Preview: Due February 6 - Canada January Employment - A second straight subdued month after three strong ones

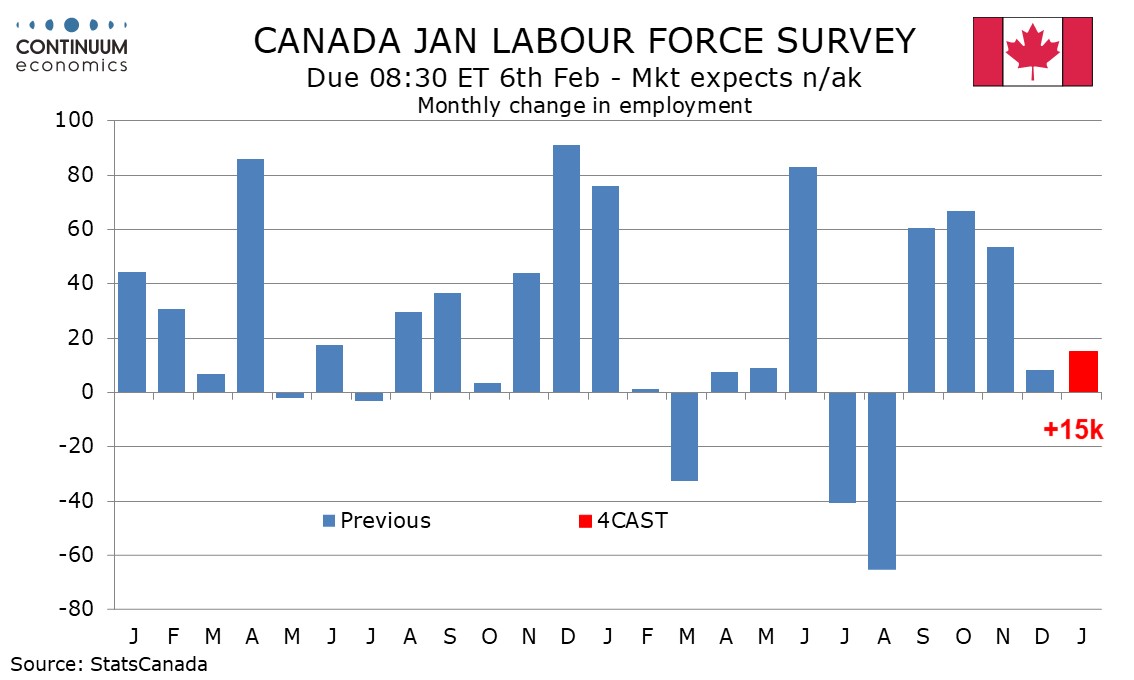

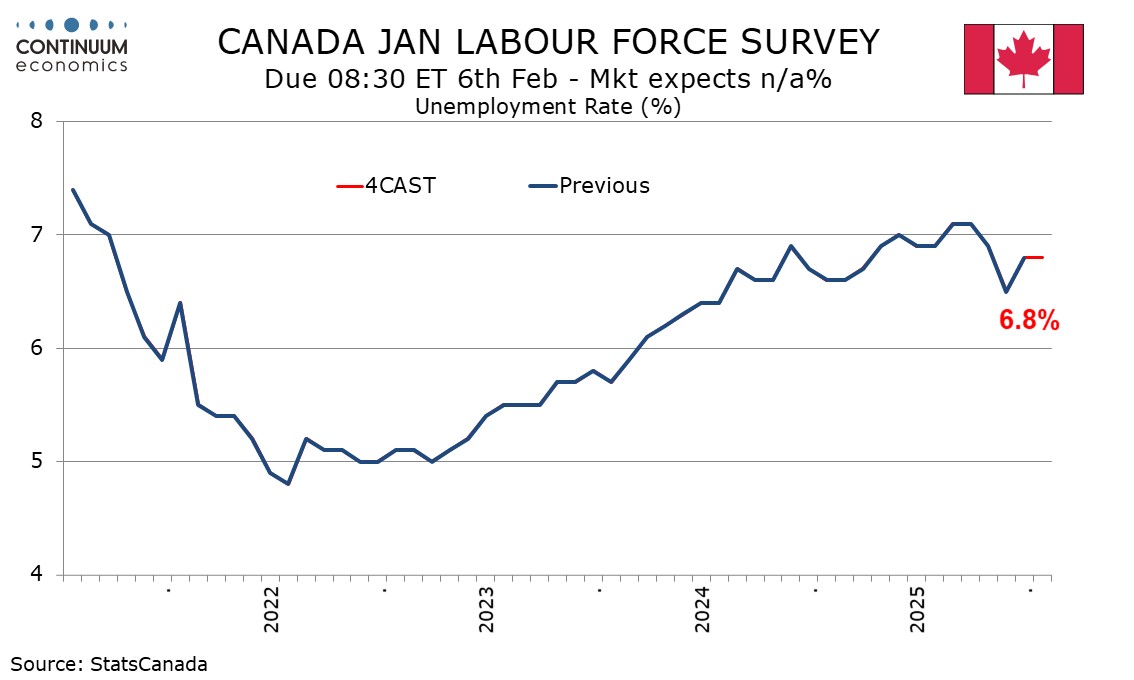

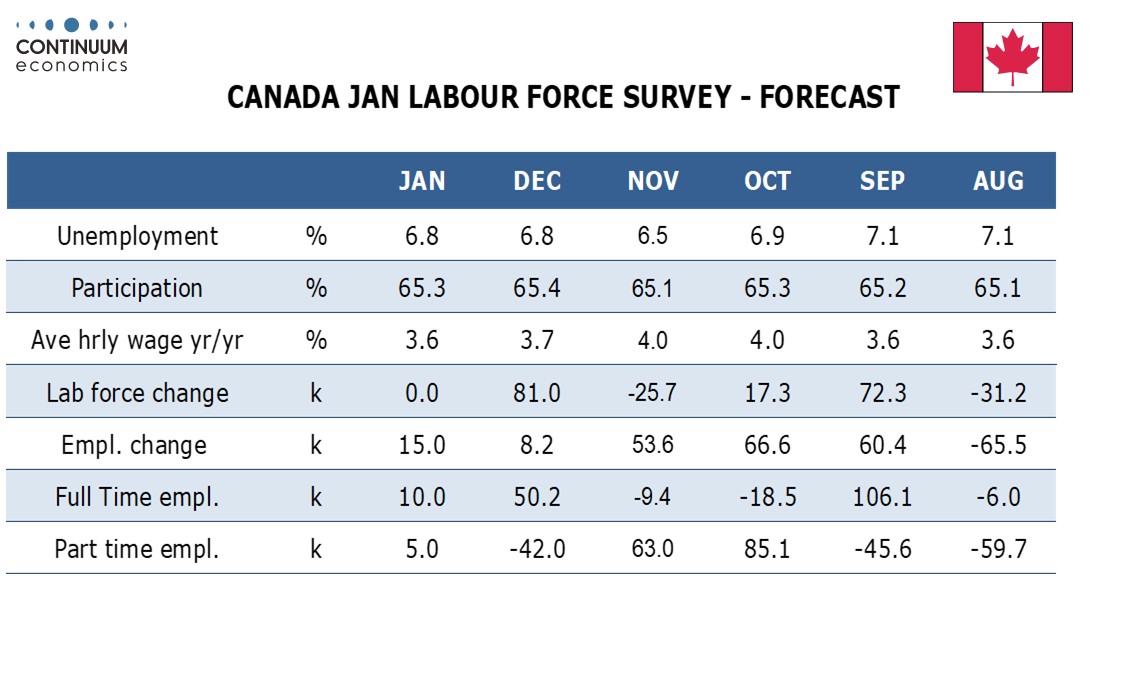

We expect Canadian employment to increase by 15k in January, a second straight moderate increase following December’s 8.2k that followed three straight strong gains averaging close to 60k. We expect unemployment to remain at December’s rate of 6.8%, but to fall before rounding.

Three strong gains in employment followed steep declines in July and August, and with Q4 GDP shaping up to be significantly slower than Q3’s 2.6% annualized gain we would expect employment growth to enter 2026 with limited momentum. December’s breakdown contained no standouts by industry that imply significant corrections in January.

We expect full-time employment to rise by 10k in January with part-time rising by 5k. December saw full time employment leading as do the six month and twelve month averages, though on a three month average part time is ahead, suggesting it is not due for a bounce despite December’s dip.

Unemployment has been volatile in recent months though only November’s 6.5% looks erratic. The rate appears to have peaked at 7.1% in August and September with December’s 6.8% below October’s 6.9%. Before rounding we expect January’s rate to slip to 6.77% from 6.83%, with a flat labor force marking a pause after a surge of 81k in December than more than compensated for a 25.7k dip in November.

We expect a modest slowing in the average hourly wage of permanent employees to 3.6% yr/yr in from December’s 3.7%, returning the pace to that seen in August and September. A bounce to 4.0% in October and November was difficult to explain given that Canada remains well below full employment, even if the unemployment rate is now starting to edge lower.