U.S. December ADP Employment - Modest slowing, but initial claims suggest strong labor market

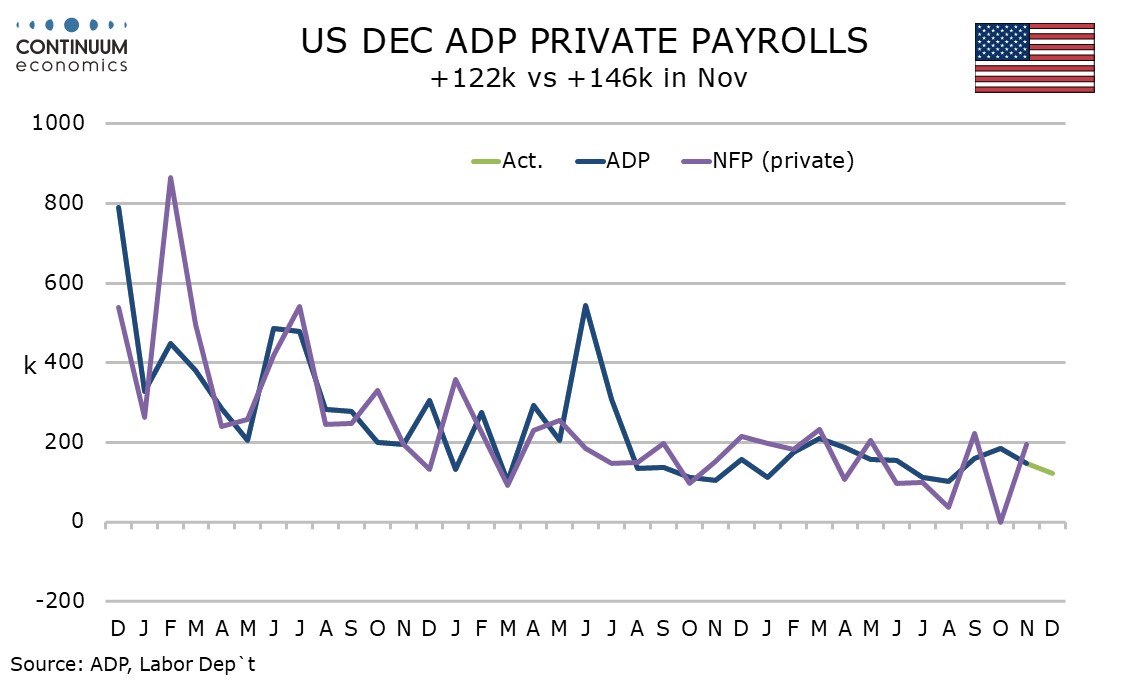

ADP’s November estimate for private sector employment growth of 122k is slightly softer than expected but not sufficiently so to change payroll expectations (we continue to expect a 175k rise, 140k in the private sector). Labor market signals, most notably initial claims, generally remain healthy.

December’s ADP job gains were led by a 57k increase in education and health. Health care has been particularly strong in ADP and non-farm payroll data in recent months. Also strong were construction at 27k and leisure and hospitality at 22k. Weakness was seen in declines of 11k in manufacturing and 5k in business and professional. None of the above are shocks.

ADP data also shows moderation in wage growth, with yr/yr data for job stayers slowing to 4.6% from 4.8% reaching its slowest since July 2021. Job changers saw a marginal slowing to 7.1% from 7.2%.

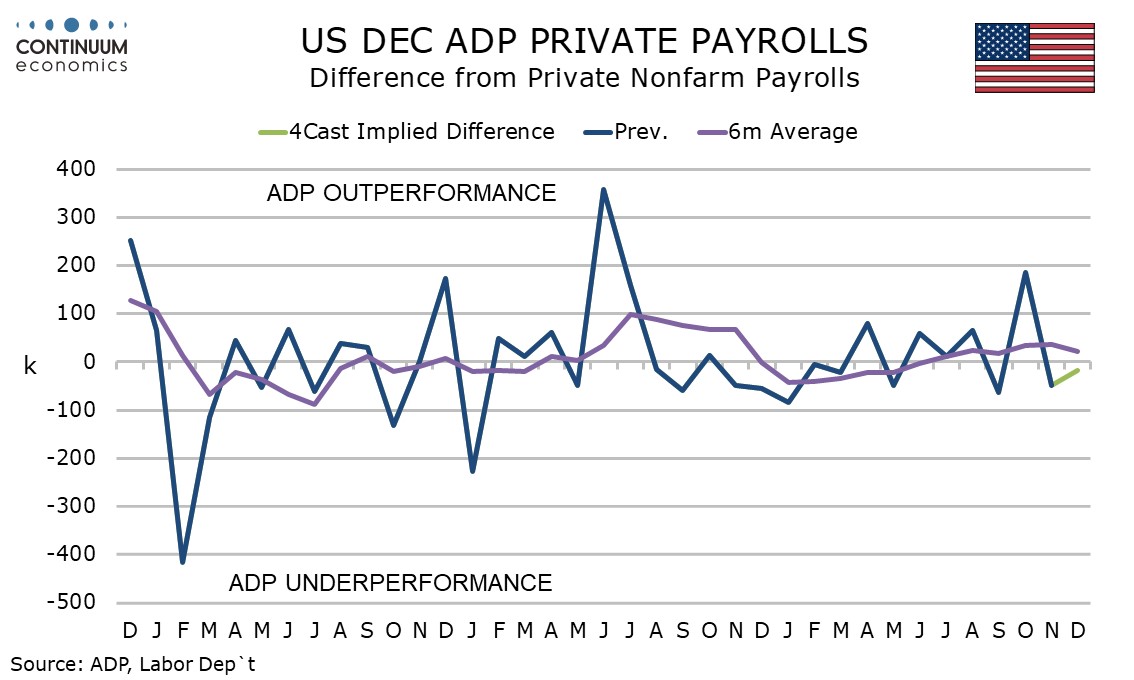

ADP data has had a slight recent bias to outperform the non-farm payroll, largely because ADP data saw a sharp outperformance in October when it was less sensitive to hurricanes than October’s payroll. If December’s ADP data slightly underperforms the payroll, this could be seen as a continued unwind of October’s outperformance.

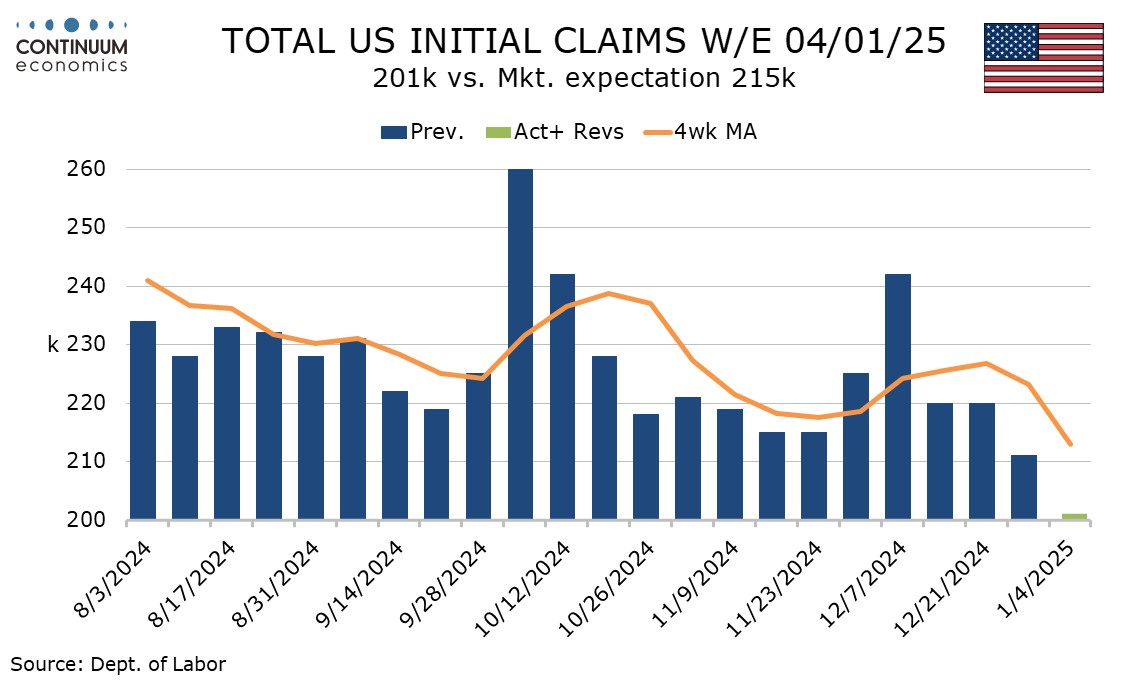

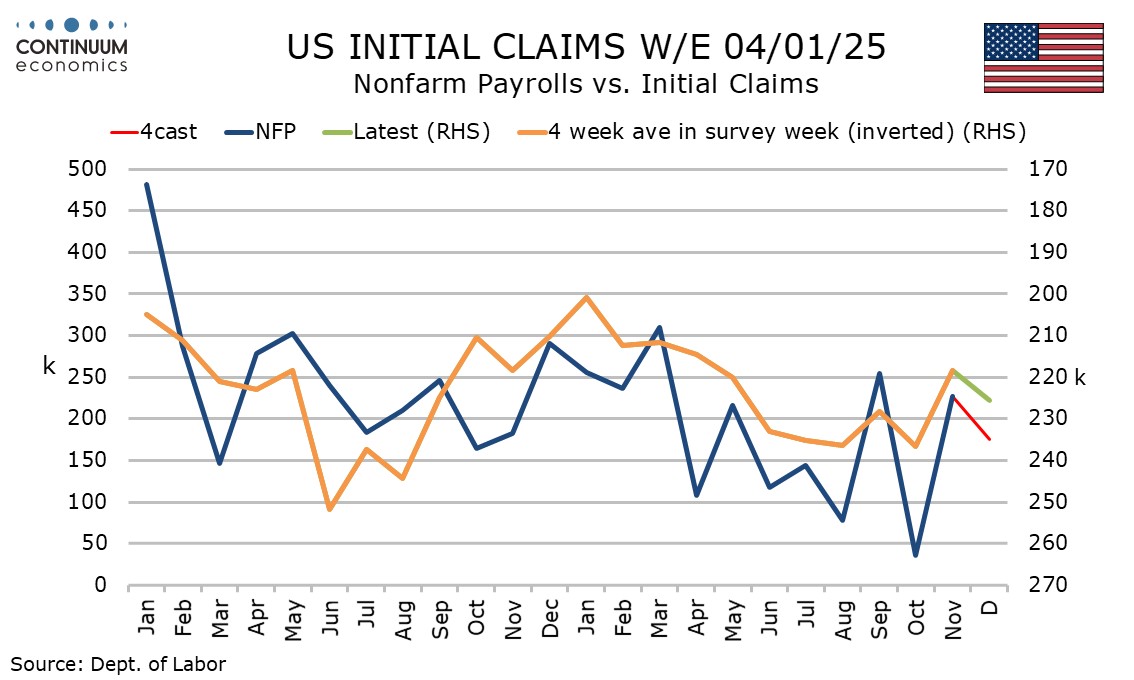

Labor market signals remain strong, particularly initial claims with a decline to 201k, the lowest since February, from 211k in the latest week. This data does however contain the New Year’s holiday so should be treated with some caution.

The latest claims data have been surveyed after December’s non-farm payroll was, so should not have an impact on payroll forecasts, but even in early December claims were mostl;y consistent with a healthy labor market. Upcoming weeks may see initial claims temporarily lifted by bad weather.

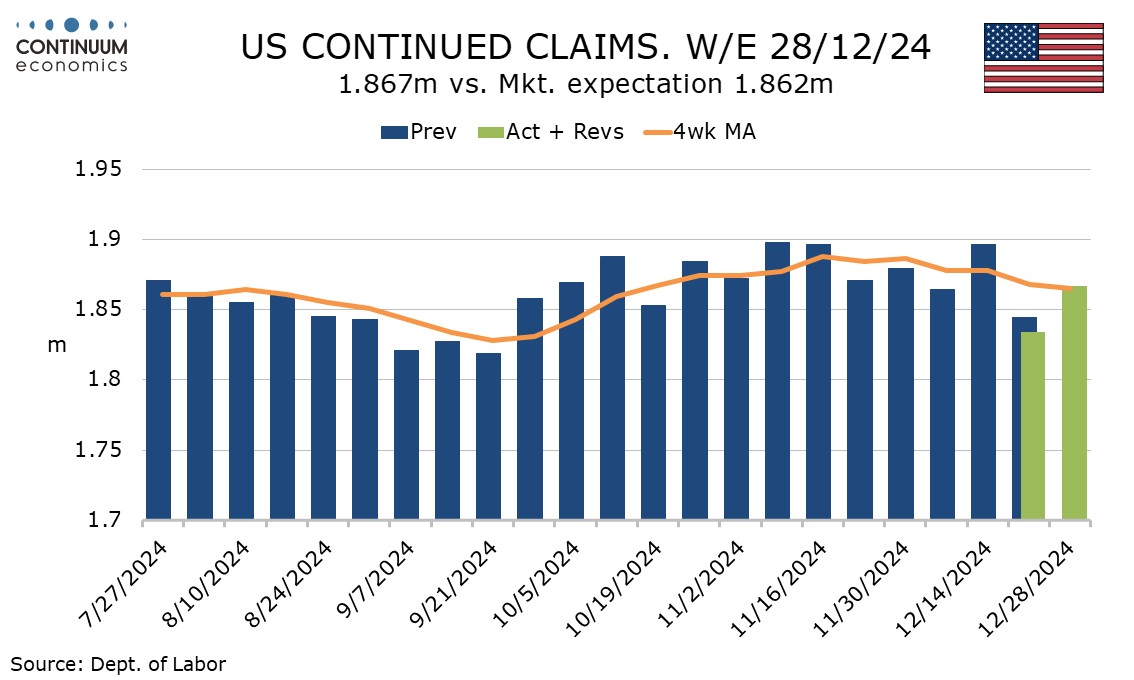

Continued claims saw an increase, to 1.867m from 1.834m, but an upturn in the 4-week average appears to have stabilized.