JPY flows: JPY hits new low for the week, policy unclear

Market may see new government as being happy with JPY weakness, but policy may be better supported by a stronger JPY

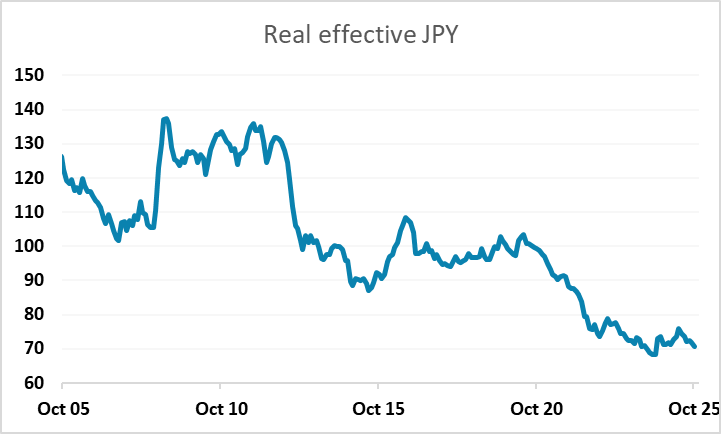

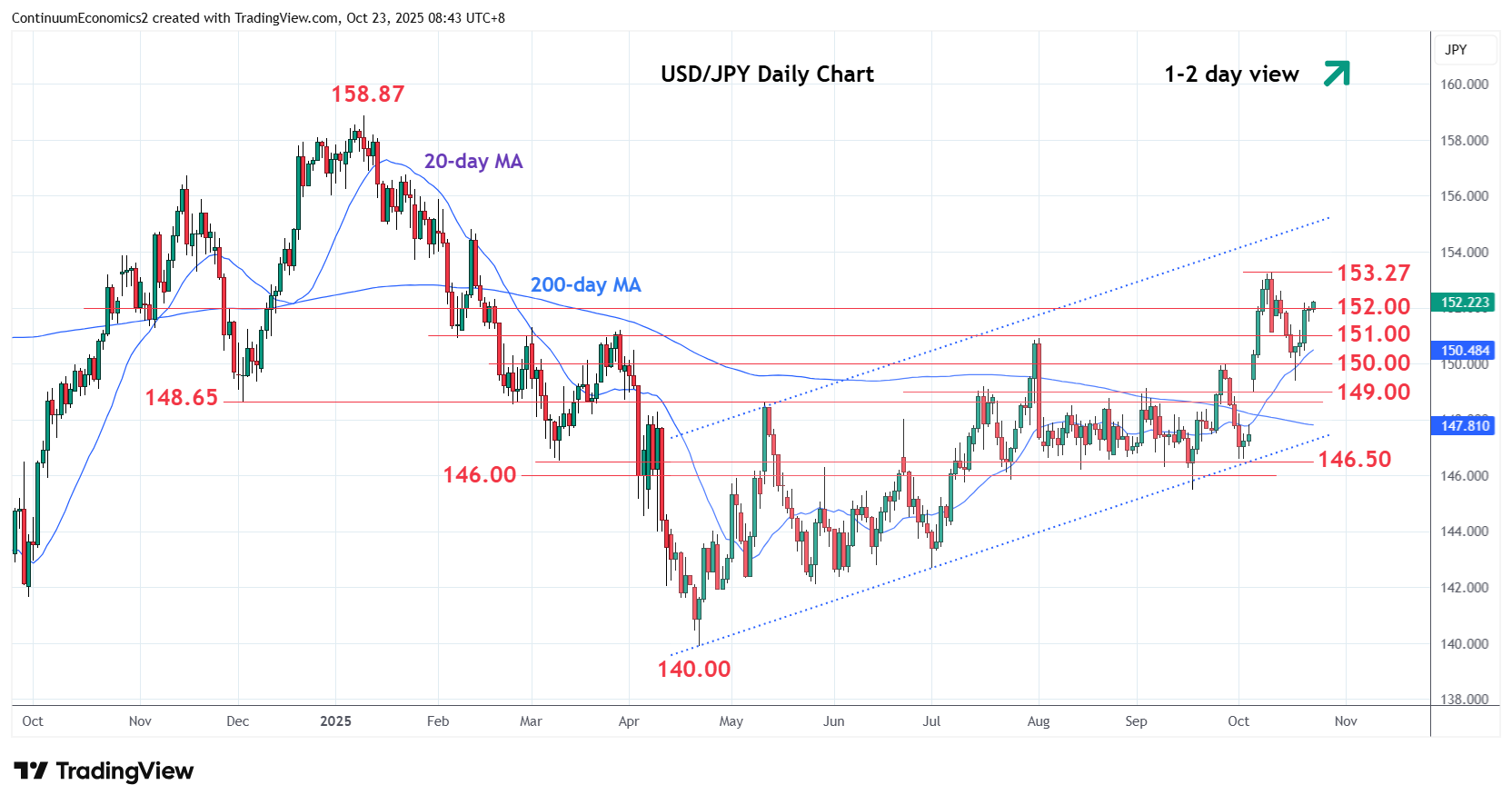

JPY weakness has been the main theme overnight, with USD/JPY and EUR/JPY both hitting a new high for the week. The rationale is unclear, although the comments from new finance minister Katayama yesterday may have been seen as JPY negative as there was no protest at JPY weakness such as had been heard from previous finance minister Kato. If intervention is off the table, JPY bears may feel emboldened and look to take the JPY to new lows. While the BoJ is in control of monetary policy, the MoF is in charge of FX policy, and if they are seen to be encouraging a weak JPY the market might see this as a green light to sell. While there has been nothing explicit along these lines, Katayama’s comments thus far appear to indicate a laissez faire attitude to the FX market. However, the government is unlikely to want the JPY to weaken too much, as this will both increase inflation and encourage the BoJ to raise rates. In the end, a policy looking for a stronger JPY might suit the government better, as this would lead to lower inflation and lower rates than would otherwise be the case. Katayama has previously indicated she saw fair value for USD/JPY in the 120-130 area, and if she wants BoJ policy to support the government’s fiscal expansion, she might be well advised to seek a stronger JPY.