U.S. April New Home Sales - Stronger than most housing sector signals

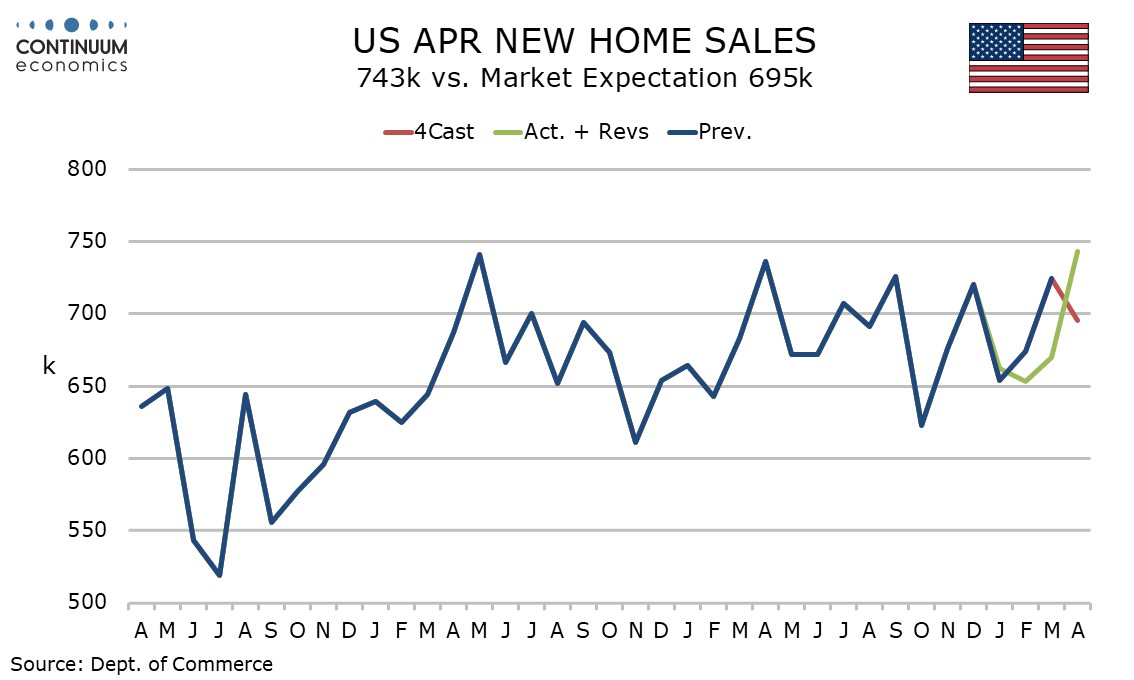

April new home sales at 743k are surprisingly strong and in contrast to the majority of housing sector indicators that have recently shown signs of weakness. The suprise is however partially offset by a downward revision to March, to 670k from 724k, a number most though would not be matched in April. Rising long term rates still pose a threat to housing demand.

April’s level is the highest since February 2022 but the upper ends of the 2023 and 2024 ranges are close to where April new sales came in. A significant revision to April data is possible but for now new home sales look resilient. Improving supply may be supporting new home sales relative to the housing market as a whole.

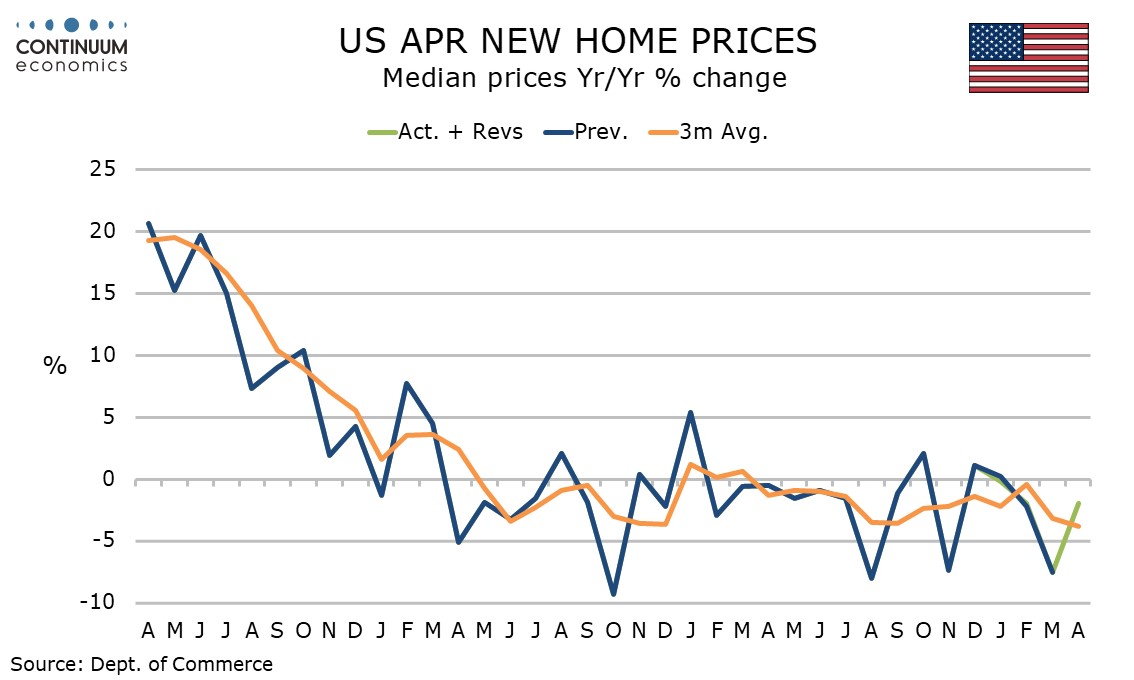

The median price rose a modest 0.9% on the month and yr/yr data is still subdued at -2.0% if up from a weak -7.5% in March.

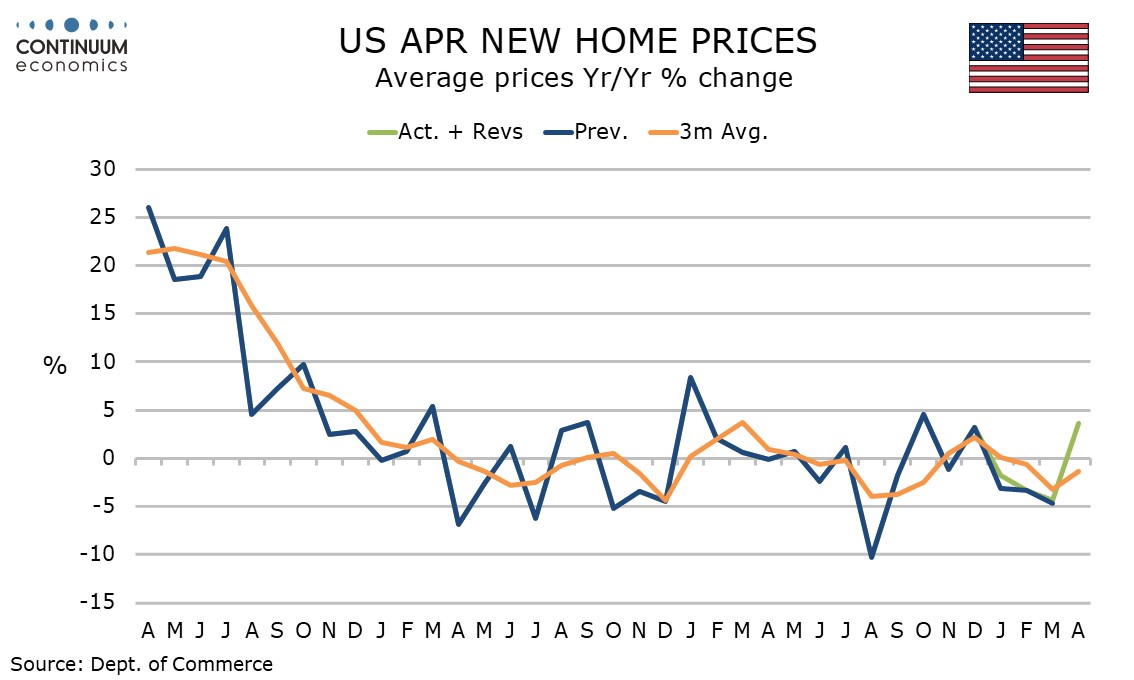

The average price however saw a 3.7% rise on the month lifting yr/yr growth to 3.6%, its first positive since October 2024, from -4.4% in March.

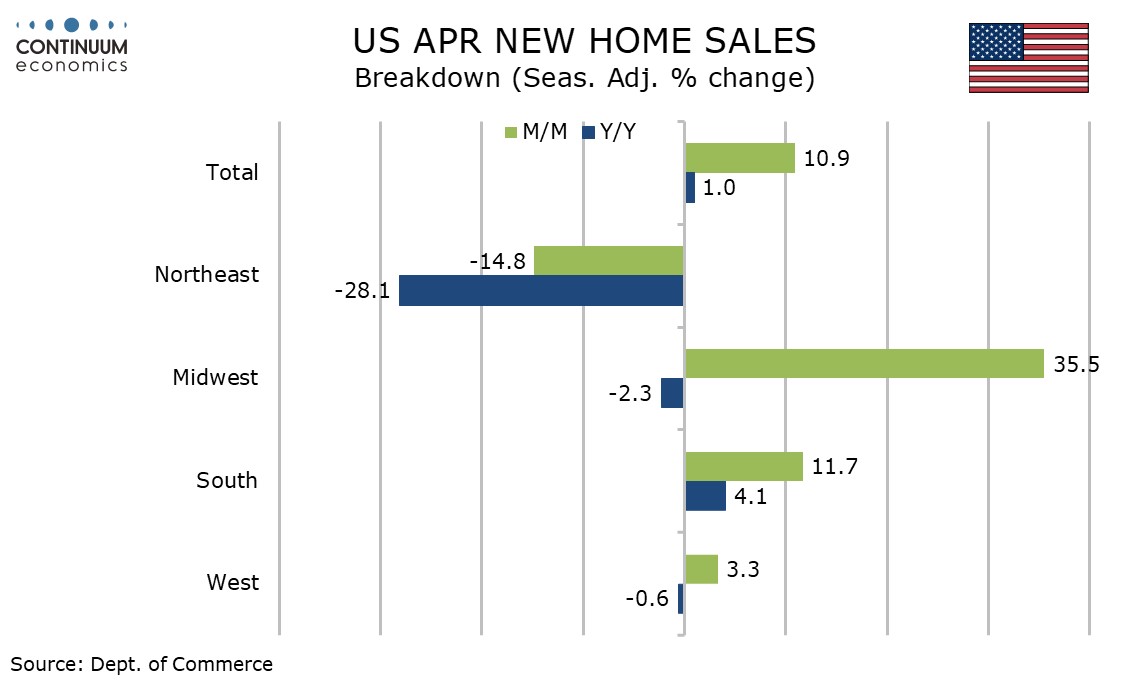

The sales gain was led by the Midwest and South, but these regions also led March’s downward revision.