U.S. January Employment - Payrolls and average hourly earnings see strong gains and upward revisions

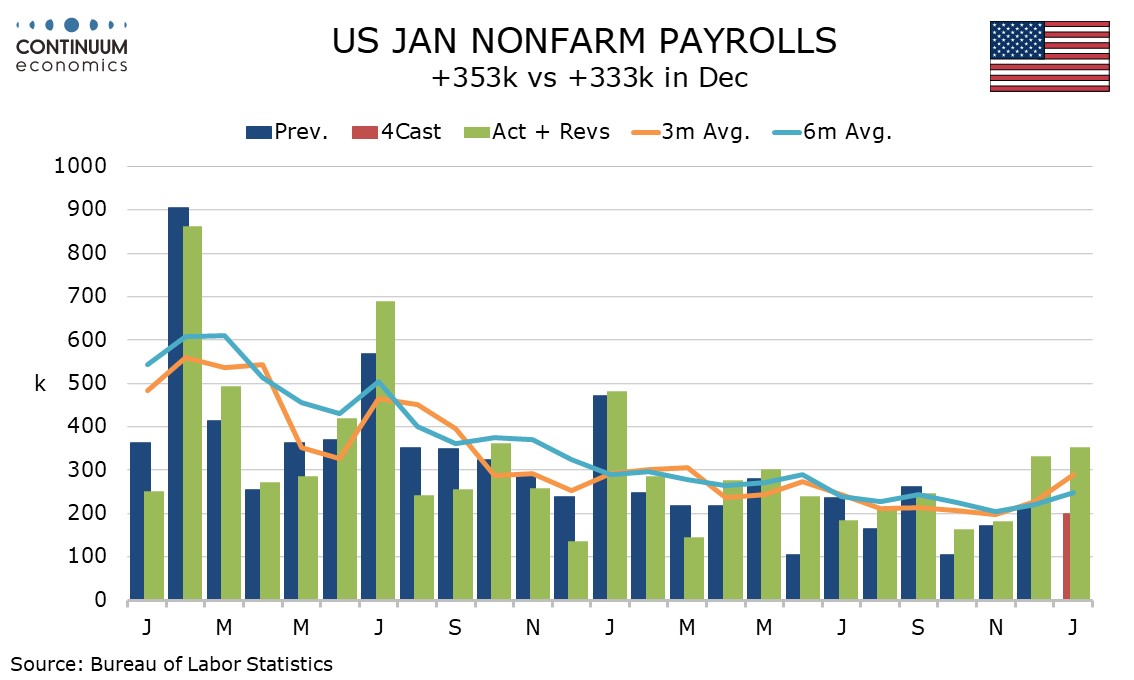

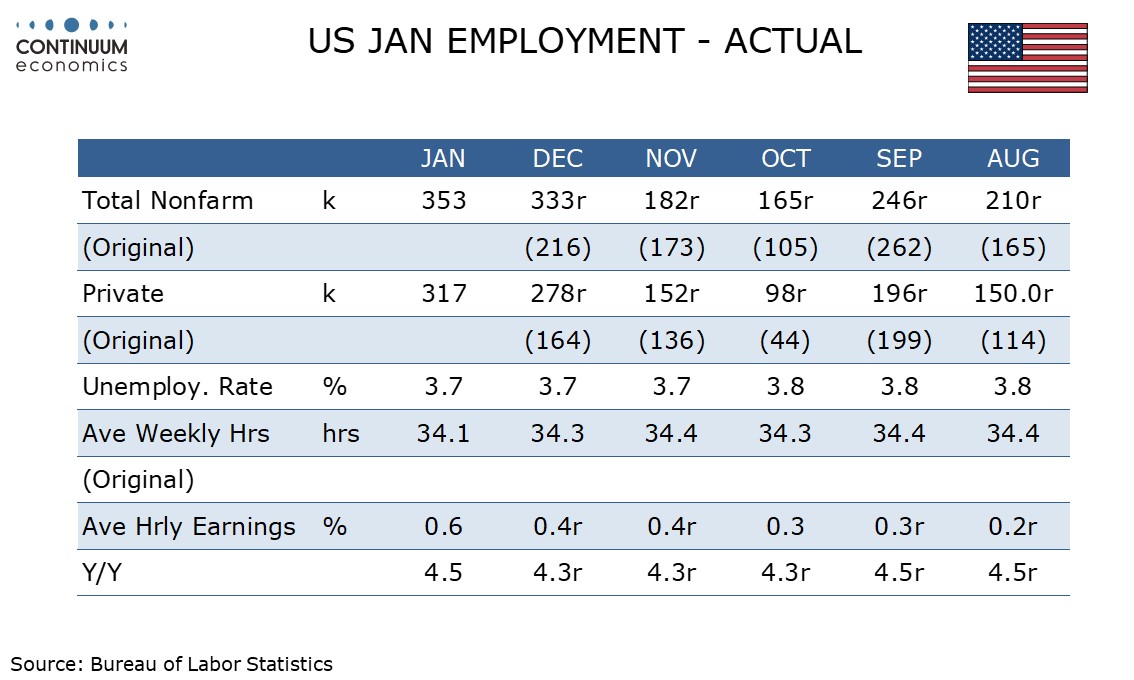

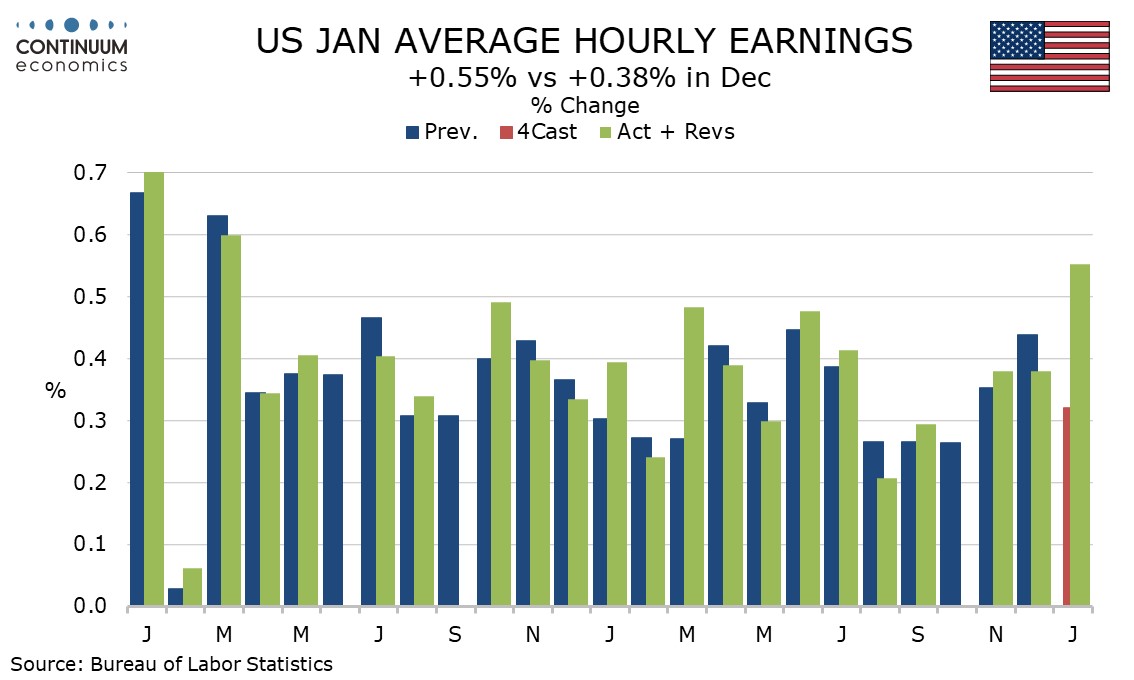

January’s non-farm payroll increase of 353k with 126k in net upward revisions to November and December is well above consensus and a 0.6% increase in average hourly earnings is an even more striking upside surprise, though possibly influenced by a sharp dip in the workweek to 34.1 from 34.3 hours. Unemployment, unchanged at 3.7%, is lower than expected.

January has strongly positive seasonal adjustments to compensate for expected winter layoffs, and January 2023 was also sharply above trend at 482k, suggesting than in the current tight labor market fewer seasonal layoffs than usual are taking place.

The January report sees historical revisions, and the March 2023 level was revised down by 266k, a slightly smaller negative benchmark revision that the -306k that had previously been signaled. Since March however the revisions have been mostly upwards, with November’s level almost unrevised, and December’s payroll seeing particularly sharp upward revision to 333k from 216k.

The upward historical revisions back the strength of GDP data through 2023, and the recent acceleration in payrolls suggests expectations that rates have peaked and will come down in 2024 is stimulating the economy.

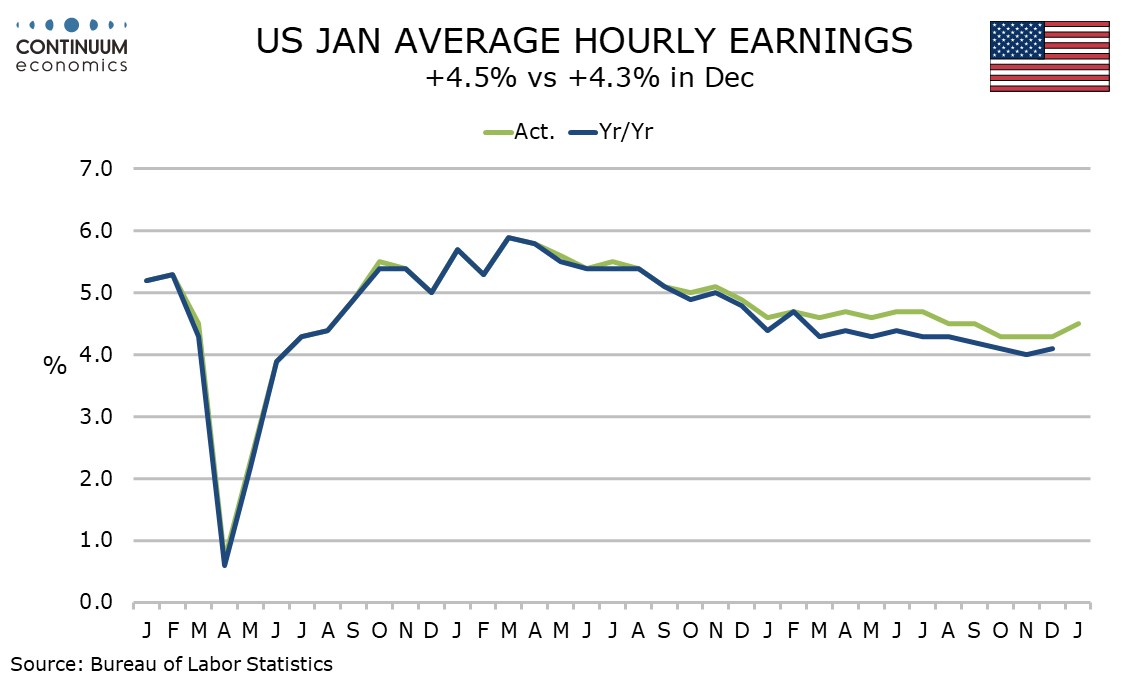

One strong month from average hourly earnings does not make a trend, particularly given a dip in the workweek that may have been weather-related, but still suggests the Fed cannot be complacent about inflation. Not only is January’s data stronger than expected, back month revisions are positive, with December’s yr/yr pace revised up to 4.3% from 4.1% and January stronger still at 4.5%.