Preview: Due August 13 - U.S. July PPI - Trade prices due for a correction lower

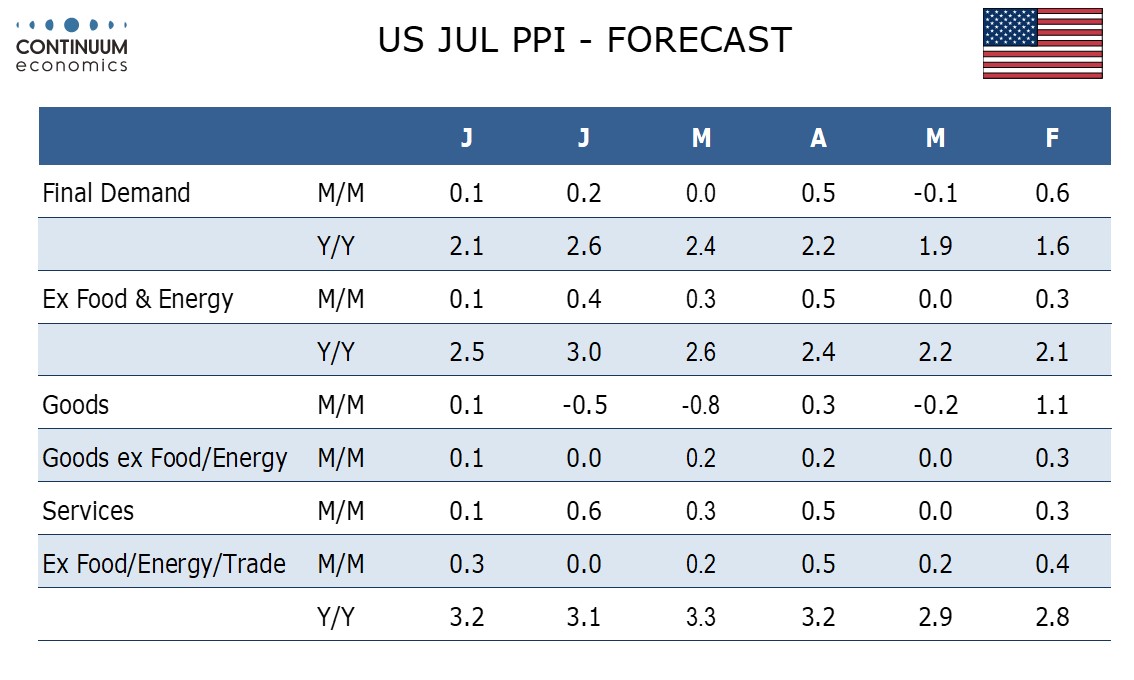

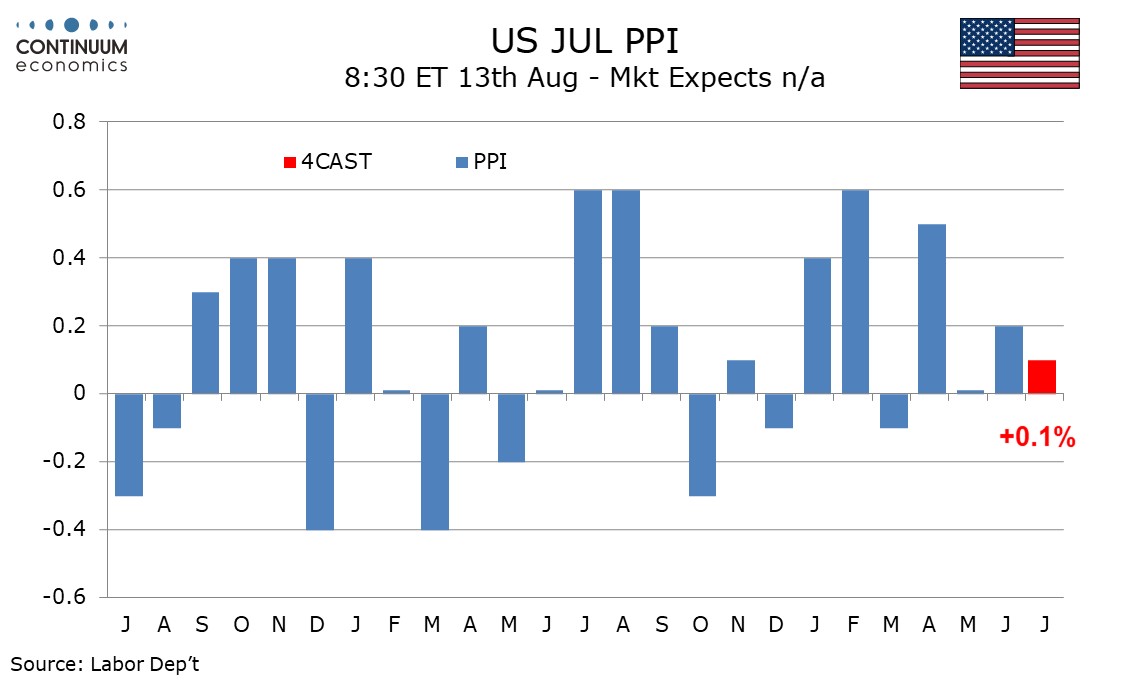

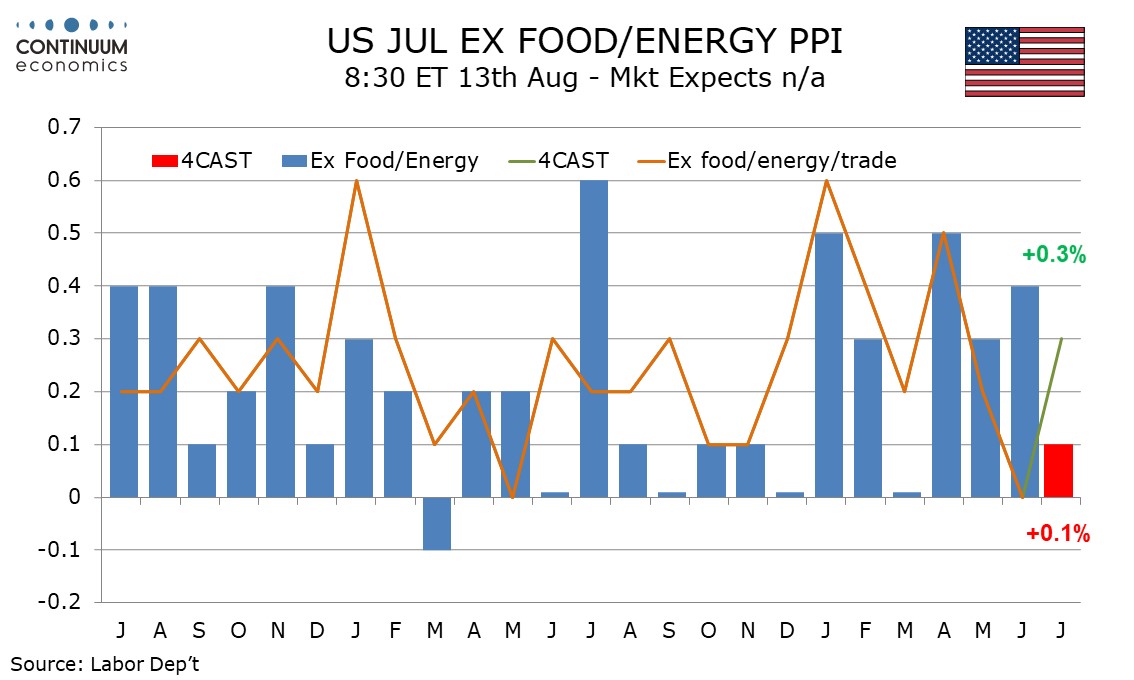

We expect a subdued July PPI, with gains of only 0.1% overall and ex food and energy, restrained by a correction lower in trade after a strong June. Ex food, energy and trade however we expect an increase of 0.3%, rebounding from a below trend unchanged outcome in June.

Energy prices appear to have stabilized after two straight declines and we expect July to be unchanged while we expect a marginal 0.2% increase in food after a 0.4% June decline. We expect goods ex food and energy to increase by 0.1% which is in line with trend.

We also expect services to rise by 0.1%, this a below trend gain after an above trend 0.6% rise in June. June’s services gain came largely on a 1.9% bounce in trade, which was the third straight gain in the series and looks due for a correction. Otherwise we expect a stronger outcome from July services PPI.

Our forecast would leave yr/yr growth slipping to a four month low of 1.9% overall from 2.6% with the ex food and energy rate falling to 2.5% from 3.0%. However ex food, energy and trade we expect a marginal increase in the yr/yr pace, to 3.2% from 3.1%.