Published: 2024-01-17T18:23:59.000Z

Due January 25 - U.S. December Advance Goods Trade Deficit - Widest deficit since April

Senior Economist , North America

-

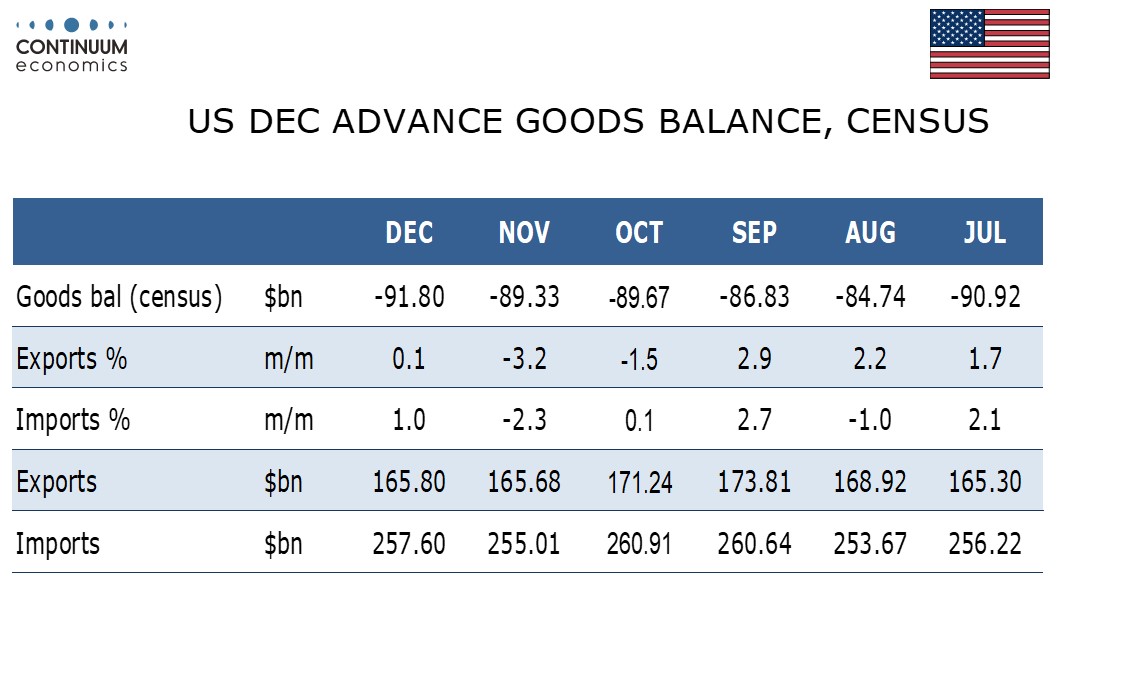

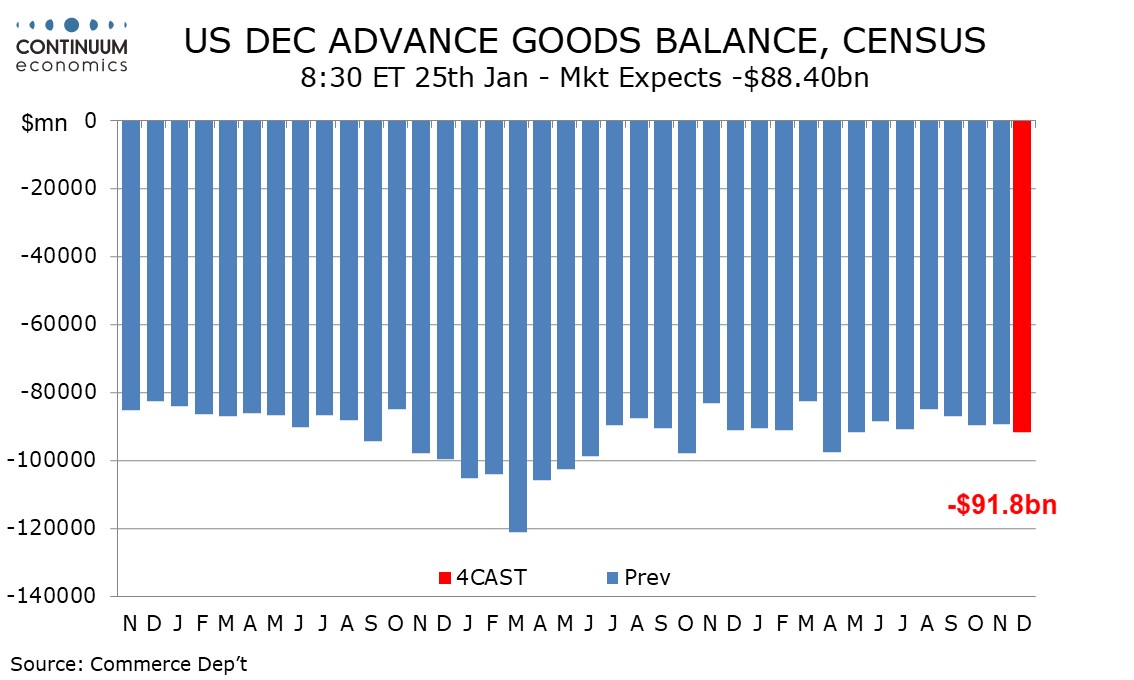

We expect an advance goods trade deficit of $91.8bn, up from $89.3bn in November and the widest deficit since April, though the deterioration will be exaggerated by price effects.

We expect exports to rise by 0.1% and imports to rise by 1.0%, though with export prices having fallen by 0.9% and import prices having been unchanged the changes will be similar in real terms. This still implies some increase in the deficit in real terms as similar gains in exports and imports in percentage terms mean a larger gain for imports in USD terms.

Export and import volumes will be correcting from dips in November which corrected increases in September (October saw volumes little changed). The trade data, as well as advance wholesale and retail inventory data released with the report, will influence the Q4 GDP report due for release at the same time. Our forecasts imply little change in either export or import volumes in Q4.