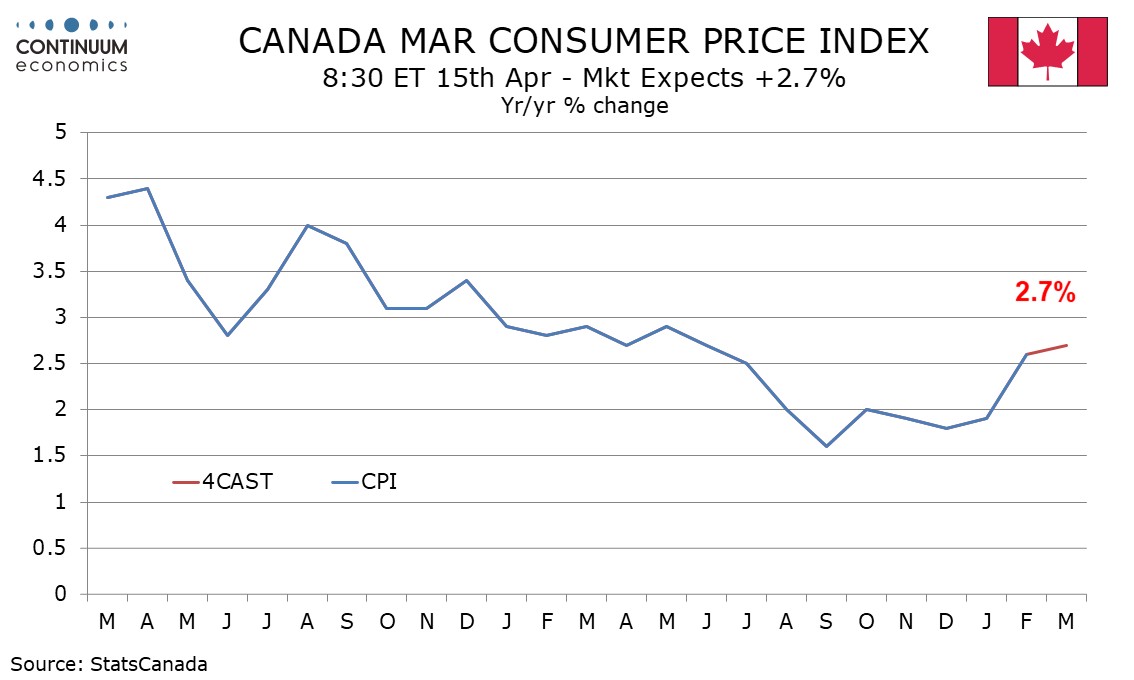

Preview: Due April 15 - Canada March CPI - Another acceleration as sales tax holiday ends

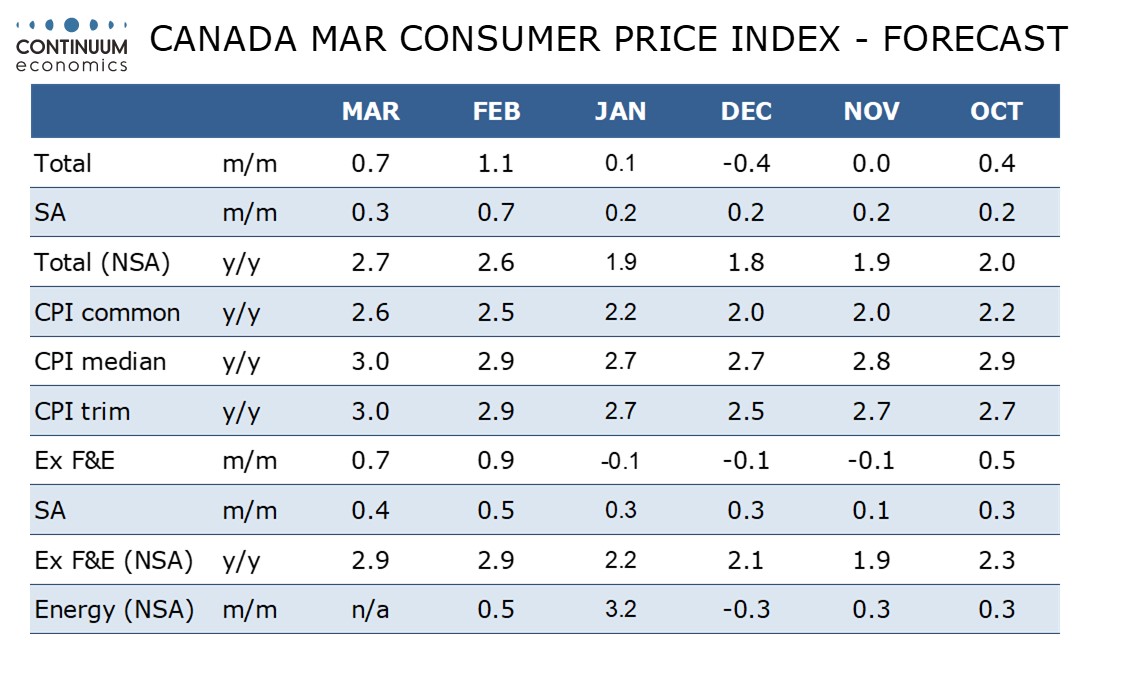

We expect March Canadian CPI to increase to increase to a 9-month high of 2.7% yr/yr from 2.6% in February. We also expect the Bank of Canada’s core rates to move higher, moving further above the 2.0% target.

A sales tax holiday which ran from mid-December through mid-February will continue to unwind in this report. The holiday depressed CPI less than was expected, probably because of late 2024 CAD weakness, the effect of which is probably starting to fade.

We expect CPI ex food and energy to rise by 0.4% seasonally adjusted, slightly slower than a 0.5% increase seen in February, with the overall pace slightly slower at 0.3%. Before seasonal adjustment, we expect 0.7% gains both overall and ex food and energy.

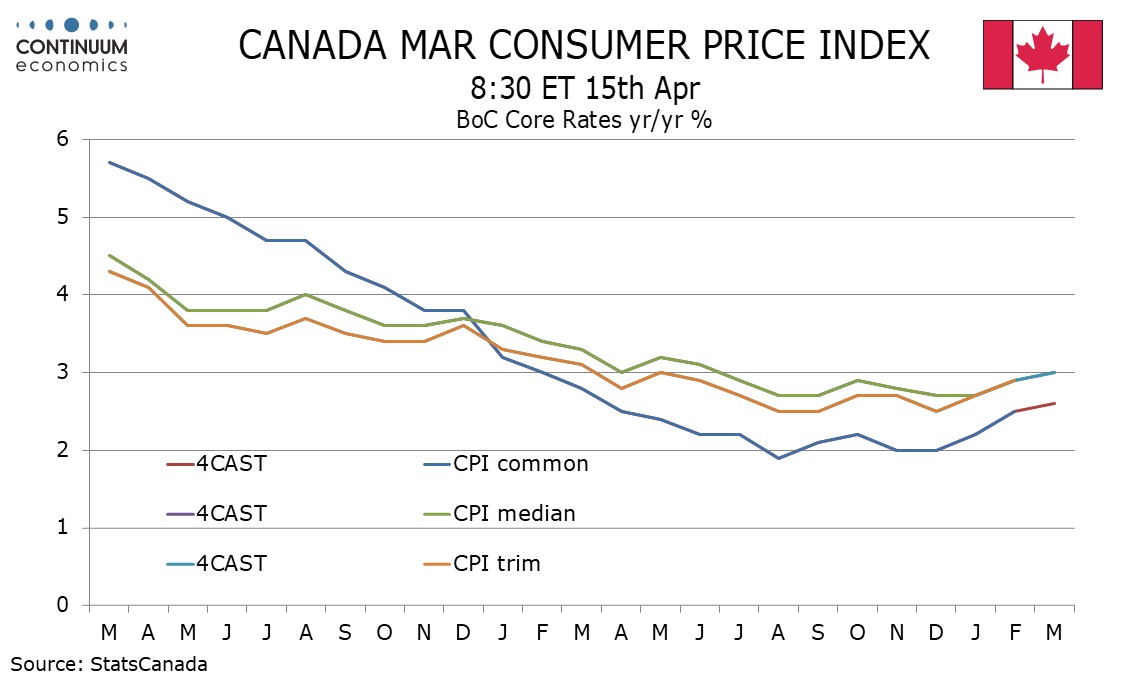

While the ex-food and energy rate would then remain unchanged at 2.9% yr/yr, after a sharp acceleration in February from January’s 2.2%, it is not one of the BoC’s core rates. These are likely to moderately extend accelerations seen in February, CPI-Common to 2.6% from 2.5%, and CPI-Median and CPI-Trim both to 3.0% from 2.9%.