Published: 2025-02-12T14:22:46.000Z

Preview: Due February 13 - U.S. January PPI - Core rates to bounce from a weak December, but yr/yr rates to slip

2

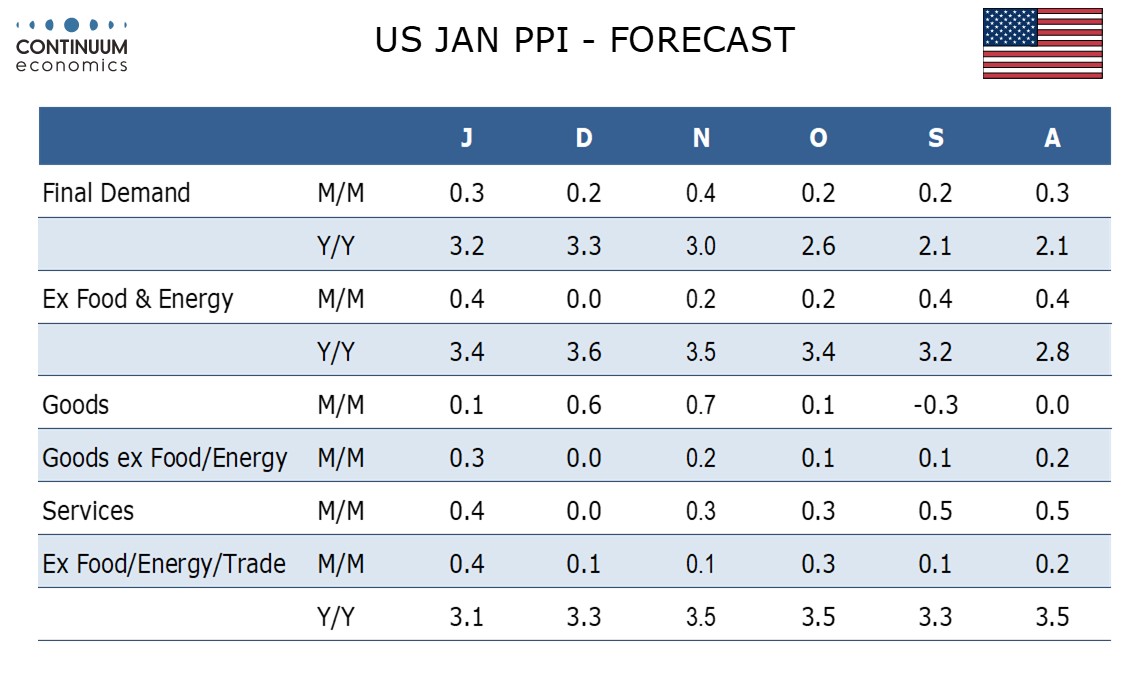

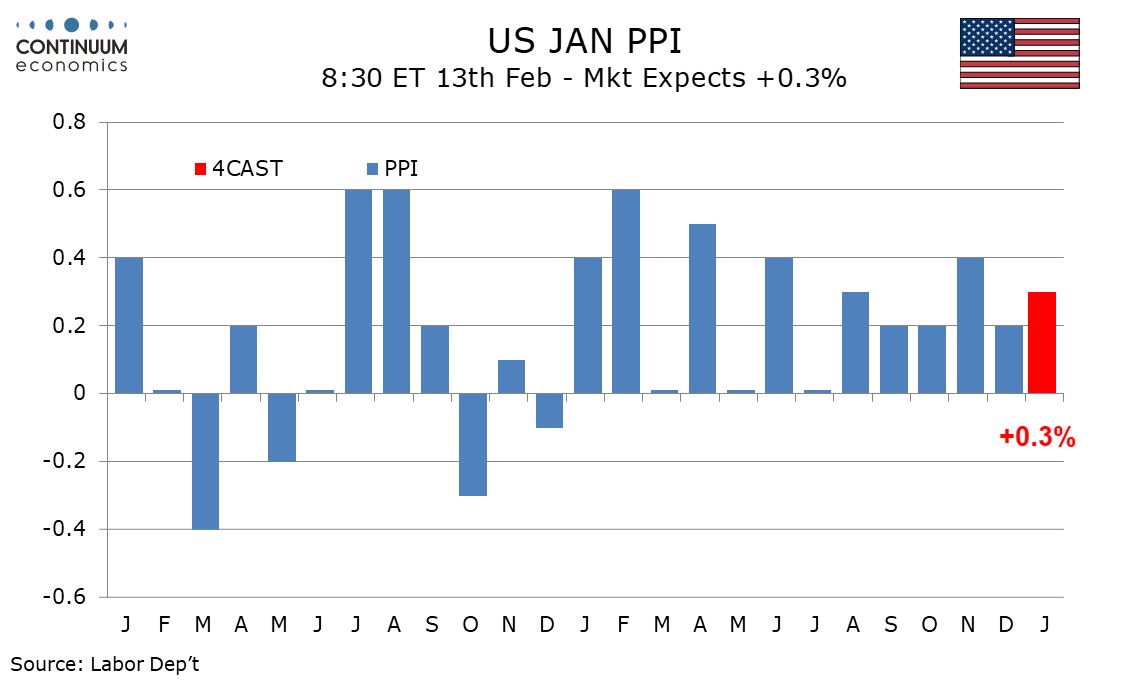

We expect January PPI to pick up from a below trend December, rising by 0.3% overall and 0.4% in both core rates, ex food and energy and ex food, energy and trade, as new year price hikes are introduced. However, a stronger rise in January 2024 will allow yr/yr rates to slip.

We expect energy prices to see a marginal 0.5% increase after a strong 3.5% rise in December, though we look for a 1.0% fall in food as the 3.0% surge in November, led by eggs, sees a more significant correction after December’s marginal dip of 0.1%.

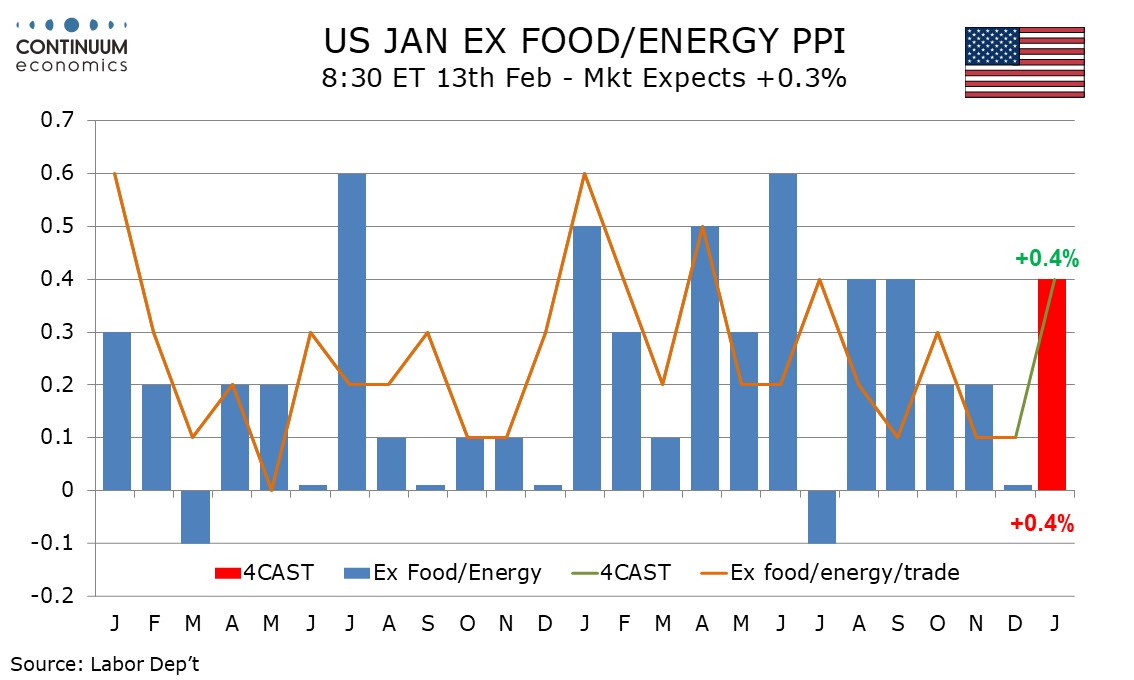

An unchanged December ex food and energy PPI was the softest since July and looks vulnerable to a rebound particularly given the risk of new year price hikes being introduced in January. We expect a 0.4% increase ex food and energy, with a matching gains ex food, energy and trade, this following two straight subdued gains of 0.1%.

Yr/yr growth would then fall to 3.2% from 3.3% overall, and to 3.4% from 3.6% ex food and energy. Both of these have seen softer yr/yr gains quite recently, but a 3.1% yr/yr pace ex food, energy and trade, down from 3.3% in December, would be the lowest since March 2024.