Canada January Employment - Strong headline, details less impressive

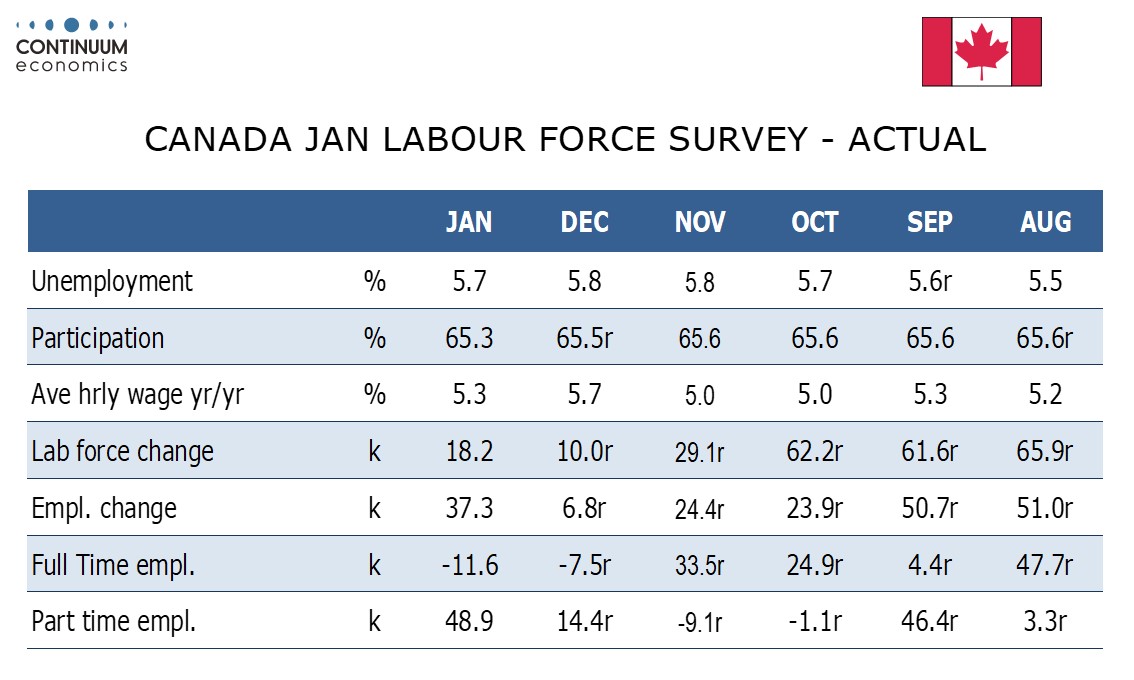

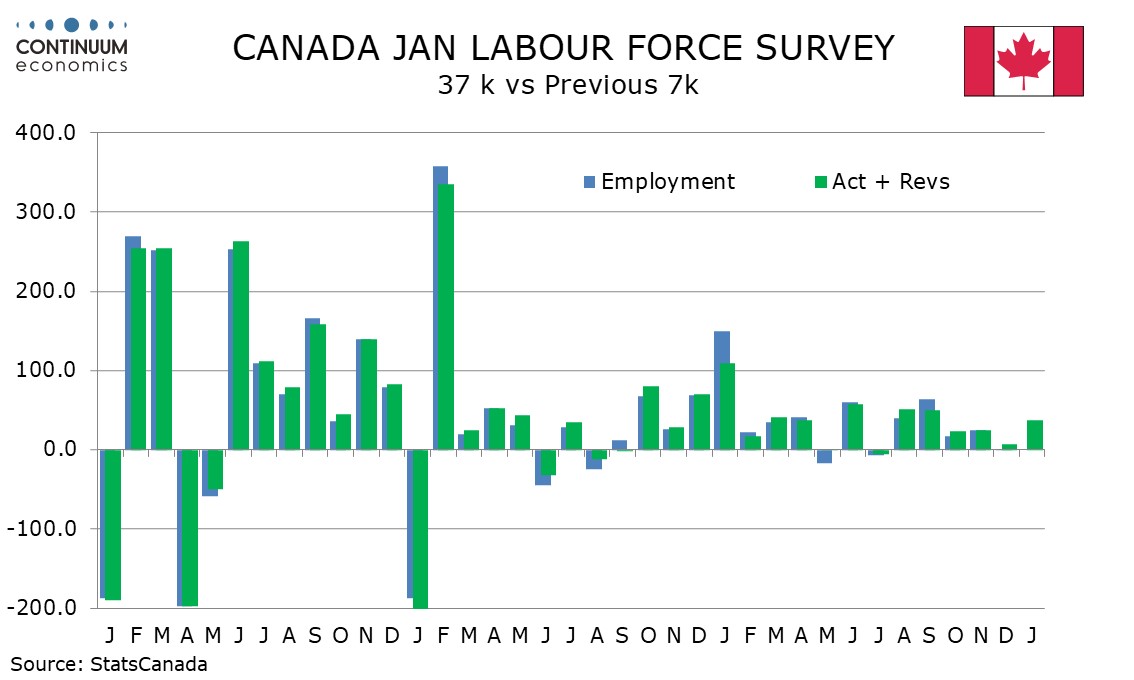

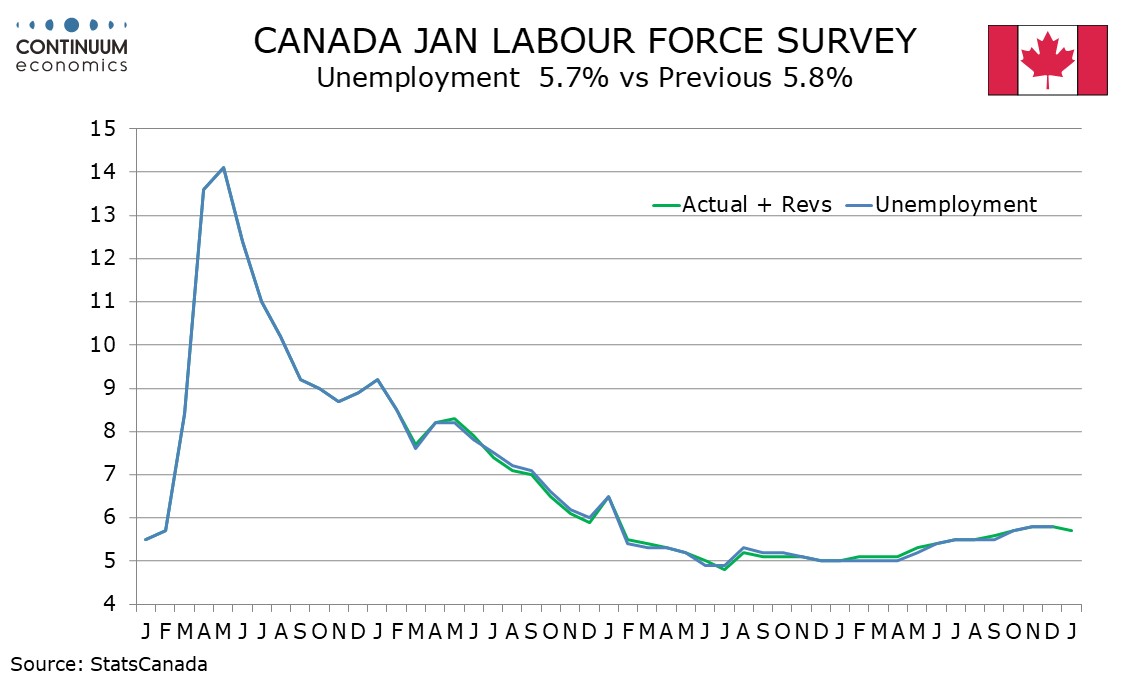

Canada’s employment data is stronger than expected on the headline with a rise of 37.3k and a fall in unemployment to 5.7% from 5.8% but the strong headline masks a fall of 11.6k in full time work while the BoC will be relived to see wage growth slow to 5.3% yr/yr from 5.7%. The report is consistent with Q4 GDP exceeding the BoC’s uncaged projection though growth still appears to be quite modest.

Part time work increased by 48.9k while the employment gain was also fully explainable by a 47.8k increase in public sector work. Private employment rose by 7.4k while self-employment fell by 17.7k. The labor force rise by 18.2k, underperforming employment and lending to the drop in unemployment, the first since December 2022 fell to 5.0%.

Goods producing employment fell by 23.0k with manufacturing, construction and agriculture all falling by around 6k. Service producing employment rose by 60.4k, but details were mixed. Wholesale and retail rose by 31.3k, finance, insurance, real estate and leasing by 28.1k and education by 27.7k, but there was a sharp 30.3k decline in accommodation and food services.

The average hourly wage of permanent employees fell to 5.3% yr/yr after surging to 5.7% in December from 5.0% in November. Wage growth still looks too high to be consistent with the BoC’s 2% inflation target but the correction from December’s surge does provide some relief.