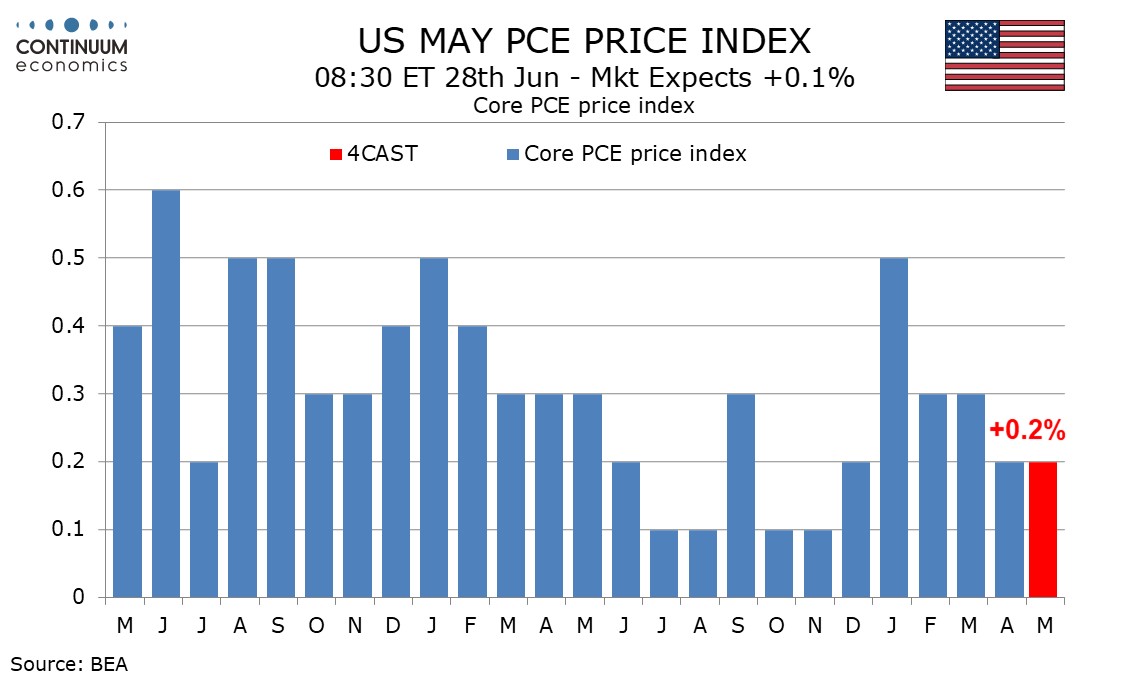

Preview: Due June 28 - U.S. May Personal Income and Spending - Core PCE Prices to round up to 0.2%

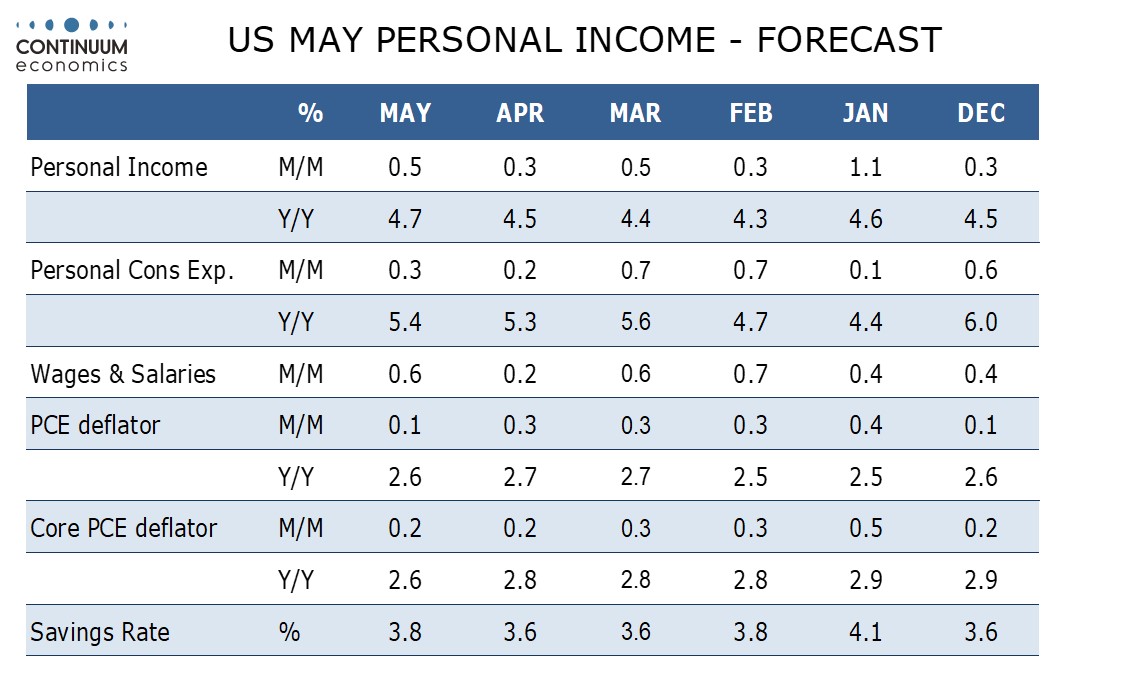

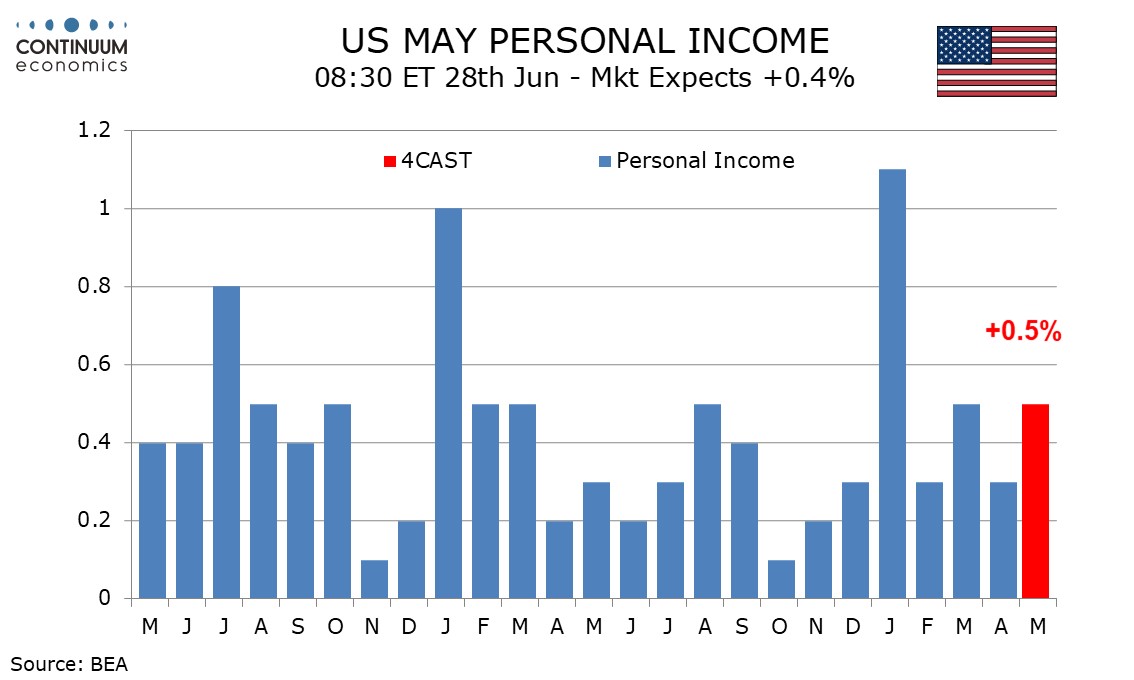

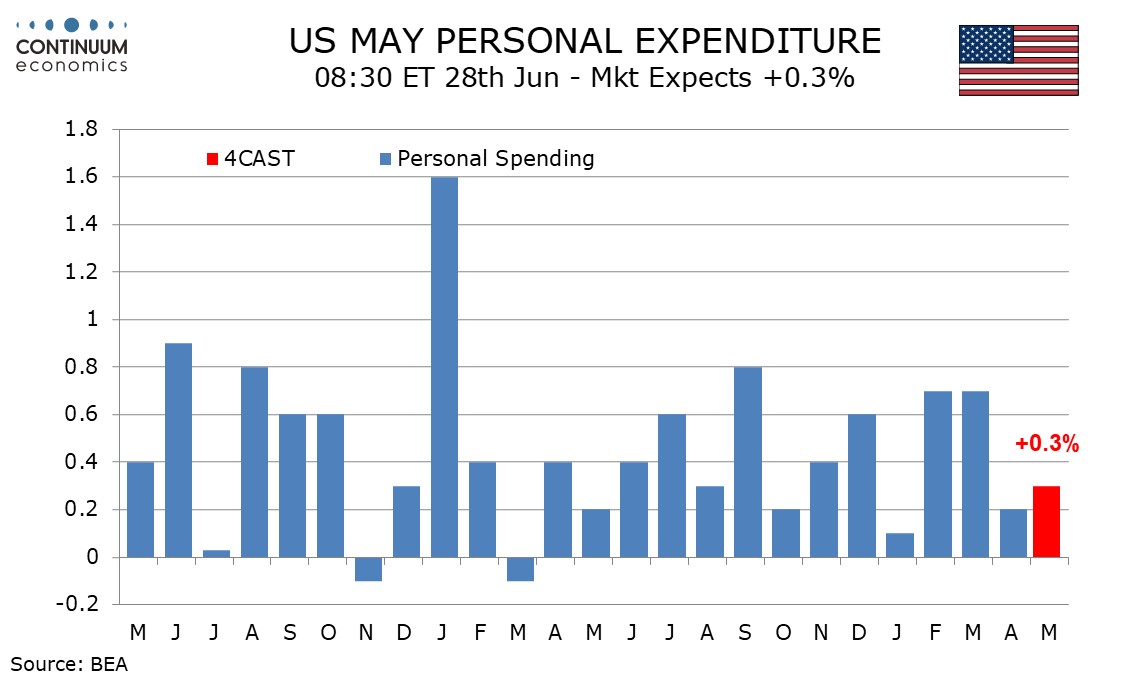

We expect a 0.2% increase in May’s core PCE price index, consistent with the core CPI though like the CPI we expect the gain to be on the low side of 0.2% before rounding. We expect a 0.3% rise in personal spending, underperforming a 0.5% rise in personal income.

With the core CPI up only 0.16% before rounding the core PCE price index is a close call between 0.1% and 0.2% particularly with core PCE prices usually underperforming core CPI. However core CPI was well below trend and we expect the core PCE price index to be a little less striking.

Overall CPI was unchanged but with PCE prices less sensitive to gasoline we expect overall PCE prices to rise by 0.1%, though by less than 0.1% before rounding. Yr/yr growth will then fall to 2.6% from 2.7% for overall PCE prices, and to 2.6% from 2.8% for the core rate.

We expect personal income to increase by 0.5% led by strong non-farm payroll details for both employment and average hourly earnings, bringing a 0.6% increase in wages and salaries.

We expect a 0.3% rise in spending. Retail sales rose by 0.2% excluding weaker food services which are considered as services in the PCE breakdown. We expect a 0.3% rise in services despite weakness in food services.