This week's five highlights

FOMC Suggest March Easing Seen Unlikely but Q2 Remains Plausible

U.S. January Non-Farm Payrolls To Show Strong Labor Market

DXY Remains Choppy on Headlines and Geopolitical Risk

More EZ Core Disinflation Signs But Services Inflation More Stubborn

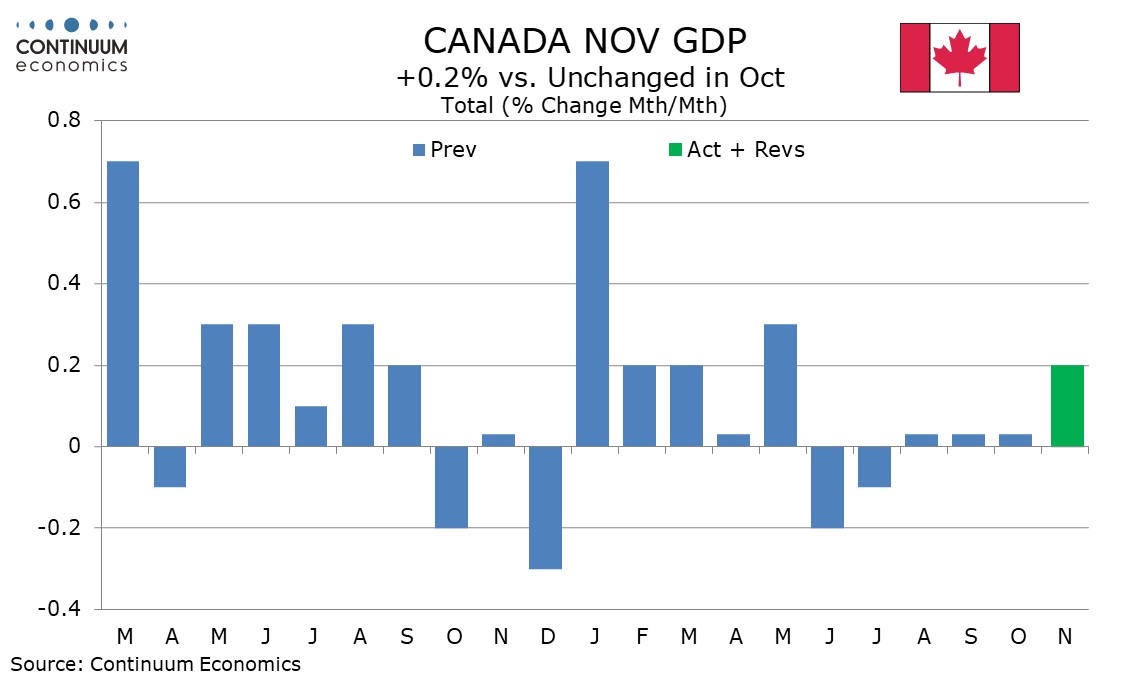

Canada November GDP looking stronger than BoC projected

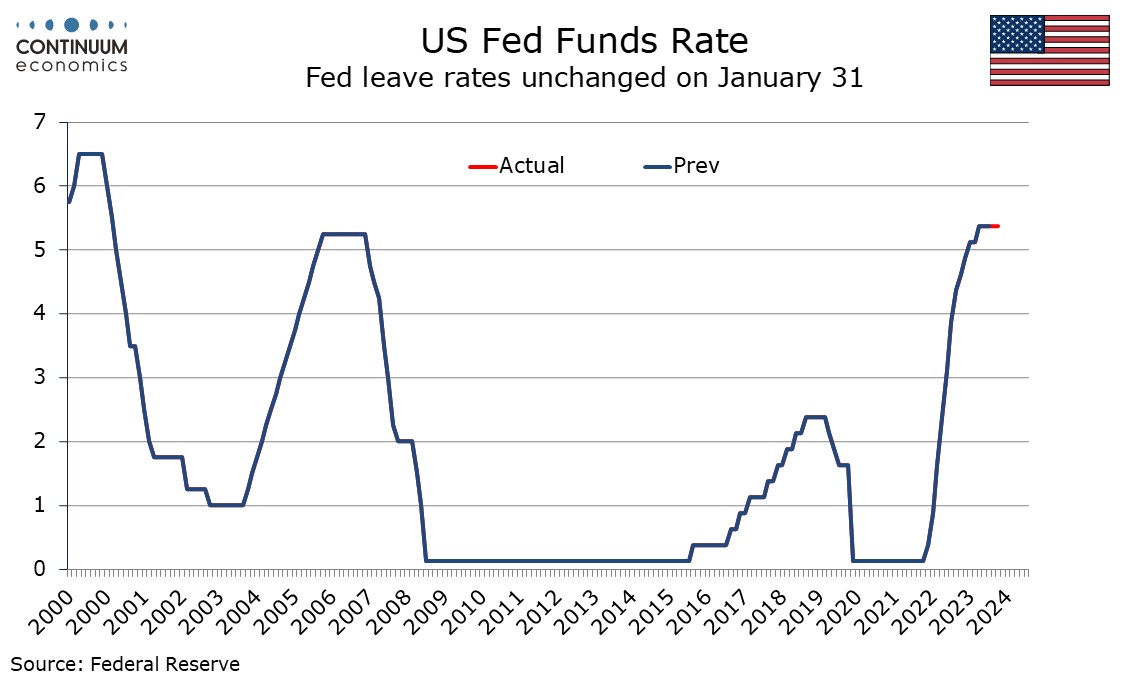

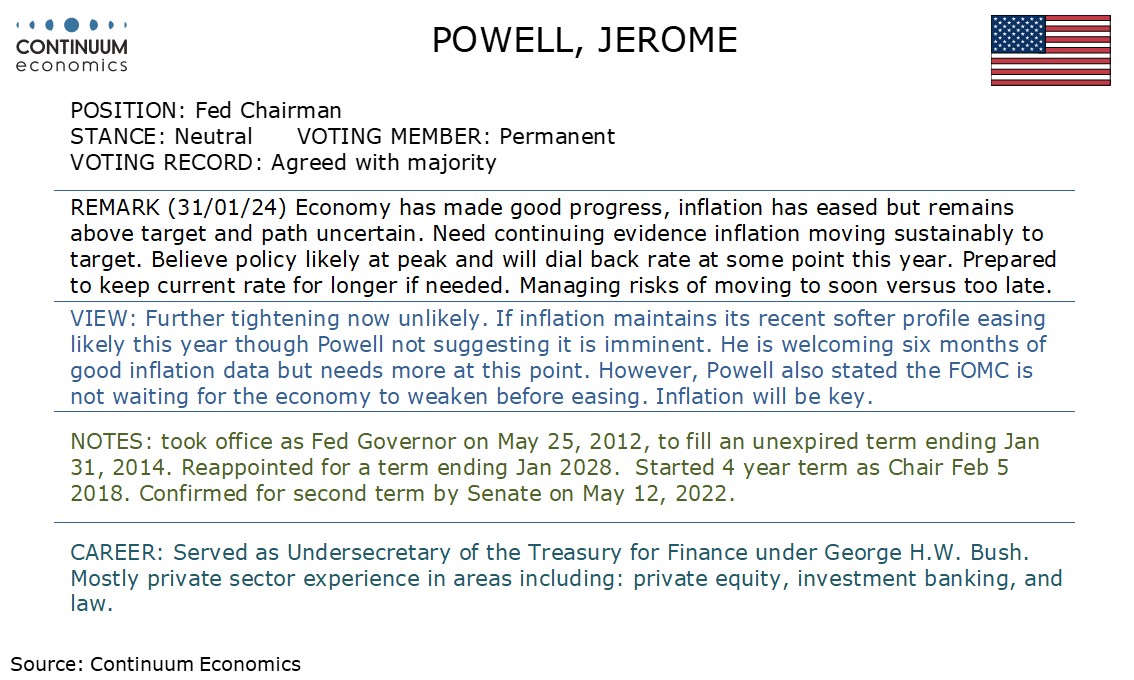

The FOMC has left rates unchanged at 5.25-5.50% as expected. While the FOMC has moved away from a tightening bias, seeing risks having moved into better balance, it is making it clear it is not in a rush to ease, requiring greater confidence that inflation is moving sustainably to the 2% target. The latest FOMC statement and press conference from Fed’s Powell has had a limited impact on the market which took it as slightly hawkish, though it was a little more dovish than we expected. The Fed appears to have responded less to recent strong activity data than we expected, focusing more on progress on inflation, while making it clear that more progress is needed before easing starts.

The statement has seen plenty of adjustments from the last one on December 13. It does not overreact to the stronger than expected Q4 GDP, stating that the economy has been expanding at a solid pace, not inconsistent with its prediction that Q4 would be slower than Q3. Inflation is still described as having eased over the past year while remaining elevated. A reference to the banking system being strong and resilient has been removed, without making clear if worries in the market today over New York Community Bancorp are relevant to this, but also removed a reference to tighter financial and credit conditions weighing on activity.

Powell seemed pleased with the progress made on inflation, stating that we have seen six months of good data. He saw strong GDP growth as more likely to leave inflation stuck above the 2% target rather than triggering a re-acceleration. It is unclear how much more subdued inflation data we will need to satisfy the Fed but if Q1 core PCE comes in near the 2% target on an annualized basis that would make three straight quarters, and then the Fed would probably consider easing. Powell stated that the Fed is not waiting for the economy to weaken before starting easing, so unexpected weakening of the economy could bring easing forward.

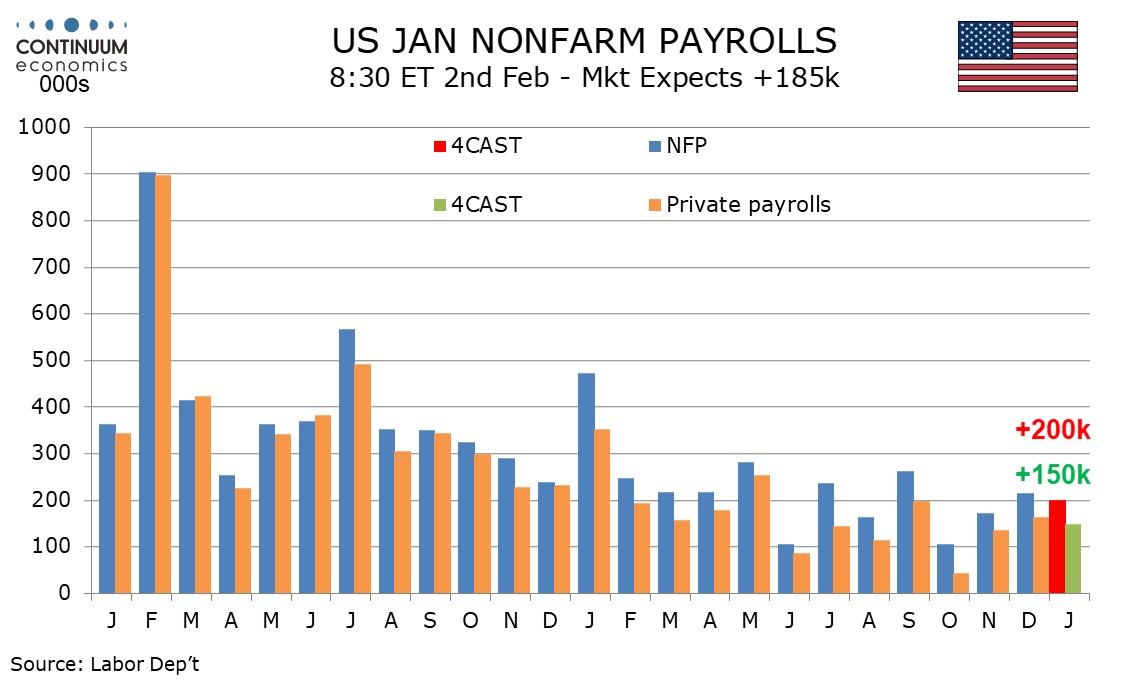

We expect a 200k increase in December’s non-farm payroll, with private payrolls up by 150k, slightly slower than December’s respective outcomes of 216k and 164k but stronger than the October and November reports. We expect unemployment to nudge up to 3.8% from 3.7% and a 0.3% increase in average hourly earnings to follow two straight gains of 0.4%. Risks are reasonably balanced around our 200k forecast but there is greater uncertainty than usual. Higher December job openings and stronger labor market perceptions in January's consumer confidence report imply upside risk. Lower initial claims (despite an uptick since the payroll was surveyed) are another positive signal.

Seasonal adjustments are strongly positive in January to compensate for expected seasonal layoffs. January in 2023 was well above trend with a rise of 472k (originally reported as 517k) as seasonal layoffs failed to materialize, but weather was then unusually mild for January. This January, some harsh weather may weigh against the upside risks. ADP data, which tends to be less weather-sensitive to payrolls, slowed in January after a stronger December.

Despite the Fed has pushed back expectation of a March rate cut and should keep the USD afloat in a short run, the ebbs and flow of risk asset and geopolitical headline has kept the volatility for the greenback. While risk asset initially slumped on high rates for longer, the potential ceasefire between Israel and Hamas sparked a rally and draw away the haven bids for the USD. U.S. Treasury Yields are also testing Jan lows and further erodes the base for market participants holding USD for carry.

On the chart, the sharp rejection from the 103.82 resistance see pressure returning to the 103.00 level. Daily studies have turned down from overbought readings and suggest scope for break here and the 102.77 support to retrace the December/January rally. Lower will see scope to retest the November low at 102.50. Below this will open up deeper pullback to the 102.00/101.77 area. Meanwhile, the 200-day MA and January high at 103.54/103.82 now expected to cap. Clearance here needed to see extension to the 104.00/26 area and 104.75, 61.8% Fibonacci level.

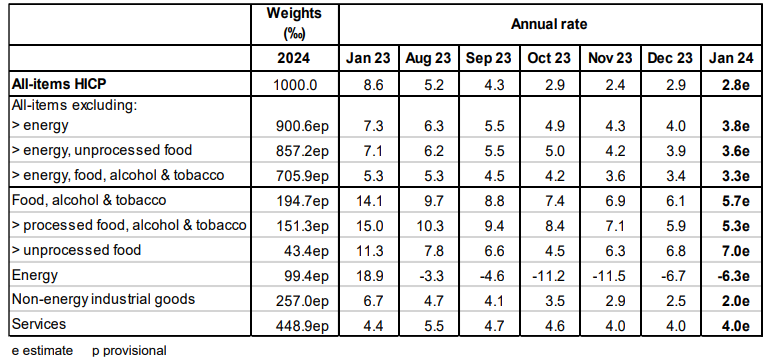

Figure : Headline and Core Inflation Falling Together Again

Source: Eurostat

There has been repeated positive EZ news in the form of plunging inflation. This continued in the January numbers, albeit with the 0.1 ppt drops in both headline and core being less that most anticipated. As a result, the headline, at 2.8%, resumed its recent decline having risen to 2.9% in December due to based effects, the later partly reversing in January. The core fell a notch to 3.3%, a 22-month low and very much on course to meet the ECB Q1 projection of 3.1%, if not undershoot it. The ECB may be somewhat troubled by the failure of services inflation (Figure) to have fallen in the last few months, this stable 4.0% y/y reading also evident in more resilient but still more modest m/m adjusted numbers. This is the first signs of price resilience for some time and will be grasped by the hawks, although it may reflect fiscal-driven indirect tax hikes (most notably in Germany) rather than solid demand factors. The next few months will be telling as there are very marked and favourable base effects that should bring services y/y inflation down at east 0.5 ppt!

Regardless, we still envisage that the headline now hit target before mid-2024, well over a year earlier than the ECB envisages, while the core should continue to fall in the interim regardless. There are ever-clearer signs of softer underlying inflation at least in terms of non-energy goods and also in terms of persistent price pressures which are now running below the 2% target. Admittedly, services inflation has failed to fall for two successive months, a stability seen in seasonally adjusted m/m numbers, albeit the later running at an annualized rate of half the headline 4% outcome.

November Canadian GDP with a rise of 0.2% saw momentum pick up after there straight flat outcomes which flowed two straight negatives. The preliminary estimate for December is stronger still at 0.3%, which suggests Q4 will come in stronger than a flat forecast from the BoC. If December meets the preliminary projection and October and November see no revisions we calculate that Q4 would come in up by 1.2% annualized, which would fully reverse a decline seen in Q3. This suggests the BoC need be in no hurry to ease with inflation still too high.

The November details are not particularly impressive with services up a weak 0.1% for the second straight month though there was a modest negative from strikes causing a 0.3% decline in education. Goods increased by 0.6%. Manufacturing rose by 0.9% after a 1.0% October decline and weather-sensitive utilities rise by 1.4%. Agriculture saw a second straight rise, and a strong one at 2.4%, but is still down by 8.7% yr/yr. Overall GDP stands at 1.1% yr/yr, versus 0.9% in October.