EUR flows: Little impact from weak French CPI

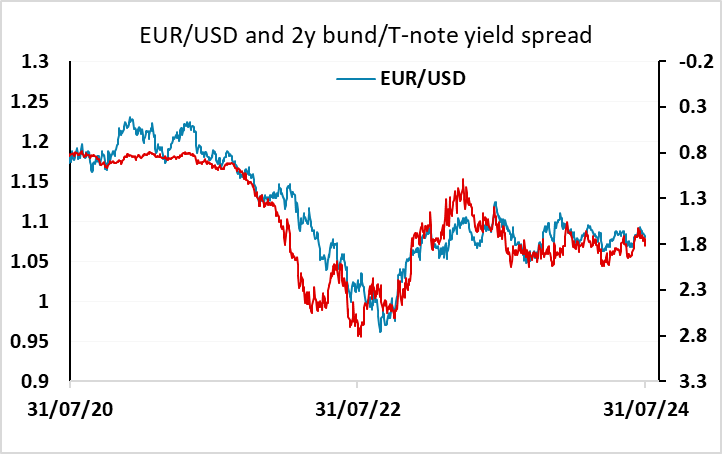

Soft French CPI, with HICP at 2.6% y/y against a market expectation of 2.7%, should ensure that the Eurozone HICP is close to expectations later, after stronger than expected German data and weaker than expected Spanish data yesterday. EUR/USD not much changed with the focus very much on the JPY and yield spreads still suggesting EUR/USD stability.

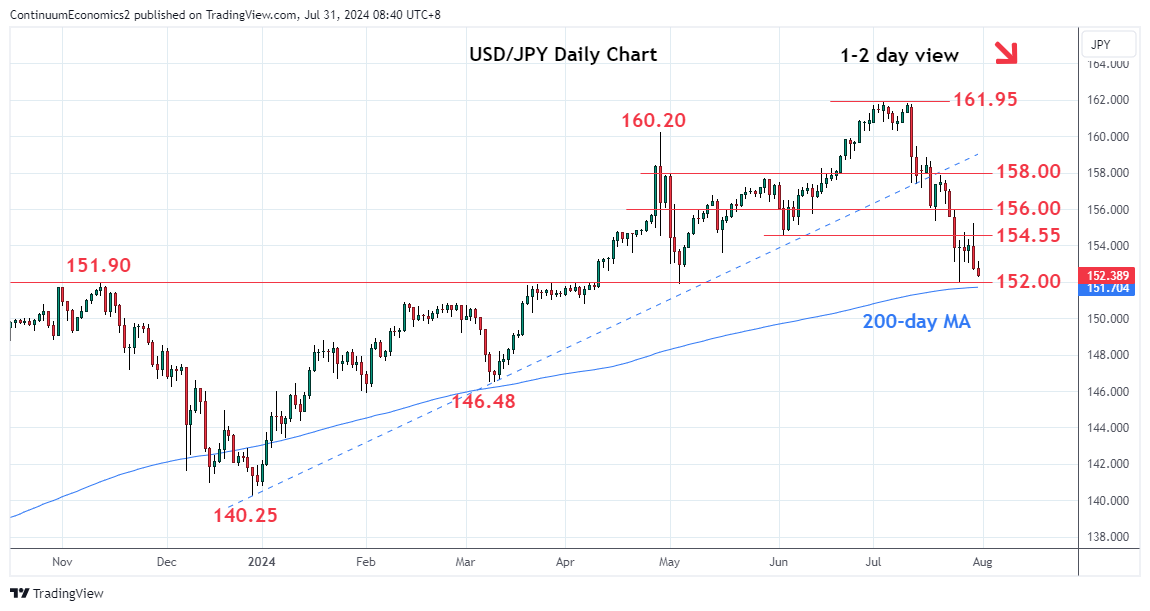

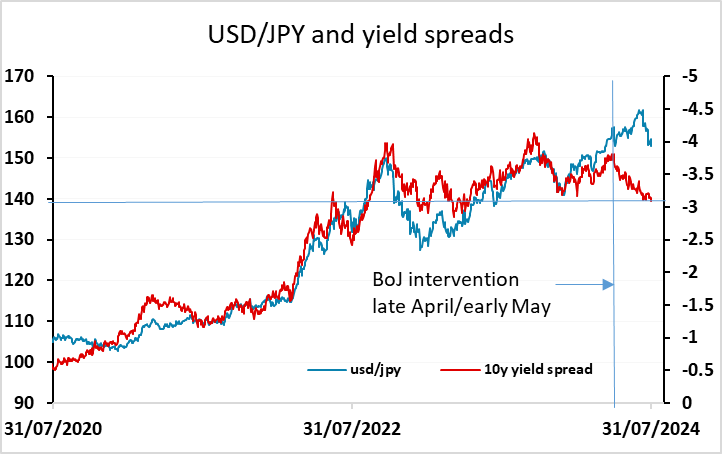

JPY strength has extended after the Ueda new conference, in which he indicated a readiness the raise rates further if BoJ projections for growth and inflation proved correct. He also said JPY weakness was one of the factors behind the BoJ’s decision. The near term key for the JPY now looks to be the technical support area at 152, with the 151.70 level the 200-day moving average. Yield spreads suggests that there is scope for a move down to 140 and if we see a break of 151.70/152 this could be a target.