U.S. May ADP Employment - Weak but non-farm payroll likely to be less so

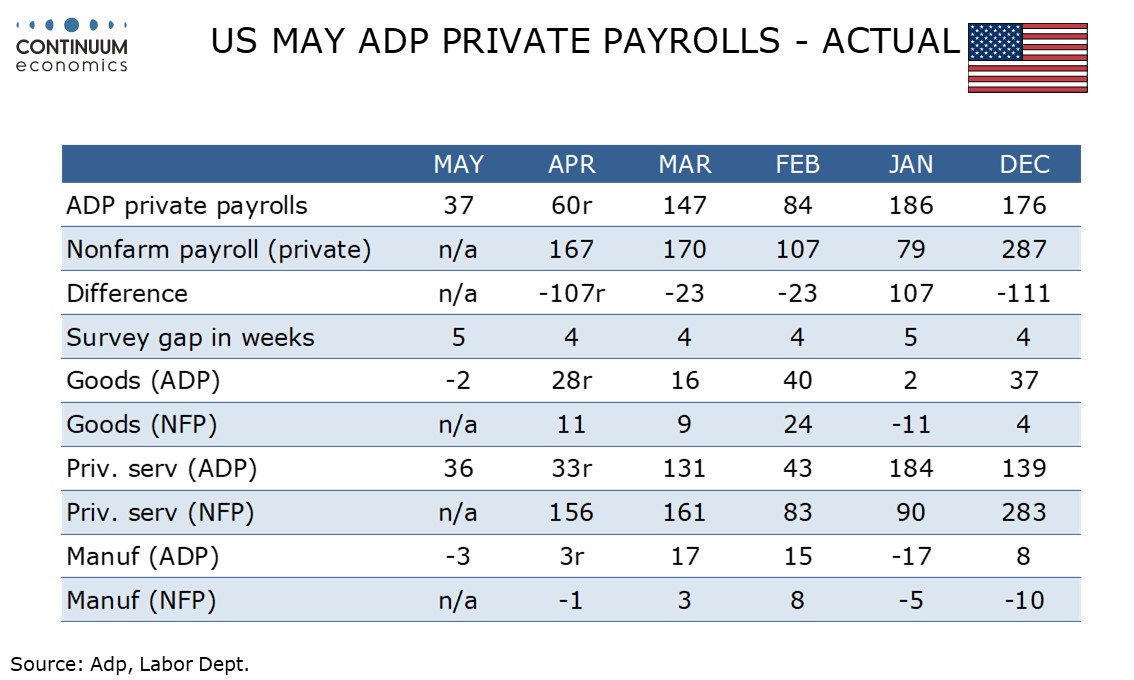

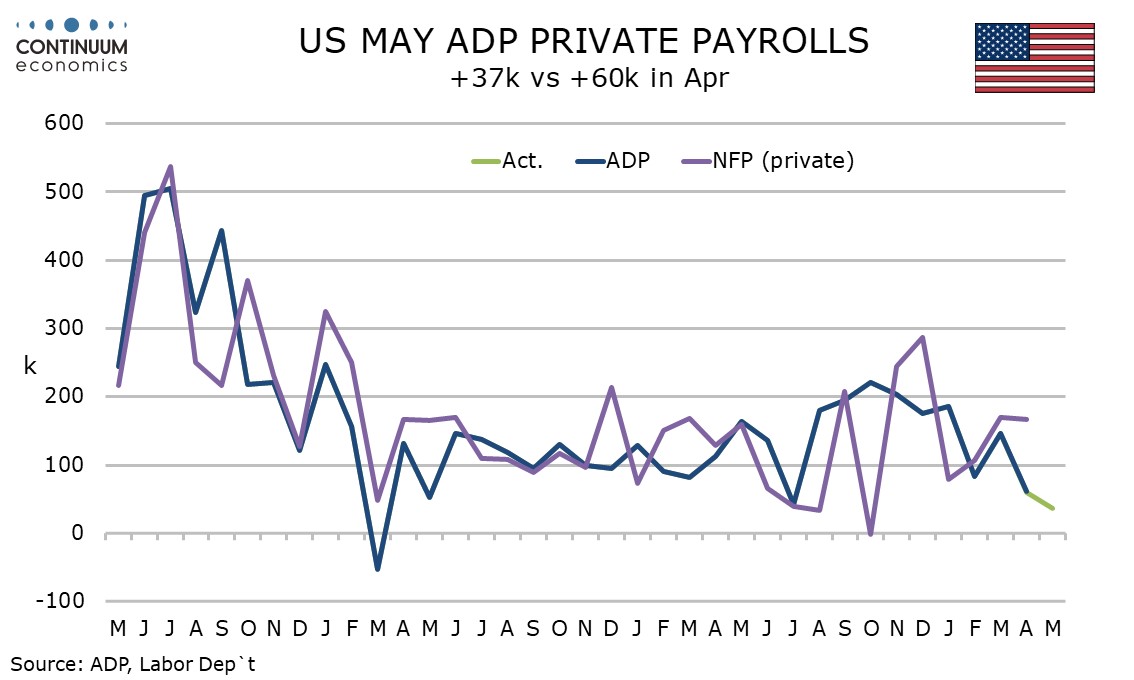

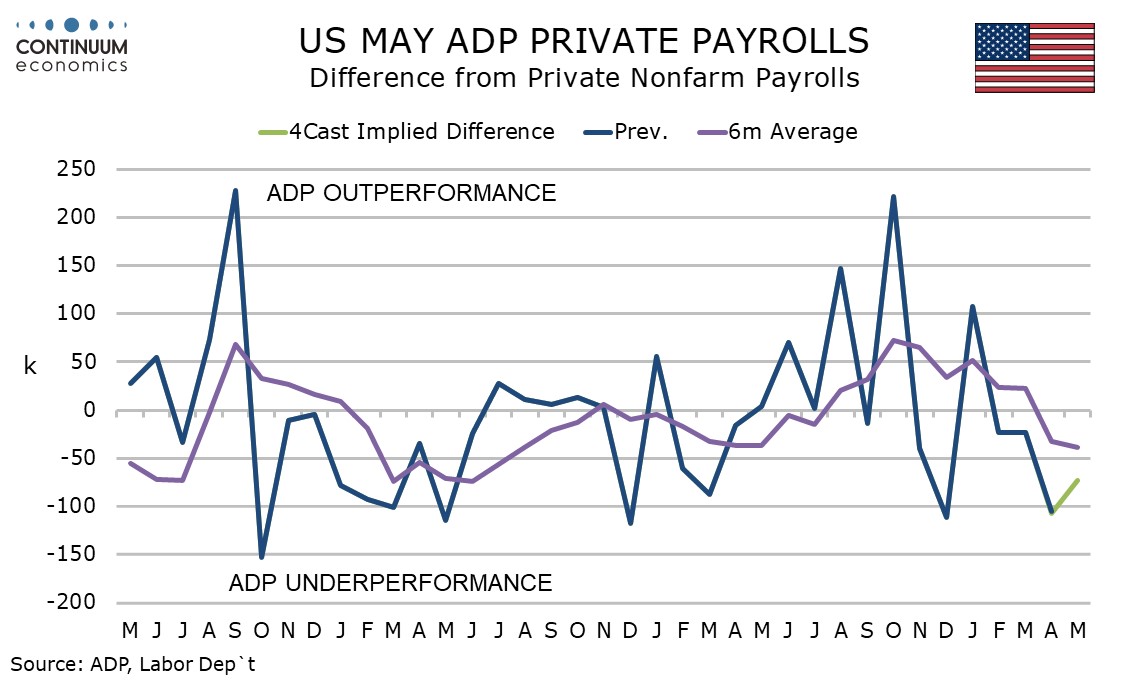

ADP’s May estimate of private sector employment growth of 37k is significantly weaker than expected and the weakest since a decline in March 2023, extending a recent slowing in trend. ADP data has recently been underperforming payrolls for which it is not a reliable guide, though this data does weigh against the positive signal from yesterday’s job openings data.

We will stick with our forecast for a 120h rise in May’s non-farm payroll, 110k in the private sector, which would be consistent with a modest slowing in the labor market, as is also implied by initial claims data.

The largest negatives in the ADP data were professional and business at -17k and education and health at -13k. The latter component has been consistently leading non-farm payroll growth and similar weakness in the non-farm payroll looks unlikely. Positives in the ADP breakdown include financial at 20k and leisure and hospitality at 38k, neither components where we expected strong gains. Manufacturing at -3k and construction with a 6k increase both saw only marginal changes.

Yr/yr growth in wages was little changed in the ADP report, job stayers at 4.5% and job changers at 7.0%. This contrasts recent signs of slowing in non-farm payroll average hourly earnings data. We expect a 0.3% rise in non-farm payroll average hourly earnings, slightly stronger than April’s 0.2%, though this would see yr/yr data slowing to 3.6% from 3.8%.