Preview: Due July 25 - U.S. June Durable Goods Orders - Correcting a strong May, not only in aircraft

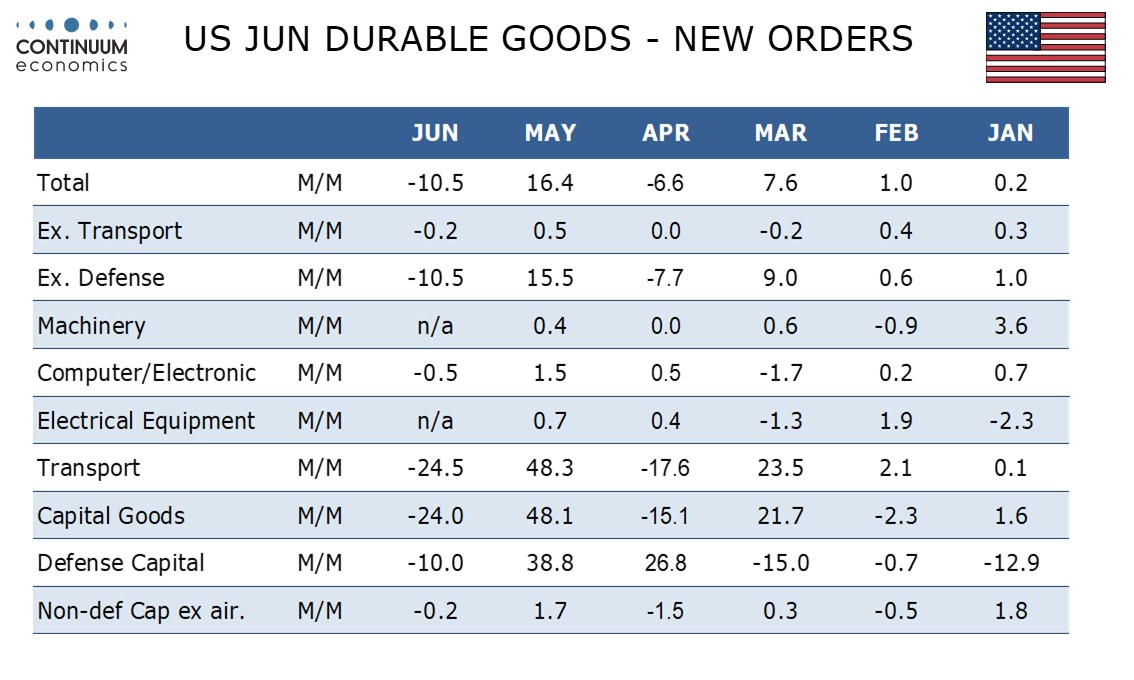

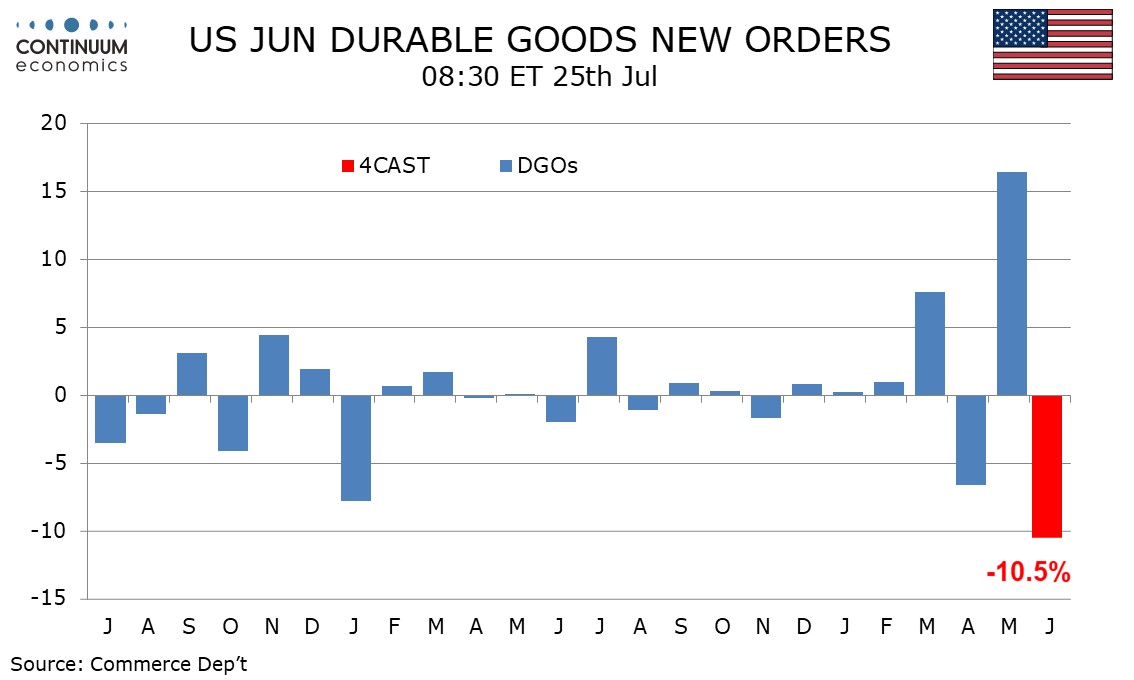

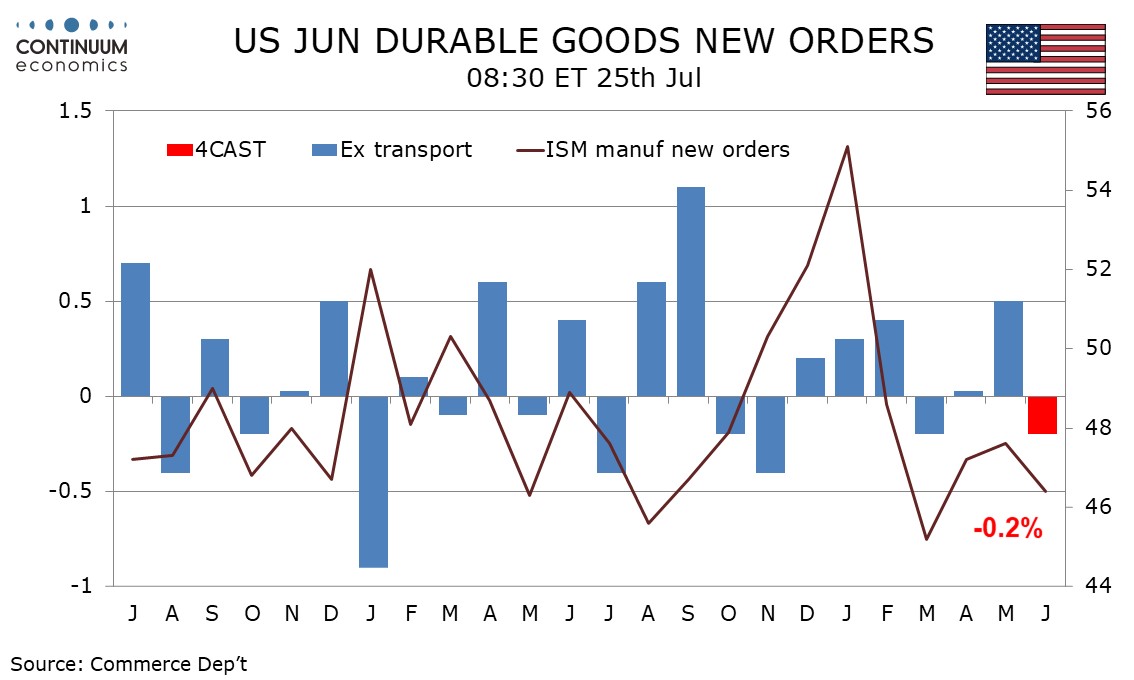

We expect June durable goods orders to fall by 10.5% after a 16.4% surge in May, with the fall, like May’s rise, largely on aircraft. Ex transport orders have been showing much less volatility, but we expect a 0.2% decline in June to correct an above trend 0.5% increase in May.

Aircraft have been volatile recently with a strong rise in March corrected in April, and an even stronger rise in may likely to be corrected in June, though Boeing orders remained quite firm in June even if significantly below May. Transport orders are unlikely to fully reverse May’s rise.

We expect defense to also see a moderate correction from two strong gains, leaving orders ex defense at -10.5%, matching the overall decline.

May’s 0.5% increase ex transport was the strongest since September 2024 and with ISM manufacturing orders slipping in June, we expect a 0.2% decline in June ex transport orders. Computers and electronics are particularly vulnerable to a correction after a 1.5% increase in May. We also expect non-defense capital orders ex aircraft, a key indicator of business investment, to fall by 0.2%, following a 1.7% May increase that reversed a steep 1.5% decline in April, possibly related to tariff uncertainty.