This week's five highlights

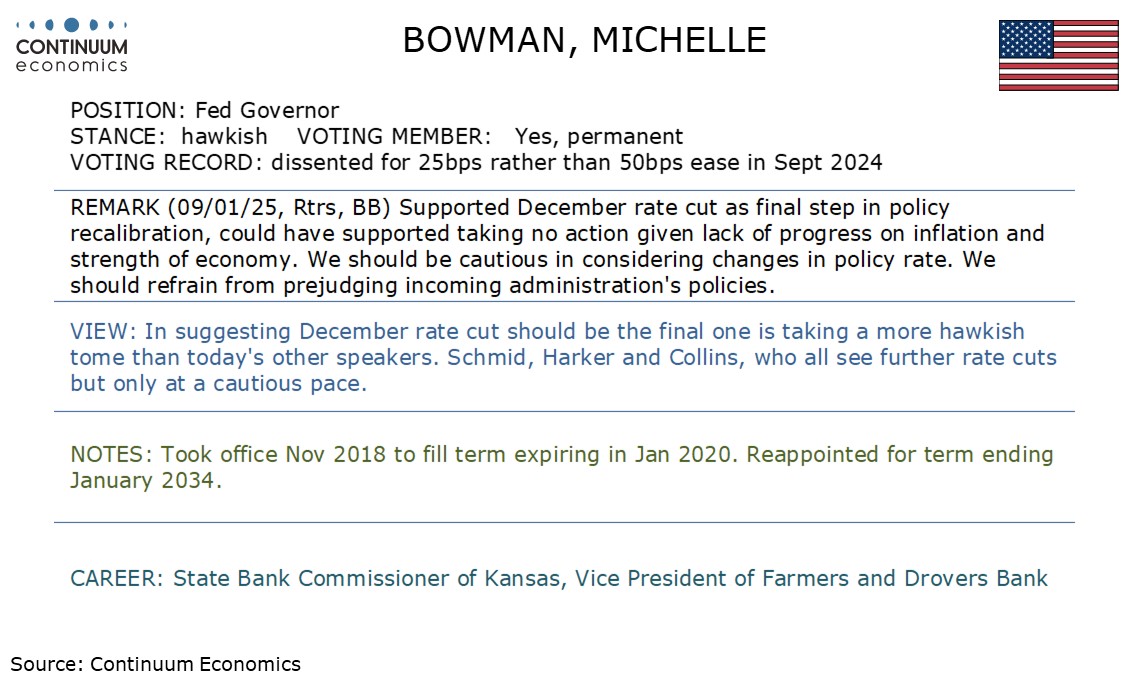

2025 First round of Fed Speaker's Remark

December FOMC Minutes Moving towards a more careful approach

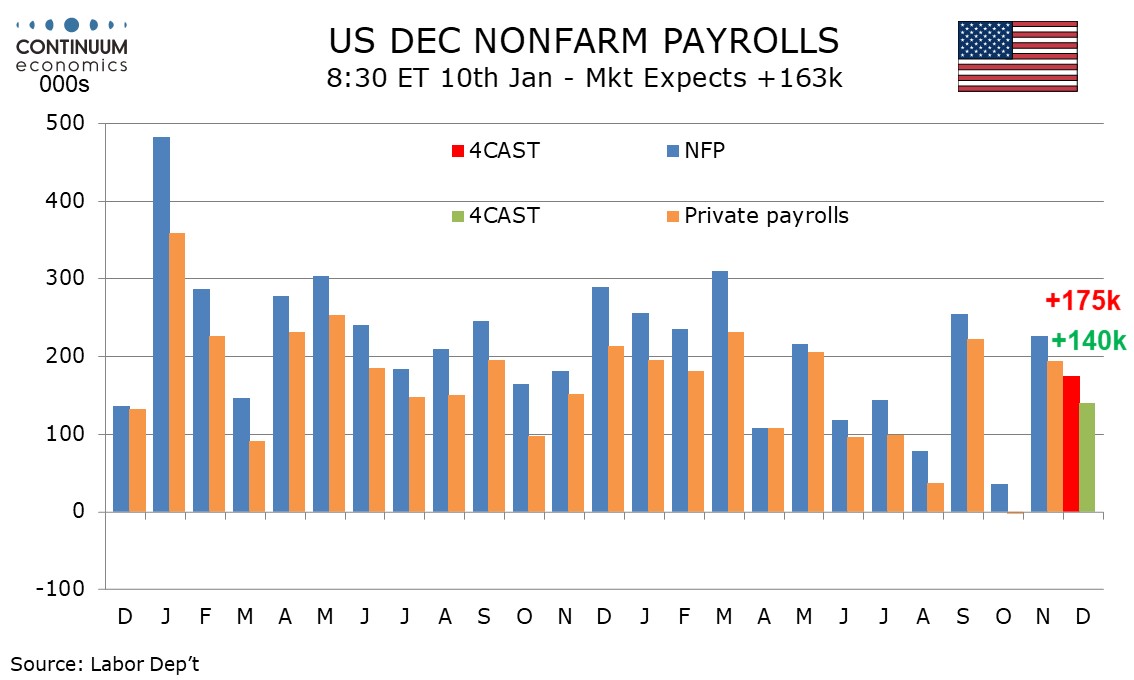

U.S. December Employment Closer to solid underlying trend

Our thoughts on Trump Policies

Japan Wage Continue to Grow at 3%

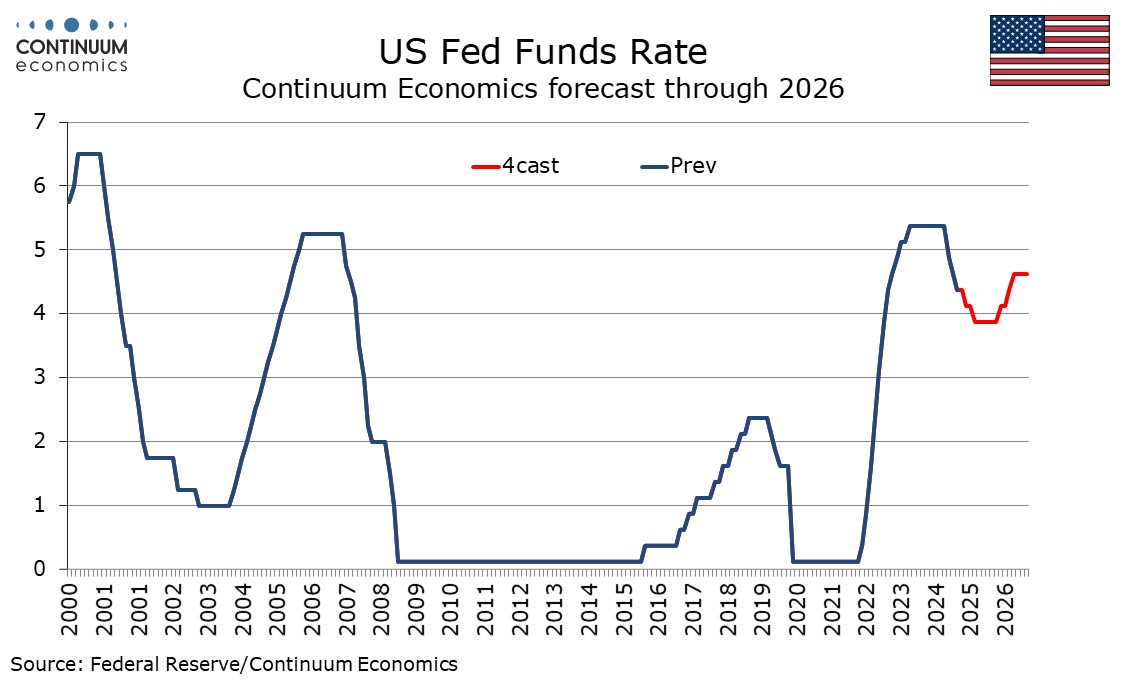

Minutes from the December 17-18 meeting show the FOMC moving to a more cautious stance, which appears largely a response to recent disappointment on inflation data but uncertainty over policy following the election also seems to be playing a part. Inflation was still seen moving towards 2%, but recent higher than expected data and potential trade and immigration policy changes suggested the prices could take longer than expected. Upside surprises in activity data were also noted, but the strength of activity was seen as unlikely to be a source of inflationary pressures, nor was the labor market, though conditions were expected to remain solid. While the vast majority judged risks to the dual mandate to be roughly balanced almost all judged that upside risks to inflation had increased.

The vast majority of participants backed the decision to ease by 25bps, though a majority noted that their judgements had been finely balanced with some seeing merit in keeping rates unchanged. Participants indicated the FOMC was at or near the point at which it would be appropriate to slow the pace of easing, which implies not moving at each meeting after three straight moves totaling 100bps. However, if data came in about as expected, it was seen as appropriate to continue to move gradually toward a more neutral stance. Factors underlining the need for a more careful approach included recent elevated inflation readings, continued strength of spending, reduced downside risks to the labor market and increased upside risks to inflation. Uncertainty also justified a more careful stance.

We expect 175k increase in December’s non-farm payroll, with 140k in the private sector, a number that should be closer to underlying trend than a strong November and a weak October. We expect unemployment to be unchanged at 4.2% and average hourly earnings to slow to a 0.3% increase after two straight gains of 0.4%. October’s 36k increase was restrained by hurricanes and a strike at Boeing and November’s 227k increase saw some catch up. Our forecasts are close to the 3-month averages of 173k overall and 138k in the private sector, though can be seen as positive given that the 3-month average includes September’s strong 255k increase but not August’s weak 78k.

The reason our forecasts are on the firm side of the 2-month and 4-month averages is that we see scope for a stronger rise in construction after two straight below trend gains totaling only 12k, and a rebound in retail after a 28k November decline. Labor market signals are generally positive, though recent very low initial claims numbers came after the payroll was surveyed.

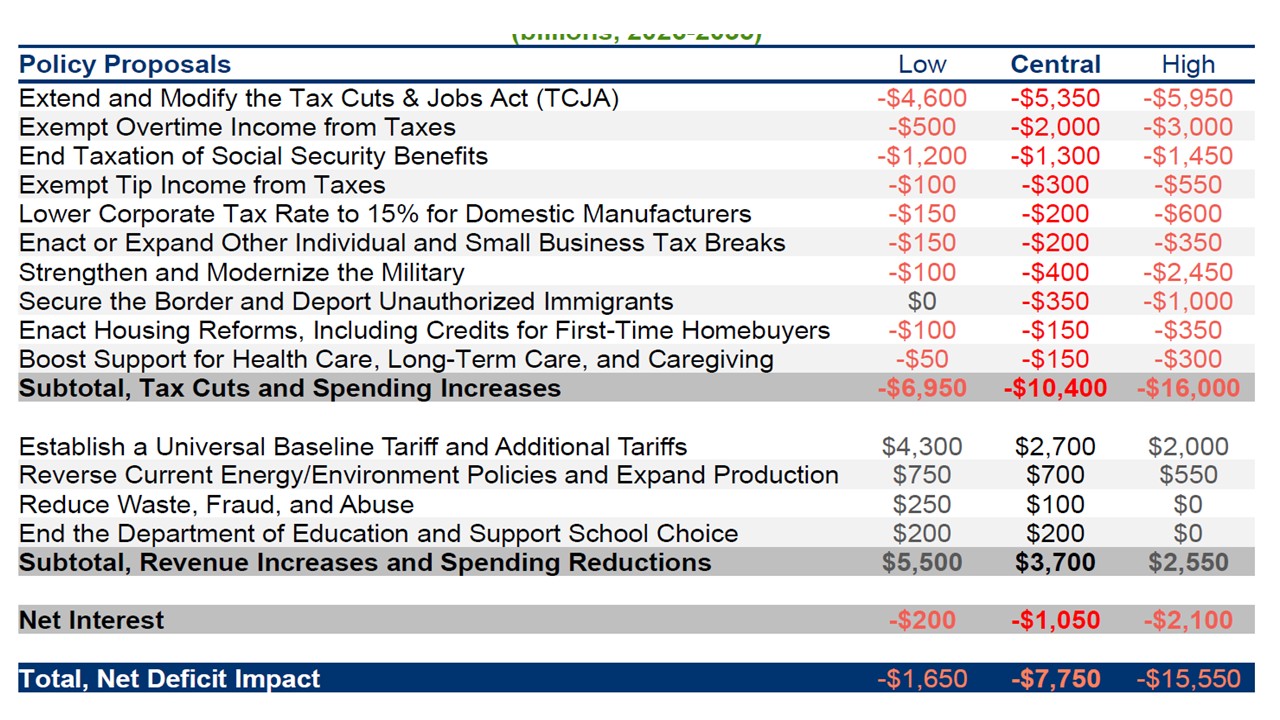

Figure: Estimates of President Elect Trump Budget Plans (USD Blns)

We see a transactional approach on trade, with tariff threats translating into actual tariffs on China initially and Trump rather than Congress having control on tariffs. On the budget, we see scope for more tax cuts than expanding the lapsing parts of the 2017 tax cuts and expenditure cuts being modest rather than large (due to Trump’s reluctance to cut Social Security, Medicare and Defense). This will likely mean budget deficits in the 8% plus region of GDP, which will also boost 10yr yields from a supply and budget deficit viewpoint.

Trump threats of a 25% tariff against Mexico and Canada suggest a transactional approach to achieving concessions on the border or enhancing a trade deal. A willingness to discuss issues by both Mexico and Canada has pleased Trump and supports the transactional approach of threats more than tariff action. After the January 20 inauguration, the focus will be on whether this transactional approach is expanded. Reports suggest some Trump supporting economists favor an across the board tariff for certain sectors, which could be more economically damaging to trade and boost inflation. However, the odds remain that Trump will not cede tariff decisions to congress and will remain in control via executive orders. We still feel that China will be the first target starting with demands for an enhanced trade deal and then an average 30% tariffs being implemented against the current 20%. China will be reluctant to quickly capitulate to the U.S., which will mean a H1 2025 trade war with China. We also feel that Germany and the EU are at high risk of tariff threats and actual tariffs in 2025 , alongside Vietnam.

The Labor Cash Earning for Japan in November ramped up to 3%, repeatedly above 2% for months. It further shows the pirce/wage setting behavior change in Japan persists. But it seems to be not persuasive enough for the BoJ as we heard little strength nor commitment from the remarks from Ueda and other BoJ officials. The BoJ may have spoke too soon in July 2024 by being too hawkish while there forecast are likely to be disappointed in a medium horizon. The key going forward would be 2025's wage negotiation where union have asked for another historical wage hike but SMEs are unlikely to keep up.

On the chart, the pair is consolidating at the 158.00 level as prices unwind overbought intraday studies following extension to 158.55 high. Daily studies remains positive and suggest room for further gains to the 158.85 resistance. Beyond this, if seen, will open up the 160.00/23 level and April high to retest. Meanwhile, support remains at the 157.50 congestion which now underpin. Break here will see room for pullback to the strong support at the 156.75/156.00 area. Would take break here to fade the upside pressure and open up room for deeper retracement of the strong run-up from the December low.