SEK flows: SEK softer after more dovish Riksbank

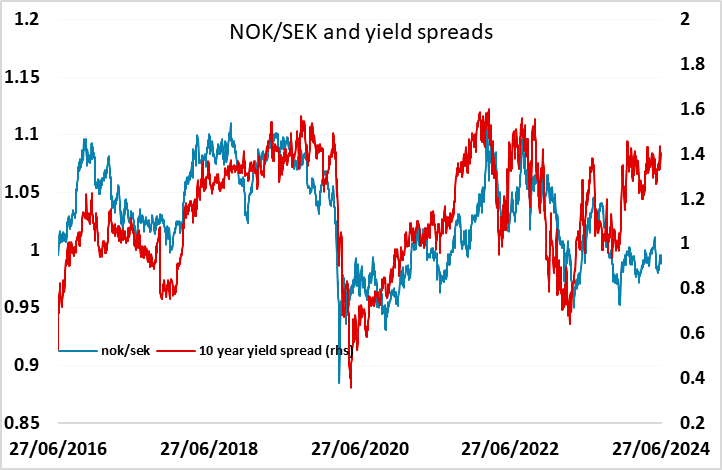

Riksbank seeing scope for up to 3 cuts this year. SEK softer, NOK/SEK looks to have the most potential.

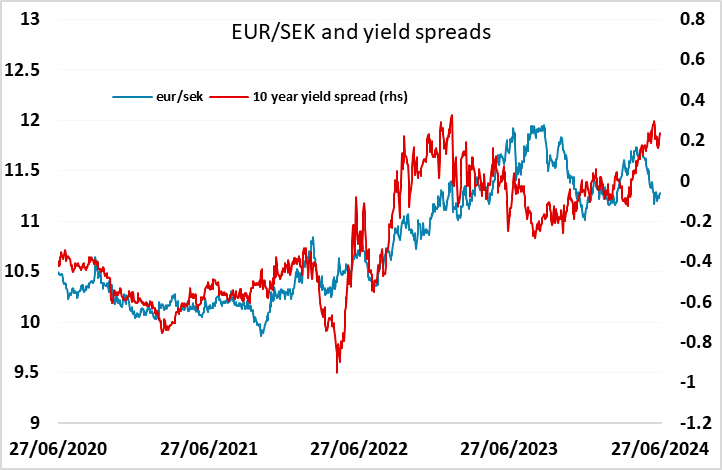

A more dovish than expected Riksbank guidance indicating two to three rate cuts are possible this year, as against two suggested after the May meeting, has helped the SEK weaken in the initial aftermath. The SEK has in any case been somewhat stronger than is consistent with recent yield moves, primarily against the EUR, in part because of the concerns surrounding the French election. The political issues in France are likely to persist for some time, and there is also potential for some renewed concerns about fiscal issues in France and the Eurozone in general. So while EUR/SEK looks a little low relative to yield spreads, we see a more stable rationale for NOK/SEK gains than EUR/SEK gains.