This week's five highlights

Geopolitical Tension Remains Headline

DPP Won Taiwan Election

U.S. December Retail Sales Show Continued Resilience

China Q4 GDP Above 5%

UK Headline and Core CPI Fail to Fall

Another round of tit-for-tat military action between Houthi military group and the U.S. escalated geopolitical tension around the Middle East. US military conducted another round of strikes on Houthi targets in Yemen and Pakistan Foreign Ministry confirms Pakistan undertook series of military strikes in Iran. This seems to suggest early signs of geopolitical tension spreading and getting neighbor countries to involve. On the other hand, Saudi Arabia less hostile relationship with Iran maybe curtailing the risk of a major war in the Middle East. Saudi Arabia turned a new page with Iran and Turkiye in 2023, maintaining closer diplomatic relations while the war is testing the sincerity of these rapprochement. It appears Saudi Arabia’s relations with Israel will stay complicated in the near future as the country officials recently stated that the country will normalize relations with Israel only if there is a two-state solution between the Israelis and Palestinians. There are also headlines crossing the wire that Arab nations are developing plan to end Israel-Hamas war by creating a Palestinian state. It is still a long way to go and uncertainty remains in the geopolitical front.

The DPP have won the Taiwan presidential election. However, the DPP has lost its majority in parliament, while the 3rd party (Taiwan People Party (TPP) are signalling they will not form a coalition with (Kuomintang) KTT. This will restrain the DPP. However, China will still likely show its displeasure, with large scale military exercises in the spring.

While the DPP candidate (Lai Ching Te) was elected president, the DPP did not do as well as the 2020 election. Firstly, in the presidential vote Lai Ching Te attracted 40% compared to 57% for DPP Tsai Ing Wen in 2020. Secondly, the DPP lost its majority in parliament and achieving only 51 seats compared to the 52 for the KTT. With 57 seats needed for a majority the TPP with 8 seats is now key, but has signalled that it is unlikely to form a formal coalition with KTT and instead will align on a vote by vote basis. Nevertheless, KTT and TPP have tried to work together in the past and the DPP is likely to lose out in parliament. This is important as the last time such an imbalance of power occurred 10 years ago, it saw parliament slowing the build-up of military expenditure by the president. This all means that the DPP president is in a weaker position than 2020.

While China will take note of less power for the DPP, the election of a DPP president will still likely cause displeasure from China in 2024. Already China government has been critical, but the key for geopolitics is military movements in the coming months (here). The most likely flashpoint remains the spring, where large scale military exercises are expected.

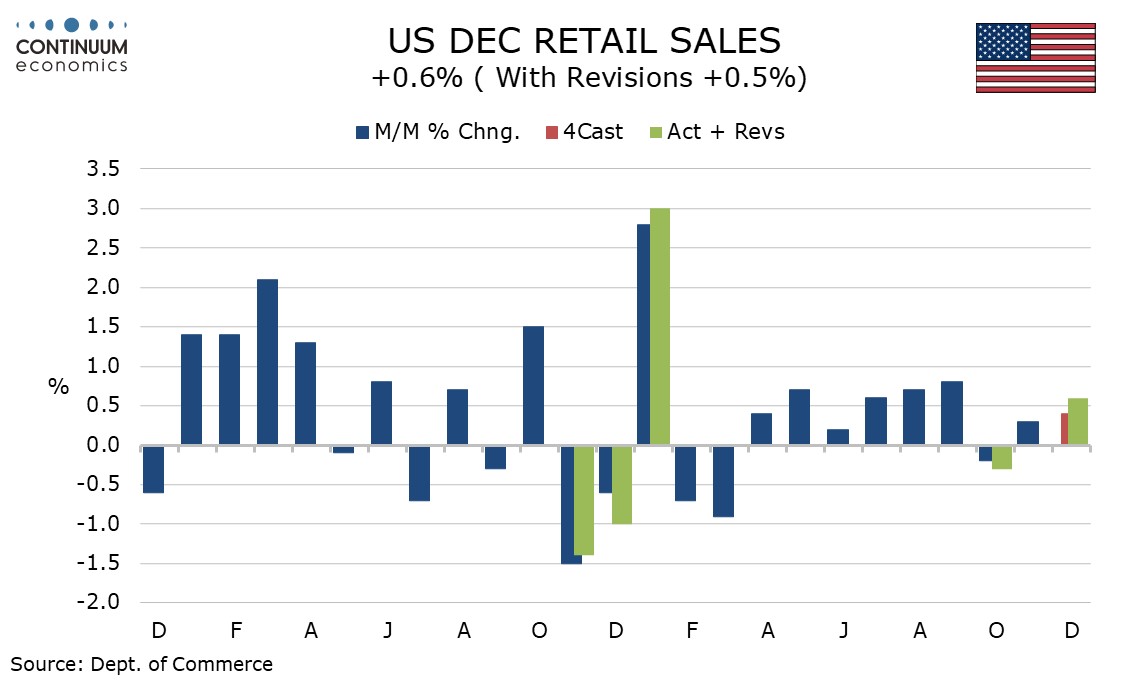

US retail sales made a solid finish to Q4, rising by a stronger than expected 0.6% with ex auto sales up by 0.4% and sales ex auto and gas up by 0.6%. Particularly impressive was a 0.8% rise in the control group, which contributes to GDP. Back month revisions were minimal with October revised down to -0.3% from -0.2% and November unrevised at +0.3%. This leaves Q4 sales up by 1.0% overall and ex auto, still solid but slower than gains of 1.7% and 1.8% (not annualized) respectively in Q3. Ex autos and gasoline the slowing is marginal, to 1.3% in Q4 from 1.6% in Q3.

This leaves the consumer maintaining solid momentum, with real disposable incomes getting a boost from lower inflation, while the boost to savings during the pandemic may not yet be fully depleted. The Q3 strength of the consumer was a surprise to the Fed who will note the continued resilience in Q4. While the data is solid overall details are mixed. Strength was seen in general merchandise, clothing as well as autos as industry data had already signaled. Weakness was however seen in furniture, health and personal care and gasoline. December’s slippage in gasoline, unlike those of October and November, appears to be on volumes rather than prices.

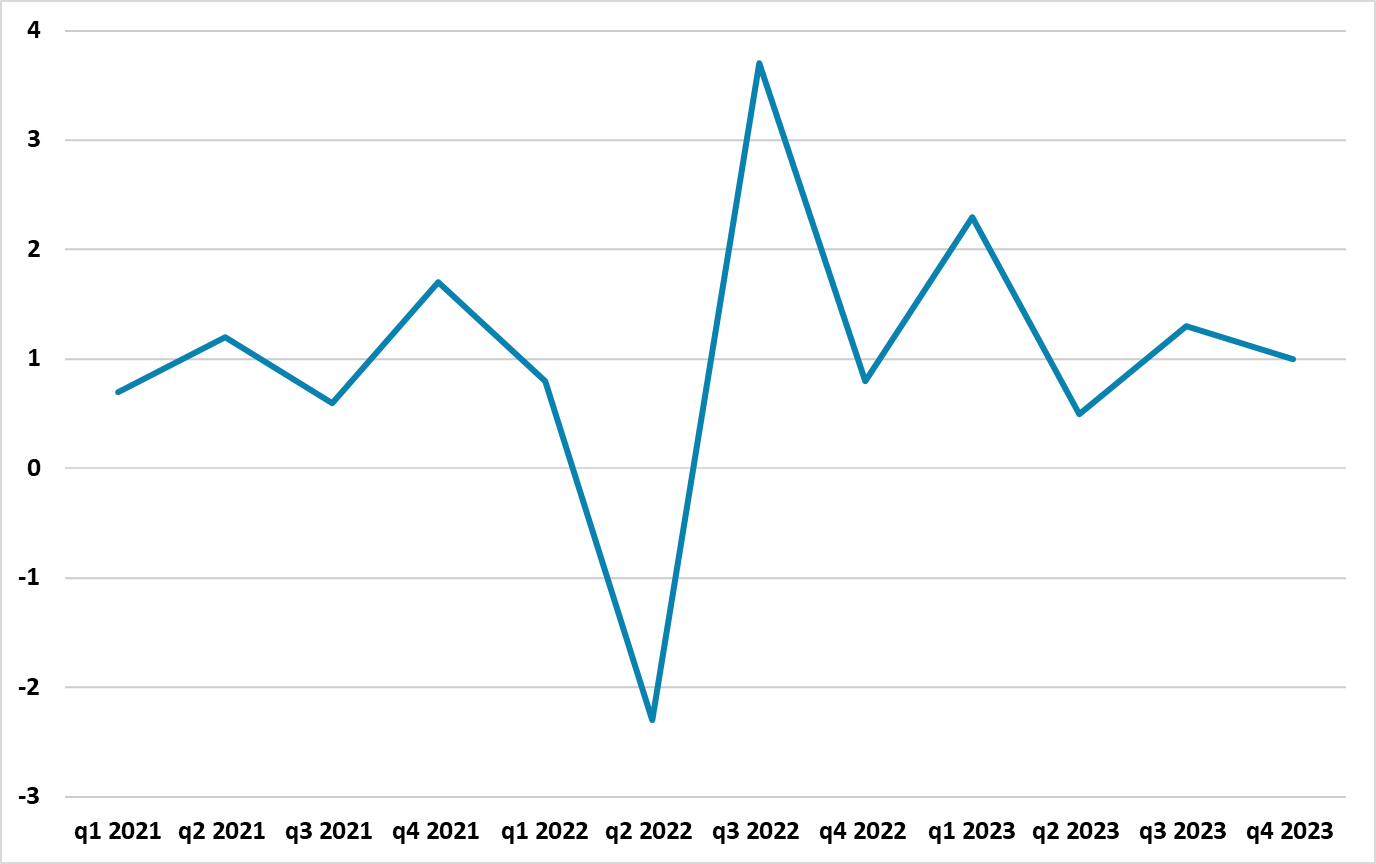

Figure: Quarterly China GDP Profile and Forecasts (%)

Quarterly GDP is interesting and came in at 1.0% after the 1.3% quarterly gain in Q3. The trend in quarterly GDP (Figure) is also not consistent with 5% growth and the Yr/Yr will dip in Q1 2024 when the large gain in Q1 2023 drops out (due to the end of zero COVID policies). We maintain the 4.2% 2024 GDP, as further policy stimulus will likely be targeted rather than aggressive.

China 2023 GDP came out at 5.2%, which was marginally lower than economists forecasts of 5.3% but had been leaked on Tuesday by Premier Li in Davos. The monthly numbers in December are difficult to interpret, as the Yr/Yr numbers are inflated by zero COVID policies in December 2022 and YTD numbers now contain 12 months. However, the December retail sales at +7.4% was lower than the consensus at 8.0%, while the breakdown of the data shows tourism/eating out doing well but anything housing related depressed. Though industrial production Yr/Yr was slightly better at 6.8% v 6.6% expected, this is not good news on a longer term basis. Production has been holding up, but without a retail sales pick-up the risk is excess production causes further disinflation and production cuts at a later date.

Quarterly GDP is also interesting and came in at 1.0% after the 1.3% quarterly gain in Q3. The trend in quarterly GDP (Figure 1) is also not consistent with 5% growth and the Yr/Yr will dip in Q1 2024 when the large gain in Q1 2023 drops out (due to the end of zero COVID policies). The Yuan 1trn package for local government building will kick in during H1 2024, but we feel that the underlying momentum is consistent with around 4% growth – especially as tourism will likely lose momentum in 2024, as pent up demand is satisfied. We maintain the forecast of 4.2% GDP growth for 2024.

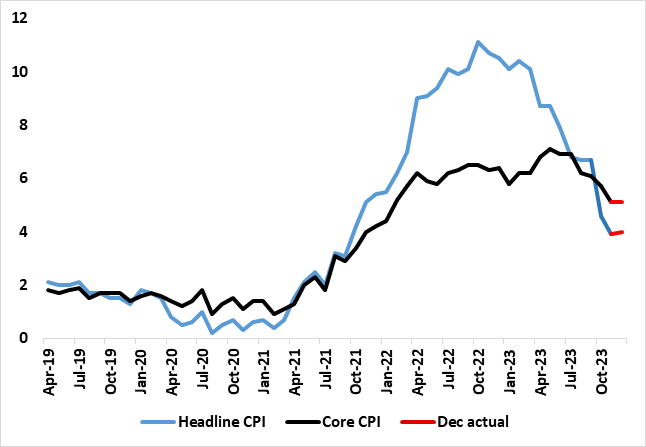

Figure: Headline and Core Inflation Drop Stalls

Superimposed over both upside and downside surprises, UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%, the first rise in 10 months (Figure) and where remained at 5.1%, still a 23-month low. The data came alongside clearly soft PPI data at least for manufacturing but where services PPI edged up to 3.6%. The headline rate is still some 0.6% ppt below formal BoE thinking but is clearly a disappointment, not least as half of the 12 main components saw a fresh pick-up and where our estimate of the seasonally adjusted data (Figure 2) saw something of a reversal of the hitherto clear disinflation core trend seen in previous months. The CPI data are perturbing for the BoE hawks but come alongside wages data softness which the BoE majority may view as tempering its worries about persistent price pressures, especially if also presented on such an adjusted m/m basis.

The government has made much of the fact that CPI inflation slowed to 4.6% y/y in October 2023, down from 6.7% in September and thus has more than halved from its peak of over 11% a year ago. The drop has little to do with government action, the very opposite. Instead, both supply (we think predominantly) and demand (to a lesser extent) factors are reining in price and cost pressures and more broadly so. Indeed, the recent rise in tobacco duty very much contributed to the surprise rise in the headline rate in December. As for these latest numbers, CPI inflation rose by 4.0% in the 12 months to December 2023, up from 3.9% in November, and the first time the rate has increased since February 2023. On a monthly basis, CPI rose by 0.4% in December 2023, the same rate as in December 2022. The largest upward contribution to the monthly change in CPI annual rates came from alcohol and tobacco while the largest downward contribution came from food and non-alcoholic beverages. Core CPI (excluding energy, food, alcohol and tobacco) rose by 5.1% in the 12 months to December 2023, the same rate as in November; the CPI goods annual rate slowed from 2.0% to 1.9%, while the CPI services annual rate increased from 6.3% to 6.4%.