JPY flows: Dip on Ishiba resignation unlikely to last

JPY lower after Ishiba resignation, but has scope for major recovery

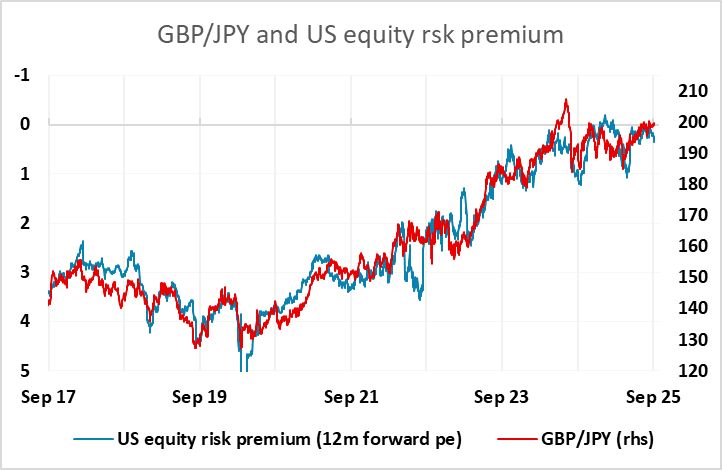

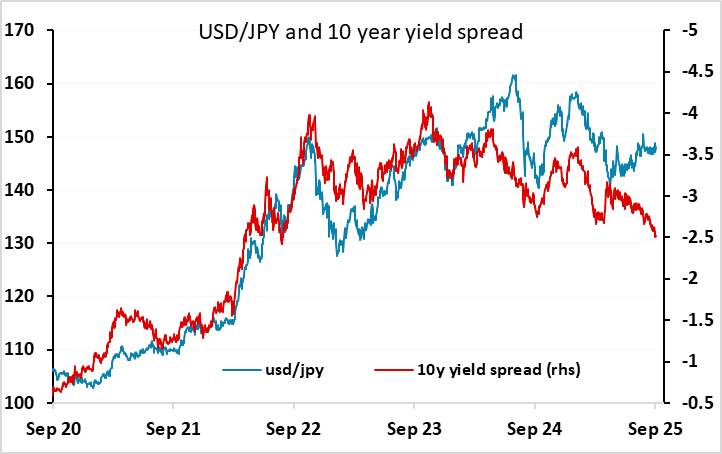

The resignation of Japanese PM Ishiba over the weekend has led to a general decline in the JPY at Monday’s Asian open. However, it is less clear that this decline will be sustained. While there is potential for policy changes under a new leader, the international environment still suggests things are moving in the JPY’s favour. Lower US yields and a declining US/Japan yield spread suggest susbtantial potential for JPY gains from what are still extremely undervalued levels. Declining US yields mean the JPY is also starting to look too low on the crosses based on the correlation with equity risk premia that has held for the last 8 years. While political uncertainty can have a short term impact, it is unlikely that any change in LDP leadership will have a significant impact on policy. If it does, it would likely be in the direction of easier fiscal policy, increasing the chances of early BoJ tightening. Before his resignation, Ishiba secured the trade deal with the US which set the Japanese tariff at 15%, in line with the EU, thus providing no reason for JPY cross weakness. And the Q2 Japanese GDP data released this morning, showing an upward revision to 0.5% q/q, provided further reason to see an early BoJ tightening. All in all, the negative JPY reaction to Ishiba looks to provide a JPY buying opportunity.