USD flows: USD lifted by higher New York Fed inflation expectauons

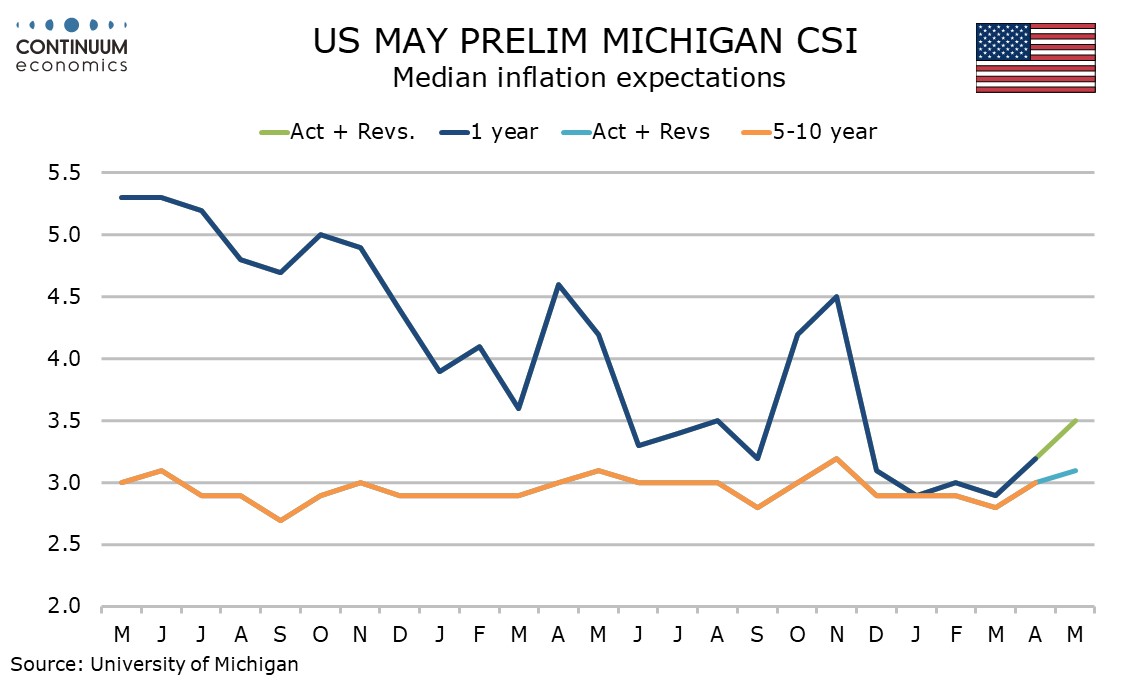

The USD has seen a bounce on the New York Fed’s April survey of consumer inflation expectations, showing market sensitivity to the issue. This reinforces a message of stronger inflation expectations in May’s preliminary Michigan CSI report on Friday.

The New York Fed survey shows the 1-year view at 3.26% from 3.00% in March, which was almost unchanged from the January and February readings. This looks similar to the preliminary May Michigan CSI view of 3.5%, up from 3.2% in April and 2.9% in March. Both surveys are at their highest since November.

The New York Fed survey does show a dip in the 3-year view, to 2.76% from 2.90%, still above February’s 2.71% and January’s 2.35%, but the 5-year view rose to 2.82% from 2.62%, though remains below February’s 2.89%. The Fed tends to be concerned with longer term views, in particular the Michigan CSI’s 5-10 year view, which in May rose to 3.1% from 3.0%, also its highest since November, though the range remains tight.