U.S. Initial Claims up but still low, narrowing in Trade Deficit may be temporary

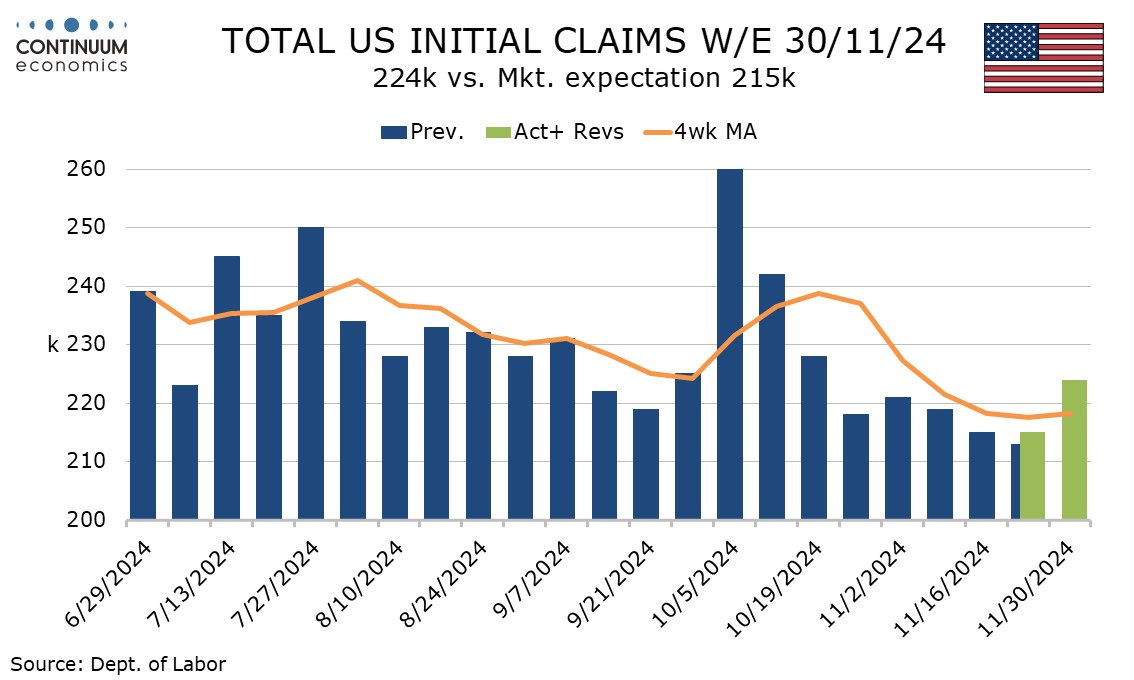

Initial claims at 225k are a little higher than expected after two weeks at 215k (last week was revised up from 213k which was the lowest since April). The level is still low and it is possible that seasonal adjustments for the Thanksgiving holiday influenced the latest weekly data.

The survey week for November’s non-farm payroll came two weeks ago and the dip in claims in early November after hurricane-induced gains in early October suggest a rebound in payrolls from October’s weak outcome.

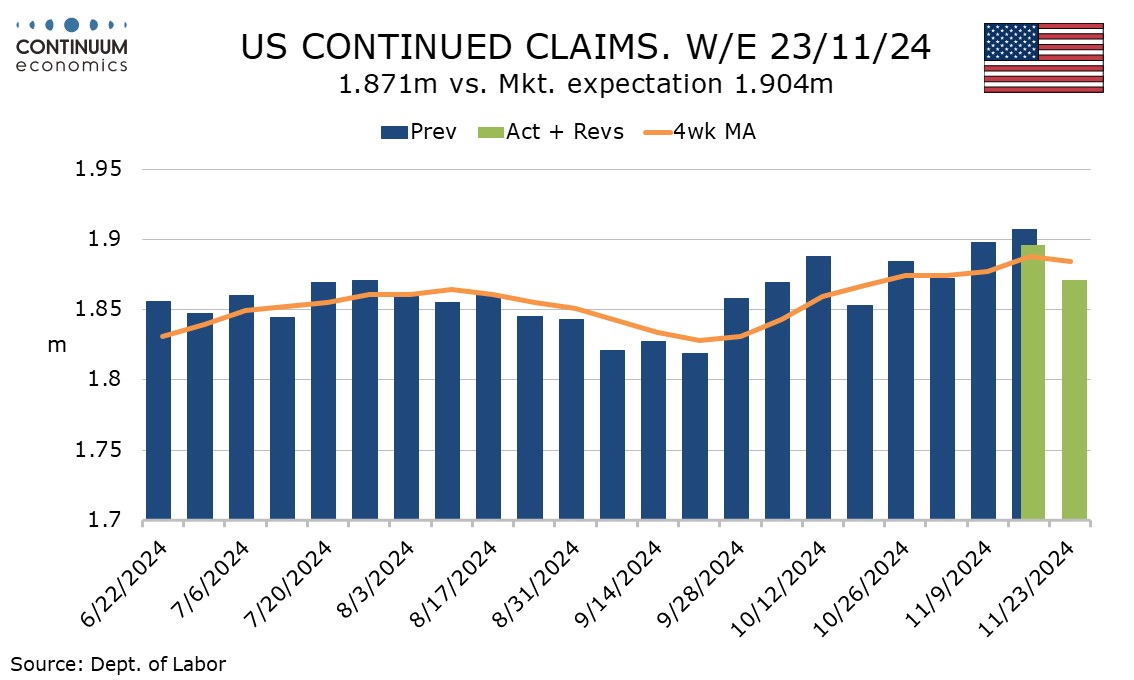

Continued claims ae lower than expected with a 25k fall to 1.871m. Recently continued claims had been continuing to trend higher despite initial claims falling, but this latest data suggests continued claims are slipping too, a sign of jobs being created in addition to layoffs being low.

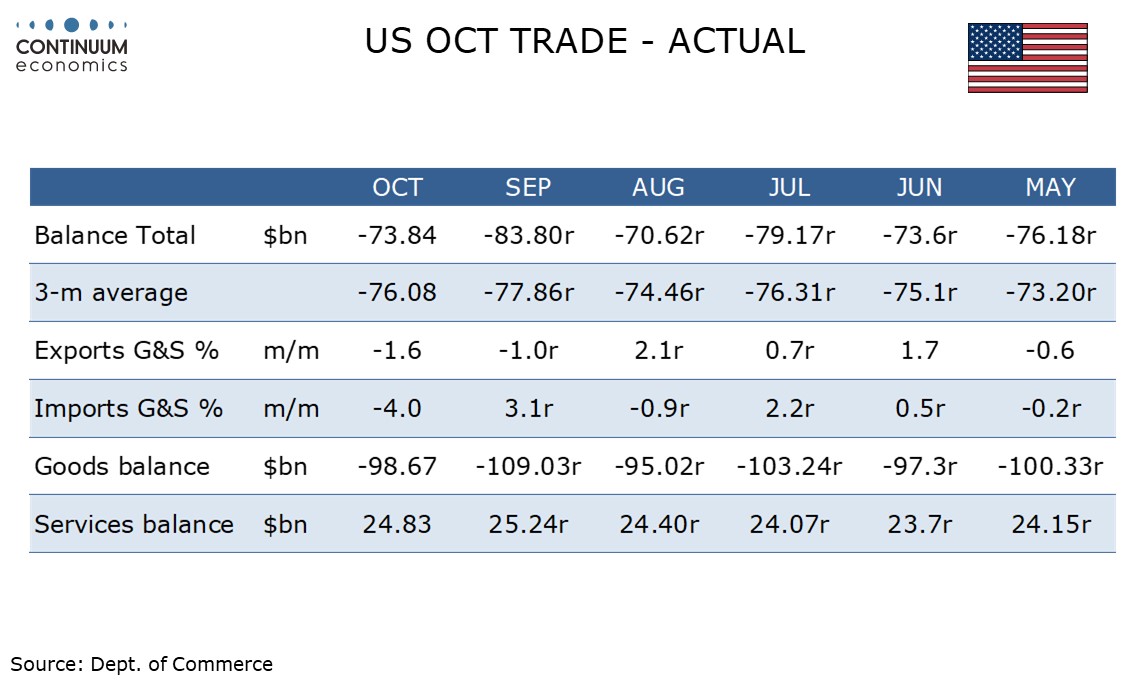

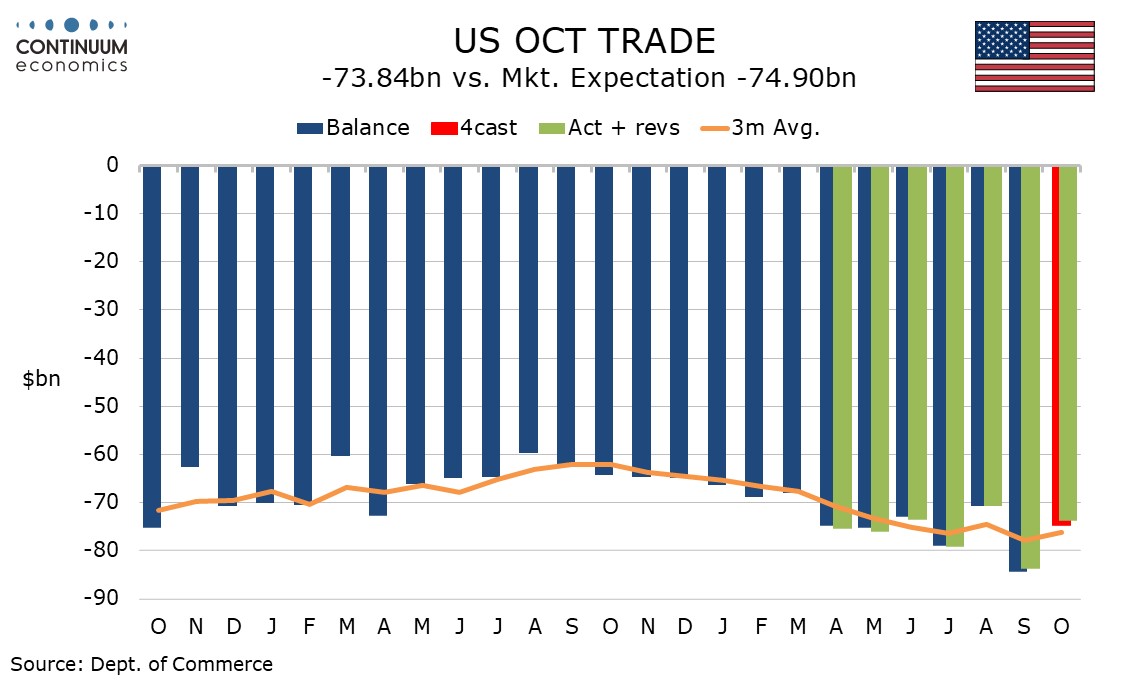

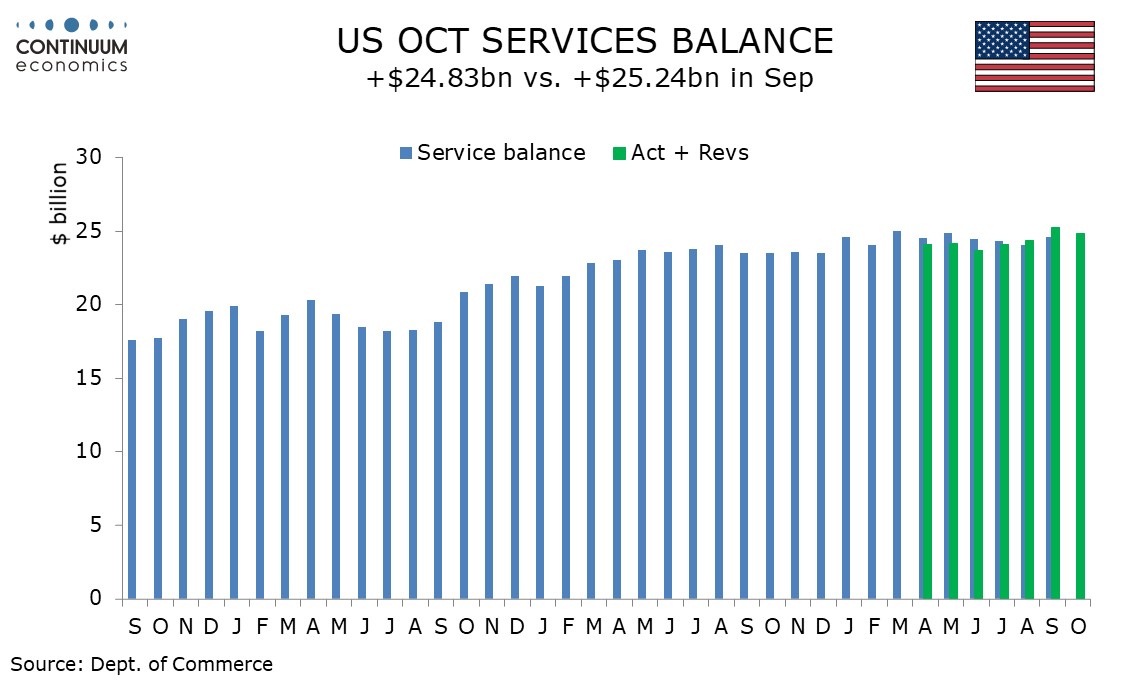

October’s trade deficit of $73.8bn is a little lower than expected, and down from $83.8bn in September, which was revised lower from $84.4bn, the revision led by an upward revision to September’s services surplus.

October’s goods data showed exports falling by 3.0% rather than 3.2% as in the advance data, while a 5.5% fall in goods imports compares to 5.4% in the advance data, both series probably depressed by a brief strike at East Coast ports early in the month, and imports further depressed by a correction from a strong September.

Services data showed exports up by 1.1% after a 0.6% September rise and imports up by 2.1% after a 0.4% September decline. Overall exports fell by 1.6% and overall imports fell by 4.0%. The threat of tariffs may bring some strong import gains ahead of Trump’s inauguration.