This week's five highlights

BoJ Keep Rates on hold with upward revision in CPI

USD/JPY Rally Continues on Shaky Ground

U.S. GDP Slows on Imports and Inventories

Bank of Canada Minutes Look to Gradual Easing

UK Services Inflation Resilient

In the April 25-26 meeting, the BoJ has kept short term interest rate at 0-0.1% range and removed wordings in the monetary policy statement (we do not read that as a change in policy). They acknowledged the 2% inflation target can be sustainably reached with current inflation dynamics and see target likely to be reached by 2025 to 2026. Market has speculated a reduction in buying of JGB and was left disappointed.

The move aligns with BoJ's take towards trend inflation and wage. While the results of wage negotiation came in stronger than expected, not only it takes time to filter into the economy, the willingness of Japanese consumers to accept higher prices are also low. Despite price setting and wage behavior are seeing changes, latest MOF business survey suggest that 50.2% SME are unable to pass the cost to customers. Moreover, PPI has been treading below 1% for the past four months, further decreasing the push for business to hike prices. No doubt the change in wage and price setting behavior will fuel trend inflation in a medium run but its impact maybe even lower than BoJ's forecast and limit the room for tightening.

In Ueda's press conference, there is nothing new regarding monetary policy. He confirmed underlying inflation is gradually rising and is "extremely" close to reach their inflation target. The 2024 y/y CPI has been revised higher with less fresh food from 2.4% to 2.8% and 2025 to 1.9% from 1.8%. With data dependency in the driver seat, we believe CPI will undershoot BoJ's forecast with aforementioned reasons and see only one more 0.1% hike. In the FX space, Ueda add fuel to the fire by suggesting "chance of a prolonged weakness in the yen is not zero" and goal of monetary policy is not pointed toward foreign exchange rate. However, he did try to cover himself by saying if exchange rate drive higher inflation, monetary policy maybe adjusted accordingly.

The soft rhetoric Japanese cabinet officials and Ueda are using does not sound like someone who is ready for an actual intervention. There was not change to the monetary policy and also disappoints the hawks who expects multiple hike from the BoJ and kept a lid for speculation of imminent JPY strength. Once market participants are clear with that, it is a one way train north bound. However, the grounds are shaky. While USD/JPY march a figure higher after BoJ's meeting, the fear of intervention exacerbate any volatile moves. There was a Quick dip of almost two figure without obvious sign of BoJ intervention, suggesting market participants are well aware of the risk they are facing and will not stand in front of an intervention train.

On the chart, the further extend break of the 155.00 level to approach the 155.80, June 1990 high. Consolidation below the latter see prices unwinding the deep overbought intraday and daily studies. A later break, if seen, will see room to extend gains to the 156.00/20 resistance. Pullback see support raised to 155.00/154.79 area and where break will open up deeper pullback to unwind the deep overbought daily and weekly studies. Lower will see room to correct strong run-up from the March low and see scope to the 154.00 level then the 153.00/152.60 area.

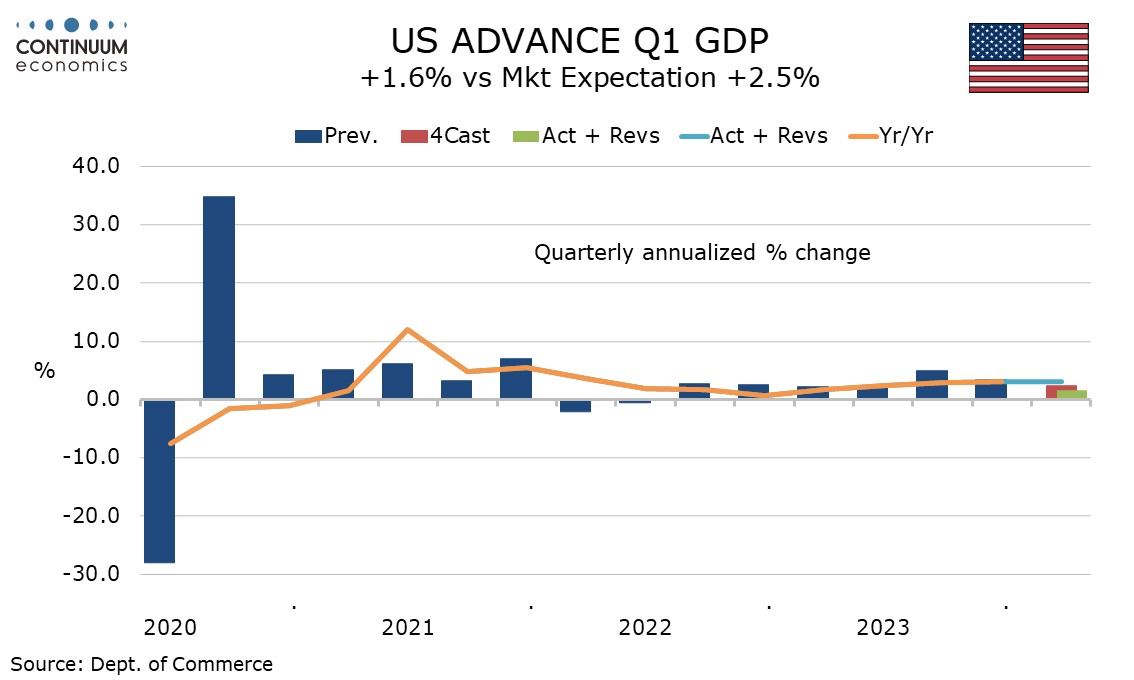

Q1 GDP has come in weaker than expected at 1.6% annualized but with a stronger than expected 3.7% annualized increase in the core PCE price index. Weaker inventories and stronger imports are the main reason for the GDP slowing so the data is not a clear signal of underlying weakness. Lower initial (207k from 212k) and continued (1781k from 1796k) claims show the labor market remains strong. The GDP breakdown shows a 2.0% rise in final sales (GDP less inventories) and a 2.8% rise in final sales to domestic buyers (GDP less inventories and net exports) with net exports taking 0.86% from GDP and inventories taking off 0.35%. A wider advance March trade deficit and weaker than expected advance March retail and wholesale inventory data released alongside the GDP data is consistent with this.

Exports with a 0.9% increase were significantly slower than we expected and well behind a 7.2% rise in imports, which was also not as strong as we expected, but still left a significant negative from net exports. Consumer spending at 2.5% was slower than the previous two quarters showing strength in services at 4.0% but weakness in retail, though much of this was due to bad weather in January. Consumer spending continues to outpace real disposable income, which rose by 1.1%. Business investment also rose at a moderate rise, of 2.9%, with structures slowing from recent strength but equipment showing its first increase in three quarters. Government at 1.2% saw a 7-quarter low with Federal slightly negative and State and Local up a modest 2.0%. The 3.7% rise in the core PCE price index suggests either an upside surprise in March data tomorrow or upward revisions in January and February. This follows two straight quarters on the 2.0% target and leaves yr/yr growth at 2.9%, still down from 3.2% in Q4 and the slowest since Q1 2021.

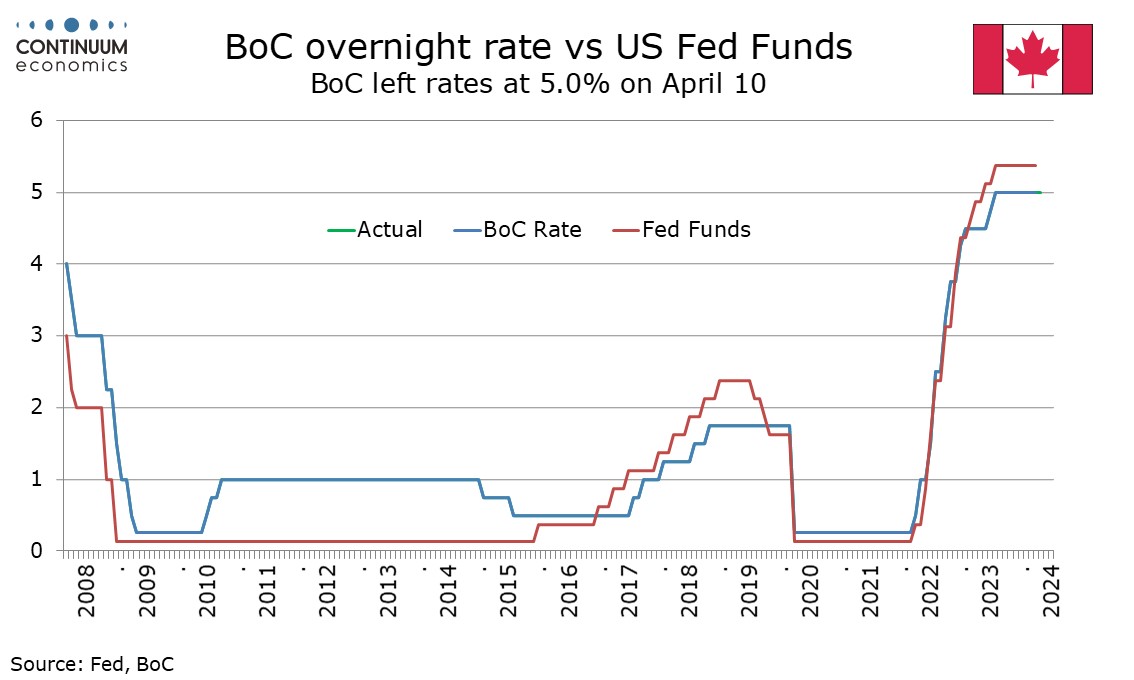

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and the slow path for returning inflation to target. The discussion opens with the global economic outlook being seen as stronger than previously expected, with focus on the United States. Canadian GDP growth was expected to strengthen in early 2024 supported by population growth. Members were encouraged by recent progress on Canadian inflation and confident that their outlook for inflation was reasonably balanced. Factors seen as favorable to the inflation outlook were excess supply seen persisting through 2024, corporate price behavior normalizing, lower business’ inflation expectations and expectations of easing wage growth.

There was however a split on when easing would become appropriate. Some felt that stronger growth prospects reduced the risk of too tight policy slowing growth more than was necessary and more reassurance on inflation was needed. Others placed more emphasis on progress on inflation and felt there was risk in keeping policy too restrictive. They did however agree that inflation remained too high and were more concerned about the upside risks, though risks on both sides had become less acute. The previous two BoC statements had sought “further and sustained easing in core inflation". This meeting agreed that January and February data delivered further easing, but this still needed to be sustained.

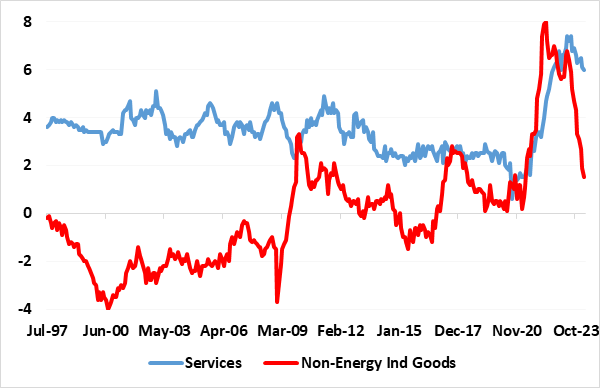

Figure: Services Inflation Historically More Persistent than for Goods

Although still with three members openly resistant to cutting Bank Rate, it does seem as if an MPC majority is nevertheless edging toward easing policy conventionally. This reflects a view among the less hawkish and more pliable MPC members that risks to persistence in domestic inflation pressures are receding. We would agree that there are such signs but would also argue that some of the hitherto worries about price resilience, most notably with services, has been overdone. Indeed, while what we regard to be underlying services inflation is still well above that for core goods, this is nothing unusual (Figure). More notably, the recent fall in overall services inflation has been at a pace very similar to the previous surge, hardly an indication of more recent price resilience. Indeed, the pace of the recent fall is actually much greater when looked at using more short-term dynamics.

It is clear that an economic and ensuing policy reassessment is occurring within large parts of the BoE. A recent speech by Deputy Governor Ramsden highlighted that consideration such as inflation expectations and wages, suggest that the restrictive stance of policy and the more symmetric unwinding of second round effects are also reducing the more persistent components of inflation such as services inflation. As a result, he now says that the balance of domestic risks to the outlook for UK inflation is now tilted to the downside compared to the MPC’s February 2024 forecasts that inflation stays close to the 2% target over the whole forecast period.

Fundamental to this is a reassessment of services inflation, currently still at 6.0% in y/y terms. From the BoE perspective, services inflation are a better indication of persistence than goods as they more reflected domestic inflationary pressures, in large part from the labour market, and that these pressures are inherently more slow moving or stickier, particularly when labour markets are tight as seemingly has been the case in the UK of late. And against an emerging backdrop of softening pay pressures and energy prices (energy prices to be more important in driving services), it is understandable how worries about price resilience, particularly for services have diminished, at least for what appears to be a majority of the nine-string MPC