JPY flows: JPY firmer on intervention threat

JPY firmer as Finance Minister Katayama suggests joint US/Japan intervention is possible

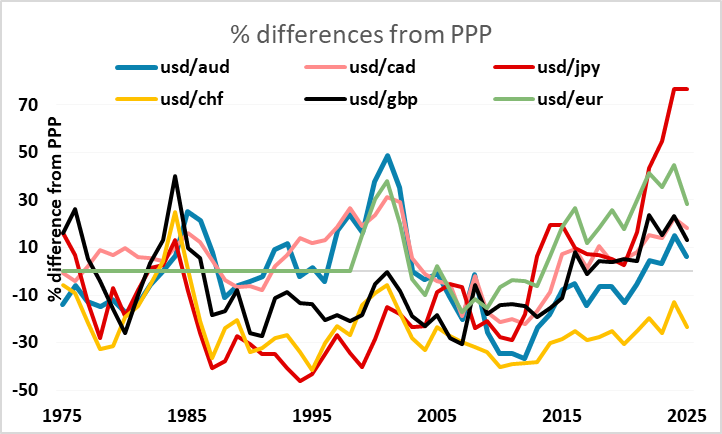

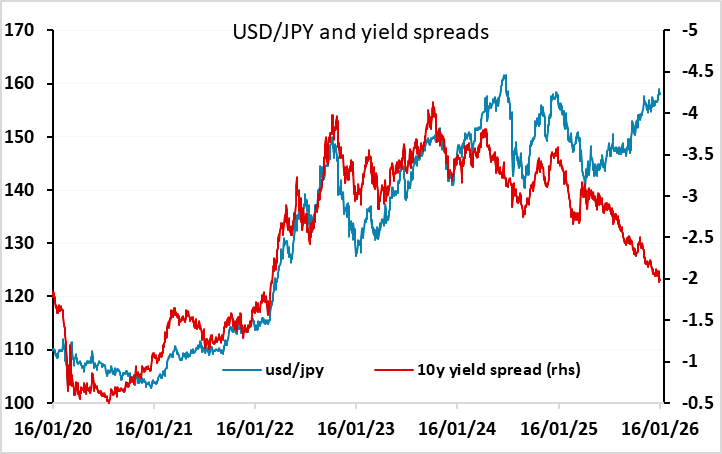

There’s nothing much on the calendar for Friday. Overnight the JPY managed a modest recovery helped by comments from Finance minister Katayama who hinted at the possibility of joint intervention between the US and Japan. But with the JPY already managing a small recovery, this is not an imminent possibility. Whether the threat will be enough to trigger a trend reversal remains to be seen. Certainly the JPY is extraordinarily weak – the weakest any developed market currency has ever been – but this has been true for some time, and the normal triggers of narrowing yield spreads and rising risk premia have not been enough to reverse the trend so far. We still suspect that the Japanese authorities will need to put their money where their mouth is if they are to reverse the JPY downtrend, with strong US data supporting general USD strength and a positive risk tone for the moment.

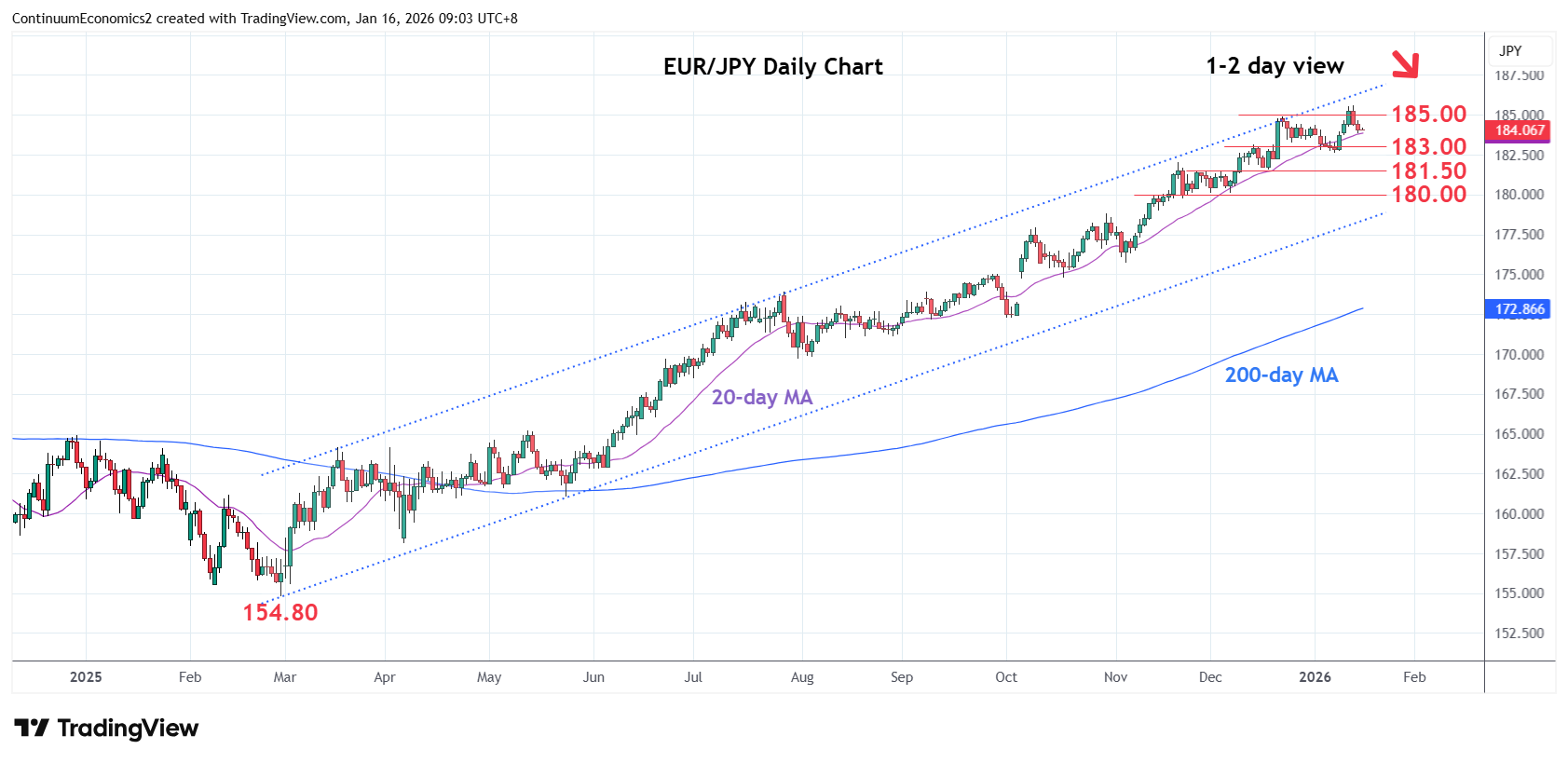

Having said this, there are some early technical signs of a turn in the JPY crosses, with EUR/JPY seeing a key reversal day on Wednesday (higher high, lower low, lower close). But there have been many false dawns for JPY bulls, and a break below the lows of the year at 182.64 looks necessary to generate any real downward momentum in EUR/JPY. We doubt there is enough on the calendar today to trigger any major break.