Published: 2025-06-17T19:26:19.000Z

Preview: Due June 26 - U.S. Final (Third) Estimate Q1 GDP - Another marginal upward revision, but still negative

3

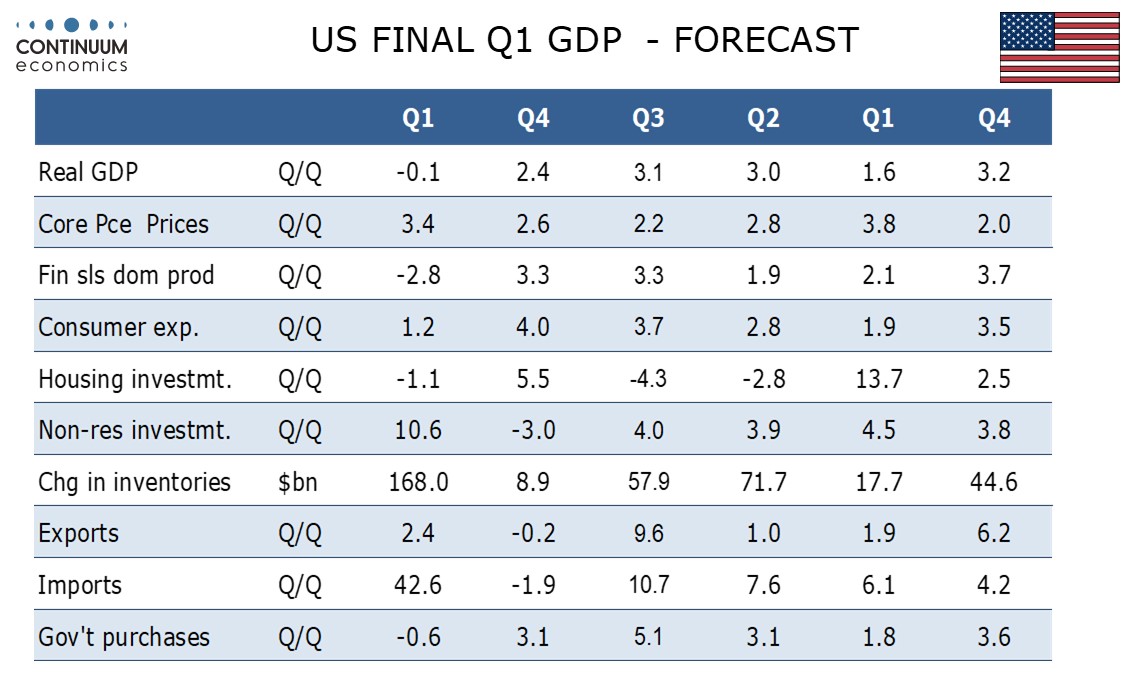

We expect the third (preliminary) estimate of Q2 GDP to be revised marginally higher to -0.1% from the second (preliminary) estimate of -0.2%. This would follow an upward revision from the first (advance) estimate of -0.3%.

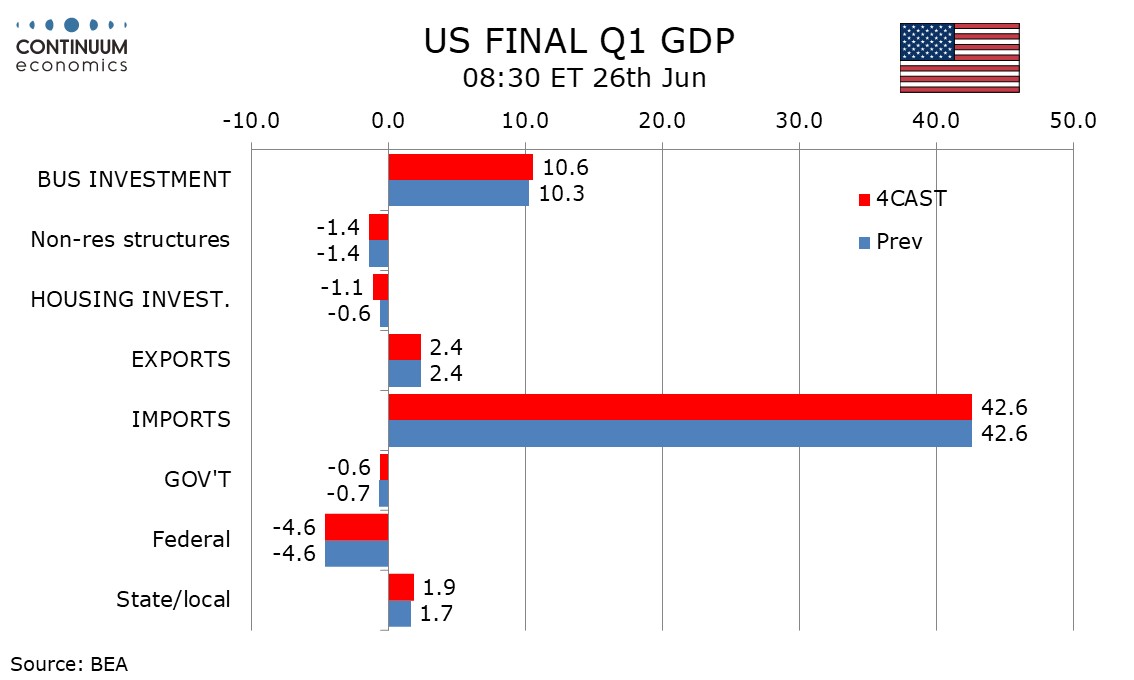

The upward revision in the preliminary estimate was more than fully explained by inventories and business investment from already strong levels, helping to explain where the surge in imports (which more than fully explained the decline in GDP) went, and we expect further upward revisions in these sectors.

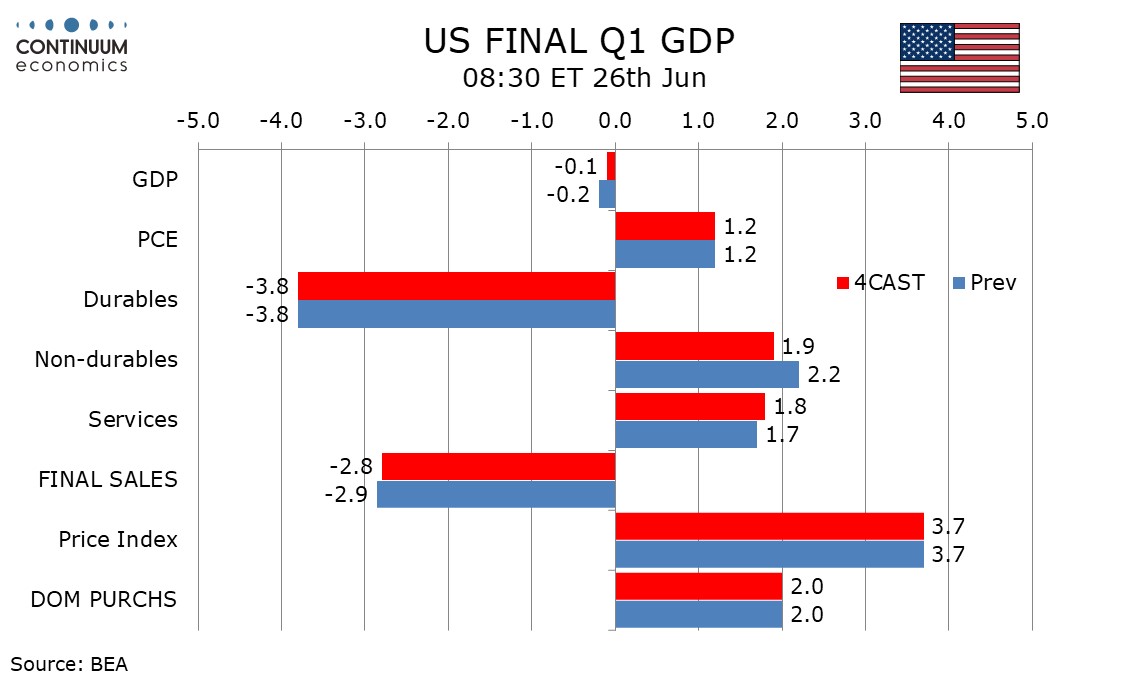

While inventories will make the largest contribution to the revision, we also expect an upward revision to final sales (GDP less inventories) to -2.8% from -2.9%. We expect final sales to domestic buyers (GDP less inventories and net exports) to be unrevised at a positive 2.0%.

We expect consumer spending to be unrevised at 1.2% with a negative revision to retail offset by an upward revision to services. We expect a negative revision to housing investment to be offset by an upward revision to public sector construction. We do not expect any revisions to the price indices, 3.7% for GDP, 3.6% for PCE and 3.4% for core PCE.