This week's five highlights

More Cuts on the Way for SNB

Faster and a Little Further Rate Cuts for Riksbank

RBA Waiting to ease

U.S. GDP Historical revisions mostly positive

China Steps Up Support, But Not a Game changer

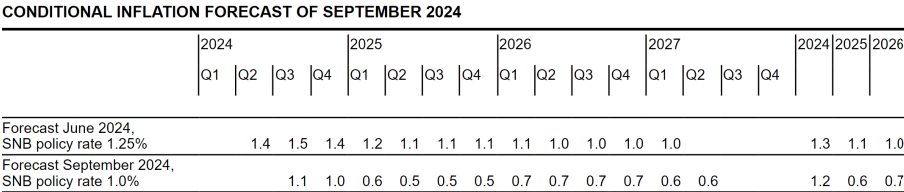

Figure: SNB CPI Inflation Projections Even Further Below Target

Very much as expected, the SNB today repeated the 25 bp policy rate cut that it had made twice since March. This took the policy rate to 1.0% and reflected an even clearer below-target inflation picture in both recent actual numbers and the updated outlook (Figure). This flagged further easing. Indeed, the SNB was quite open about this suggesting that ‘Further cuts in the SNB policy rate may become necessary in the coming quarters’. Perhaps somewhat excessively, much of this inflation weakness is attributed to the strong Swiss Franc, but we stress that domestic inflation is also softening too, especially in regard to seasonally adjusted m/m numbers which show that such price pressures are falling in line with core inflation albeit not to a degree that warrant the inflation undershoot seen by the SNB (Figure 2). Notably, this much weaker inflation outlook comes even with solid and near-trend GDP growth of around 1% this year and 1.5% expected next year. Even though we think the SNB inflation picture is probably too low, another same sized move in December looms and now with it likely that a policy rate trough of 0.5% will arrive in Q1.

SNB Chair Thomas Jordan is going out with a bang. This was his last policy assessment before retiring at the end of the month and he leaves his successor - Martin Schlegel (current Vice Chair) - with a clear precedent in the form of a marked and even softer inflation outlook. We think that the clear sub-1% rates projected for 2025 and 2026 are probably too low, not least as domestic inflation - while falling – is still running at a much higher pace, while the strong currency is unlikely to deliver persistent additional bouts if disinflation. Moreover, there are better signs in terms of property prices and the apparent resilience in the economy does not suggest such marked disinflation. Indeed, The SNB GDP growth projection was unchanged at 1.0% in 2024 as was the 2025 forecast but at 1.5% the GDP strength this year is due special factors such as sporting events and gold sales. But such rates of growth are near potential and do not suggest such marked disinflation ahead, even with special factors unique to Switzerland in the form a marked looming fall in electricity prices as of early next year.

This revised inflation outlook actually saw further downward revision in the inflation outlook compared to three months ago. Indeed, the 2025-26 annual projections were each cut by between 0.3-0.5 ppt, even after taking account of the new policy rate. It is noteworthy that the SNB will continues to threaten further CHF sales, with the implied opposition to balance sheet increases now being tempered by the persistent CHF strength. But its balance sheet has nevertheless resumed contracting of late suggesting little actual such FX intervention. Otherwise, the SNB continued warnings about the property sector, even though house and apartment prices do seem to have settled after the clear recent slowing.

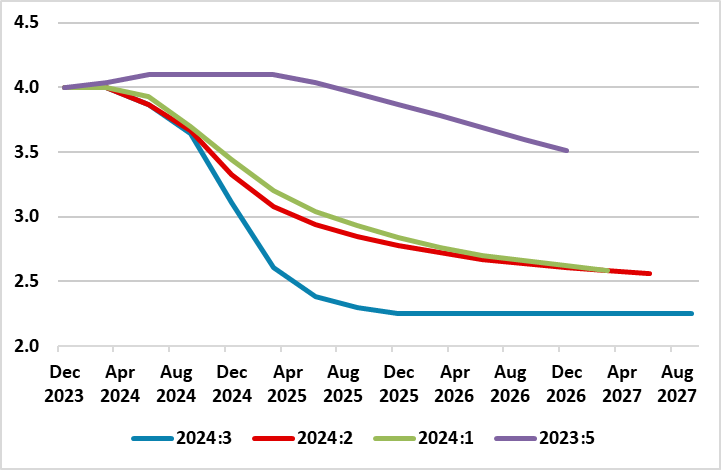

Figure: Policy Outlook Details – No Longer Gradual

A third successive 25 bp rate cut (to 3.25%) surprised no-one at this month’s Riksbank meeting. More notably, updated forecasts more formally validated both the likelihood and the rationale for the two added cuts by end-year that the Board hinted at after the August easing and which largely are in line with the alternative (downside) policy scenario outlined in June. Indeed, the new projections in the fresh Monetary Policy Report (MPR) actually suggest even a 50 bp possible move at one of the meetings this year (Figure). Indeed, it is clear that while lower inflation has provided the scope to ease policy in this speedier manner, the rationale is increasingly that from a weak economy. The latter is highlighted by a marked downgrade to the Riksbank’s’ 2024 GDP picture, partly offset by small upgrade to an above trend and what we think is an optimistic 1.9% 2025, albeit solely a result of the faster easing in its monetary stance bow being flagged. Notably, the Riksbank now points to additional easing some 25 bp lower than the circa-2.5% terminal rate its previous projections suggest may be the case., thereby now in line with our long-standing forecast.

Since the spring, it was very much a question of how fast, not if, as far as policy easing was concerned for the Riksbank, with Figure 1 underscoring how policy thinking has been markedly reshaped this year. From the Board’s perspective, by initiating easing relatively early in May, it was both reacting to weak data (both real and price wise), but more notably in giving itself flexibility to pursue what it then thought needed to be a gradualist approach to further easing. That now has changed and increasingly radically with policy put into a faster gear to front-load, both a result of an undershoot of inflation (partly energy related but ever clearer in terms of short-run dynamics) but also due to a still weak economy which has failed to grow on balance since end-2021, albeit with clear quarter-to-quarter volatility.

The RBA kept the cash rate on hold at 4.35% as the current inflation picture does not support any change of monetary policy. The forward guidance statement has changed to "The Board will continue to rely upon the data and the evolving assessment of risks to guide its decisions.", suggesting the RBA is patiently waiting for the CPI to rotate till their target range before any action. While Q2 CPI came in higher at 3.9% y/y, the latest monthly CPI is showing moderation and we believe target range maybe met by year end 2024. RBA has acknowledged the growth of Australia to be weak and easing wage pressure. To keep a balanced dynamic, the RBA will likely begin easing once headline CPI touches the upper-bound of target range to cushion the weak economics growth. There is not much changes since the last meeting in terms of forecast or economic development.

The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in late 2025 yet we maintained our forecast of terminal rate to be 4.35% and now see one 25bps easing by year end 2024.

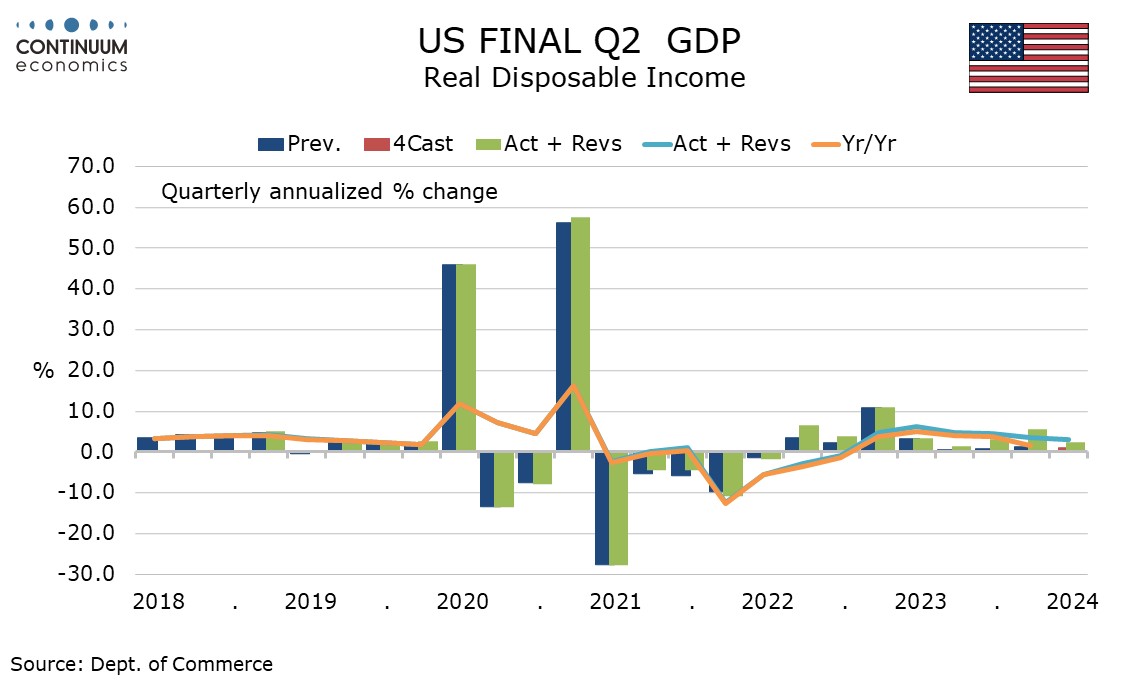

While Final Q2 GDP was unrevised at a strong 3.0% pace and the core PCE price index was also unrevised at 2.8%, Gross Domestic Income saw a strong upward revision to 3.4% from 1.3%. More significantly, the release included historical revisions for the past five years, and these were generally positive and particularly so for income. The stronger income data reduces downside economic risks, in particular for consumer spending, going forward. Real disposable income is now up by 3.1% yr/yr compared with only 0.9% in the preliminary data, and is now running ahead of consumer spending which is up by 2.7% yr/yr, unrevised from the preliminary. The savings rate has been revised up sharply to 5.2% from 3.3%, showing consumers on a much more solid footing than previously thought. The upward revisions to income come as a surprise given that employment is set to be revised down, hinting that there may be more strength in wages than was previously realized.

Looking into the personal income detail, 2023’s upward revision was led by components other than wages and salaries, but in early 2024 wages and salaries led the upward revision. Q2 real disposable income was revised up to 2.4% from 1.0%, with Q1 revised sharply higher to 5.8% from 1.3%. 2023 real disposable income was revised up to 5.1% from 4.1%, still not fully reversing a 2022 decline as stimulus payments ended, that was revised to -5.5% from -5.9%. 2021 was revised modestly higher to 3.4% from 3.1%. 2020, which saw the largest stimulus payments, now stands at 6.3% rather than 6.4%.

China has surprised and cut the 7 day reverse repo rate by 20bps to 1.5%, with a 50bps cuts in the RRR rate. Combined with other measures this is a step-up in support and could help GDP on the margin, but the measures are not game changers as monetary policy is currently ineffective. While further fiscal easing will likely arrive in the next few weeks, we still maintain our forecast of 4.0% GDP growth for 2025.

China has announced a package of measures to support the economy, which is helpful but are not game changers. Key points to note.

· Rate cuts but Household borrowing caution. The 20bps cut in the 7 day reverse repo rate (the new key benchmark rate) from 1.70% to 1.50% had not been expected until Q4/Q1 2025. Meanwhile, the 50bps RRR cut was larger than the 25bps anticipated. The PBOC also signalled that remortgage to lower lending rates could occur 3-6 months early, though it has yet to be clarified whether this is first time buyers or all existing remortgages – this process normally occurs in Q1 every year. The deposit on 2 properties has also been reduced from 25% to 15%. This can have some benefit to households cash flow with mortgages, but this may not translate into extra borrowing and spending. China households are paying down debt due to the ongoing property crisis. Also deposit rates are expected to be cut to protect bank margins and this will hurt households!

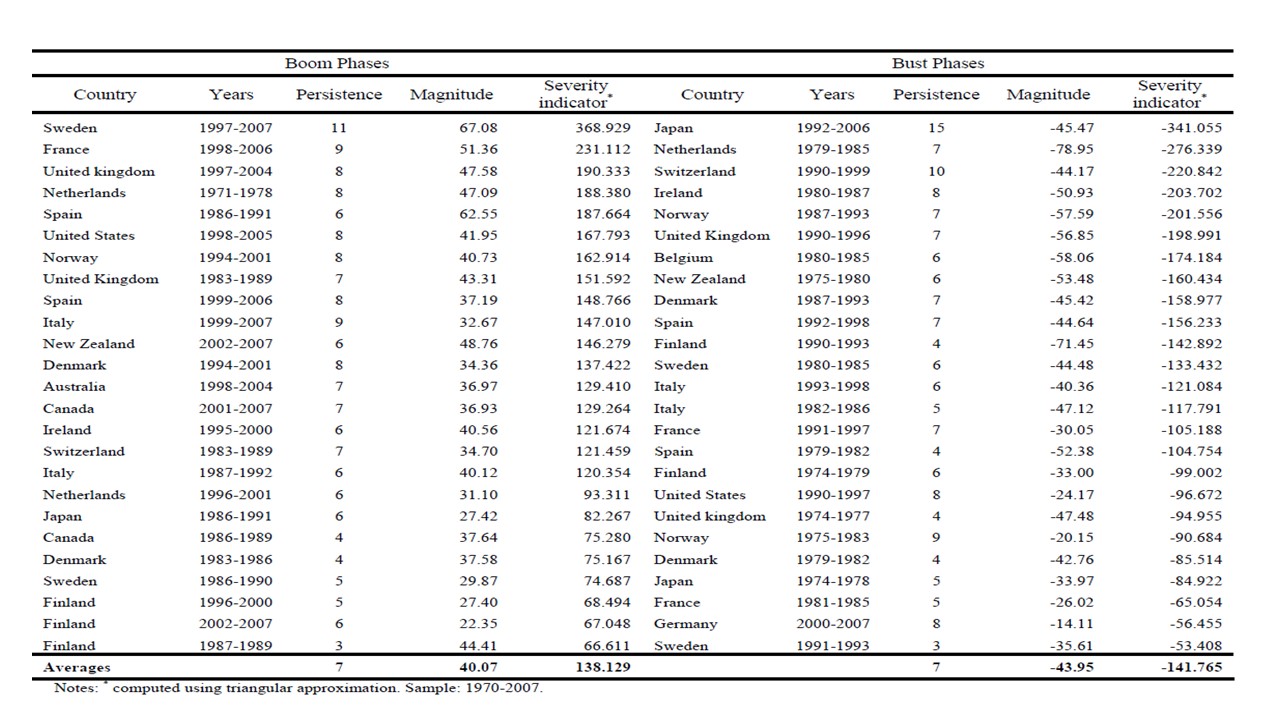

· No game changer for residential investment or buying. The package include an ability for state banks to increase principal funds to 100% from 60% for state banks to use for lending to buy unsold homes. However, the take-up has been modest so far. Additionally, no extra funds were added to the Yuan300bln to buy completed homes for affordable housing, whereas we estimate Yuan3-4trn would be required to be a real game changer. Property purchases are unlikely to pick up either until house prices have fallen enough to find a bottom, which we feel would be around 30% for real national house prices given excessive house price/income ratio in an environment of slowing wage growth. Nominal national house prices could fall 20-25% peak to trough. The experience from DM and EM economies is that the housing bust takes a long time and has averaged 7 years in DM countries (Figure 1).

· More monetary easing 2025 but no QE. We had expected a 10bps 7 day reverse repo rate cut in Q4, but this has now arrived. We look for two further 10bps cut in Q1/Q2 2025 to take the 7 day rate down to 1.3%. Additionally, we now look for the next RRR cut in Q1/Q2 also for a cumulative 50-100bps to help banks sustain profitability in an environment of squeezed net interest margins. We do not see QE or zero interest rate in China however. Such a policy would hurt banks too much and reduce the effectiveness of monetary policy still further. Instead, we would expect pressure for the banks to increase lending. However, recent M2 growth shows that small and mid-sized banks are reducing credit supply (here), while private businesses and households have very low credit demand – effectively balance sheet recession for these borrowers. The extra support for the equity market meanwhile has also helped sentiment, but the economy needs to be fixed to sustain a rally (here). While further fiscal easing will likely arrive in the next few weeks, we still maintain our forecast of 4.0% GDP growth for 2025.