Published: 2025-10-16T17:21:32.000Z

Preview: Due October 24 - U.S. October S&P PMIs - Stronger manufacturing, slower services

2

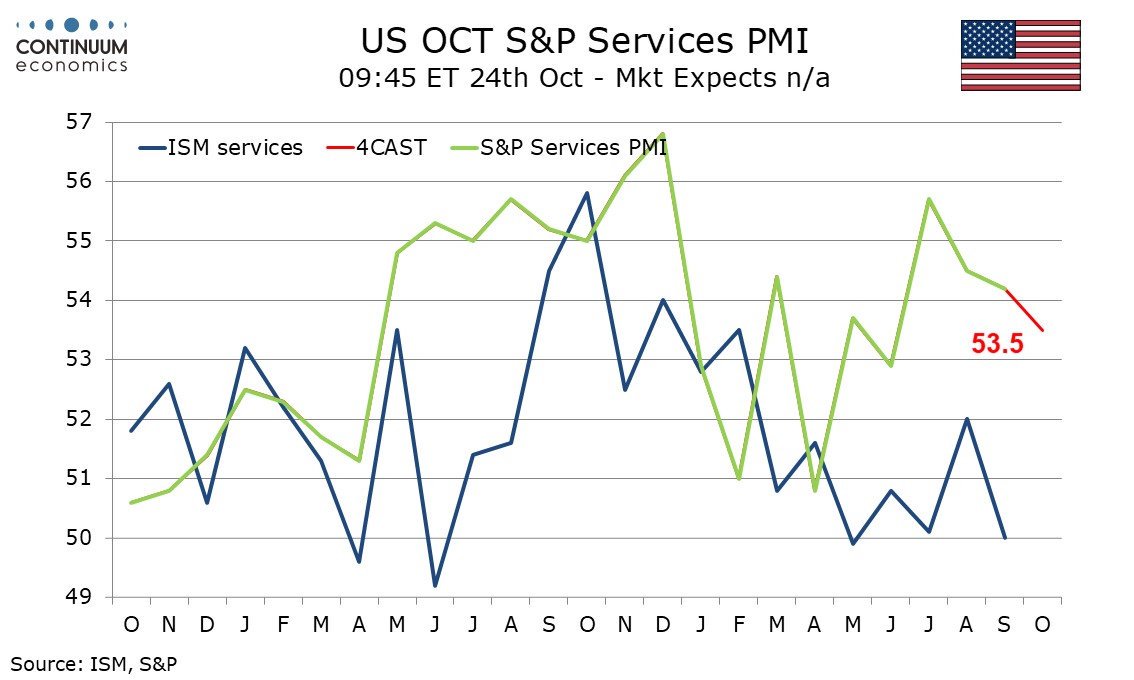

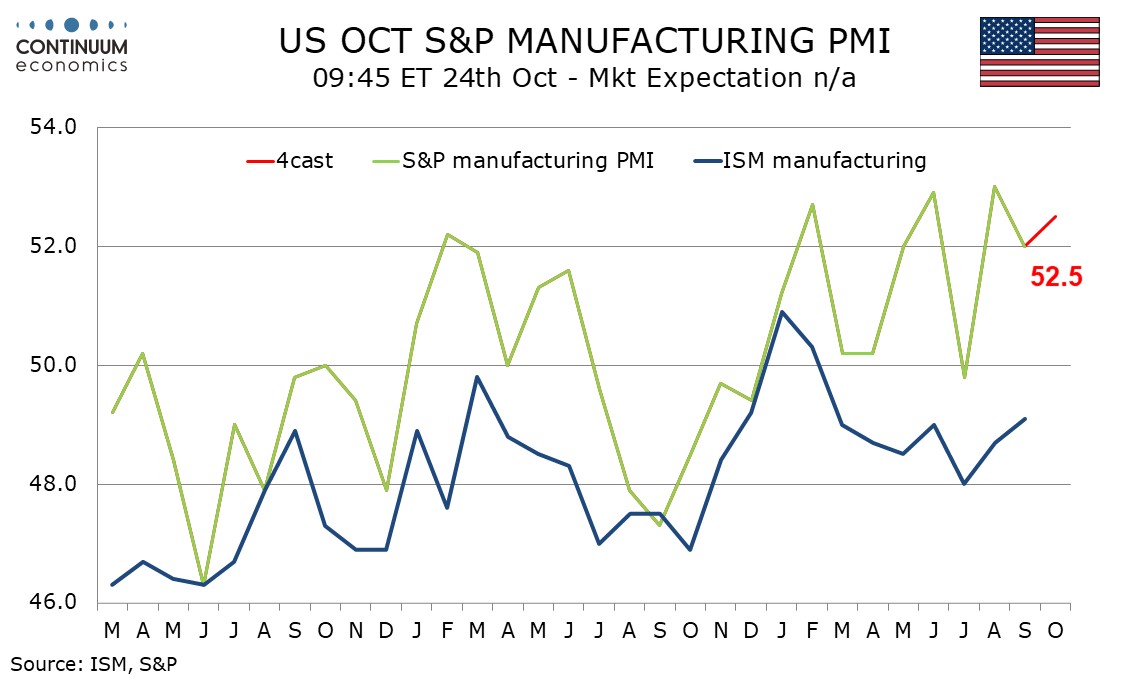

We expect October’s S and P PMIs to show manufacturing seeing renewed upside with a rise to 52.5 from 52.0 but services to see a continued move off its recent high, falling to 53.5 from 54.2.

October’s Philly Fed manufacturing survey slipped after a strong September but the Empire State’s picked up from a weak October. On balance we see the net picture as marginally positive with the Philly Fed detail showing new orders accelerating. This hints at a modest rise in the S and P manufacturing index after a dip in September, though it remained well ahead of its ISM counterpart.

The S and P services PMI has also been outperforming its ISM counterpart, though has seen two straight declines from July’s 55.7. While there is upside risk from Fed easing, with the S and P index tending to be more sensitive to rates than the ISM’s, this is outweighed by the fact Q3 data is likely to show consumer spending rising well ahead of real disposable income, hinting at downside risk to service consumption as we enter Q4.