U.S. November ADP Employment - Mostly strong despite weak manufacturing

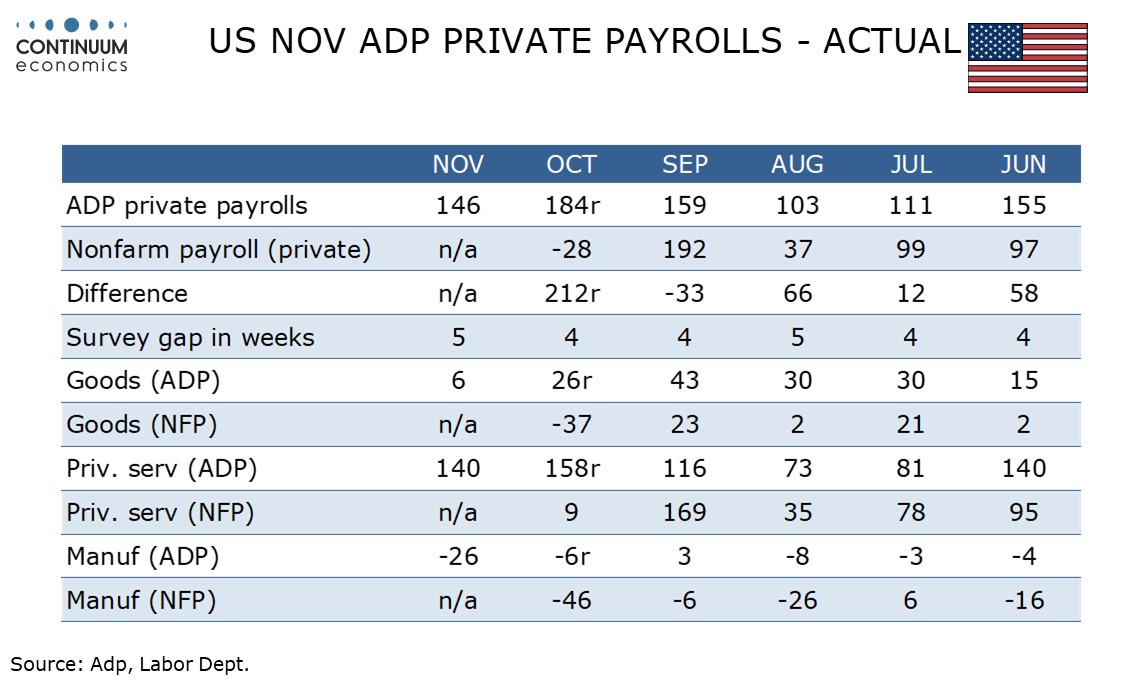

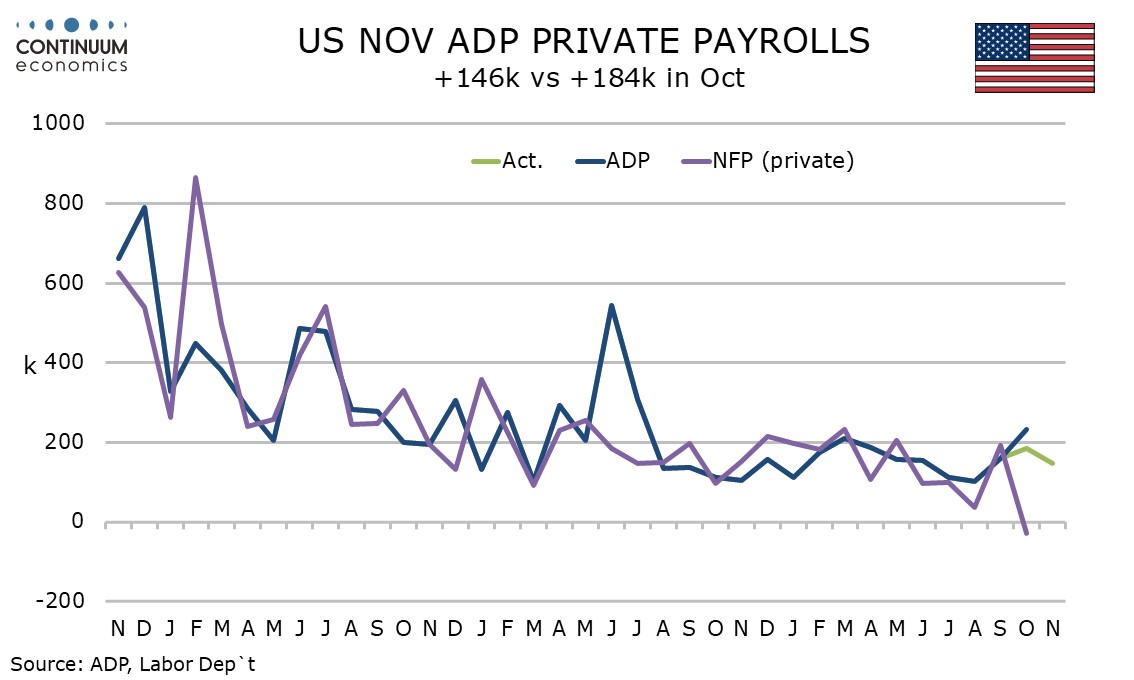

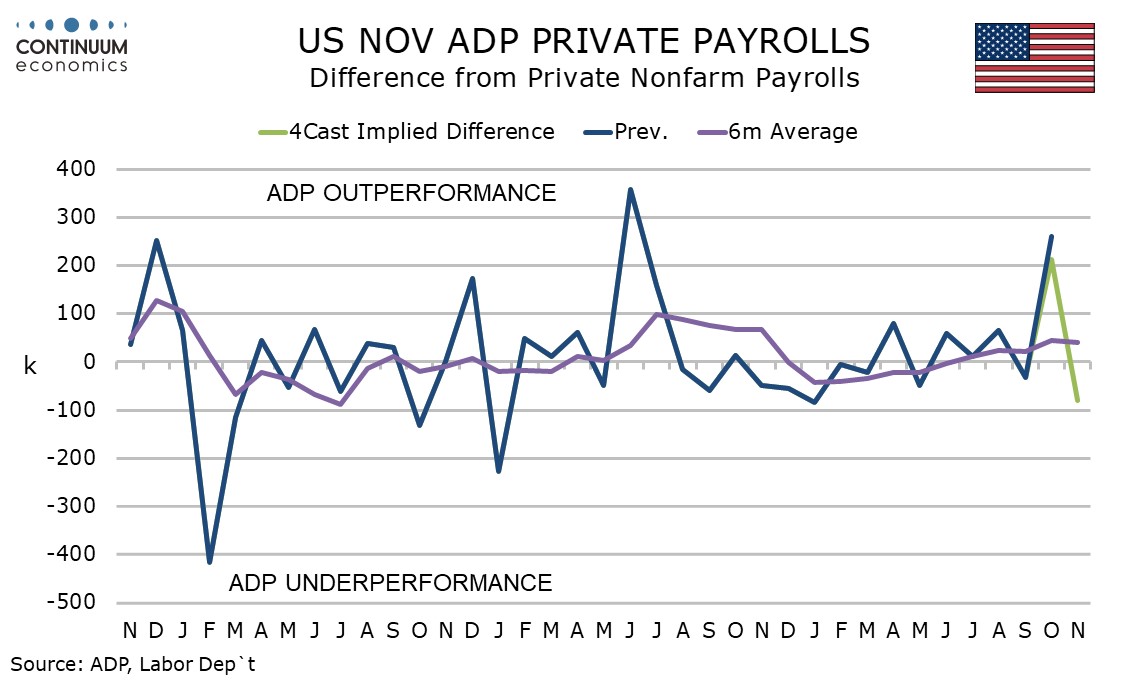

ADP’s November estimate for private sector employment growth of 146k is in line with expectations and a modest slowing from October’s 184k (revised down from 233k). Trend still looks solid and it appears that October’s weak non-farm payroll which saw a 28k decline in the private sector reflects temporary factors from hurricanes and a strike at Boeing, and a bounce back above trend is likely.

ADP data tends to be less sensitive to weather than the non-farm payroll. November ADP data shows a 26k decline in manufacturing suggesting that an October decline in ADP manufacturing data was not caused by the Boeing strike. ADP’s manufacturing data is surprisingly weak.

Construction with a 30k increase looks solid, as do services, led by a 50k rise in education and health. ADP sees financial services and leisure/hospitality as soft, but both managed gains, of 5k and 15k respectively.

One surprising area of strength in the ADP data was an acceleration in wages. Yr/yr growth for job stayers of 4.8% from 4.6% saw the first rise in 25 months while gains for job changers bounced to 7.2% from 6.2% in October. While there may be a few areas of weakness, the labor market looks firm overall.