AUD, JPY flows: AUD firm after RBA, JPY remains well bid on shutdown concerns

AUD benefits from more neutral RBA stance. JPY still favoured on US government shutdown concerns

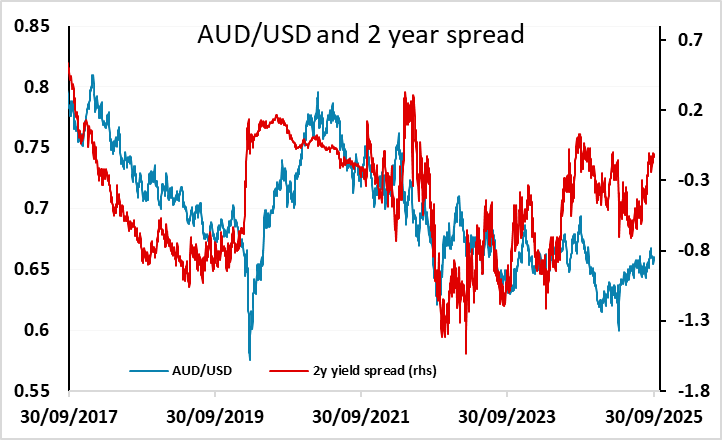

A fairly quiet overnight session saw the USD continue to edge lower, with the AUD and JPY the best performers. The AUD benefited slightly in the aftermath of the RBA meeting, although yields fell back after the meeting after rising into the decision. Rates were left unchanged as expected, but the tone was slightly more neutral than the doves were hoping for. Ahead of the meeting, the market was pricing around a 60% chance of a rate hike by year end, and this is now down to near 50%. The AUD remains in the shallow uptrend seen for most of the year. Yield spreads still favour further gains, but we are wary of an equity downturn that could be seen at any time given current very high valuations, and would typically undermine the AUD and the other risk friendly currencies.

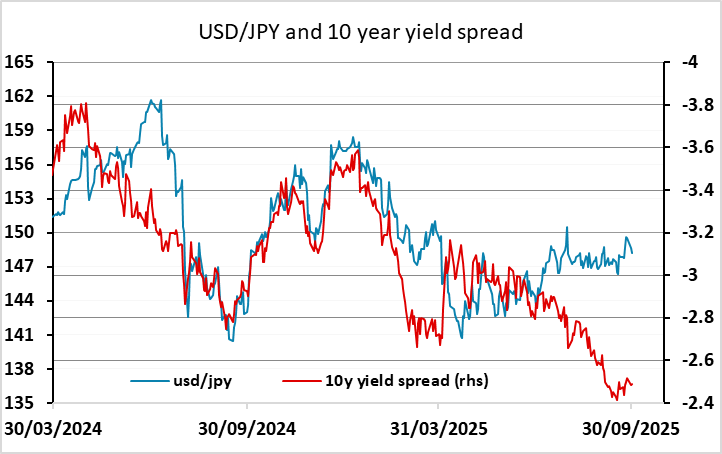

The AUD kept pace with the JPY overnight, with the JPY continuing to be the main beneficiary of concerns about the potential US government shutdown tomorrow if Congress fail to pass a funding bill today. The previous shutdown from December 222018-January 25 2019 saw some significant JPY strength in the early part of the period, and the extreme weakness of the JPY now suggests we could see sharp JPY gains if a shutdown extends for any length of time.