This week's five highlights

ECB Inflation Outlook Lowered

UK CPI Below Target and BoE Hawks Placated

Canada CPI Subdued and pause in BoC core rates downtrend likely to be temporary

U.S. Retail Sales and Industrial Production

China September Data Rotates Higher

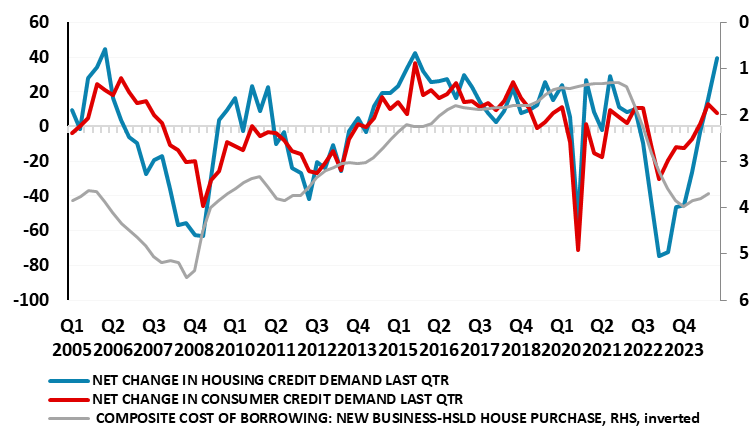

Figure: Household Loan Demand Recovering Strongly?

The latest 25 bp rate cut from the ECB was obviously not anticipated at the previous meeting, although perhaps the Council was more open to such a move than the press conference then suggested. But it is clear a reassessment is occurring, not just of the inflation outlook but the real economy too. Indeed, the ECB has brought forward inflation hitting target durably now to be in the course of next year as opposed to late 2025 as suggested in the September projections. Presumably, this revised outlook is based on market interest rate thinking. If so, it endorses the fall in the deposit rate to around 2% that is now being discounted. Regardless, the ECB is clear that it remains data dependent and is not pre committing but with the Council saying the disinflation process is well on track, we continue to see the deposit rate falling to around 2.25% by next summer, a rate that would be around neutral. Without the potential boost of the recent build in household savings and the indications that rate cuts have already stared to boost credit demand (Figure 1) we would be arguing for deeper/faster cuts – the risk of the latter is still clear though!.

The ECB has cut rates at a successive Council meeting for the first time in this easing cycle dating back to June, with the deposit rate now down to 3.25%. To date the ECB has allowed the impression that it would ease only every other meeting, ie once a quarter, partly to give it access to what it sees as key labor cost numbers. But yet another downside inflation surprise, alongside business survey data highlighting both fresh stagnation risks and much reduced cost pressures, have changed the ECB mindset and very much point to another cut in December. Given that energy base effects may push y/y headline inflation back above target (in contrast to what adjusted monthly data suggest), at this juncture we think the ECB may revert back to a slower easing pace in 2025. But amid signs that downside growth risks may be materializing, the risk from hereon of easing at every meeting into mid-2025 is a growing. After all, that is how policy was tightened amid the marked jump in inflation, but where the subsequent fall has actually been faster.

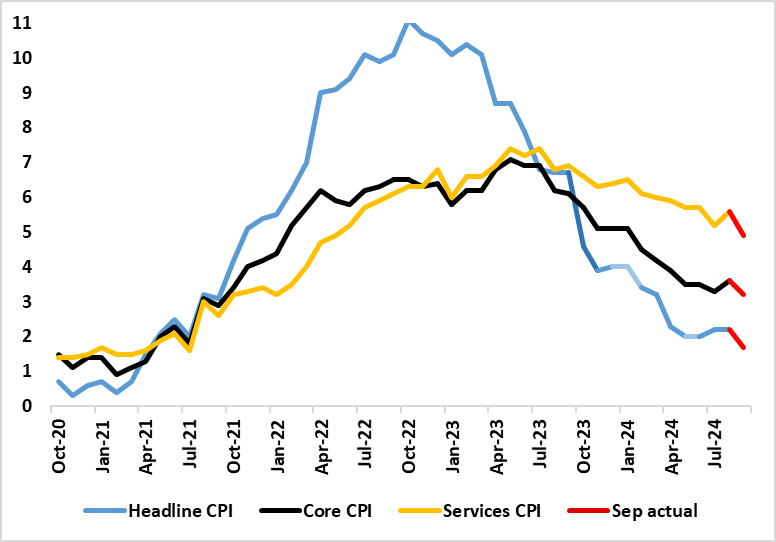

Figure: Clear and Broad Inflation Drop?

Helped by a fall in fuel prices and airfares, amplified by base effects, alongside some belated broader softening in services costs, UK inflation dropped to 1.7% in the September CPI (from 2.2%), thus falling below target for the first time since April 2021. This drop was greater than expected and included an unexpectedly large fall in services inflation to a 28-mth low of 4.9%, in turn dragging the core down 0.4 ppt to a cycle low of 3.2% (Figure). Admittedly, the drop in the headline is likely to be short-lived as this month’s rise in the energy price cap and a recovery in airfares should pull the headline rate back to around 2.2% in October and average a little higher for the whole of Q4. Regardless, the data backdrop is consistent with underlying inflation having fallen, especially when assessed in shorter-term dynamics (Figure 2) but with still some services stickiness. As such a CPI picture, now weaker than BoE thinking, should make the much-vaunted Bank Rate cut at the looming November MPC meeting almost a given. But as for a possible further mover as soon as the December MPC meeting this is still a possibility, but a growing one, even given apparent splits within the BoE hierarchy as real economy risks emerge afresh.

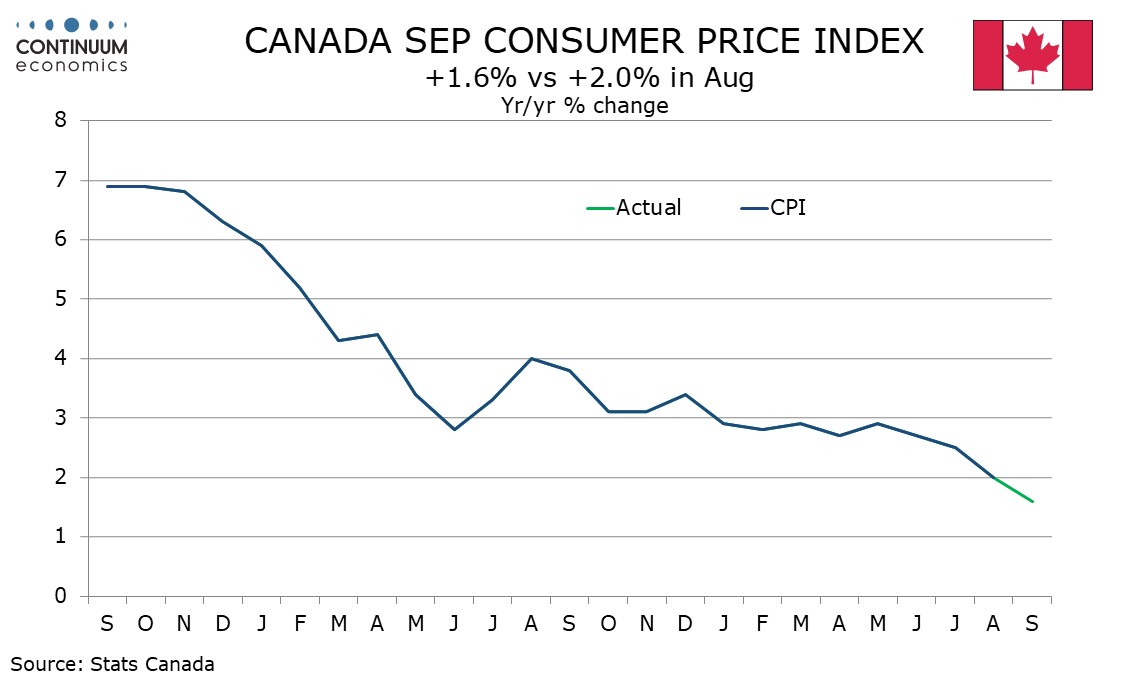

September Canadian CPI is weaker than expected overall at 1.6% from 2.0% yr/yr, and subdued on the month, though there has been a lack of further progress on the Bank of Canada’s core rates, largely because year ago data dropping out was also subdued and below where trend then was. This leaves next week’s BoC call a close one, but we feel a 25bps easing is more likely than 50bps. Overall yr/yr CPI is the slowest since February 2021, and is now below the BoC’s 2.0% target, but the BoC’s core rates remain above, and CPI-Median at 2.3% and CPI-Trim at 2.4% are unchanged from August. The third BoC core rate, CPI-Common, actually edged up to 2.1% from 1.9%. This puts all three above target, but only marginally. Renewed slippage is likely in Q4 with the year ago data due to drop out not as subdued at that seen in September 2023.

On the month the data is clearly subdued, with overall CPI falling by 0.4% unadjusted on energy with ex food and energy CPI falling by 0.1%. Seasonally adjusted CPI was unchanged overall and up by 0.2% ex food and energy. The seasonally adjusted ex food and energy gain follows two straight gains of 0.1% and will not trouble the BoC. Even if the yr/yr core rates are still above 2% Q3 ex food and energy CPI is consistent with underlying trend falling below. Yr/yr ex food and energy CPI, not one of the BoC’s core rates, was unchanged from August at 2.4%.

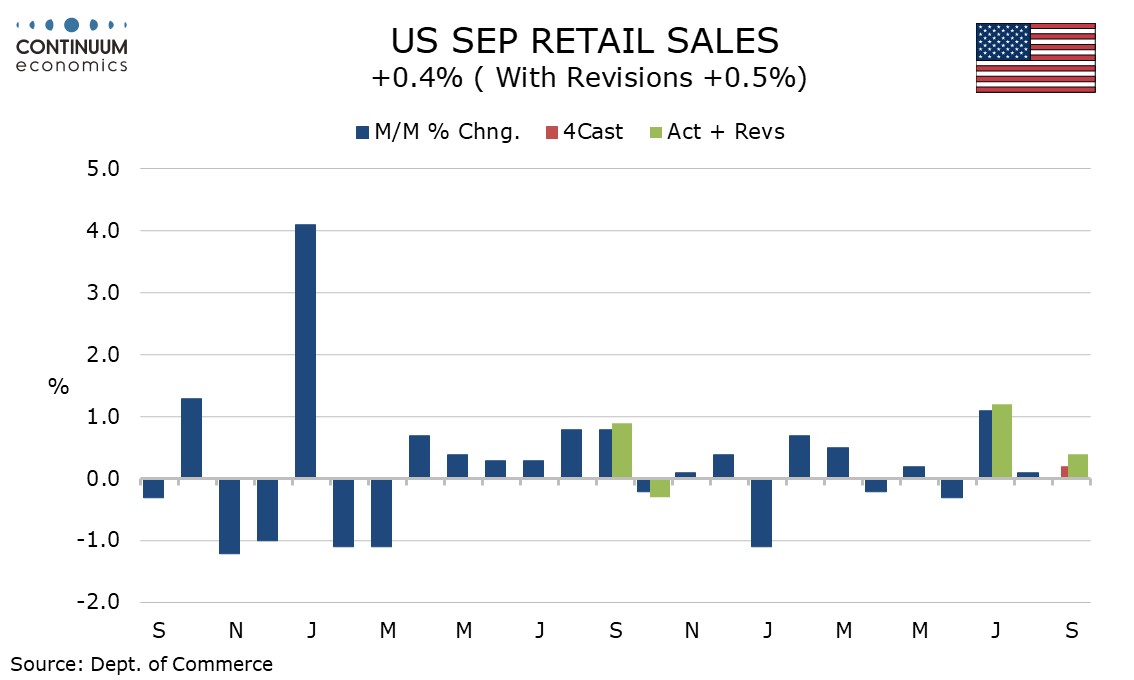

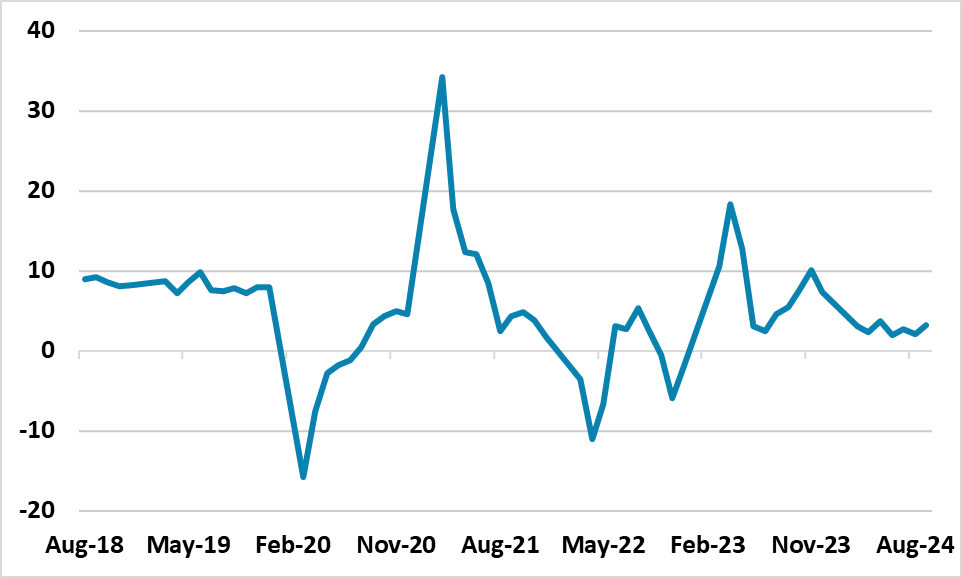

September retail sales show the consumer sustaining solid momentum through Q3 with a stronger than expected rise of 0.4% overall, 0.5% ex autos and impressive gains of 0.7% both ex autos and gasoline and in the control group that contributes to GDP. Initial claims in the survey week for October’s non-farm payroll slipped to 241k from 260k, which may reflect a lesser impact from Hurricane Milton than feared, though the impact of the Hurricane may not be fully reflected yet. Auto retail sales were unchanged, slightly underperforming the total, and gasoline sales slipped by 1.6% on lower prices. The 0.7% rise ex auto and gasoline is stronger than expected with both preceding months revised up by 0.1%, leaving a solid Q3.

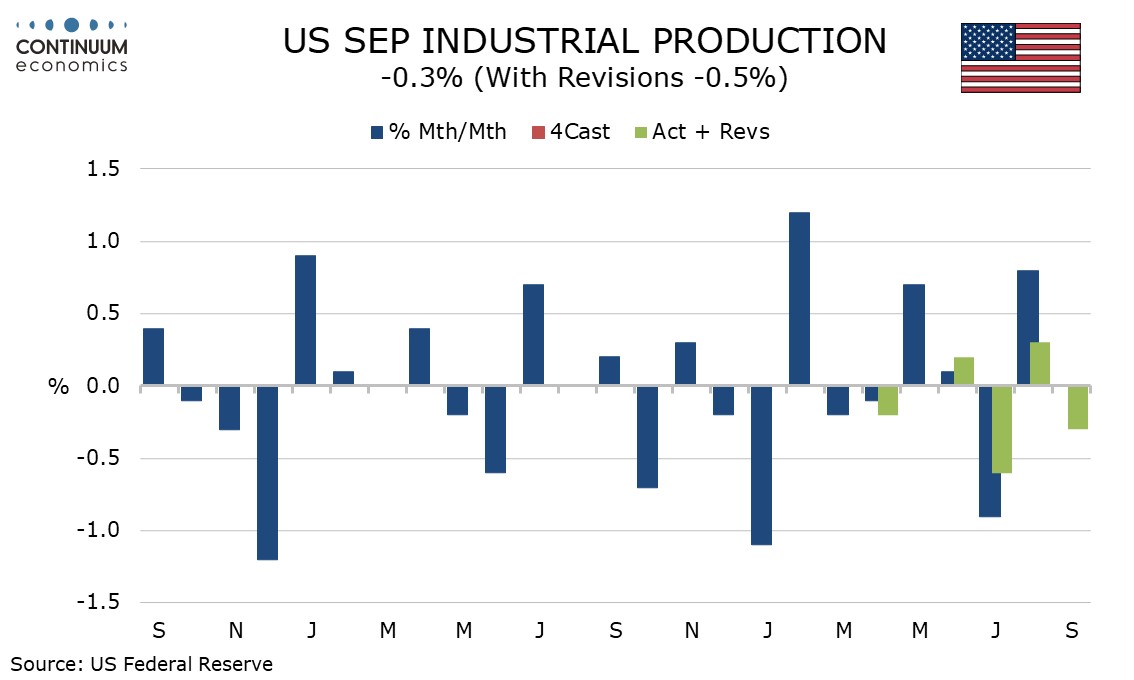

September industrial production was a little weaker than expected with a 0.3% decline, with manufacturing down by 0.4%, but the Fed stated that a strike at Boeing which started in mid-September took 0.3% off the total, and the impact of two Hurricanes took off an additional 0.3%, meaning a modestly positive underlying picture, though August data was revised lower. The hurricanes that impacted the September data are not named, but they are likely to be Francine, which impacted oil production in the Gulf of Mexico, and Helene. Hurricane Milton will have its impact in October while the Boeing strike is continuing and if it lasts through the month could have a bigger negative impact than in September.

Figure: Retail Sales Yr/Yr (%)

Q3 GDP and September monthly figures were slightly better than expected. Combined with a speed up of local government spending in Q4 and more completion of uncompleted homes, we change our 2024 GDP forecast to 4.8% v 4.6%. However, despite a further Yuan1.5-2.0trn of fiscal stimulus to come, we still see 4.5% 2025 GDP. Stimulus is not focused on the consumer, while the residential housing market has not bottomed in construction or sales terms.

The 4.6% Yr/Yr for Q3 was somewhat better than expected and stabilizes after the downward trend in recent quarters. However, Q/Q was +0.9%, while the GDP deflator was -0.6% Yr/Yr. We are revising our 2024 GDP forecast up from 4.8% to 4.6% for a number of reasons. Firstly, local authorities are expected to speed up spending in Q4, both as they have been slow so far this year and due to central government pressures. Secondly, the government is putting emphasis on finishing uncompleted homes, with reports that gross lending by banks will be boosted from Yuan2trn to Yuan4trn – the net figure is less clear however. Thirdly, government trade in funds for housing appliances had an impact in September retail sales (+20.5% Yr/Yr v +3.4% in August) and this will still have a modest help in Q4. It could be that GDP turns out at 5.0% for 2024, but this would likely be accompanied by more deflation – the disaggregation of nominal GDP into real GDP and GDP deflation is tricky.

Industrial production Yr/Yr was higher than expected at 5.4% v 4.6% expected, with high tech manufacturing buoyant and auto production getting less worse at -1.0% Yr/Yr. However, cement and steel production still maintain substantive falls, due to the bust in residential property construction. Retail sales at 3.2% Yr/Yr was also better than expected v 2.5% expected. Home appliance surged helped, with good sales of communication devices. However, the post COVID surge in eating out appears over, with restaurant spending slowing further to +3.1% and jewelry remain weak – autos were less bad but still -0.4% Yr/Yr.

We are keeping out 2025 GDP forecast at 4.5%. The breakdown of the September data suggests that the economy remains unbalanced and signs of consumer weakness remain evident. Though fiscal stimulus will be announce late October by the National People Congress, we see this totaling Yuan1.5-2.0trn for 2025 (here). The lack of major fiscal stimulus for households will not lift the gloom for consumption. Meanwhile, we still see residential investment construction subtracting from GDP. Though more uncompleted homes will now likely be finished, this is likely to be at the cost of new starts. Meanwhile, despite the recent anecdotal bounce, most households will remain cautious about buying until the market is seen to have properly bottomed – which would likely require house prices to consistently rise.