This week's five highlights

Geopolitical Tension Continues after U.S. Military Action

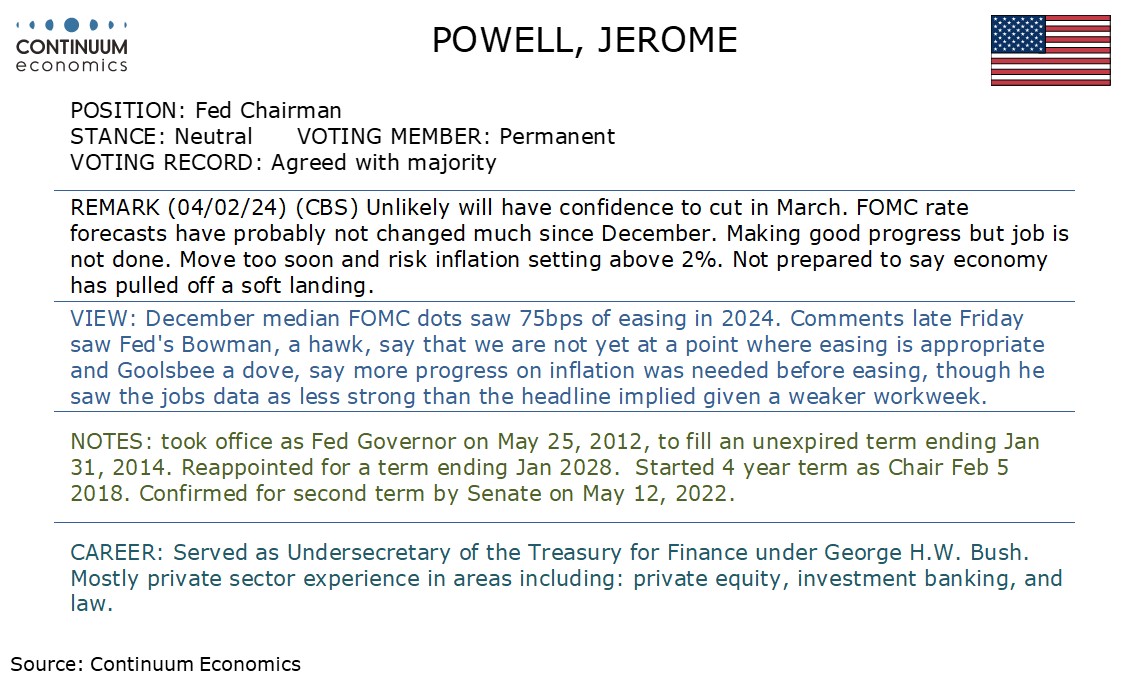

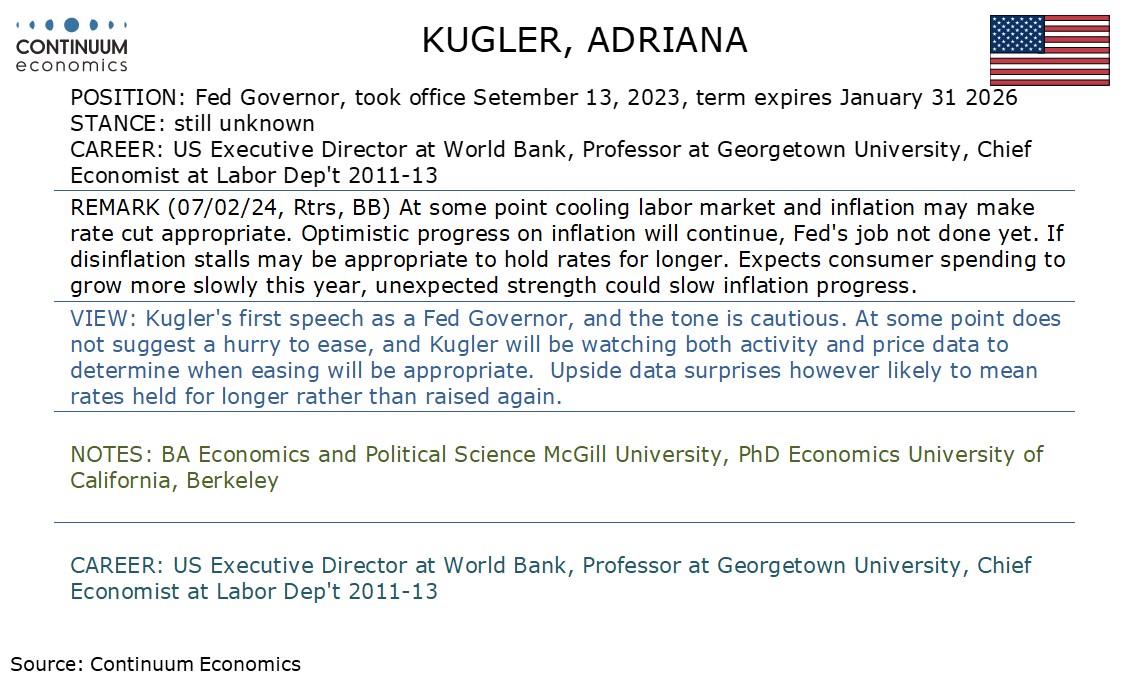

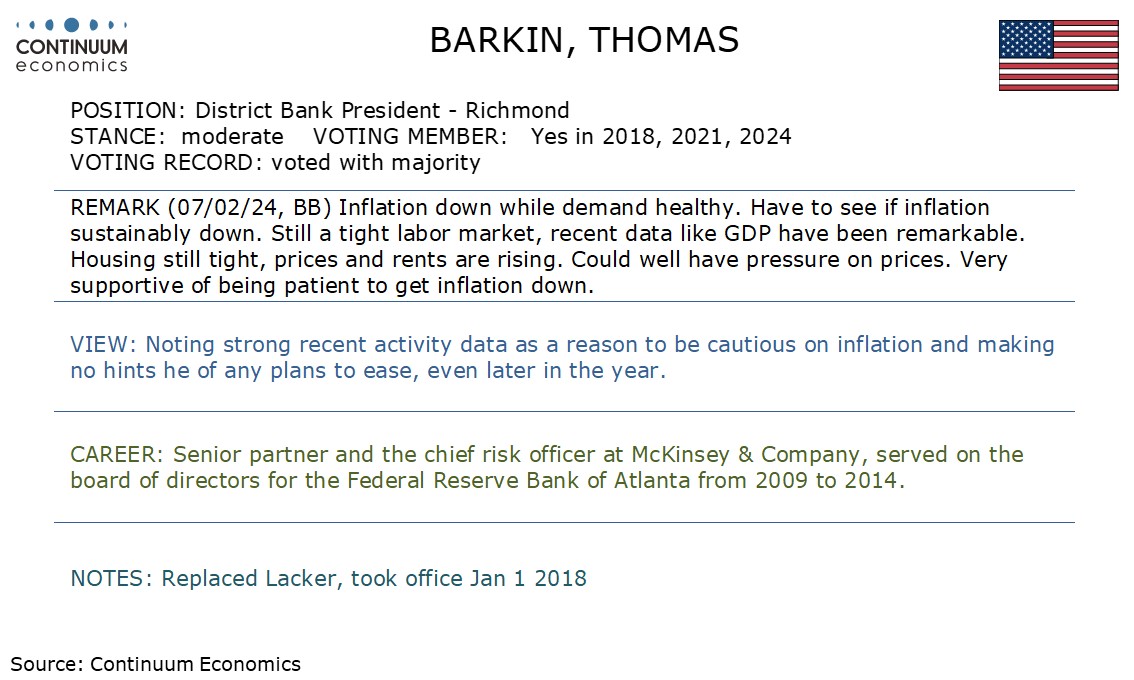

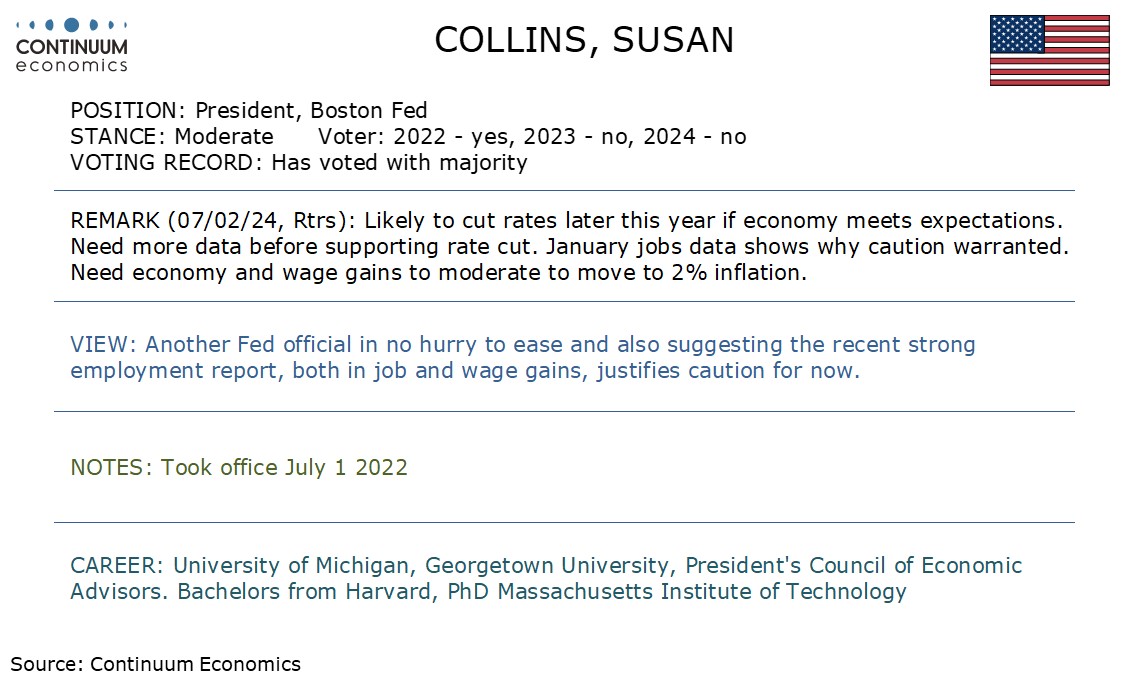

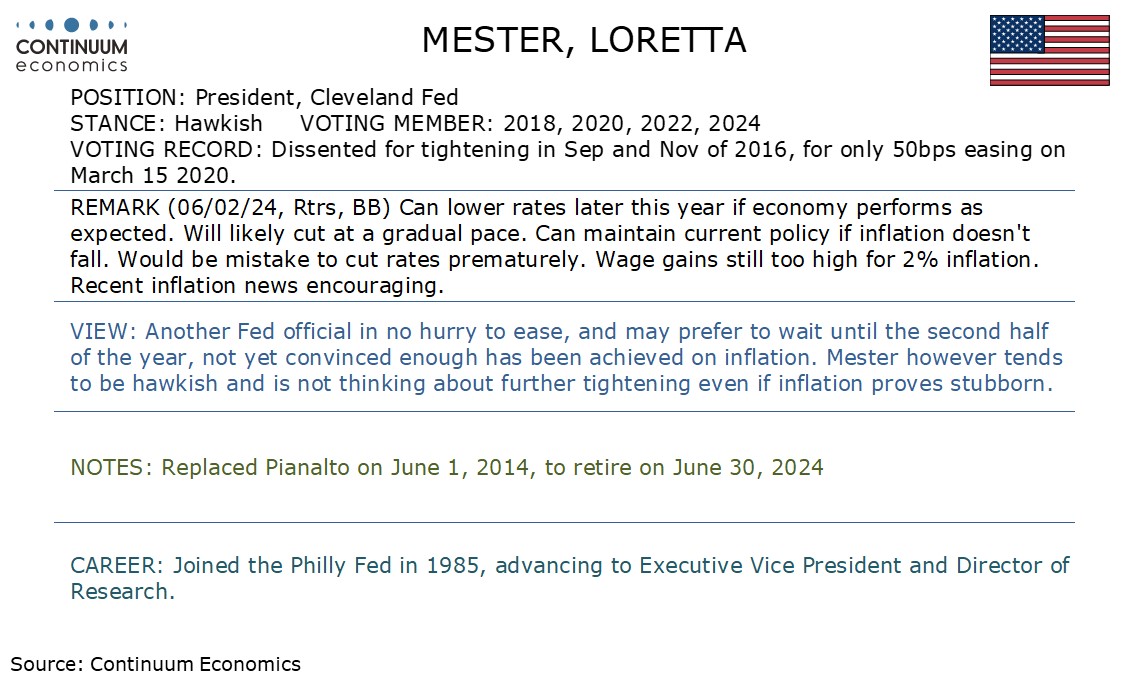

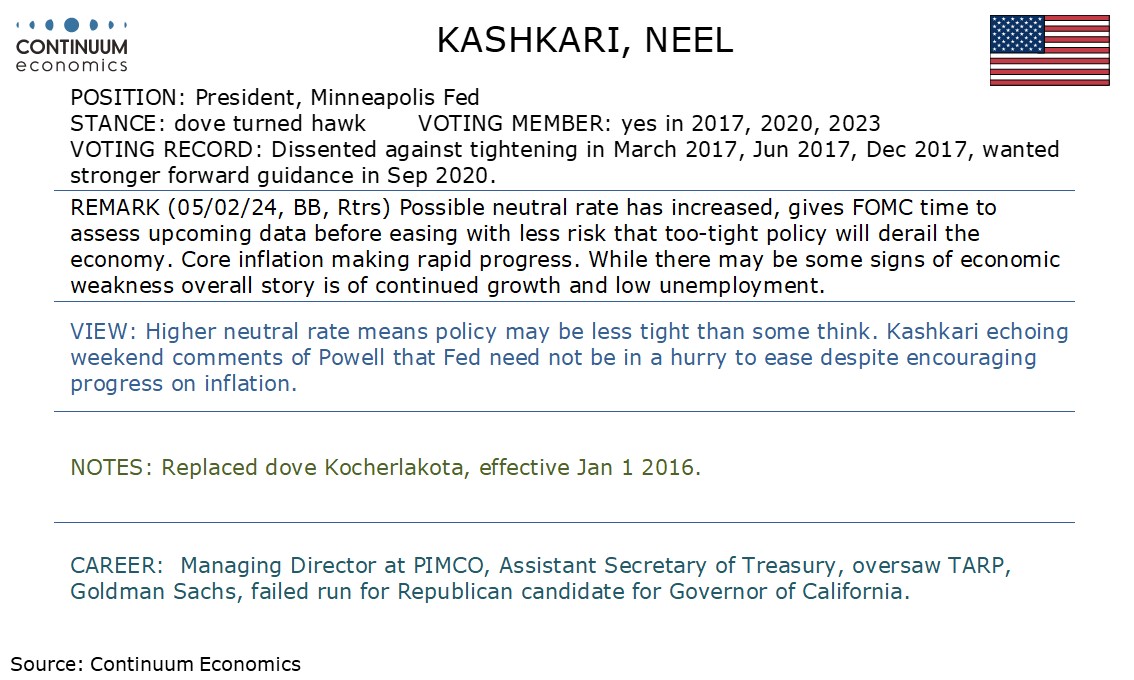

Slate of Fed Speakers' View on Rates

USD/JPY Inching Closer to 150 on "Dovish" Uchida

RBA Kept Rates on Hold and Leave Doors Open

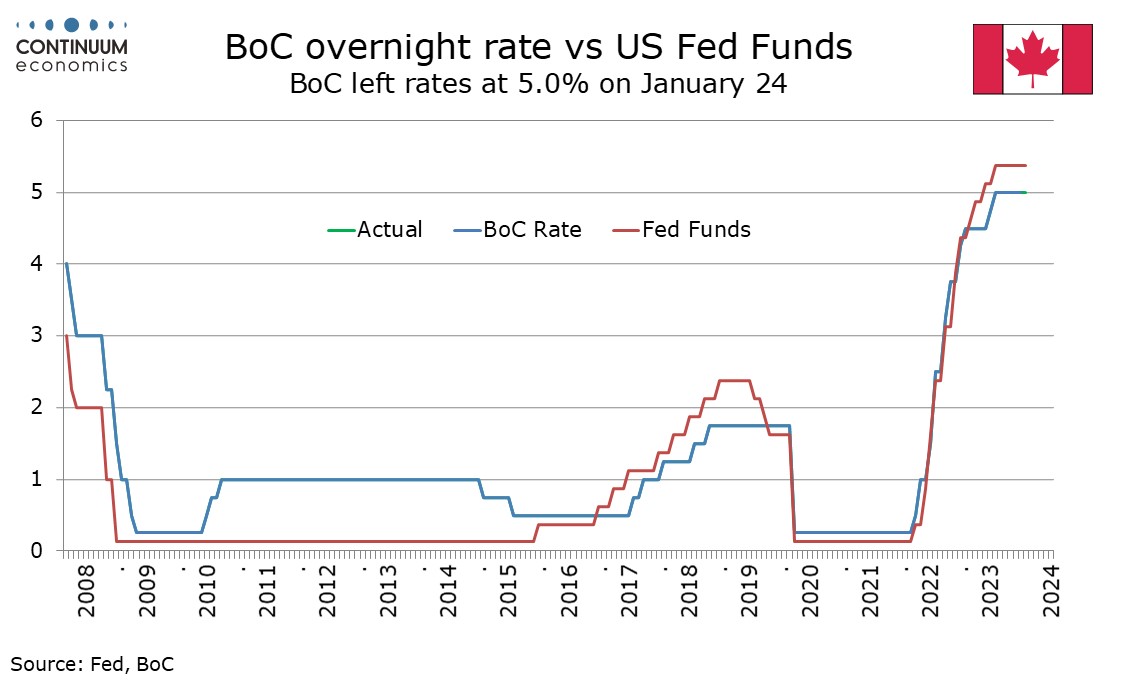

Bank of Canada Minutes Detail Inflationary Concerns

Over the weekend, US Central Command reported that forces had conducted strikes on four Houthi cruise missiles. Even it does not look like a direct struck to Iran, very likely such tit-for-tat retaliation will further escalate. Since then, we haven't heard much from both ends but the uncertainty and potential disruption to Red Sea vessels are keeping market participants on their toes. Israel - Hamas ceasefire does not seem to be working out and we are hearing remarks from Putin not suggesting a stop to Ukraine invasion, thus geopolitical tension is ready to catch your eyes when they cross the wire.

Bank of Japan Uchida says does not expect very easy policy to change in a big way and such remark was perceived to be "dovish" by some market participants. Yet in reality, no market participants had expected the BoJ to hike rates aggressively with most settling below 0.5%. Moreover, Uchida’s comments did suggest that the BoJ would be exiting from ultra-easy policy, noting that companies were hiking wages and passing on the impact of higher wage costs in service prices despite that the exit would not be rapid. Thus, the spike should be short lived after the follow through momentum fades. In a medium run, the pciture does not change as U.S. rates peaked and BoJ ready to exit ultra-loose, seeing a narrowing yield differentials.

On the chart, the consolidation around congestion support at 148.00 has given way to a push higher, as intraday studies strengthen, with prices once again pressuring strong resistance at the 148.80 weekly high of 19 January. Mixed daily readings suggest fresh range trade around here, before rising weekly charts prompt a break towards the 149.15 Fibonacci retracement. A further close above here is needed to turn sentiment outright positive and confirm continuation of late-December gains towards 150.00. Meanwhile, support remains at 148.00. A close beneath here would turn price action cautiously negative and prompt a deeper reaction towards further congestion around 147.00.

The RBA has kept the cash rate on hold at 4.35% and forward guidance to be data dependency leading the future rate path as per our forecast. The key forward guidance statement of "Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks." has changed to "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out.". While market participants are reading such change in forward guidance to be hawkish, the forward guidance seems to only suggest data dependency remains and door remains open for tightening. We do not see the RBA to hike further because the room to balance between economics growth and inflation dynamics are minimal.

The decision is in line with RBA's rhetoric of being data dependent. The Q4 CPI slowed to 4.1% y/y from 5.4% in Q3 and missed estimates at 4.3%. RBA welcomes the data and acknowledges inflation moderates but suggest inflation remains too high above 4%, thus kept the door open for more tightening. They are also aware of that cumulative hikes is bringing balance between economics growth and inflation with tight labor market not inspiring a rapid wage growth. We maintained our forecast of terminal rate to be 4.35% with no more hikes in sight. We do not see the RBA having a specific hawkish nor dovish take because they are letting CPI take the wheel in rate decision. But the room for RBA to tighten without significantly hindering economic growth is small. The household balance sheet are restricted by mortgage cost and inflationary living pressure while business are facing the tightest financial conditions in years. The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in 2025.

The Bank of Canada’s minutes from January 24 show significant concern about the persistence of inflation, despite seeing the economy as having moved into excess supply due to slowing demand. This leaves the BoC unsure about when to cut rates, though further increases now look unlikely. The minutes note broad based wage growth of around 4-5% which was seen potentially holding inflation up unless productivity was exceptionally strong. Members expected wage growth to moderate gradually in an economy with more supply than demand. Inflation was discussed in detail, with just over half of the CPI components seen growing by more than 3% (the BoC’s target is 2%). While shelter remains the single biggest contributor to above target inflation, it is far from the full story. Still, members expressed concern that shelter would continue to keep inflation elevated with a potential upside risk being a stronger than expected rebound in the housing market in the spring of 2024. The BoC is not looking at inflation excluding shelter to assess underlying price pressures.

The first half of 2024 was seen showing continued weakness in economic growth and inflation remaining around 2%, with growth picking up in the second half of the year and inflation gradually falling to reach the 2% target in 2025. Risks were seen on both sides, with the potential for monetary policy to have a greater impact on consumer spending than expected causing a marked contraction in activity, but also inflation proving more persistent than expected. While future rate hikes were not ruled out, members agreed that future discussion would shift to how long to keep the rate at 5%. This will be data dependent. Price data will be the most important, but a growing likelihood hat Q4 2023 GDP will exceed a flat forecast made by the BoC is a further argument against any rush into easing beyond the inflation concerns outlined in the minutes.