EUR, JPY flows: Awaiting US data, German and Japanese data mixed

US employment report will be the focus today. German production daa weaker than expected, but underlying trend improving. Japanese data strong enough to maintain expectations of BoJ tightening

It’s a quiet start in Europe with most pairs not much changed from yesterday’s closing levels. The US and Canadian employment reports this afternoon are obviously the main focus, and there is unlikely to be a lot of volatility before then. We continue to see some USD upside risks as our forecasts are on the strong side of consensus (see here).

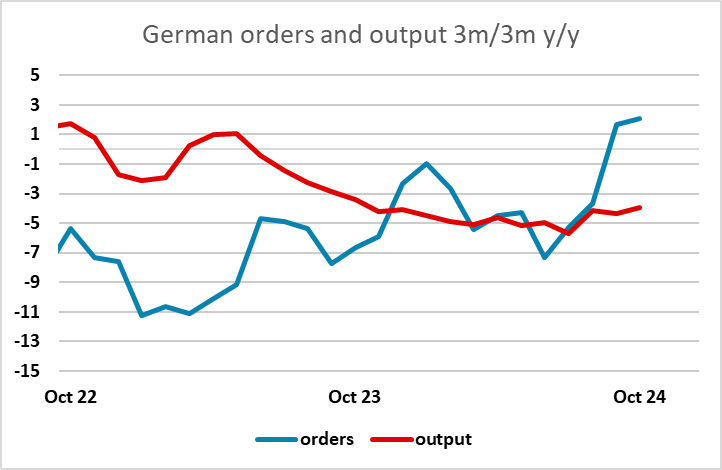

This morning we have seen German industrial production data for October, which has come in weaker than expected, falling 1% m/m. But the underlying trend continues to improve modestly, although the data remains volatile and the improvement is tentative. Even so, there has been an clearer pick-up in German orders of late, and that will tend to lead the production data, so there are some reasons for cautious optimism about a German recovery, even if the political uncertainty in Germany and France necessarily limits and EUR bullishness. For now, EUR/USD continues to move with short term yield spreads, and will key off this afternoon’s US data.

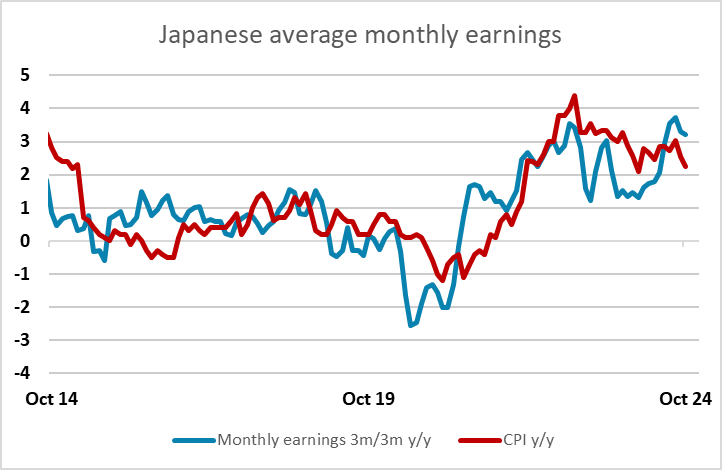

Overnight the Japanese wage data was mixed. The recent pick-up in wage growth may have stalled slightly, but there is still an underlying improvement, and real wages are better. There was also unexpected strength in household spending, so we continue to look for a 25bp BoJ hike in December. But as with EUR/USD, USD/JPY continues to follow yield spreads and this afternoon’s US data will be key.