U.S. October Empire State Manufacturing Survey - Activity rebounds, prices stronger

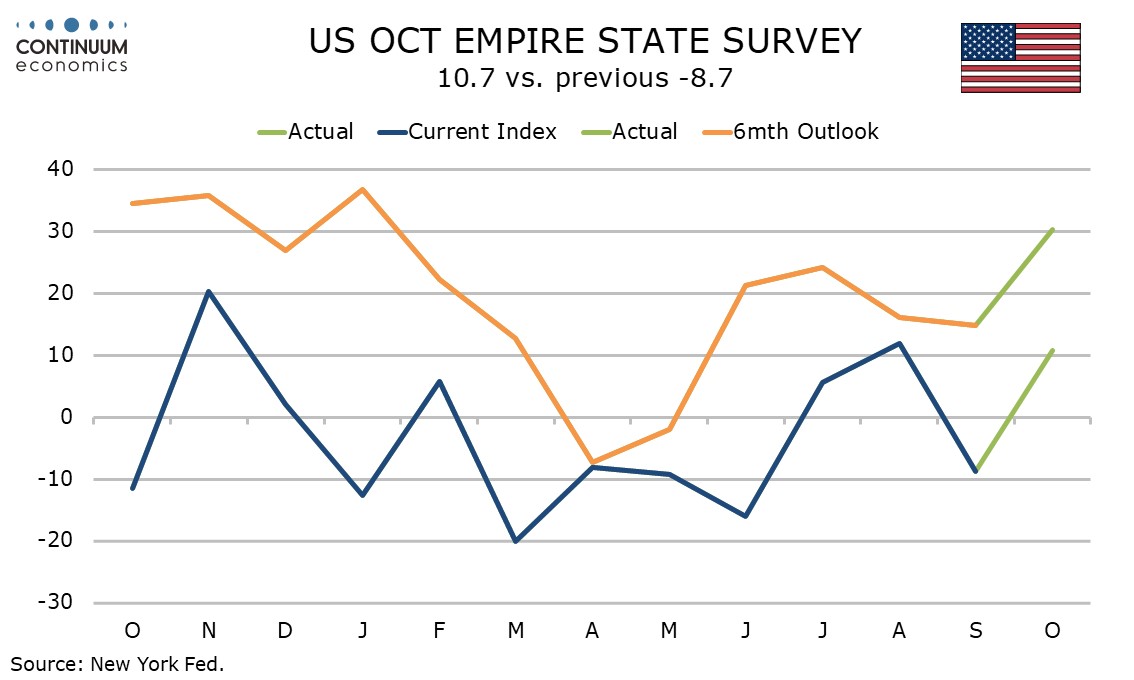

October’s Empire State manufacturing index at a positive 10.7 has rebounded from a weak -8.7 in September though remains below August’s level of 11.7. The series is volatile and may not be a useful signal for other surveys. In September, when the Empire State index was weak, the Philly Fed manufacturing survey as surprisingly strong at 23.2. The underlying manufacturing picture is probably still fairly neutral.

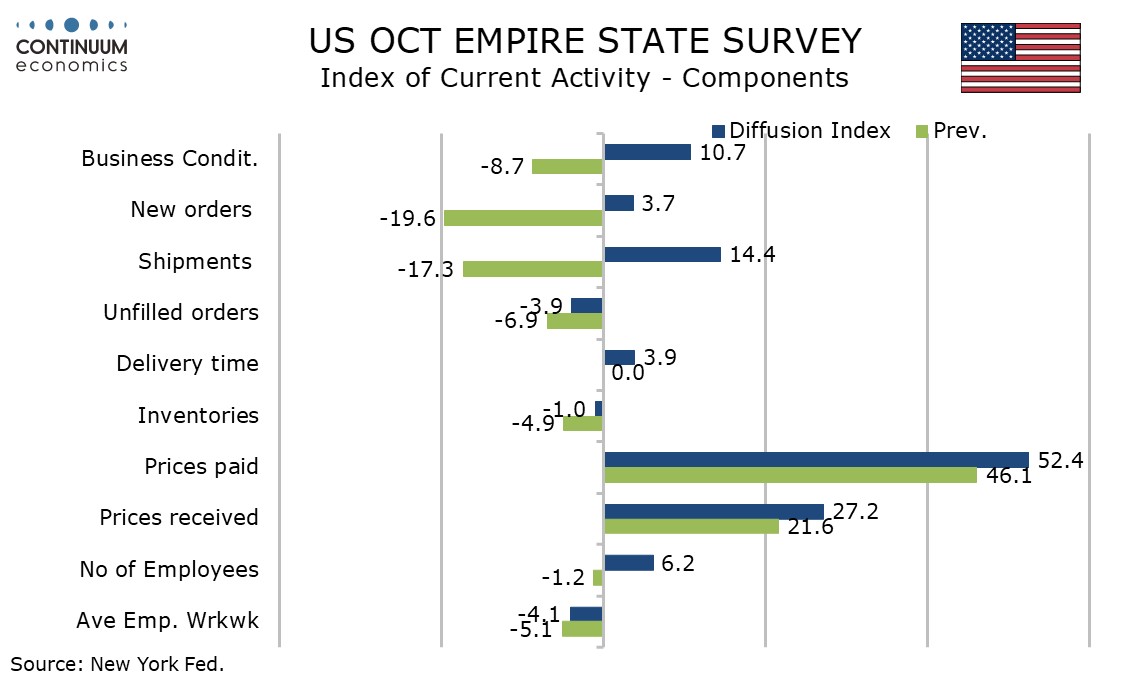

The current month details are mixed. New orders at 3.7 are positive and up from -10.6 in September but a lot less impressive than the headline. Employment saw a significant bounce to 6.2 from -1.2 but the workweek remains weak at -4.1 from -5.1.

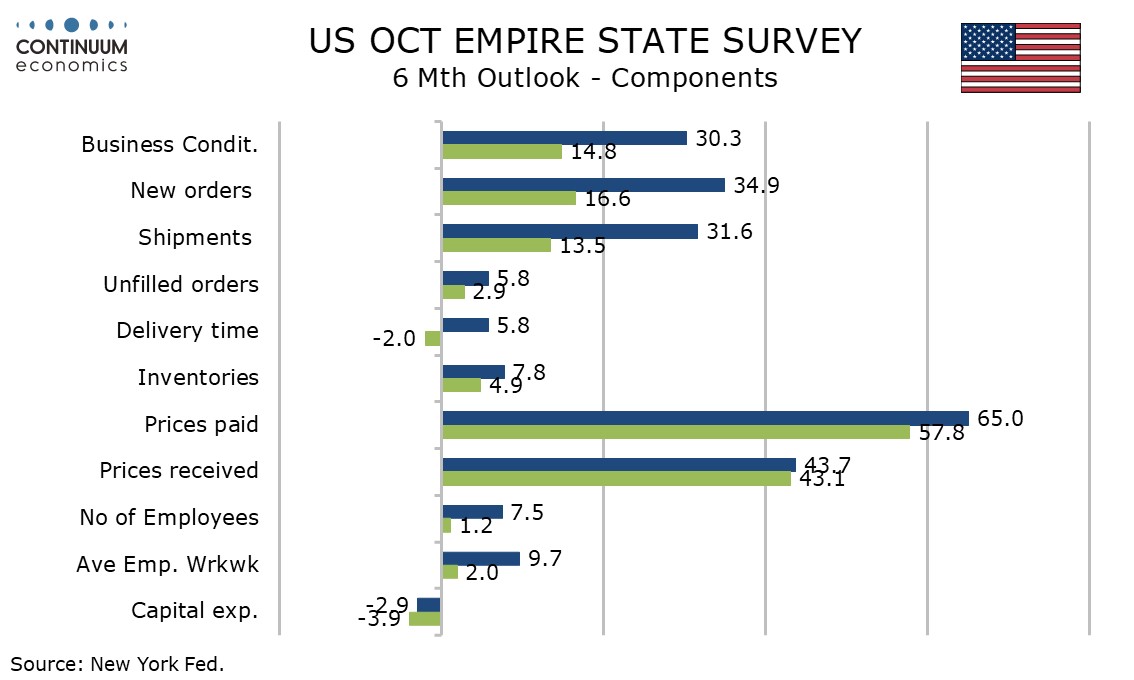

Six month expectations are more positive, at 30.2 from 14.8 reaching their highest since November 2024. Worries about tariffs, which appeared to be behind negative readings in April and May, appear to be fading. A recent increase in tensions with China however may not be reflected in this survey.

Price data looks strong. The current month data shows prices paid at 52.4 from 46.1, the highest since July, and prices received at 27.2 from 21.6, the highest since April. Six month expectations for prices are also firm, paid at 65.0 from 57.8, the highest since May, and received at 43.7 from 43.1, the highest since April. Tariffs may be fading as a threat to activity but appear to be inflating prices.