JPY flows: Renewed sell off on election fears

JPY renews downtrend as Takaichi call election and pledges to suspend food tax

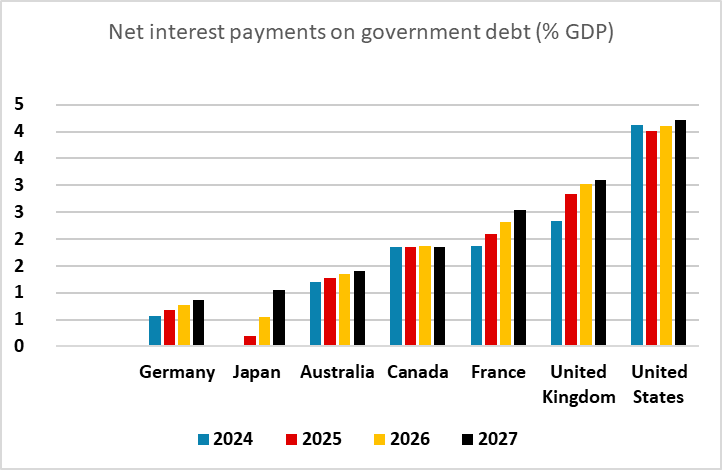

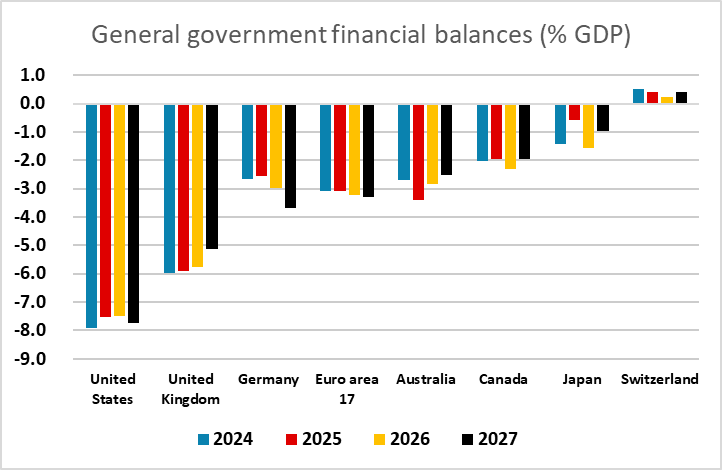

Early European trading is seeing a significant sell off in the USD and particularly in the JPY on the crosses, following yesterday’s election call from PM Takaichi. She vowed to suspend an 8% levy on food sales for two years as one of her election promises and although she said this would not be financed by additional debt, she didn’t specify how it would be financed. JGB yields surged to new highs, and the JPY has sold off aggressively in early European trade. In reality, it’s hard to see why the market would be concerned about Japanese public finances, as the deficit is already well below that of other major nations, and interest payments on debt are also among the lowest of the developed countries. Rising JGB yields in part reflect the QT program, which means that there is big net selling of JGBs by the government and BoJ, as large debt maturities outweigh current buying by the BoJ. Even if Takaichi does increase the budget deficit, the impact on JGB supply is likely to be minor compared to BoJ decisions on bond buying.

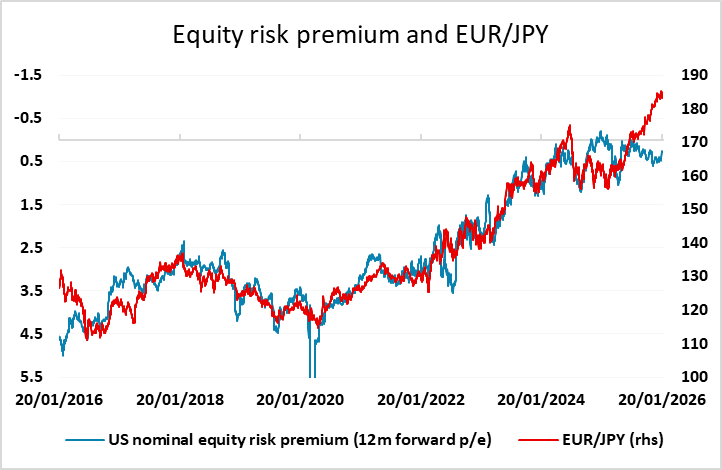

In reality, the JPY sell off reflects a continuation of the strong JPY downtrend of recent years more than any fundamentals. The pause in JPY weakness seen at the end of last week was due in part to the threat of intervention, potentially including US involvement. With the Japanese election coming up and Greenland dominating the public discourse, the market may feel that intervention is less likely. But if the Japanese authorities want to avoid more new lows in the JPY, they will need to pull the trigger intervention before a pre-election JPY sell off gathers more momentum.