Preview: Due November 5 - U.S. October ISM Services - Correcting from a strong September

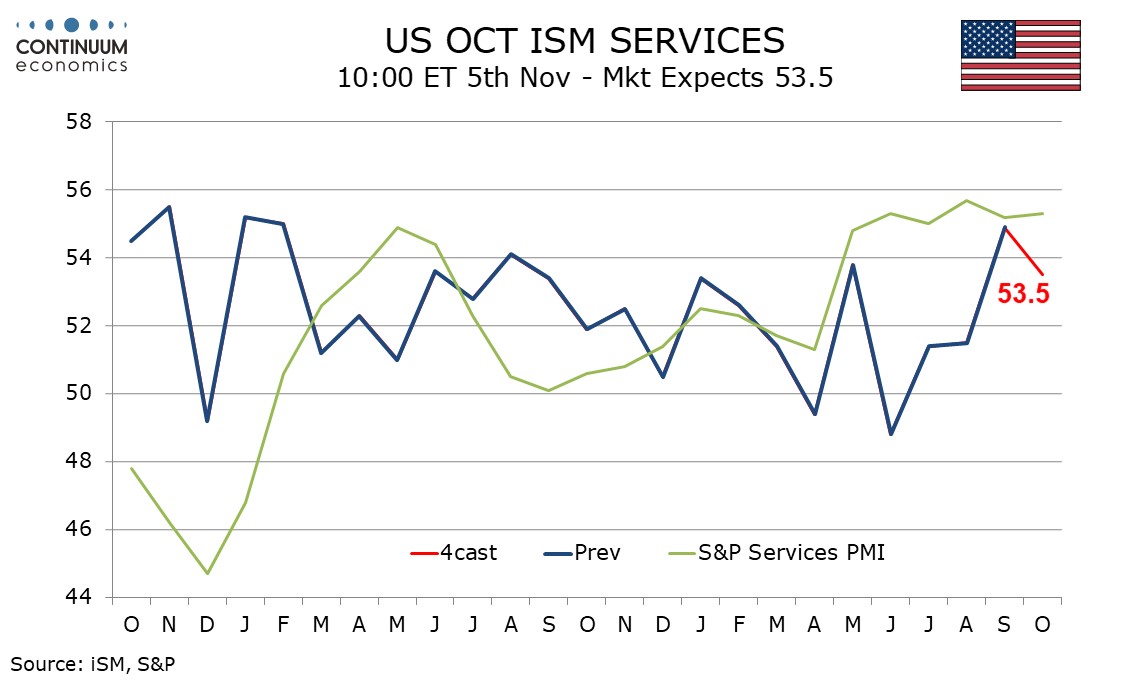

We expect October’s ISM services index to correct lower to 53.5 from September’s 54.9 outcome that was the highest since February 2023. An October index of 53.5 would still be stronger than most recent months.

September’s ISM services data brought it closer to the S and P services PMI, which has been trending near 55 since May and remained firm in October, but the two series are not closely correlated. Regional services PMIs were generally slightly stronger in October than September, with the majority marginally positive rather than marginally negative, but still largely subdued. We expect a healthy October ISM services PMI, but September’s strength will be difficult to sustain.

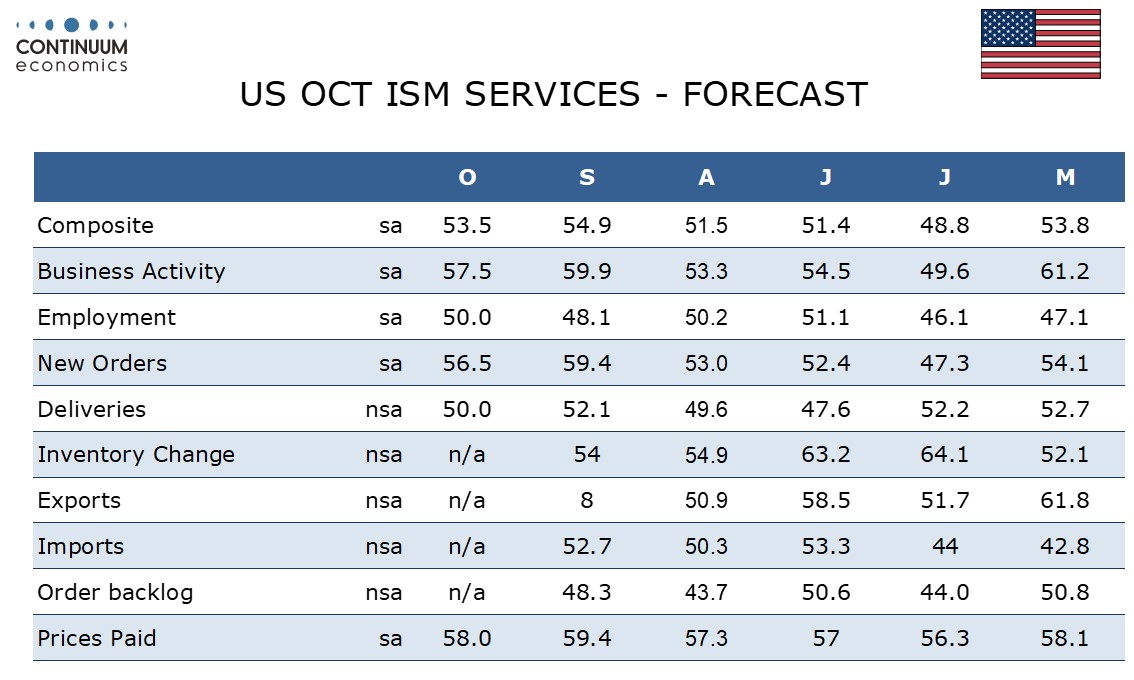

Looking at the four components that make up the ISM services composite, we expect new orders and business activity to correct from strong September readings above 59, to 56.5 and 57.5 respectively. We see neutral levels of 50.0 for employment and deliveries, the former correcting from a weak September and the latter correcting from a strong September. Prices paid do not contribute to the composite. Here we expect a modest slowing to 58.0 from September’s 8-month high of 59.4, but trend has had little direction for over a year.