U.S. Initial Claims bounce a warning rather than a clear change of trend

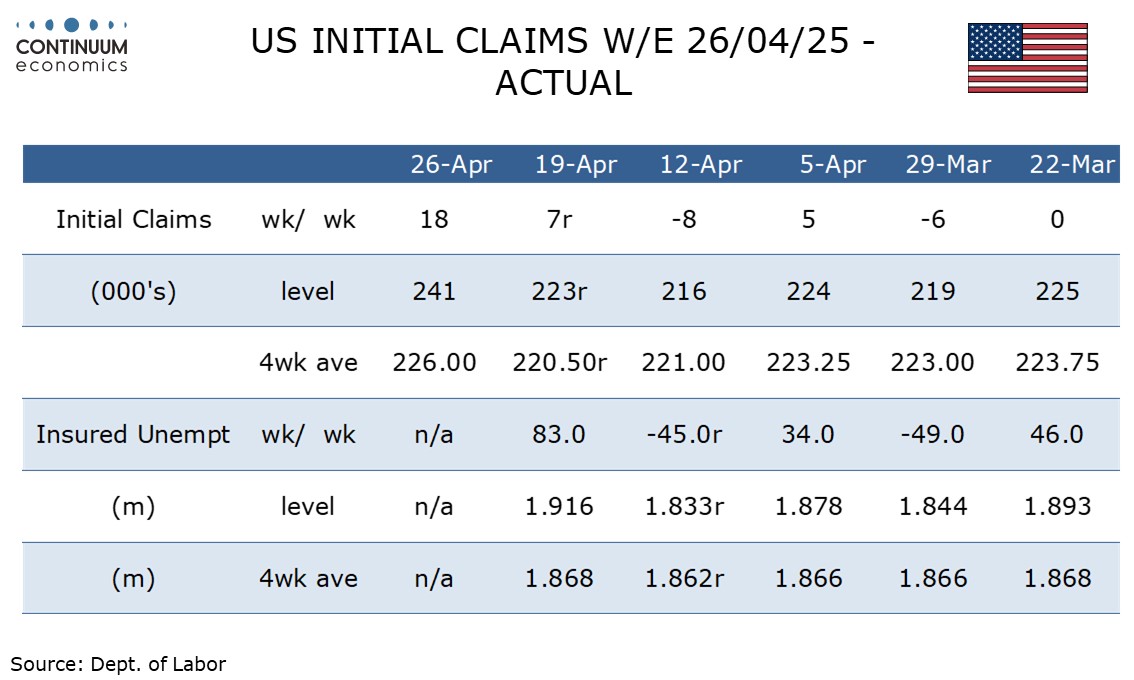

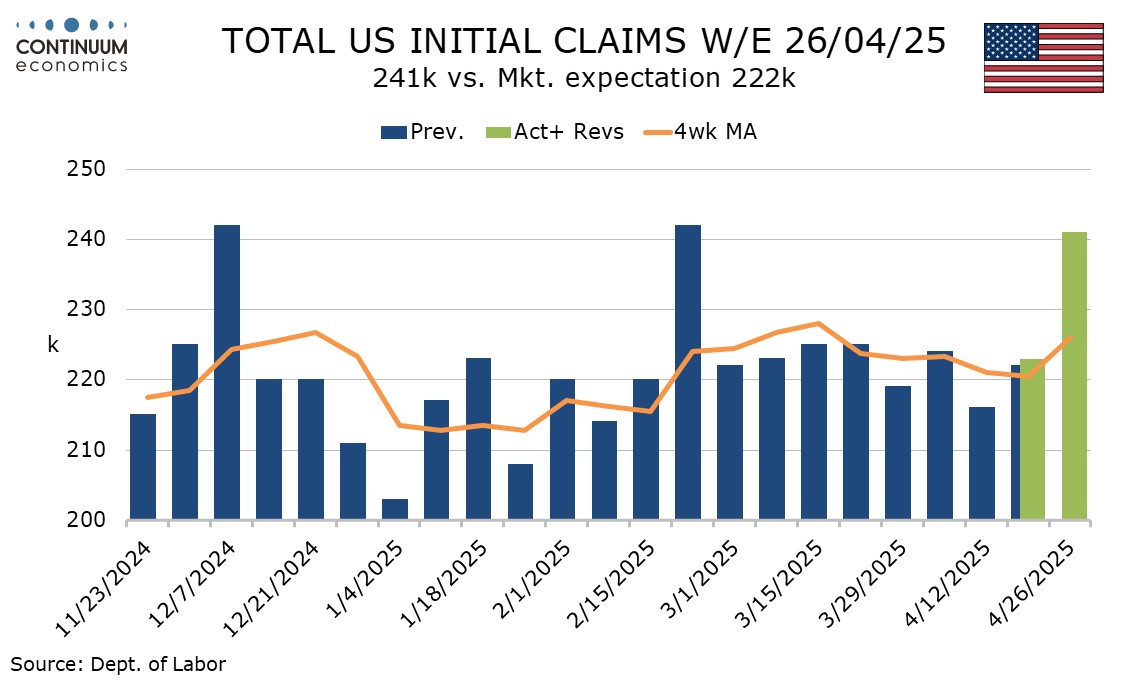

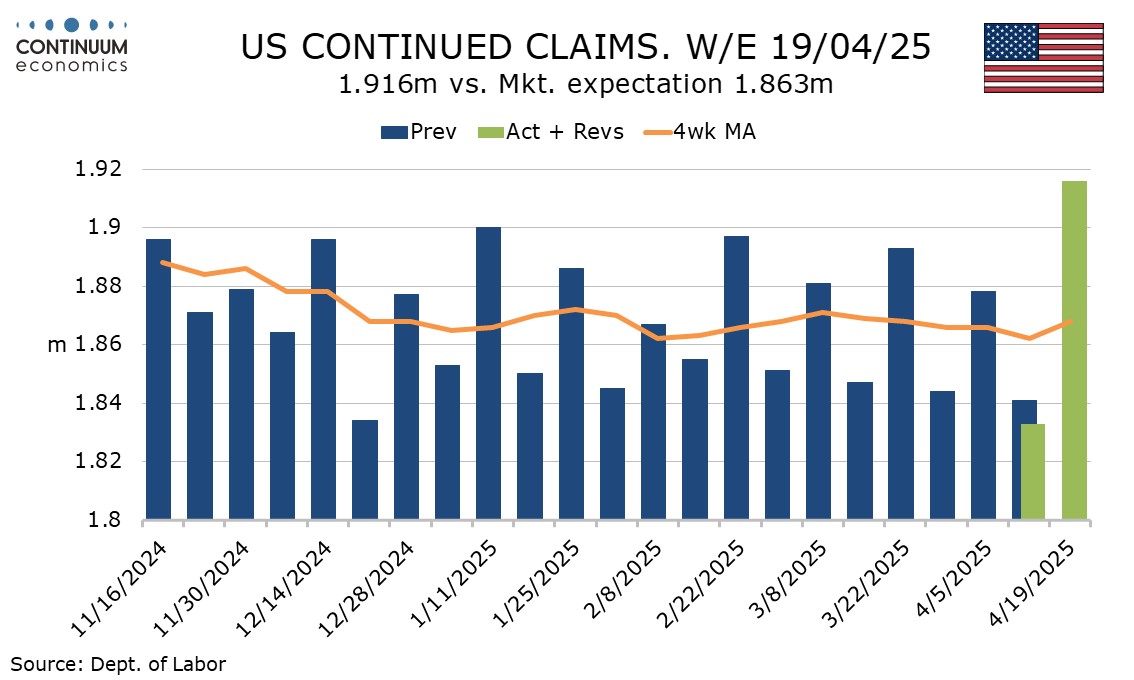

Initial claims and continued claims have both seen a bounce in the latest week, the former to 241kk from 223k and the latter to 1916k from 1833k. While there may be some seasonal adjustment issues from Easter, the data serves as a tentative warning that the labor market may be starting to lose momentum.

The initial claims data covers the week two weeks after that in which April’s non-farm payroll was surveyed, while continued claims cover the week after the payroll survey week. The data does not justify a sharp reassessment of April payroll expectations, though there may be some warning signs for May.

The initial claims level is the highest since February 22, a week that included Presidents Day, and that the February 22 spike proved temporary means that some caution is justified in looking at the latest bounce. The 4-week average of 226k is a 6-week high.

Continued claims are at their highest level since November 2021 which is not something that can be dismissed, though recent weeks have been alternating between up and down and the 4-week average was higher as recently as March. Last week’s continued claims outcome was the lowest since September 2024, again cautioning that not too much can be read into one week of data.