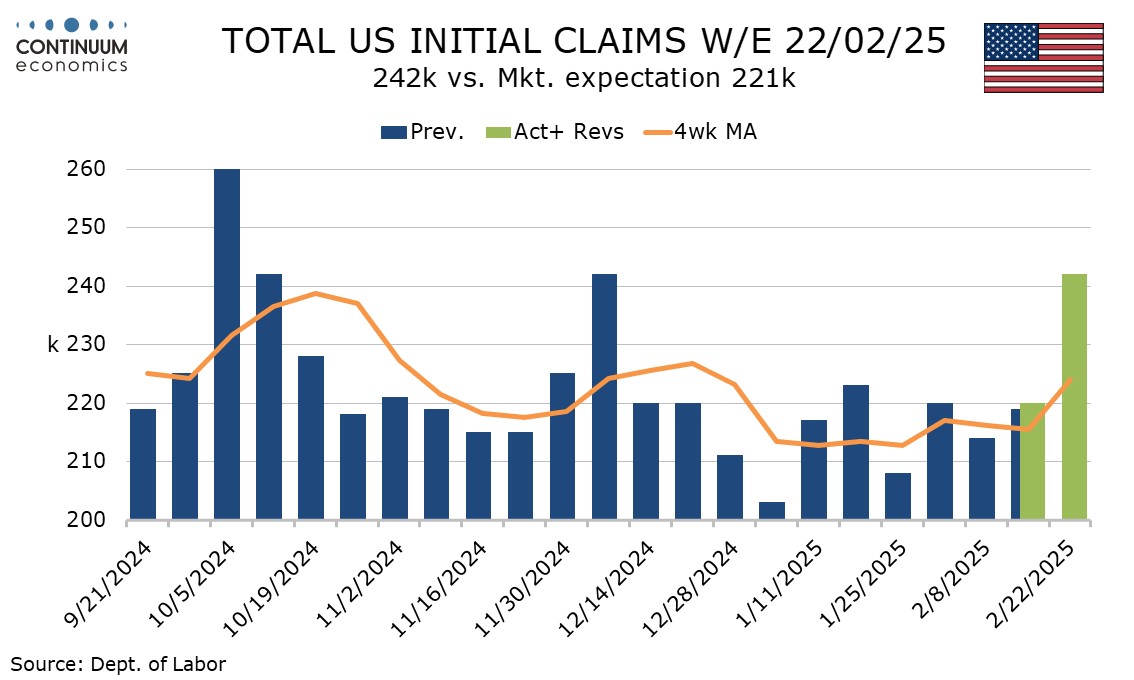

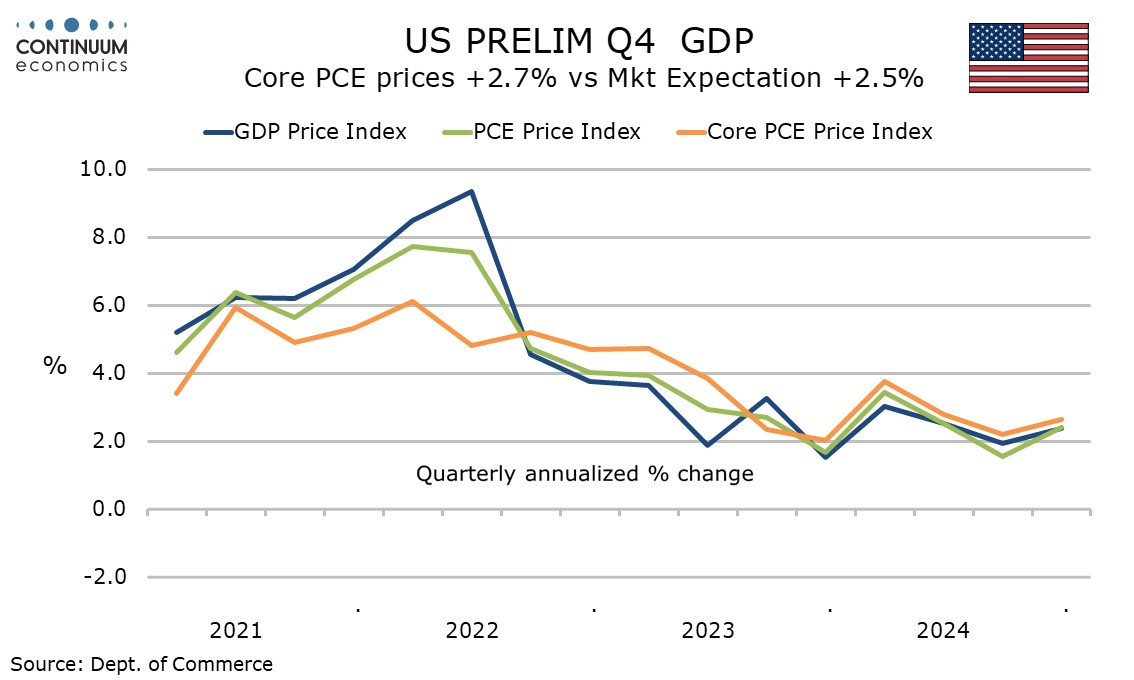

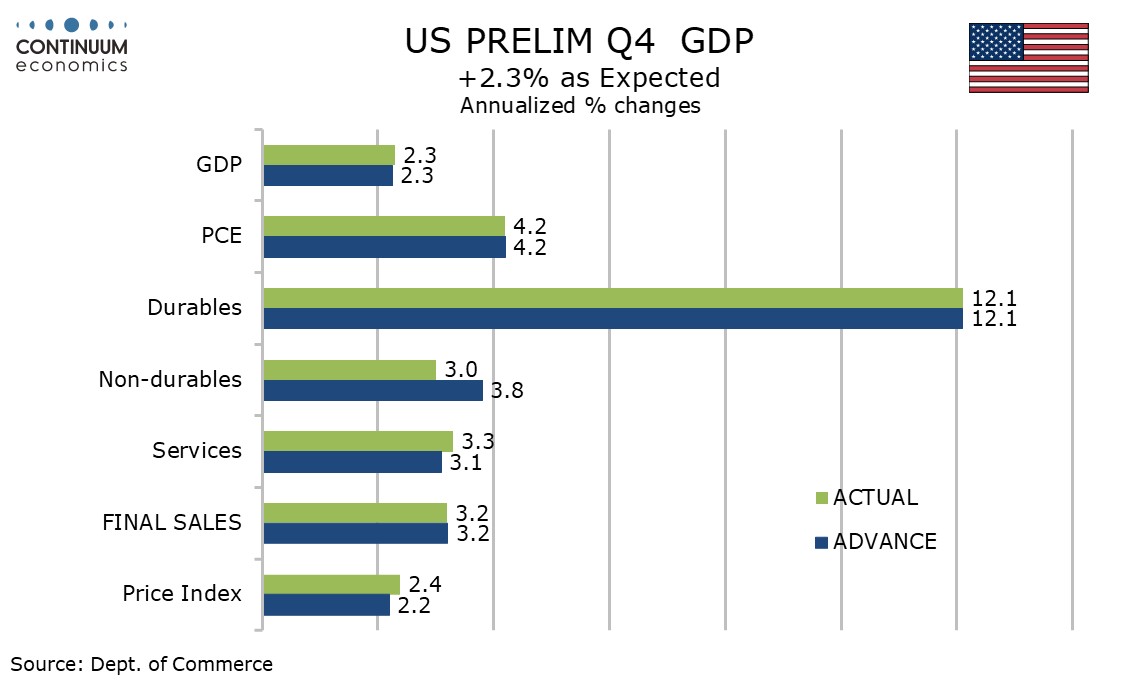

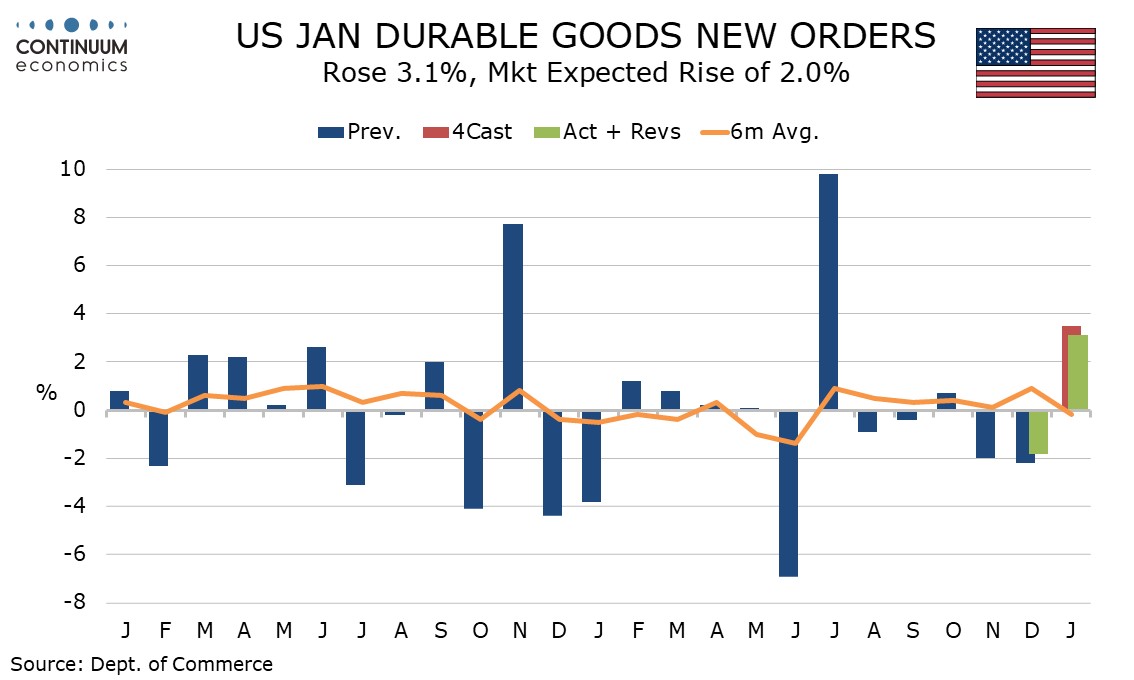

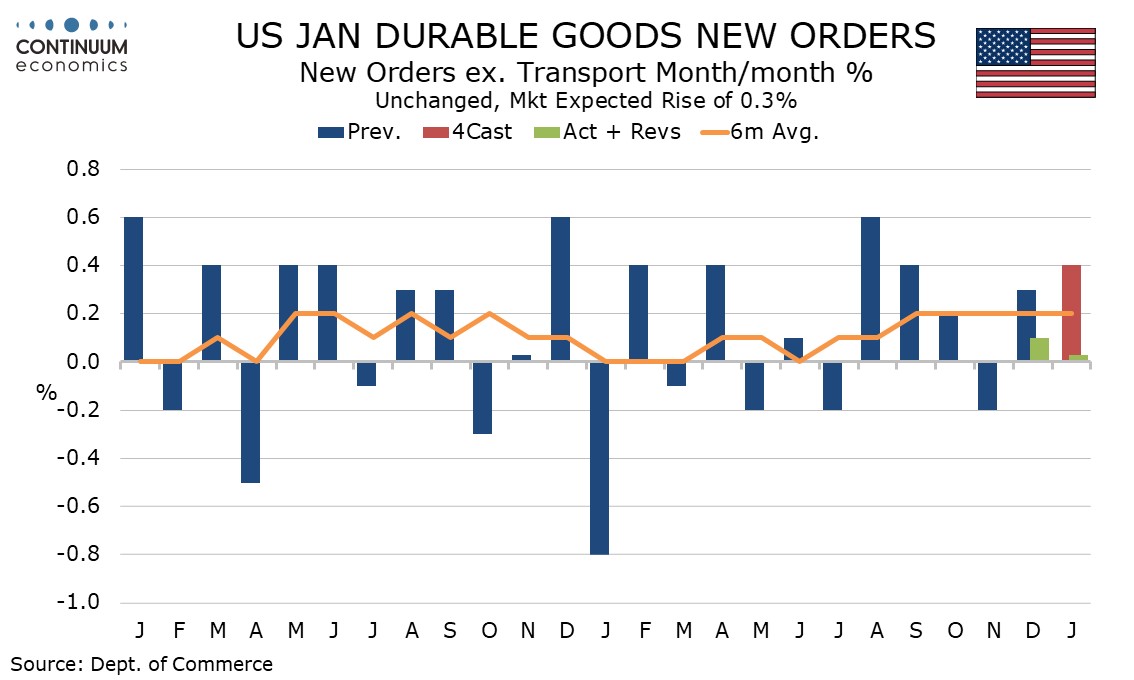

A sharp rise in initial claims to 242k from 220k is likely to have been influenced by Federal Government layoffs, though weather and seasonal adjustments may also have played a part. Q4 GDP was unrevised at 2.3% but core PCE prices were revised up to 2.7% from 2.5%. A 3.1% rise in January durable goods orders was led by aircraft, with ex transport orders unchanged.

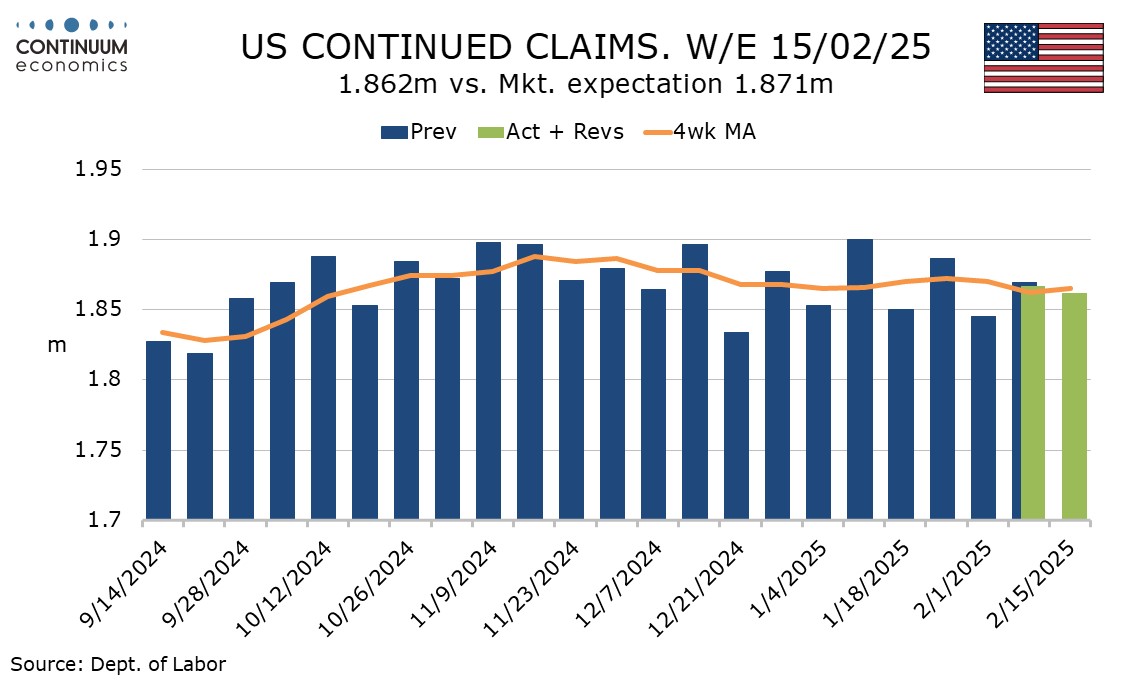

The latest initial claims data covers the week after February’s non-farm payroll was surveyed. Continued claims, covering the week before initial claims and this the payroll survey week, fell by 5k to 1.867m.

Federal Government layoffs ate not the only possible factor behind the sharp rise in initial claims, with much of the country having experienced exceptionally cold weather during the week and the Presidents Day holiday adding to the risk of seasonal adjustment difficulties.

Before seasonal adjustment initial claims fell by 3k to 220.5k in the week. There is no clear sign in the unadjusted state breakdown of major Federal layoffs, though DC saw a 0.4k rise in claims when the overall unadjusted number was down. No state saw a move as high as 4k in either direction.

The upward revision to core PCE prices is disappointing and makes the likelihood of January’s core PCE price index being not as high as January’s 0.5% core CPI less of a relief. Inflation remains higher than the Fed would like.

Overall GDP was unrevised at 2.3% but the details are not constructive, with inventories and government revised up and business investment revised down. The upward revision to inventories was modest but stronger government may not persist under Trump while lower business investment could persist due to rising uncertainty.

Government was revised up to 2.9% from 2.5% but business investment revised down to -3.2% from -2.2%. Consumer spending was unrevised and still strong at 4.2%.

That January durable goods orders showed a 0.8% rise in non-defense capital orders ex aircraft can however be seen as a positive for business investment despite ex transport orders being unchanged. There has been little movement in ex transport orders now for four months, and that is disappointing given improving ISM manufacturing data.

Overall orders rose by 3.1% with ex defense up by 3.5%. With autos negative the rise in transport was more than fully explained by civil aircraft, with Boeing data picking up as the company recovers from a recent strike.